Ronald K. Drucker, et al. v. Just for Feet, Inc., et al. 97-CV

advertisement

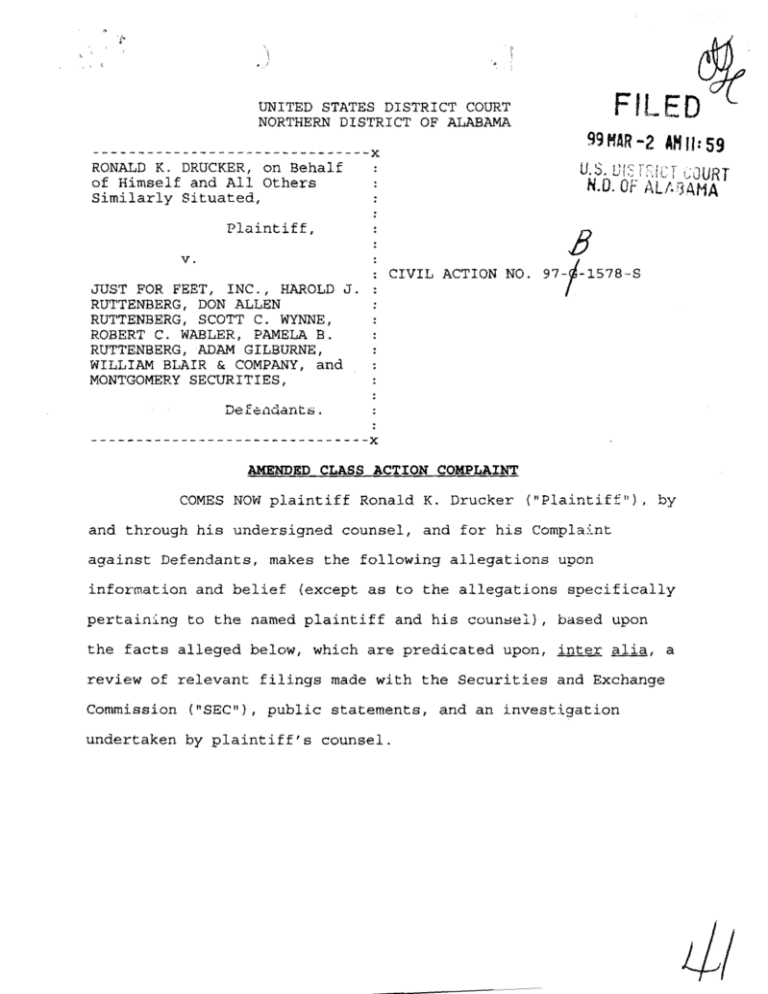

ipt) FILED UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ALABAMA fr 99 tiAR -2 AN 11 : 59 RONALD K. DRUCKER, on Behalf of Himself and An Others Similarly Situated, Plaintiff, : u1:5, C T UR T N.D. OF ALAMA 5A • 19 V. : CIVIL ACTION NO. 97- -157B-S JUST FOR FEET, INC., HAROLD J. : RUTTENBERG, DON ALLEN • RUTTENBERG, SCOTT C. WYNNE, ROBERT C. WABLER, PAMELA B. • RUTTENBERG, ADAM GILBURNE, WILLIAM BLAIR & COMPANY, and MONTGOMERY SECURITIES, Defendants. • - x AMENDED CLASS ACTION COMPLAINT COMES NOW plaintiff Ronald K. Drucker ("Plaintiff"), by and through his undersigned counsel, and for his Complaint against Defendants, makes the following allegations upon information and belief (except as to the allegations specifically pertaining to the named plaintiff and his counsel), based upon the facts alleged below, which are predicated upon, inter alia, a review of relevant filings made with the Securities and Exchange Commission ("SEC"), public statements, and an investigation undertaken by plaintiff's counsel. 44/ NATURE OF THE ACTION 1. This is a class action on behalf of a class (the "Class") consisting of all persons, other than defendants, who purchased the common stock of Just For Feet, Inc. ("Just For Feet" or the "Company"), on or traceable to a public offering by the Company, that became effective on or about June 17, 1996. By that offering, the Company and the Individual Defendants (defined below) offered and sold, through the Underwriter Defendants (defined below), 1,950,000 shares of Just For Feet common stock at a price of $51.375 per share (post-split price of $34.25 per share l ) (the "Offering"). The Registration Statement and Prospectus (together, with all amendments thereto and documents incorporated therein, the "Prospectus"), filed and issued in connection with the Offering, was materially false and misleading. 2. The Prospectus highlighted the Company's operating results for the quarter ended April 30, 1996. The Company's reported financial results in the Prospectus were materially overstated because the Company used inappropriate accounting practices with respect to reporting pre-opening store costs. These inappropriate accounting practices had the effect of making the Company appear more profitable than it actually was. The Company's reported results for the fiscal years ending January 31, 1995 and January 31, 1994 (reported in the Prospectus, and A three-for-two Just For Feet common stock split was effectuated on October 15, 1996. Accordingly, references throughout this complaint will be made to "pre-split" and "postsplit" common stock prices, as appropriate. -2- : earlier) also were materially overstated because of these inappropriate accounting practices on pre-opening store costs. 3. For all these fiscal periods, the Company deferred pre-opening store costs until after the opening of a new store; at which time, the Company amortized those costs over the ensuing twelve month period. As described below, and as later acknowledged by the Company, this accounting treatment was inappropriate under the circumstances. 4. On March 18, 1997 -- after the Offering was successfully completed and two significant stock-for-stock acquisitions were consummated -- the Company announced that it . would change its method of accounting for these pre-opening store costs. In conjunction with this change in accounting. practice, the Company restated historic financial results for the first three-quarters of 1996, including a change in the first quarter for the cumulative effect of the change on periods prior to fiscal 1996. This restatement had a materially negative impact on the Company's previously reported results, which results the Company has now acknowledged were inaccurate. 5. As a result of the restatement, Just For Feet's net income and earnings per share were materially decreased by approximately 10 percent for the first fiscal quarter ended April 30, 1996, before taking into account the cumulative effect of the ----change on prior periods, and decreased 68 percent after taking into account the cumulative effect of the change on prior periods. -3- , 6. On March 18, 1997, when the Company formally announced its revision of financial results as a result of the change in accounting methods, Just For Feet's stock price closed down 44% from the Offering price, at $18.75 share. On June 27, 1997, Just For Feet's stock was at a low of $16.56 a share. 7. As a result of the use of this inappropriate method of accounting for pre-opening store costs, the financial statements presented by defendants in the Registration Statement and Prospectus were materially false and misleading. Plaintiffs and class members who purchased Just For Feet stock on or • traceable to the Offering were damaged. 'JURISDICTION AND VENUE • 8. The claims asserted herein arise under and pursuant to Sections al, 12(a) (2), and 15 of the Securities Act of 1933, as amended (the "Securities Act") [15 U.S.C. §§ 77k/ 771(a) (2) and 7701 and Section 8-6-19 of the Alabama Securities • Act, 8 Ala. Code § 8-6-1, et seq. 9. This Court has jurisdiction over the claims asserted in this Complaint pursuant to Section 22 of the Securities Act [15 U.S.C. § 77v] and 28 U.S.C. § 1367. 10. Venue is properly laid in this judicial district pursuant to Section 22 of the Securities Act. The majority of the acts and conduct complained of herein, including the dissemination of materially false and misleading information to the investing public, occurred in this District. Just For Feet maintains its corporate headquarters and principal place of business in this District and did so at all relevant times. -4- • 11. In connection with the acts and conduct alleged in this Complaint, defendants, directly or indirectly, used the means and instrumentalities of interstate commerce including, but not limited to, the mails, interstate telephone communications and the facilities of the NASDAQ National Market System, a national securities exchange. PARTIES 12. Plaintiff Ronald K. Drucker purchased 400 shares of Just For Feet common stock on or traceable to the Offering on June 17, 1996, pursuant to the Registration Statement and Prospectus, as described in the certification att.adaed hereto, and was damaged thereby. 