Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

Mesirow Financial POLICE Report®

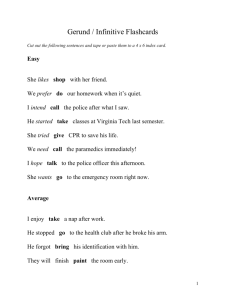

identifies current and potential issues for investment options on the Mesirow Financial Elite List:

Performance – ranks all investment options against their appropriate peers

Organization – tracks personnel, ownership, adviser/sub-adviser changes

Legal Issues – discloses lawsuits, settlements or regulatory issues

Investment Policy – identifies changes in strategy and/or operations

Consistent Style – evaluates consistency in investment style

Expense – compares fees to a peer group average to assess competitiveness

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

Overview of Mesirow Financial POLICE Report®

The Mesirow Financial POLICE Report is a proprietary watch list which identifies current and potential issues for investment options on the Mesirow Financial Elite List in the

following six categories: Performance, Organizational issues, Legal issues, Investment policy, Consistent investment style and Expense. Inclusion in the Mesirow Financial

POLICE Report may not necessarily indicate fiduciary coverage for a particular investment option will terminate due to the issue(s) cited. Investment options are added to, and

remain on, the Mesirow Financial POLICE Report while concerns are being monitored. They are removed from the Mesirow Financial POLICE Report when the issues have been

sufficiently resolved. If an issue is not sufficiently resolved during the monitoring period, the investment option may be removed from fiduciary coverage.

Overview of Contents

Summary:

Lists investment options on the Mesirow Financial Elite List that are being monitored for issues in one or more of the six categories described above

Investment Options Removed from Mesirow Financial Elite List This Quarter:

Identifies investment options that have been removed from the Mesirow Financial Elite List and no longer qualify for Mesirow Financial's fiduciary coverage due to prolonged

issues in one or more of the six categories

Investment Options Added to Mesirow Financial POLICE Report This Quarter:

Identifies investment options with current or potential issues that were added to the Mesirow Financial POLICE Report in the current quarter

Investment Options Removed from Mesirow Financial POLICE Report This Quarter:

Identifies investment options that have experienced consistent improvements over three consecutive quarters and no longer need to be monitored on the Mesirow Financial

POLICE Report

Morningstar Category and Mesirow Financial Asset Class Changes This Quarter:

Identifies investment options that have experienced a change in Morningstar Category and/or Mesirow Financial Asset Class in the current quarter. The changes indicated in this

section would not impact an investment option's Mesirow Financial Elite List status. However, the changes may impact an investment option's Mesirow Financial Core Asset

Class status. To qualify for fiduciary coverage, Plan Sponsors must select and maintain at least one investment option from the Mesirow Financial Elite List in each of the

following Core Asset Classes: Large Cap Domestic Equity; Small Cap Domestic Equity; Large Cap Foreign Equity, Domestic Bonds, and Cash Equivalents/ Principal FocusedExtended Duration. Plan Sponsors may choose as many investment options as they would like in the Supplemental Asset Classes.

Complete Mesirow Financial POLICE Report:

Includes investment options on the Mesirow Financial Elite List that are being monitored—both newly added investment options and carry-overs from previous quarters

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

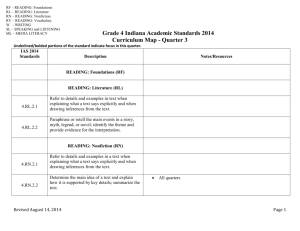

First Quarter 2014

All information is through 03/31/2014

SUMMARY

* INVESTMENT OPTION NAME

AllianzGI NFJ Dividend Value

American Century One Choice 2015

American Century One Choice 2020

American Century One Choice 2025

American Century One Choice 2030

American Century One Choice 2035

American Century One Choice 2040

American Century One Choice 2045

American Century One Choice 2050

American Century One Choice 2055

American Century One Choice In Ret

American Century Ultra

American Century Value

BlackRock Equity Dividend

* Columbia Diversified Equity Income

Columbia Mid Cap Value

Fidelity Advisor Dividend Growth

Franklin Growth

Goldman Sachs Growth Opportunities

Invesco Charter

Invesco Small Cap Equity

JPMorgan Mid Cap Growth

Keeley Small Cap Value

MassMutual MSCI EAFE Intl Idx

MFS New Discovery

Mutual Beacon

Nuveen Mid Cap Growth Opps

* Nuveen Mid Cap Index

* Nuveen Small Cap Index

Nuveen Small Cap Select

* Oppenheimer Discovery

Oppenheimer Global Strategic Inc

Oppenheimer Rising Dividends

Premier Cap Appreciation

Premier Core Bond

*This investment option is not available to new plans.

