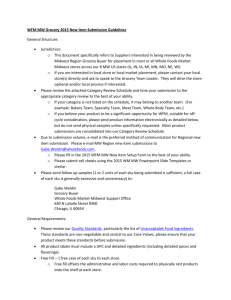

Presence News - Presence Marketing/Dynamic Presence

advertisement