13. Defendant Just For Feet is an Alabama corporation which was incorporated on September 14, 1977. The Company purports to be a superstore retailer of brand-name athletic and outdoor footwear. Just For Feet maintains its principal executive offices at 153 Cahaba Valley Parkway North, Pelham, Alabama, 35124. On or about June 17, 1996, pursuant to the Prospectus, Just For Feet offered approximately 800,000 shares of its common stock to the investing public, thereby receiving total proceeds from the Offering of approximately $41,104,000. 14. The individuals named as defendants herein (the "Individual Defendants"), at times material to the claims set forth herein, served as senior officers and/or directors of Just For Feet in the following positions: Name Position Harold J. Ruttenberg Chairman and Chief Executive Officer -5- . Don Allen Ruttenberg Executive Vice President and Secretary (formerly Vice President of Merchandising) Scott C. Wynne Executive Vice President (formerly Vice President of Operations) Robert C. Wabler Chief Financial Officer and Director Pamela B. Ruttenberg Retired Director Adam Gilburne 15. Vice President Defendant Harold J. Ruttenberg sold approximately 583,186 shares of Just For Feet stock in connection with the Offering, thereby receiving approximately $29,964,096 in proceeds. He also was a signatory to the Registration Statetent made effective June 17, 1996, in connection with the-Offering. Harold Ruttenberg is the husband of defendant Pamela Ruttenberg and the father of defendant Don Allen Ruttenberg. Harold J. Ruttenberg is also the beneficial owner of all shares held in trust in the name of defendant Pamela Ruttenberg. As described below, Pamela Ruttenberg sold 369;474 shares in the Offering. • . 16. Defendant Don Allen Ruttenberg sold approximately 7,941 shares of Just For Feet stock on the Offering, thereby receiving approximately $408,008 in proceeds. Don Allen Ruttenberg is the son of defendants Harold and Pamela Ruttenberg. 17. Defendant Scott C. Wynne sold approximately 7,941 shares of Just For Feet stock on the Offering, thereby receiving approximately $408,008 in proceeds. 18. Defendant Robert C. Wabler sold approximately 36,464 shares of Just For Feet stock on the Offering, thereby receiving approximately $1,873,520 in proceeds. Wabler was a -6- • E E E signatory to the Registration Statement made effective June 17, 1996, in connection with the Offering. 19. Defendant Pamela B. Ruttenberg sold approximately 369,474 shares of Just For Feet on the Offering, thereby receiving approximately $18,983,574 in proceeds. Patricia Ruttenberg is the wife of defendant Harold Ruttenberg and the mother of defendant Don Allen Ruttenberg. 20. Defendant Adam Gilburne sold approximately 40,700 shares of Just For Feet stock on the Offering, thereby receiving approximately $2,091,166 in proceeds. 21. In connection with and as part of t1L Offering, the Individual Defendants sold an aggregate 1,037,765 shares of Company stock, and received in the aggregate $53,320,365 as a result of the Offering. 22. Defendants William Blair & Company and Montgomery Securities (collectively, the "Underwriter Defendants"), acted as lead Underwriters on the Offering of Just For Feet's shares. The Underwriter Defendants were at all times material hereto, entities engaged in the business of investment banking, underwriting and selling securities to the investing public. The Underwriter Defendants were the lead underwriters of the Offering, for which they received substantial fees. Prior to the Offering, the Underwriter Defendants were required to and did conduct an investigation into the business, operations, prospects, financial condition and accounting and management control systems of Just For Feet, known as a "due diligence investigation." In the course of such investigation, the -7- . I j Underwriter Defendants would have obtained knowledge of the facts alleged herein if they had acted with reasonable care. At all relevant times, the Underwriter Defendants had a duty to promptly disseminate truthful and accurate information with respect to Just For Feet, which they failed to fulfill. PLAINTIFF'S CLASS ACT/ON ALLEGATIONS 23. Plaintiff brings this lawsuit pursuant to Rule 23(a) and (b)(3) of the Federal Rules of Civil Procedure, on behalf of a class (the "Class") consisting of all persons who purchased Just For Feet common stock on or traceable to the . Offering, through March 18, 1997, inclusive. Excluded from th. Class are the defendants named herein, members of the immediate family of each of the defendants, any person, firm, trust, corporation, officer, director or other individual or entity in which any defendant has a controlling interest or which is related to or affiliated with any of the defendants, and the legal representatives, agents, affiliates, heirs, successors-ininterest or assigns of any such excluded party. 24. This action is properly maintainable as a class action for the following reasons: a. The Class of investors for whose benefit this action is brought is so numerous that joinder of all Class members is impracticable. On or about June 17, 1996, a reported 1,950,000 shares of Jusu For Feet stock were sold in the Offering to hundreds, if not thousands, of investors. Members of the Class live throughout the United States. -8- b. There are questions of law and fact which are common to members of the Class and which predominate over any questions affecting only individual members. The common questions include, inter alia, the following: ;1) Whether the federal securities laws were violated by defendants' acts as alleged herein; • (2) Whether Alabama's securities laws were violated by defendants' acts as alleged herein; (3) Whether documents, including but not • limited to the Prospectus, filed with the SEC and disseminated to the investing public in connection with the OffeJ:ing, .