Chapter 5 - rasco.name

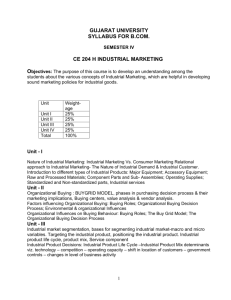

advertisement