PERFORMANCE

WATCH

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

WATCH

WATCH

PASS

PASS

PASS

PASS

WATCH

WATCH

PASS

WATCH

PASS

PASS

PASS

PASS

PASS

PASS

WATCH

PASS

WATCH

WATCH

WATCH

PASS

ORGANIZATION

PASS

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

PASS

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

PASS

PASS

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

WATCH

PASS

WATCH

WATCH

LEGAL

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

INVESTMENT POLICY

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

WATCH

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

CONSISTENT STYLE

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

EXPENSE

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

3

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

SUMMARY

* INVESTMENT OPTION NAME

Premier Diversified Bond

Premier Main Street

* Premier Money Market (Babson)

Premier Short-Duration Bond

RetireSMART Growth

RidgeWorth Mid-Cap Value Equity

Select Diversified Value

Select Focused Value

Select Growth Opportunities

Select PIMCO Total Ret

Select Small Company Gr

Select Small Company Value

Select Strategic Bond

Templeton Growth

*This investment option is not available to new plans.

PERFORMANCE

PASS

PASS

PASS

PASS

WATCH

PASS

PASS

PASS

PASS

WATCH

WATCH

WATCH

PASS

PASS

ORGANIZATION

WATCH

WATCH

WATCH

WATCH

PASS

WATCH

WATCH

WATCH

WATCH

PASS

WATCH

PASS

WATCH

WATCH

LEGAL

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

INVESTMENT POLICY

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

CONSISTENT STYLE

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

EXPENSE

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

PASS

4

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

First Quarter 2014

All information is through 03/31/2014

INVESTMENT OPTIONS REMOVED FROM ELITE LIST THIS QUARTER

*

INVESTMENT OPTION NAME

MORNINGSTAR

CATEGORY

MONITOR ISSUE

SUMMARY OF ISSUE

DATE REMOVED

ACTIONS

None

*This investment option is not available to new plans.

5

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

First Quarter 2014

All information is through 03/31/2014

INVESTMENT OPTIONS ADDED TO THE MESIROW FINANCIAL POLICE REPORT THIS QUARTER

*

INVESTMENT OPTION NAME

American Century Value

MORNINGSTAR

CATEGORY

Large Value

Franklin Growth

SUMMARY OF ISSUE

DATE

Organization

Effective April 2014, Chad Baumler is no longer a

manager on this strategy and is replaced by

Brian Woglom. Woglom joins existing managers

Kevin Toney, Michael Liss, and Philip Davidson.

Effective February 2013, Baumler was promoted

to portfolio manager.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Large Growth

Organization

Effective April 6, 2014, Serena Vinton and

Conrad Herrmann are the two managers of this

investment option. Jerry Palmieri, who had been

the lead manager since 1965, died at age 85. In

October 2008, Serena Vinton was added as a comanager to the team of Palieri and Herrman in

preparation for the lead manager's role.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Invesco Charter

Large Blend

Organization

Effective April 2014, Tyler Dann II is no longer a

manager on this strategy. Ronald Sloan and

Brian Nelson remain as co-managers.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Invesco Small Cap Equity

Small Blend

Performance

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

Mar-14

Monitor for performance improvements over

three consecutive quarters since date added.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

JPMorgan Mid Cap Growth

*This investment option is not available to new plans.

Mid-Cap Growth

MONITOR ISSUE

Investment Policy

PrecisionAlpha® and Risk, and 1-, 3- and 5-year

trailing returns.

Effective June 10, 2014, pending shareholder

approval, this investment option's objective

changes. Pursuant to its new investment

objective, the investment option seeks growth of

capital. Prior to the change, the investment

option sought growth of capital and secondarily,

current income by investing primarily in equity

securities.