• misrepresented material facts about the business, revenues, and financial condition of Just For Feet; and (4) The proper measure of the Class's damages. c. The claims of Plaintiff are typical of the claims of other members of the Class and Plaintiff has no interests that are adverse or antagonistic to the interests of the Class. d. Plaintiff is committed to the vigorous prosecution of this action and has retained competent counsel experienced in litigation of this nature. Accordingly, Plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class. e. Plaintiff anticipates that there will not be any difficulty in the management of this litigation as a class action. -9- ) 25. The names and addresses of the record purchasers of shares of Just For Feet common stock to the Offering are available from Just purchased on or traceable For Feet and its agents, including the Underwriter Defendants. Notice can be provided to such record owners by a combination of published notice and first-class mail using techniques and a form of notice similar to those customarily used in class actions arising under the federal securities laws. 26. For the reasons stated herein, a class action is superior to other available methods for the fair and efficient , . adjudication of this action and th claims asserted herein. Because of the size and complexity of the claims of individual Class members, few, if any, Class members could afford to seek . legal redress individually for the wrongs complained of herein. PRE-OFFERING EVENTS 27. Just For Feet offered stock to the investing public for the first time in an initial public offering in March of 1994. 28. In its Form 10-K for the 1995 fiscal year ended January 31, 1996, which was released on May 1, 1996, and incorporated into the Prospectus by reference, the Company described its method for accounting for pre-opening store costs as follows: Store Pre-Opening Costs - costs principally for pre-opening employee salaries and travel are capitalized and amortized over the twelve months following the store opening. Such capitalized costs are incremental and directly attributable to the opening of a new store. At January 31, 1996 and 1995, unamortized pre-opening costs aggregated -10- $3,307,000 and $1,201,000 respectively, and are included in other current assets. 29. The accounting method utilized by Just For Feet materially overstated net income and was inappropriate based on Just For Feet's factual circumstances. It is standard practice that pre-opening store costs should be expensed as incurred. There is a limited exception to this practice whereby a company can amortize or otherwise defer incremental pre-opening costs if the company has a demonstrated history of successful store openings, such that the chance for success of a new store is determined to be a reasonable certainty. When Just For Feet first implemented its accounting practice of deferring preopening expenses, the Company had little or limited history of successful store openings. Accordingly, Just For Feet was required to expense pre-opening store costs, which it did not do. THE OFFERING 30. On June 3, 1996, a Form S-3 Registration Statement was filed with the SEC announcing a public offering of 1,897,500 shares of Just For Feet common stock, of which the Individual Defendants would be selling 1,150,000 shares, the Company would be selling 500,000 shares and an overallotment of 247,500 shares would be granted to the Underwriter Defendants. 31. On or about June 13, 1996, a Form S-3 Registration Statement was filed to register an additional 345,000 shares, of which the Individual Defendants would be selling 45,000 shares and the Company would be selling 300,000 shares. The Underwriter -11- ) Defendants were also granted a further overallotment of 45,000 shares. 32. On or about June 17, 1996, the Prospectus with respect to the Offering and which forms part of the Registration Statement became effective and Just For Feet and the Individual Defendants sold, through the Underwriter Defendants, common shares of Just For Feet for 33. $51.375 per 1,950,000 share. The Prospectus included numerous financial charts and reports on pages 5, 12, 14 and 16, all of which purported to reflect the financial position and results of the Company. In • particular the Prospectus highli91ited operating and financial results as follows: 4730/96 Year Ending Year Ending 1/31/95 1/31/96 Quarter ($1,000s) ($1,000s) ($1,000s) Gross Profit Operating Income Income Before Income Taxes $ Net Income 34. 23,871 50,850 20,753 4,770 11,628 4,405 5,146 14,558 5,363 3,218 9,722 3,473 The Prospectus also highlighted operating and financial results for fiscal years 1995 and 1994, stating that net sales had increased $63.4 million or 113t for fiscal $119.8 million, compared to net sales of $56.4 million 1995 to for fiscal 1994. The Prospectus stated that net income increased to $9.7 -12- million in fiscal 1995 from $3.2 million in fiscal 1994, "representing a 203.1% increase over the prior period." • 35. SUBSEQUENT EVENTS On or about March announccd that it had acquired 18, 1997, Just For Feet Imperial Sports, a privately held Flint, Michigan, athletic shoe and apparel retailer, for between $25 to $30 million in Just For Feet common stock. The Company . • also announced that it had acquired- Athletic Attic, a privately held Gainesville, Florida, athletic shoe and apparel retailer, for $9.2 million in cash and $5 million in Just For Feet common -stock. 36. That same day, Just For Feet announced that it was restating its previously reported earnings for the first three fiscal quarters of its fiscal year 1996 (the year ending January 31, 1997) to reflect a change in its accounting method for pre- opening expenses, including the first quarter results which were highlighted in the Prospectus. The Company acknowledged that it was necessary to restate earnings for those quarters to reflect pre-opening expenses being expensed immediately upon the opening of a new store in accordance with Generally Accepted Accounting Principles ("GAAP"). Including the cumulative effect of this accounting restatement on the Company's previously reported financial results, net income for the fiscal quarter ended April 30, 1996, was reduced to $1.1 million (from the previously reported $3.5 million included in the Prospectus), and earnings per share were reduced to $0.04 per share (from $0.19 reported in the Prospectus). Without considering the cumulative effect of -13- • the restatement on prior period results, the accounting restatement for the quarter alone reduced net income and earnings per share by almost 10 percent. 37. Neither extenuating circumstances nor unantici- pated facts arose between the date of the Offering and the announcement on March 18, 1997, which would have caused the Company to reconsider its accounting position. 38. The price of the Company's common stock -- which was at a pre-split price of $51.375 per share in June of 1996 (a post-split price of $34.25 per share) -- declined sharply to close at a post-split price of $18.50 pe . . c shar (..) 