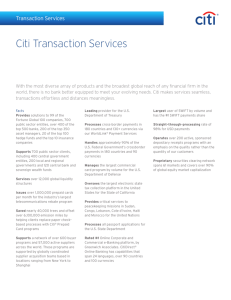

Citi UK PRA Regulated Legal Vehicles Pillar 3 Disclosures

advertisement