ACTIONS

6

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

INVESTMENT OPTIONS ADDED TO THE MESIROW FINANCIAL POLICE REPORT THIS QUARTER

*

INVESTMENT OPTION NAME

MORNINGSTAR

CATEGORY

Mid-Cap Growth

SUMMARY OF ISSUE

DATE

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

* Nuveen Mid Cap Index

Mid-Cap Blend

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

* Nuveen Small Cap Index

Small Blend

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

* Oppenheimer Discovery

Small Growth

Organization

Effective February 28, 2014, Ash Shal was

promoted to co-manager. Shal joins Ronald

Zibelli, Jr., who serves as lead manager.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Nuveen Mid Cap Growth Opps

*This investment option is not available to new plans.

MONITOR ISSUE

ACTIONS

7

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

INVESTMENT OPTIONS ADDED TO THE MESIROW FINANCIAL POLICE REPORT THIS QUARTER

*

INVESTMENT OPTION NAME

Premier Main Street

MORNINGSTAR

CATEGORY

Large Blend

Select Focused Value

SUMMARY OF ISSUE

DATE

Organization

Effective February 28, 2014, Paul Larson joined

Manind Govil and Benjamin Ram as co-portfolio

manager of this investment option subadvised

by OFI Global Institutional, Inc.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Large Blend

Organization

Mar-14

Select Growth Opportunities

Large Growth

Organization

Effective April 1, 2014, Michael Mangan

departed the team, leaving Robert Levy as the

sole manager.

Effective February 18, 2014,subadvisor Delaware

Investments and its Focus Growth team, led by

Jeff Van Harte, announced a venture called

Jackson Square Partners. The new firm is jointly

owned by members of the Focus Growth team

and Delaware Investments. The transaction is

expected to close in late April 2014.

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Select PIMCO Total Ret

Intermediate-Term Bond

Performance

Mar-14

Monitor for performance improvements over

three consecutive quarters since date added.

Select Strategic Bond

Intermediate-Term Bond

Organization

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective March 31, 2014, Kenneth Leech

replaced Stephen Walsh. The other managers are

Carl Eichstaedt, Mark Lindbloom, Keith Gardner

and Michael Buchanan.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

*This investment option is not available to new plans.

MONITOR ISSUE

Mar-14

ACTIONS

8

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

First Quarter 2014

All information is through 03/31/2014

INVESTMENT OPTIONS REMOVED FROM POLICE REPORT THIS QUARTER

*

INVESTMENT OPTION NAME

Capital Preservation

MORNINGSTAR

CATEGORY

Stable Value

Mutual Shares

SUMMARY OF ISSUE

DATE

ACTIONS

Organization

Effective June 30, 2013, Mary Wilson-Kibbe

retires. Dave Nagle assumes her responsibilities

and is the lead portfolio manager of the team.

Mar-13

Removed from Mesirow Financial POLICE

Report following completion of monitoring

period of organizational change.

Large Value

Performance

Jun-13

Removed from Mesirow Financial POLICE

Report due to performance improvement

for three consecutive quarters.

Oakmark Equity & Income

Aggressive Allocation

Organization

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective April 17, 2013, research analysts Colin

Hudson, Edward Wojciechowski, and Matthew

Logan became co-managers. They join existing

manager Clyde McGregor, who has been at the

helm since inception. McGregor co-managed the

investment option with Edward Studzinski from

2000 to January 2012, when Studzinski retired.

Dec-11

Removed from Mesirow Financial POLICE

Report following completion of monitoring

period of organizational change.

Oppenheimer International Bond

World Bond

Organization

Effective January 28, 2013, Hemant Baijal was

promoted to co-manager. He joins existing

managers Art Steinmetz and Sara Zervos.

Jun-13

Removed from Mesirow Financial POLICE

Report following completion of monitoring

period of organizational change.

Premier Small Cap Opps

Small Blend

Investment Policy

Effective April 29, 2013, along with a name

change, this investment option's primary

benchmark changed from Russell 2500 Index to

Russell 2000 Index to closely represent the new

investment strategy. The investment option now

invests at least 80% of assets in the market

capitalization range of the Russell 2000 Index.