1 . i March 18, 1997, representing an approximate forty-four (44%) percent decline from the price of the stock in the Offering. On June 27, 1997, Just For Feet's stock was at a low of $16.56 a share. 39. Plaintiff, and other members of the Claso, purchased or otherwise acquired Just For Feet common stock on or traceable to the Offering. JUST FOR FEET'S FALSE AND MISLEADING FINANCIAL STATEMENTS 40. In the Prospectus and the documents incorporated therein by reference, Just For Feet represented that its financial statements were prepared in accordance with GAAP. This representation was materially false and misleading for the reasons noted below. GAAP are those principles recognized by the accounting profession as the conventions, rules, and procedures necessary to define accepted accounting practice at a particular time. Regulation S-X [17 C.F.R. § 210.4-01(a)(1)] provides that -14- • financial statements filed with the SEC that are not prepared in conformity with GAAP are presumed to be misleading and inaccurate. 41. As set forth in Financial Accounting Standards Board ("FASE") Statement of Concepts ("Concepts Statement") No. 1, one of the fundamental objectives of financial reporting is that it provide accurate and reliable information concerning an entity's financial performance during the period being presented. Concepts Statement No. 1, • • 1 42, states: Financial reporting should provide information about an enterprise's financial performance during a period. Investors and creditors often use information about the past to help in assessing the prospects of an . enterprise. Thus, although investment and credit decisions reflect investors' and creditors' expectations about future enterprise performance, those expectations are commonly based at least partly on evaluations of past enterprise performance. 42. Just For Feet's financial statements for the years ended January 31, 1996 and 1995 and quarter ended April 30, 1996, were materially false and misleading because the Company improperly failed to expense its pre-opening store costs as required by GAAP. The failure to expense such costs materially distorted the Company's reported financial performance contained in the Prospectus. 43. By virtue of its March 18, 1997 restatement of the Company's financial statements contained in the Prospectus, Just For Feet admitted that its previously applied accounting method for pre-opening costs was improper based on the Company's particular facts and circumstances. The restatement of Just For -15- Feet's Condensed Consolidated Statement of Income, for the quarter ended April 30, 1996, as reflected in the following . chart, evidences the magnitude of defendants' accounting . . manipulation: As Reported As Restated ($1,000s) ($1,000s) • % overstated (understated) Pre-opening costs 1,044 1,508 (30.8)%. Operating Income 4,405 3,941 11.8 -% Income Before Income Taxes 5,363 4,899 9.5 Net Income 3,473 3,175 9.4 % 44. Ii addiLioii Lo-Lhe above, the resLaLuLaeuL ot Jusi. - For Feet's financial statements for the quarter ended April 30, 1996 included a $2,040,000 million charge for the "Cumulative effect on prior years (to January 31, 1996) of change in accounting principle, net of income taxes". This charge, taken in the first quarter of fiscal 1996, represents the cumulative effect of the change in the Company's policy of accounting for pre-opening score costs for financial reporting periods prior to February 1, 1996. Accordingly, Just For Feet also admitted that its financial statements for its fiscal years prior to fiscal 1996 were materially false and misleading. 45. A comparison of Just For Feet's retained earnings at January 31, 1996 and the amount of the "cumulative effect" charge demonstrates the extent to which Just For Feet's financial -16- - results prior to February 1, 1996 were misstated. 2 Just For Feet's retained earnings balance at January 31, 1996 totalled approximately $17.62 million. Accordingly, the Company's $2,040,000 charge, during the first quarter of 1996, effectively eliminated 11.5t of the earnings just For Feet accumulated since its inception. 46. GAAP generally provides that an adopted accounting policy not be changed unless the change is justifiably preferable. For example, the Accounting Principles Board ("APB") Opinion No. 20, provides that: . [Mere is a presulaption that an accounting principle once adopted should not be changed in accounting for events and transactions of a similar type. Consistent use of accounting principles from one period to another enhances the utility of financial statements to users by facilitating analysis and understanding of comparative financial data. The presumption that an entity should not change an accounting principle may be overcome only if the enterprise justifies the use of an alternative acceptable accounting principle on the basis that it is preferable (emphasis added). • - - 47. - The SEC, in Regulation S-X [17 C.F.R. § 210.10- 01(b)(6)1 requires public companies that make a material change in its method of accounting to indicate the date of the change and the reason therefore. In addition, Regulation S-X [17 C.F.R. § 210.10-01(b)(6)] also requires that a company's independent accountant file a letter with the SEC stating whether or not the change in the company's accounting policy is preferable. 2 Generally, retained earnings are the accumulated earnings of a corporation since its inception, less dividends. As of January 31, 1996, Just For Feet had not issued a dividend. -17- • 48. On March 18, 1997, Just For Feet announced a change in its policy of accounting for pre-opening store costs. Neither extenuating circumstances nor unanticipated facts arose between the date of the Offering and the announcement on March 18, 1997, which would have caused the Company to reconsider its accounting position. 