1 Business Group Performance in China: Ownership and Temporal

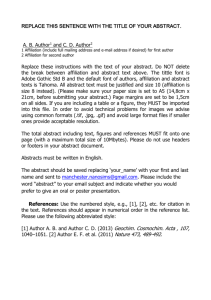

advertisement