Further, the management team typically uses

fundamental research to select securities, deemphasizing the use of quantitative models.

Jun-13

Removed from Mesirow Financial POLICE

Report following completion of monitoring

period of investment policy change.

*This investment option is not available to new plans.

MONITOR ISSUE

9

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

INVESTMENT OPTIONS REMOVED FROM POLICE REPORT THIS QUARTER

*

INVESTMENT OPTION NAME

Wells Fargo Advantage Intl Value

*This investment option is not available to new plans.

MORNINGSTAR

CATEGORY

Foreign Large Value

MONITOR ISSUE

Organization

SUMMARY OF ISSUE

DATE

ACTIONS

Effective April 15, 2013, Gary Lisenbee is no

longer a co-portfolio manager of this investment

option. Jeffrey Peck is now the sole manager.

Mar-13

Removed from Mesirow Financial POLICE

Report following completion of monitoring

period of organizational change.

10

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

First Quarter 2014

All information is through 03/31/2014

MORNINGSTAR CATEGORY AND MESIROW FINANCIAL ASSET CLASS CHANGES

*

INVESTMENT OPTION NAME

PREVIOUS MORNINGSTAR

CATEGORY

PREVIOUS MESIROW

FINANCIAL ASSET CLASS

NEW MORNINGSTAR

CATEGORY

NEW MESIROW FINANCIAL

ASSET CLASS

ACTIONS

None

*This investment option is not available to new plans.

11

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

First Quarter 2014

All information is through 03/31/2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

AllianzGI NFJ Dividend Value

MORNINGSTAR

CATEGORY

Large Value

MONITOR ISSUE

Performance

SUMMARY OF ISSUE

DATE

ACTIONS

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective December 2013, a co-CIO structure

was implemented naming Dave MacEwen and

Victor Zhang as co-CIOs. Zhang and MacEwen

are jointly leading the investment management

function and oversight of all asset allocation

products. Effective April 2013, Enrique Chang,

former CIO, is no longer a named manager on

the American Century asset allocation strategies.

He left the firm in September and the four

remaining managers consist of Radu Gabudean,

a new addition to the team, along with Scott

Wilson, Scott Wittman, and Rich Weiss.

Effective April 2012, Irina Torelli is no longer

part of the asset allocation team at American

Century.

Sep-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Mar-12

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

American Century One Choice Target Date Suite Target Date Suite

(all investment options in suite)

Organization

American Century Ultra

Large Growth

Organization

Effective August 5, 2013, Jeff Bourke was

promoted to co-manager on this strategy. He

joins Keith Lee and Michael Li.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

American Century Value

Large Value

Organization

Effective April 2014, Chad Baumler is no longer a

manager on this strategy and is replaced by

Brian Woglom. Woglom joins existing managers

Kevin Toney, Michael Liss, and Philip Davidson.

Effective February 2013, Baumler was promoted

to portfolio manager.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

*This investment option is not available to new plans.

12

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

BlackRock Equity Dividend

MORNINGSTAR

CATEGORY

Large Value

Performance

Columbia Diversified Equity Income

Large Value

Performance

* Columbia Diversified Equity Income

Large Value

Organization

Columbia Mid Cap Value

Mid-Cap Value

Organization

Fidelity Advisor Dividend Growth

Large Blend

Organization

*This investment option is not available to new plans.

MONITOR ISSUE

SUMMARY OF ISSUE

DATE

ACTIONS

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective October 9, 2013, Russell Bloomfield

joined Hugh Mullin as co-manager. Effective July

8, 2013, Hugh Mullin assumed the role of sole

portfolio manager replacing the team of Paul

Stocking, Steven Schroll and Dean Ramos.

Effective February 28, 2013, Laton Spahr is no

longer a co-portfolio manager of this investment

option. Paul Stocking and Steven Schroll

remained as co-managers along with new team

member Dean Ramos.

Sep-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Dec-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Mar-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Effective July 1, 2013, Diane Sobin is added as a

co-manager of this investment option which was

co-managed by David Hoffman and Lori

Ensinger. Lori Ensinger is no longer part of the

team. David Hoffman and Lori Ensinger comanaged this investment option since May

2012.