49. In its audited financial statements for the year ended January 31, 1997, Just For Feet disclosed: • Effective February 1, 1996, the Company changed it method of accounting for store opening costs, which are costs principally for pre-opening employee salaries and travel that are Incremental and directly attributable to the opening of a new store. The cumulative effect of this change in accounting principle resulted in a $2,040,700 ($0.07 per share) charge to operations for the year ended January 31, 1997, net of income taxes of $1,136,600. This change increased operating expenses for the year ended January 31, 1997 by approximately $5,081,000 and decreased income before cumulative effect of the change in accounting principle by approximately $3,277,400 ($0.11 per share) Under the new accounting principle, the Company charges store opening costs to operations in the month the store opens. Previously, store opening costs were capitalized and amortized over twelve months following the store opening. At January 31, 1997 and 1996, capitalized store costs of $623,500 and $3,307,000 are included in other assets of the accompanying balance sheets. 50. Just For Feet did not disclose the justification for the change in its policy of accounting pre-opening store costs, even though such disclosure was required by GAAP and the rules and regulations of the SEC. The necessary disclosures were -18- . . ) not made because the Company would have otherwise had to admit expressly that its previous accounting policy that deferred and amortized new store pre-opening costs had been improper. 51. The Prospectus highlighted the Company's financial performance during its 1995 and 1994 fiscal years and the quarter ended April 30, 1996. In preparing the financial statements which reported the Company's financial performance during these periods, Just For Feet accounted for its pre-opening store costs by deferring the recognition of such costs until the time that the new store was opened. Upon the opening of the store, Just For Feet ratably- amortized the deferred pl-e-opening store costsassociated with the store against income over a twelve month period. Until amortized; the pre-opening store costs were reported as "Other current assets" in the Company's financial statements. This accounting treatment for pre-opening store costs was improper. 52. GAAP generally defines an asset as a probable future economic benefit obtained or controlled by a particular entity as a result of a past transaction. Concepts Statement No. 6, 11 25. Paragraph 28 of Concepts Statement No. 6 indicates that an essential characteristic possessed by all assets is "service potential" or "future economic benefit". This "service potential" or "future economic benefit" eventually results in net cash inflows to the enterprise. 53. Paragraph 175 of Concepts Statement No. 6 provides that uncertainty about the capacity of a transaction to provide -19- ° ) future economic benefits may preclude its recognition as an asset. 54. Accordingly, the deferral of store pre-opening costs as an asset to be expensed at a later date is only acceptable in limited circumstances. For example, SEC Accounting and Auditing Enforcement Releases provide that pre-opening costs may be deferred if: 1) the costs are identifiable and segregated from ordinary operating expenses; 2) the costs provide a quantifiable benefit to a future period; and 3) the costs deferred as assets are recoverable from future revenues. . . 55. Accordingly, a company tay riot appropriately defer a pre-opening cost as an asset unless, among other things, it has a sufficient history of successful store openings demonstrating that the likelihood of recovering deferred pre-opening costs from the future revenues of store is reasonably certain. 56. Just For Feet's operating results, as reported in the Prospectus, were materially false and misleading because the Company failed to expense its pre-opening store costs as required because: 1) several of its new stores were not profitable; 2) its experience to date gave no reason to believe stores opened outside of Just For Feet's core markets would be profitable; and 3) and Just For Feet had little or limited history of successful store openings. In fact, the Prospectus itself contained disclosures which demonstrated that the deferral of pre-opening store costs was improper. Thus, the Prospectus specifically acknowledged that Just For Feet "has a limited history of opening and operating superstores." (Page 8) The Prospectus also -20- . ; represented, on page six, that "It]here can be no assurance that the Company's new or acquired stores will be profitable or achieve sales and profitability comparable to the Company's existing stores." Lastly, the Prospectus represented, on page eight, that "[t]he comparable store base used for the calculation of comparable store data currently consists of only 1'6 stores. The results achieved to date by the Company's relatively small store base may not be indicative of the results that may be - achieved from a larger number of stores. (Emphasis added.)" "-Jiven Just For Feet's admissions about its "limited history of • - opening and opelating superstores," the material uncertaicity - — about profitability and its existing "relatively small store base," there was reasonable uncertainty about the Company's ability to recovery pre-opening store costs. • • 57. Accordingly, Just For Feet was required to expense its pre-opening store costs because such costs did not meet the definition of an asset for which the recoverability of such costs from future store revenues was reasonably uncertain. Nonetheless, Just For Feet's Prospectus and its financial statements materially distorted the Company's operating results by improperly failing to expense its pre-opening store costs. Although Just For Feet has now admitted that the financial statements included in its Prospectus were materially false and misleading, the defendants' failure to justify the reason for the change in its policy of accounting for its store pre-opening costs evidences the impropriety of the Company's accounting for -21- • • such costs during the period between the Offering and March 18, 1997, the date of the restatment. 58. GAAP also provides that financial statement errors result from mistakes in the application of accounting principles at the time the financial statements wore prepared. APE 20, 1 13. As noted above, Just For Feet, in deferring store preopening costs as assets, violated GAAP by misapplying the application of an accounting principle. Thus, Just For Feet's financial statements for the quarter ended April 30, 1996 were erroneous and its restated financial statements should have fully disclosed the nature of the error contained in its prior • financial statements. 