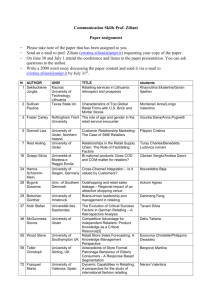

Z:on Conference) Proposal-Asian Consumer Insights

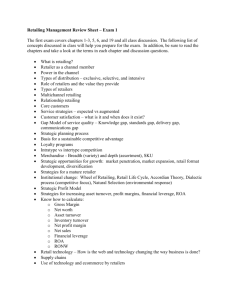

advertisement

THE COEXISTENCE OF ORGANIZED AND UNORGANIZED RETAILING IN EMERGING ECONOMIES Grant proposal submitted to the Institute of Asian Consumer Insight by Kinshuk Jerath, S. Sajeesh, Z. John Zhang† March 2012 Introduction and Problem Statement The retailing sector contributes substantially to a country's gross domestic product (GDP). For example, an estimated two-thirds of the United States GDP comes from retail consumption. The retailing landscape in most developed countries is dominated in sales by organized retailing, characterized by supermarkets, corporate-backed hypermarkets and retail chains, while in emerging economies the leading retailing format is unorganized retailing, characterized by small neighborhood stores selling groceries (“mom and pop” stores) and stalls selling fresh produces, typically run by individuals or small families. The liberalization policies on foreign direct investments in developing economies coupled with huge growth prospects has led retailing giants from developed economies, such as Wal-Mart and Carrefour, to foray into emerging markets. In fact, since 1995 global retailers have entered more than 100 new markets (A. T. Kearney 2006). The growth of organized retailing is changing the way the unorganized retailers are competing in emerging economies. Organized retailers attenuate the role of location as a source of enduring competitive advantage for unorganized retailers. But organized retail penetration seems to differ substantially even among various emerging markets (McKinsey 2008). For example, the organized retail penetration is about 36% in Brazil and 20% in China but only 15% in South Korea and 4% in India. Unorganized retailers have also reacted differently in different countries. For example, in India, activists along with local store owners have held numerous rallies to protest against entry by organized retailers citing detrimental impact on unorganized retailers. In contrast, in China, the unorganized retailers have not (or could not have) mounted persistent resistance to global retailers. In this research project, we aim to conduct an in-depth study of the factors that drive the structure of retailing markets in emerging Asian economies when unorganized and organized retailers coexist and interact, with specific focus on modeling the differences in the consumer purchasing processes at these two types of retailers. __________________________________________________________________________________ † Kinshuk Jerath is Assistant Professor of Marketing at the Tepper School of Business, Carnegie Mellon University (email: kinshuk@cmu.edu). S. Sajeesh is Assistant Professor of Marketing at the Zicklin School of Business, Baruch College, City University of New York (email: s.sajeesh@baruch.cuny.edu). Z. John Zhang is Murrel J. Ades Professor of Marketing at the Wharton School, University of Pennsylvania (email: zjzhang@wharton.upenn.edu). Organized and unorganized retailers serve consumers in very different ways, which need to be carefully understood to develop insights into their coexistence in developing countries. Even in developing countries, organized retailers operate large stores which are located further away on average (usually in large shopping plazas), and each outlet serves several thousand households spread over a large area. Customers typically make a few shopping trips per month, driving long distances, and purchase large quantities of products at low prices which they store at home and consume over the next few weeks. There is little personal interaction involved during purchasing and individual-level service is almost nonexistent. Purchasing from these stores involves various costs such as time-planning to visit the store, costs of driving and parking, and other in-store costs. However, organized retailers often offer lower prices. In contrast, a salient feature of the unorganized retailing environment is that family-run retailers operate on a small scale, with each store serving only several hundred households that reside in the vicinity of the store. The shopkeepers are closely familiar with the preferences of each household they serve and offer highly personalized service; in turn, these households are regular customers of the neighborhood stores. Due to budget and storage constraints, consumers purchase frequently and in small quantities (often multiple times a week, as need arises for a product). Under the coexistence of organized and unorganized retailers, a key trade-off for a consumer is purchasing from a small neighborhood store multiple times as and when uncertain demand is realized, or incurring larger transaction costs while making fewer trips and purchasing larger quantities from an organized retailer. If a consumer purchases a larger quantity, she also runs the risk that she may not want the entire purchase in the future because of uncertain demand, leading to either wastage or consumption with reduced utility. In addition, factors such as better service at unorganized retailers and consumers’ ability (or inability) to store products for future consumption also influence the choice of retailer and the quantity purchased. These demand-side factors influence the market-entry and pricing decisions of both unorganized and organized retailers. Most importantly, they determine how well unorganized and organized retailers will fare and how consumer welfare is affected, which will ultimately frame and inform policy debates in a country. In addition to the above, the marketing strategies of retailers are also influenced by cost-side factors. More specifically, the survival strategy of unorganized retailers will depend on nuances of the factors on the demand as well as supply side. In a market with multiple unorganized retailers, each retailer serves a part of the market and has to invest resources to maintain a store that has the capacity to serve all of its clientele. Developing economies are characterized by high population density and scarcity of real estate (especially in the