Jun-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Effective January 1, 2014, Ramona Persaud

replaced Larry Rakers as manager of this

investment option.

Dec-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

13

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

Franklin Growth

MORNINGSTAR

CATEGORY

Large Growth

Goldman Sachs Growth Opportunities

SUMMARY OF ISSUE

DATE

ACTIONS

Organization

Effective April 6, 2014, Serena Vinton and

Conrad Herrmann are the two managers of this

investment option. Jerry Palmieri, who had been

the lead manager since 1965, died at age 85. In

October 2008, Serena Vinton was added as a comanager to the team of Palieri and Herrman in

preparation for the lead manager's role.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Mid-Cap Growth

Organization

Effective July 2013, Craig Glassner is now a

member of the management team for this

strategy. Effective April 2013, Scott Kolar is no

longer with the firm. Co-managers Steven Barry

and Jeffrey Rabinowitz remain to run this

strategy. Effective October 2011, David Shell and

Warren Fisher are no longer portfolio managers

on this investment option.

Mar-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Invesco Charter

Large Blend

Performance

Dec-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Invesco Charter

Large Blend

Organization

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective April 2014, Tyler Dann II is no longer a

manager on this strategy. Ronald Sloan and

Brian Nelson remain as co-managers.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Invesco Small Cap Equity

Small Blend

Performance

Mar-14

Monitor for performance improvements

over three consecutive quarters since date

added.

*This investment option is not available to new plans.

MONITOR ISSUE

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

14

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

JPMorgan Mid Cap Growth

MORNINGSTAR

CATEGORY

Mid-Cap Growth

Keeley Small Cap Value

SUMMARY OF ISSUE

DATE

ACTIONS

Investment Policy

Effective June 10, 2014, pending shareholder

approval, this investment option's objective

changes. Pursuant to its new investment

objective, the investment option seeks growth of

capital. Prior to the change, the investment

option sought growth of capital and secondarily,

current income by investing primarily in equity

securities.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Small Blend

Performance

Sep-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Keeley Small Cap Value

Small Blend

Organization

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective December 31, 2013, Kevin Chin joined

existing portfolio manager John L. Keeley, Jr. as

co-portfolio manager. Effective Jan. 31, 2011,

Brian Keeley was named assistant portfolio

manager for this investment option. He joins

lead manager John Keeley.

Dec-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

MassMutual MSCI EAFE Intl Idx

Foreign Large Blend

Organization

Effective October 31, 2013, Steven Santiccioli

replaces Shaun Murphy as portfolio manager.

Dec-13

MFS New Discovery

Small Growth

Organization

Effective December 2013, Michael Grossman

was promoted to co-manager. He joins long

time manager Thomas Wetherald.

Dec-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Mutual Beacon

Large Blend

Organization

Effective January 2, 2014, Aman Gupta joins

Mandan Hormozi and Christina Correa as comanager. Effective January 2011, Mandana

Hormozi was promoted from assistant portfolio

manager to portfolio manager. Mandana was an

assistant portfolio manager since 2009.

Christian Correa was the other portfolio manager

of this investment option.

Dec-13

*This investment option is not available to new plans.

MONITOR ISSUE

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

15

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

MORNINGSTAR

CATEGORY

Mid-Cap Growth

* Nuveen Mid Cap Index

* Nuveen Small Cap Index

Nuveen Mid Cap Growth Opps

Nuveen Small Cap Select

*This investment option is not available to new plans.

MONITOR ISSUE

SUMMARY OF ISSUE

DATE

ACTIONS

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Mid-Cap Blend

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Small Blend

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Small Growth

Performance

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Jun-13

Monitor for performance improvements

over three consecutive quarters since date

added.