59. As a result of the foregoing, Just For Feet's financial statements included in its Prospectus were materially false and misleading. In addition to the accounting improprieties noted above, the Company presented the financial statements in its Prospectus in a manner which also violated at least the following provisions of GAAP: (a) The concept that financial reporting should provide information that is useful to present and potential investors and creditors and other users in making rational investment, credit and similar decisions (Concepts Statement No. 1, 1 34); (b) The concept that financial reporting should provide information about the economic resources of an enterprise, the claims to those resources, and the effects of -22- , transactions, events and circumstances that change resources and claims to those resources (Concepts Statement No. 1, 1 40); (c) The concept that financial reporting should provide information about how management of an enterprise has discharged its stewardship responsibility to owners (stockholders) for the use of enterprise resources entrusted to it. To the extent that management offers securities of the enterprise to the public, it voluntarily accepts wider responsibilities for accountability to prospective investors and to the public in general (Concepts Statement No. 1, 1 50); (d) The concept that financial reporting should . provide information about an enterprise's financial performance during a period. Investors and creditors often use information about the Past to help in assessing the prospects of an enterprise. Thus, although investment and credit decisions reflect investors' expectations about future enterprise performance, those expectations are commonly based at least partly on evaluations of past enterprise performance (Concepts Statement No. 1, 1 42); (e) The concept that financial reporting should be reliable in that it represents what it purports to represent. The fact that information should be reliable as well as relevant is a notion that is central to accounting (Concepts Statement No. 2, Ili 58-59); (f) The concept of completeness, which means that nothing is left out of the information that may be necessary to -23- , ensure that it validly represents underlying events and conditions (Concepts Statement No. 2, 79); and (g) The concept that conservatism be used as a prudent reaction to uncertainty to try to ensure that uncertainties and risks inherent in busincss situations are adequately considered. The best way to avoid injury to investors is to try to ensure that what is reported represents what purports to represent (Concepts Statement No. 2, 11 it 95, 97). COUNT . . .• [Against All Defendants For Violations Of Section 11 Of The Securities Act] . 60. Plaintiff repeats and realleges each and every allegation contained above. 61. • This Count is brought by Plaintiff for himself and on "nehalf of the Class pursuant to Section 11 of the.SecUritieS Act, 15 U.S.C. 77k, against all defendants and does not sound in fraud. 62. The Registration Statement for the Offering was inaccurate and misleading, contained untrue statements of material facts, omitted to state other facts necessary to make the statements made not misleading, and concealed and failed to adequately disclose material facts as described above_ 63. The Company is the registrant for the Offering. The defendants named herein were responsible for the contents and dissemination of the Prospectus. -24- • , herein alleged, each defendant violated, and/or controlled a person who violated, Section 11 of the Securities Act. 68. Plaintiff and other members of the Class acquired shares of Just For Feet pursuant to, or traceable to, the Prospectus and were legally entitled to receive a copy of the Prospectus. 69. Plaintiff and the Class have sustained damages. The value of Just For Feet shares was inflated and has declined substantially subsequent to and due to defendants' violations. 70. At the times they purchased Just For Feet shares, Plaintiff and the other members of the Class were without knowledge of the facts concerning the wrongful conduct alleged herein and could not have reasonably discovered those facts prior to March 18, 1997. Less than one year elapsed from the time that Plaintiff discovered or reasonably could have discovered the facts upon which this complaint is based to the time that Plaintiff commenced this Action. Less than three years elapsed from the time that the securities upon which this Count is brought were bona fide offered to the public to the time Plaintiff commenced this Action. COUNT II [Against All Defendants For Violations Of Section 12(a)(2) Of The Securities Act] 71. Plaintiff repeats and realleges each and every allegation contained above. 72. This Count is brought by Plaintiff for himself and on behalf of the Class pursuant to Section 12(a) (2) of the -26- Securities Act, 15 U.S.C. § 77k, against all defendants and does not sound in fraud. 73. Defendants were sellers, offerors, and/or solicitors of sales of the shares offered pursuant to the Prospectus. 74. The statements complained of herein, identified above, were each made or incorporated in a "prospectus" as that term is defined in Section 2(a)(10) of the Securities Act, contained untrue statements of material facts, omitted to state other facts necessary to make the statements made not misleading, and concealed and failed to disclose material facts. The defendants sold and/or solicited the sale of shares of Jut For Feet common stock in the Offering for their personal financial gain. Their actions of solicitation included participating in the preparation of the false and misleading Prospectus and other materials used in the sale of Just For Feet common stock identified above. 75. The defendants owed to the purchasers of Just For Feet shares, including Plaintiff and the other members of the Class, the duty to make a reasonable and diligent investigation of the statements contained in the Offering materials, including the Prospectus contained therein, to insure that such statements were true and that there was no omission to state a material fact required to be stated in order to make the statements contained therein not misleading. The defendants knew of,. or in theexercise of reasonable care, should have known of, the -27- - misstatements and omissions contained in or left out of the Offering materials as set forth herein. 