urban areas where organized retailers are present). This makes it increasingly difficult for a small, family-run unorganized retailer to set up and manage a larger store to serve more people. This is because many of the recurrent costs of running a store, which act as fixed costs, are characterized by quantity premia, i.e., increasing per-unit cost with increased consumption (e.g., real estate rents in crowded urban areas and cost of electricity used). Proposed Methodology and Expected Contributions We construct a stylized mathematical model which captures the essential aspects of consumer behavior in emerging markets. We assume that consumers and multiple unorganized retailers are spatially distributed in a given geographical area. Each consumer considers purchasing from her nearest unorganized retailer, but incurs a per-unit-distance disutility (or transportation cost) if this retailer is not located at her ideal point. One organized retailer enters the market, and is located further away from the nearest unorganized retailer for any consumer. When a consumer purchases from the organized retailer, she incurs a constant and large disutility. This assumption reflects the fact that organized retailers have stores located in a central shopping area, and visiting this store requires incurring costs associated with advance planning, vehicular transportation, parking, and waiting in checkout lines. However, consumers obtain lower prices at the organized retailer To capture the phenomenon of bulk purchasing by consumers from the organized retailer, we consider a two-period model for consumer demand. In Period 1, each consumer needs to consume exactly one unit of the product. For Period 2, however, consumers are uncertain about their need, and a demand of one unit is realized with some probability. Every consumer has to make a trip to a retail store to purchase the product to be consumed in Period 1. For Period 2 consumption, she may make a second trip in Period 2 only if demand is actually realized. On the other hand, to avoid travel costs in Period 2, she may purchase a second unit for Period 2 consumption during her Period 1 trip (and risk letting this unit go to waste if need doesn't arise subsequently). To reflect the reality in developing countries, we assume that only a fraction of consumers in the market have the required storage/refrigeration capability and the budgetary capacity to purchase in bulk; the remaining consumers do not have the ability to make bulk purchases and must necessarily purchase as and when demand arises. For an unorganized retailer, we assume that there are two costs: a constant marginal cost of goods sold, and a fixed periodic cost (store rent, utility bills, payroll, etc.). The periodic cost increases with the market coverage of the unorganized retailer since a store that serves a larger clientele has to be larger. We assume that the fixed cost increases in a convex manner with the capacity of the store. This is an important and careful assumption, invoked to model the fact that urban areas in emerging economies are heavily congested and real-estate rental cost schedules and utility cost schedules are typically characterized by quantity premia. From this model, we investigate the factors that facilitate or hinder the growth of organized retailing in emerging economies, and derive implications for the impact on market prices and the profitability of local unorganized retailers. Our theoretical analysis will help us understand various substantive issues, such as: 1. What is the impact of organized retailing on unorganized retailers' profitability? Our model allows us to understand the strategic incentives facing the organized retailer to enter a market as well as the strategic incentives facing the unorganized retailers to resist entry. The conventional view is that the entry by the organized retailer will lead to greater price competition. In contrast, our preliminary analysis suggests that the entry by the organized retailer triggers the exit of a fraction of the unorganized retailers leading to an increase in prices charged by the remaining unorganized retailers. 2. Why do organized retailers expand more rapidly in some emerging economies but less so in other developing countries? Our objective in this research is to go beyond the usual explanation of countryspecific deregulation policies and look at the organized retailers’ strategic incentives to enter and expand in a market based on factors such as differences in consumer characteristics, degree of retail competition and infrastructure in the economy. Our preliminary results show that as the retail market expands, unorganized retailers may gain a larger share in a growing market, while at the same time this may not necessarily imply that organized retailers are not faring well. Note that this has been observed in India (Kohli and Bhagwati 2012); this observation perplexed retail analysts and our model provides an explanation. 3. What actions can the unorganized retail sector as well as policy makers take to alleviate the possible unfavorable impact of entry by organized retailers? Our model sheds light on the influence of government policies on creating special economic zones for organized retail activities and the impact of policies influencing growth of the retail sector on the coexistence of these two types of retail formats. To empirically test our theoretical findings, we also plan to collect data (the specifics of which we will decide based on our exact theoretical findings). Since the data required by us are unlikely to exist, we will have to syndicate this data collection, which is an expensive and time-consuming task. At this time, we are considering such data collection in India as well as China, and exploring avenues for the data collection. References • A.T. Kearney Report. 2006. Selling the World on Modern Retail. Vol. IX (1) 63-66. • Kohli, Rajeev and Jagdish Bhagwati. 2012. Organized Retailing in India: Issues and Outlook. Working paper, Columbia University. • McKinsey Global Institute 2008. India's urban awakening: building inclusive cities, sustaining economic growth," April 2008.