16

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

SUMMARY OF ISSUE

DATE

ACTIONS

Organization

On April 14, 2014, it was announced that TIAACREF will acquire Nuveen Investments and will

operate as a separate subsidiary. John Amboian

will remain the CEO of Nuveen Investments, and

Nuveen's current leadership and key investment

teams are anticipated to remain in place. The

transaction is expected to be complete by yearend 2014. Effective August 26, 2013, Gregory

Ryan replaced Allen Steinkof as a portfolio

manager. He joins Mark Traster existing comanager of the strategy.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Small Growth

Organization

Effective February 28, 2014, Ash Shal was

promoted to co-manager. Shal joins Ronald

Zibelli, Jr., who serves as lead manager.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Oppenheimer Global Strategic Inc

Multisector Bond

Performance

Dec-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Oppenheimer Global Strategic Inc

Multisector Bond

Organization

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective January 28, 2013, Jack Brown replaced

Joseph Welsh as co-manager of this investment

option. Brown joins existing managers Art

Steinmetz, Krishna Memani, and Sara Zervos.

Mar-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Oppenheimer Rising Dividends

Large Blend

Performance

Sep-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Premier Cap Appreciation

Large Growth

Performance

Mar-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Nuveen Small Cap Select

* Oppenheimer Discovery

*This investment option is not available to new plans.

MORNINGSTAR

CATEGORY

Small Growth

MONITOR ISSUE

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

17

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

Premier Cap Appreciation

MORNINGSTAR

CATEGORY

Large Growth

Organization

Premier Core Bond

Intermediate-Term Bond

Premier Diversified Bond

Premier Main Street

* Premier Money Market (Babson)

*This investment option is not available to new plans.

MONITOR ISSUE

SUMMARY OF ISSUE

DATE

ACTIONS

Effective May 16, 2014, this investment option

liquidates. Effective May 31, 2013, Julie M. Van

Cleave is no longer a co-portfolio manager of

this investment option subadvised by

OppenheimerFunds, Inc. Michael Kotlarz is now

the sole manager.

Jun-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Organization

Effective July 1, 2013, Mary Wilson-Kibbe is no

longer part of the management team at subadvisor Babson Capital. David Nagle, William

Awad, Charles Sanford and Douglas Trevallion

remain as portfolio managers.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Intermediate-Term Bond

Organization

Effective July 1, 2013, Mary Wilson-Kibbe is no

longer part of the management team at subadvisor Babson Capital. David Nagle, William

Awad, Charles Sanford and Sean Feeley remain

as portfolio managers. Effective September 27,

2011, co-portfolio manager Jill Fields left the

team. Sean Feeley replaced her as a co-portfolio

manager on the five member management team

led by Mary Wilson Kibbe.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Large Blend

Organization

Effective February 28, 2014, Paul Larson joined

Manind Govil and Benjamin Ram as co-portfolio

manager of this investment option subadvised

by OFI Global Institutional, Inc.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Money Market

Organization

Effective July 1, 2013, Mary Wilson-Kibbe is no

longer part of the management team at subadvisor Babson Capital. Scott Simler and Scott

Riecke remain as portfolio managers.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

18

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

Premier Short-Duration Bond

MORNINGSTAR

CATEGORY

Short-Term Bond

RetireSMART Growth

SUMMARY OF ISSUE

DATE

ACTIONS

Organization

Effective December 31, 2013, Williman Awad

joined the portfolio management team. Effective

July 1, 2013, Mary Wilson-Kibbe is no longer

part of the management team at sub-advisor

Babson Capital. David Nagle, Ronald Desautels,

Charles Sanford and Douglas Trevallion remain

as portfolio managers.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Large Blend

Performance

Jun-13

Monitor for performance improvements

over three consecutive quarters since date

added.

RidgeWorth Mid-Cap Value Equity

Mid-Cap Value

Organization

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

On December 11, 2013, employees of

RidgeWorth Investments, in partnership with

Lightyear Capital, a leading private equity firm,

announced that they have entered into an

agreement to acquire RidgeWorth from SunTrust

Banks, Inc. This transaction is expected to close

in the second quarter of 2014.

Dec-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Select Diversified Value

Large Value

Organization

Effective September 30, 2013, James Carroll is

no longer part of the management team at subadvisor Loomis Salyes. Brandywine Global

Investment Management is the other subadvisor of this investment option.

Sep-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Select Focused Value

Large Blend

Organization

Mar-14

Select Growth Opportunities

Large Growth

Organization

Effective April 1, 2014, Michael Mangan

departed the team, leaving Robert Levy as the

sole manager.