76. The defendants sold and/or solicited the sale of the Company's common stock offered pursuant to the Prospectus for their individual financial gain. 77. The Individual Defendants and the Company solicited Plaintiff and the other Class Members for the sale of Just For Feet common stock in the Offering by, among other things, employing the Underwriter Defendants. 78. Plaintiff and the other members of the Class purchased or otherwise acquired Just For Feet shares pursuant to, or traceable to, the Prospectus. Plaintiff and the other'members of the Class did not know, or in the exercise of reasonable diligence could not have known, of the untruths, omissions and materially false and misleading statements contained in or made in connection with the Prospectus. 79. By reason of the conduct alleged herein, these defendants violated, and/or controlled a person who violated, § 12(a)(2) of the Securities Act. Accordingly, Plaintiff and the members of the Class who hold Just For Feet shares purchased in the Offering have the right to rescind and recover the consideration paid for their Just For Feet shares and, hereby elect to rescind and tender their Just For Feet shares to the defendants sued herein. The members of the Class who have sold their Just For Feet shares are entitled to rescissory damages. 80. Plaintiff, individually and representatively, on behalf of all members of the Class who continue to own such -28- securities, hereby offers to tender to defendants those securities which he and the other members of the Class continue to own, in return for the consideration paid for those securities together with interest thereon. 81. Less than three years elapsed from the time that the securities upon which this Count is brought were sold to the public to the time of the filing of this action. Less than one year elapsed from the time when Plaintiff discovered or reasonably could have discovered the facts upon which this Count is based to the time of the filing of this action. COUNT III [Against The Individual Defendants For Violations of Section 15 of the Securities Act] 82. Plaintiff repeats and realleges each and every allegation contained above. 83. This Count is brought by Plaintiff for himself and on behalf of the Class pursuant to Section 15 of the Securities Act, 15 U.S.C. § 77o, against the Individual Defendants and does not sound in fraud. 84. Just For Feet is liable as an issuer under Section 11 of the Securities Act as set forth in Count I herein and under Section 12(a)(2) of the Securities Act as a seller or solicitor of Just For Feet common stock, as set forth in Count II herein. 85. Each of the Individual Defendants was a control person of Just For Feet by virtue of their positions as directors and/or as senior officers of Just For Feet. Furthermore, the Individual Defendants each had a series of direct and/or indirect -29- business and/or personal relationships with other directors and/or major shareholders of Just For Feet. By virtue thereof, they were able to and did, directly or indirectly, in whole or in material part, control the content of public statements issued by or on behalf of the Company including the Registration Statement and the Prospectus filed by Just For Feet with the SEC in connection with the Offering, which they either signed in their capacities as officers or tacitly approved by virtue of their participation in the sale of Just For Feet common stock in the Offering. By reason of their positions with the Company, the Individual Defendants had access to internal Company documents, reports and other information, including the adverse non-public information concerning the Company's business and future prospects, and attended management and/or board of director meetings at which such subjects were discussed. 86. As a result, the Individual Defendants are liable to Plaintiff and the other members of the Class under Section 15 of the Securities Act for Just For Feet's primary violations of Sections 11 and 12(a)(2) of the Securities Act. COUNT IV (Against All Defendants For Violations Of Section 8-6-19 Of The Alabama Securities Act] 87. Plaintiff repeats and realleges each and every allegation contained above. 88. This Count is brought by Plaintiff for himself and on behalf of the Class pursuant to Section 8-6-19 of the Alabama -30- Securities Act against all defendants and does not sound in fraud. 89. The Registration Statement and Prospectus for the Offering was inaccurate and misleading, contained untrue statements of material facts, omitted to state other facts necessary to make the statements made not misleading, and concealed and failed adequately to disclose material facts as described above. 90. The Company is the registrant for the Offering. The defendants named herein were responsible for the contents and dissemination of the Registration Statement and the Prospectus. 91. As issuer of the shares, Just For Feet is strictly liable to Plaintiff and to the members of the Class for the misstatements and omissions. 92. Each of the Individual Defendants was a control person of Just For Feet by virtue of their positions as directors and/or as senior officers of Just For Feet. Furthermore, the Individual Defendants each had a series of direct and/or indirect business and/or personal relationships with other directors and/or major shareholders of Just For Feet. By virtue thereof, they were able to and did, directly or indirectly, in whole or in material part, control the content of public statements issued by or on behalf of the Company including the Registration Statement and the Prospectus filed by Just For Feet with the SEC in connection with the Offering, which they either signed in their capacities as officers or tacitly approved by virtue of their participation in the sale of Just For Feet common stock in the -31- Offering. By reason of their positions with the Company, the Individual Defendants had access to internal Company documents, reports and other information, including the adverse non-public information concerning the Company's business and future prospects, and attended management and/or board of director meetings at which such subjects were discussed. 