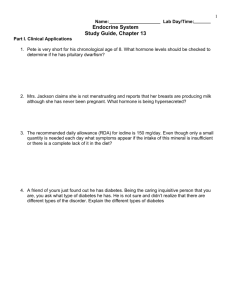

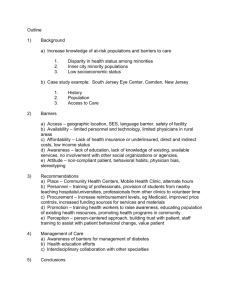

Building the Business Case for Diabetes Self

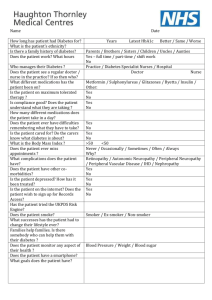

advertisement