Effective February 18, 2014,subadvisor Delaware

Investments and its Focus Growth team, led by

Jeff Van Harte, announced a venture called

Jackson Square Partners. The new firm is jointly

owned by members of the Focus Growth team

and Delaware Investments. The transaction is

expected to close in late April 2014.

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

*This investment option is not available to new plans.

MONITOR ISSUE

Mar-14

19

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

Select PIMCO Total Ret

MORNINGSTAR

CATEGORY

Intermediate-Term Bond

Performance

Select Small Company Gr

Small Growth

Performance

Select Small Company Gr

Small Growth

Organization

Select Small Company Value

Small Blend

Performance

Select Strategic Bond

Intermediate-Term Bond

Organization

*This investment option is not available to new plans.

MONITOR ISSUE

SUMMARY OF ISSUE

DATE

ACTIONS

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective September 17, 2013, Timberline Asset

Management is the sole subadvisor of this

investment option replacing Boston Company

Asset Management and Eagle Asset Managment.

Kenneth A. Korngiebel, CIO of Timberline

manages the portfolio. Effective May 10, 2013,

Hans von der Luft and Randall Watts, Jr are no

longer portfolio managers of this investment

option. Todd Wakefield and Rober Zeuthen

replace them at subadvisor Boston Company

Asset Management. There are no changes at the

other subadvisor Eagle Asset Management.

Mar-14

Monitor for performance improvements

over three consecutive quarters since date

added.

Dec-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Jun-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

4th quartile rank relative to category on at least 3

out of the 5 following performance criteria:

PrecisionAlpha and Risk, and 1-, 3- and 5-year

trailing returns.

Effective March 31, 2014, Kenneth Leech

replaced Stephen Walsh. The other managers are

Carl Eichstaedt, Mark Lindbloom, Keith Gardner

and Michael Buchanan.

Sep-13

Monitor for performance improvements

over three consecutive quarters since date

added.

Mar-14

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

20

Mesirow Financial POLICE Report® for Small Plan Platform - All Tiers

March 31, 2014

COMPLETE MESIROW FINANCIAL POLICE REPORT

*

INVESTMENT OPTION NAME

Templeton Growth

*This investment option is not available to new plans.

MORNINGSTAR

CATEGORY

World Stock

MONITOR ISSUE

Organization

SUMMARY OF ISSUE

DATE

ACTIONS

Effective January 1, 2014, Heather Arnold joins

the team. Effective June 28, 2013, Matthew

Nagle is no longer listed as a co-manager of this

investment option. Norm Boersma, Lisa Myers,

Tucker Scott and Jim Harper remain as comanagers. Effective March 31, 2011, Cindy

Sweeting is no longer part of the portfolio

management team. Norm Boersma took her

place. Effective August 2010, Matt Nagle and Jim

Harper were added as portfolio managers of this

investment option.

Jun-13

Monitor performance and strategy for three

quarters from the date the change was

implemented or finalized.

21

www.mesirowfinancial.com

Investment Management | Global Markets | Insurance Services | Consulting

The Mesirow Financial Investment Strategies Group is a division of Mesirow Financial Investment Management Inc. The information provided herein is for informational purposes only and should not be construed as

a recommendation to purchase or sell any particular security or investment vehicle(s) offered by Mesirow Financial Investment Management, Inc. (MFIM) or affiliates of MFIM. The information contained herein has

been obtained form sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. Other Mesirow Financial

affiliates may receive fees for selling or advising on the purchase or sale of products mentioned herein. Additionally, Mesirow Financial affiliates may also receive fees paid by manufacturers or distributors of said

products in connection to other professional services provided by the applicable Mesirow Financial affiliate. The sale or advice provided is in no way related or contingent upon the payment received for these other

services. It should not be assumed that any recommendations incorporated herein will be profitable or will equal past performance. Mesirow Financial does not provide legal or tax advice. Investment advisory

services provided through Mesirow Financial Investment Management, Inc., a SEC-registered investment advisor. Advisory Fees are described in Mesirow Financial Investment Management Inc.’s Part II of the Form

ADV. Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and logo are registered service marks of Mesirow Financial Holdings, Inc.

© 2014, Mesirow Financial Holdings, Inc. All rights reserved.