93. As a result, the Individual Defendants are also liable to Plaintiff and the other members of the Class under Section 8-6-19 of the Alabama Securities Act for Just For Feet's primary violations of Section 8-6-19 of the Alabama Securities 94. As underwriters of the Offering, each of the Underwriter Defendants owed to the purchasers of the shares of Just For Feet, including Plaintiff and the other members of the Class, the duty to make a reasonable and diligent investigation of the statements contained in the Prospectus at the time it became effective, to ensure that said statements were true and that there was no omission to state a material fact required to be stated in order to make the statements contained therein not materially false and misleading. The Underwriter Defendants knew, or in the exercise of reasonable care, should have known of the material misstatements and omissions contained in or left out of the Prospectus as set forth herein. As such, the Underwriter Defendants are liable to Plaintiff and the other members of the Class. 95. None of the defendants named herein made a reasonable investigation or possessed reasonable grounds for the -32- -- belief that the statements contained in the Registration Statement and the Prospectus were true and without omissions of any material facts and were not misleading. 96. Defendants issued, caused to be issued and participated in the issuance of materially false and misleading written statements to the investing public which were contained in the Prospectus, which misrepresented or failed to disclose, inter alia, the facts set forth above. By reasons of the conduct herein alleged, each defendant violated, and/or controlled a person who violated, Section 8-6-19 of the Alabama Securities 97. Plaintiff and other members of the Class acquired shares of Just For Feet pursuant to, or traceable to, the Registration Statement and were legally entitled to receive a copy of the Prospectus. 98. Plaintiff and the Class have sustained damages. The value of Just For Feet shares was inflated and has declined substantially subsequent to and due to defendants' violations. 99. At the times they purchased Just For Feet shares, Plaintiff and the other members of the Class were without knowledge of the facts concerning the wrongful conduct alleged herein and could not have reasonably discovered those facts prior to March 18, 1997. Less than one year elapsed from the time that Plaintiff discovered or reasonably could have discovered the facts upon which this complaint is based to the time that Plaintiff commenced this Action. Less than three years elapsed from the time that the securities upon which this Count is -33- brought were bona fide offered to the public to the time Plaintiff commenced this Action. WHEREFORE, Plaintiff, on behalf of himself and the Class, pray for judgment as follows: A. declaring this action to be a plaintiff class action properly maintained pursuant to Rule 23 of the Federal Rules of Civil Procedure; B. awarding Plaintiff and the other members of the Class damages together with interest thereon; C. • awarding Plaintiff and the members of the Class rescission on Count II to the extent they still hold Just For Feet shares, or if sold, awarding rescissory damages in accordance with Section 12(a)(2) of the Securities Act; D. awarding Plaintiff and the members of the Class rescission on Count IV to the extent they still hold Just For Feet shares, or if sold, awarding rescissory damages in accordance with Section 8-6-19 of the Alabama Securities Act; E. awarding Plaintiff and the other members of the Class their costs and expenses of this litigation, including reasonable attorneys' fees, accountants' fees and experts' fees and other costs and disbursements; and F. awarding Plaintiff and the other members of the Class such other and further relief as may be just and proper under the circumstances. WHEREFORE, premises considered, plaintiff requests relief on all counts as specified herein above. -34- • _ JURY TRIAL DEMANDED Plaintiff hereby demands a trial by jury. Dated: March 2, 1999 LAW OFFICES OF M. CLAY RAGSDALE, ESQ. By: /4 r24C— M. Clay Ragsrle a E. Ans 1 Strickland ' Farley Building, Suite 550 1929 Third Avenue North Birmingham, Alabama 35203 (205) 251-4775 Liaison counsel For Plaintiff Robert P. Sugarman Joan T. Brown MILBERG WEISS BERSHAD HYNES & LERACH LLP One Pennsylvania Plaza 49th Floor New York, NY 10119 (212) 594-5300 Richard S. Schiffrin Andrew L. Barroway SCHIFFRIN & BARROWAY, LLP Three Bala Plaza East Suite 400 Bala Cynwyd, PA 19004 (610) 667-7706 Steven J. Toll COHEN, MILSTEIN, HAUSFELD & TOLL, P.L.L.C. 999 Third Avenue, Suite 3600 Seattle, Washington 98104 (206) 521-0080 -andLisa M. Mezzetti COHEN, MILSTEIN, HAUSFELD & TOLL, P.L.L.C. 1100 New York Avenue N.W. Suite 500 - West Tower -35- Washington, D.C. 20005 (202) 408-4600 Co-Lead Counsel For Plaintiff Alfred G. Yates, Jr. LAW OFFICES OF ALFRED G. YATES, JR. 519 Allegheny Building 429 Forbes Avenue Pittsburgh, PA 15219 (412) 391-5164 Richard Freese LANGSTON FRAZER SWEET & FREESE, P.A. Morgan Keegan Center 2900 Highway 280 Suite 240 Birmingham, Alabama 35223 (205) 871-4144 Co-Counsel For Plaintiff - -36- • , • . .. • • • • • 14AMSD PLAINTIFF CERTIFW.ATION W 15111aWslan.11UMALICCEICIMIAMI • . - Ronald IL Molar, ("Ploindr) dod gem, esto the deism aseeriset amar the ideal seentidss laws, dot • • • 1. Phietiffha reviewed the assindad is soden complaint sod =diorites Iii • • • 2. • Plaisdirdid not pardon the smoky Oar 011114110a1a miss attihe &Woe aphides coma! ar in ceder to path:limes in this pdeeto notion. - 3. Pheintiff mans to al 1 revalicatithg WAY as baling do deo, adobe provng tostiotony dtpasitiss sednini, if siossory. • • 4. tbilowe. Plaintiff's tnessectiog is Just For Past, Inc. thst is the whim &dal sodas is a Oxman -Stook Timmins Cie Perchsood 400 germ 647-96 • S. Daring the threnyeas pier to ths date edit Caiae. Plahniftbas sought is serve or saved a a represents* portray a dash. the islossigg minas tiled ander die *dorsi seserides lairE RONALD K. DRUCKER.% TWIPLAB CORPORATION, CIVIL AMON NO. SII .CV7423 U.S.D.0 E.D. N.Y. . 6. The Plaiseiff sill not accept any moan ler ars* us repressatative pay co Moira/the ohms *aid the Mild& pro Ma Owe ormei recovery, isceptasoll ressoesiis costs ad sepessas Crectudel; lost vows) dint* Midis to the repressetetioe ores dna as Geduld or apposed by the watt . • 1 &dors idr malty of perjury Oat **throwing is true aid coaeot. Rolinassi da .1999. Air of Wards lat • • Ion& L Moder ! . I • . 3 . • . .• • • _ TOTAL P.02

![[2012] NZEmpC 75 Fuqiang Yu v Xin Li and Symbol Spreading Ltd](http://s3.studylib.net/store/data/008200032_1-14a831fd0b1654b1f76517c466dafbe5-300x300.png)