indianapolis international airport tax impact study

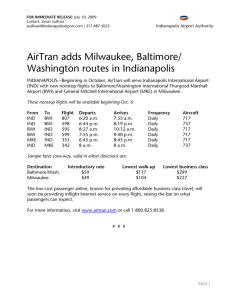

advertisement

Indianapolis International Airport Tax Impact Study table of contents Executive Summary....................................................................................1 Indianapolis Airport Authority – 2011 Principal Tax Type Revenues by Source Entity Category & Benefiting Jurisdiction................................2 Introduction................................................................................................3 Objectives of the Study.............................................................................4 Approach and Assumptions Used.............................................................4 Results of Study..........................................................................................7 Observations and Conclusions................................................................19 Appendix..................................................................................................20 Ameriplex and Park Fletcher Property Maps Executive Summary There have been a number of studies performed in recent years that attempt to quantify the nature and magnitude of the various financial benefits airports provide to the overall economy. Industry and regional studies provide high-level views of the economic activity and impacts airports generate, often in terms of numbers of employees, total annual wages and total direct and indirect spending. For instance, a recent 2010 study (released in 2012) finds that 10.5 million jobs, $365 billion in annual payroll and $1.2 trillion in annual economic output can be attributed to commercial airports. However, these studies do not typically translate the benefits to their effect on local communities. The economic benefit of an individual airport is not easily captured in a single measure, because of the variety of its activities and its broad and dispersed impact. This particular study examines the specific direct and indirect tax impacts on the State of Indiana and six local jurisdictions within Marion County (the Benefiting Jurisdictions) produced by Indianapolis International Airport (IND) and certain surrounding off-airport developments, the existence of which are greatly benefited by their proximity to IND. There is an incremental direct and indirect tax impact to other tax jurisdictions not analyzed in this study. More specifically, this study identifies a total of 186 businesses and organizations that comprise IND’s footprint and analyzes their combined economic impact on neighboring local communities and the State of Indiana in the form of the 10 most significant state and local tax revenues they generate. The resulting analysis reveals that these businesses and organizations annually generate more than $44 million in tax revenues for the Benefiting Jurisdictions. As an example, car rental agencies, logistics companies (including FedEx) and airlines—businesses most closely linked to the existence of IND—contribute more than 69% of the total $44 million in tax revenues. [See the diagram on the following page for a summary of these findings.] This study also finds that surrounding off-airport developments produce more than $12.5 million in real property taxes for some of the same aforementioned tax jurisdictions. When combined with the latter, this amounts to more than $56.5 million in annual tax benefits. Note that this study excludes the impact of the various other taxes generated by off-airport businesses. Overall, the observations in this study generally mirror the findings of industry and regional studies by demonstrating considerable economic impacts on a local scale. In other words, IND is the impetus behind certain positive economic impacts on surrounding populations; those stemming from the amount of tax revenues generated from airport and airport-related activities. In this context, it is important to mention that the operations of IND are not supported by any state and local taxes, but instead by rentals, fees and other charges from its tenants, concessionaires and customers. In fact, the economic activity occurring at IND and certain surrounding businesses actually generate substantial tax dollars that are then returned to local communities and the State of Indiana to be used to support the health, education and welfare of their respective populations. 2012 1 INDIANAPOLIS AIRPORT AUTHORITY – 2011 PRINCIPAL TAX TYPE REVENUES BY SOURCE ENTITY CATEGORY & BENEFITING JURISDICTION Aggregate Principal Tax Type Revenues Received from IND Entities $5,174,782 [Total = $44,943,938] $5,313,350 $13,186,633 $4,249,885 $12,585,965 SOURCE IND Entities $4,433,323 Income Tax COIT LOIT USE – Benefiting Jurisdictions County State Governments & IAA Airlines Income Tax COIT LOIT Personal Property Tax Services & Contractors Income Tax COIT LOIT Food/Beverage, Restaurant & Hotel Car Rental Sales Tax Auto Rental Excise Tax Marion County Excise Surtax Income Tax COIT LOIT Personal Property Tax Personal Property Tax Sales/Use Tax Income Tax COIT LOIT Food & Beverage Tax Innkeeper’s Tax Personal Property Tax Logistics Income Tax COIT LOIT Personal Property Tax $ State Marion County MSD Decatur Decatur Twp Aggregate Principal Tax Type Revenues Received by Benefiting Jurisdiction $21,594,616 $6,434,461 $7,231,993 $4,660,400 MSD Wayne Wayne Twp Capital Improvement Board [Total = $44,943,938] $241,223 $845,318 $3,935,927 2 Indianapolis International Airport Tax Impact Study Introduction There is no question: airports are drivers of economic development. In fact, airports can create a sizeable economic impact in thriving, growing communities in a time frame and breadth that is difficult to match using any other means. Generally, an airport’s direct economic impact comes in the form of jobs, wages, spending and tax revenues from businesses located at the airport, visitor spending at the airport and the airport’s own operations. Additionally, airports provide commerce and economic opportunities for businesses that are within close proximity to the airport. Finally, there is the intrinsic value received by individuals who utilize an airport’s facilities and services. Several studies issued in recent years provide confirmation of the economic impact of airports and also attempt to quantify such impact. In January 2012, a study entitled The Economic Impact of Commercial Airports in 2010, prepared for Airports Council International – North America was released. It summarized the contribution that 490 commercial airports in the United States make to the national economy. The analysis tabulated the economic contributions in terms of employment, annual payroll and annual output and concluded that, in the aggregate, commercial U.S. airports: • Support 10.5 million jobs • Create an annual payroll of $365 billion • Produce an annual economic output of $1.2 trillion The Aviation Association of Indiana (AAI) produces periodic studies of the economic impact of airports in Indiana. AAI has issued 12 studies since its first in 1984, with the most recent completed in 2007. This study addressed the value of economic benefits generated at airports in Indiana. Its conclusions are based on survey responses received from 47 of 73 publicly owned airports in Indiana and U.S. Department of Transportation public airport operating data. Summary findings of the study follow: • The total annual impact of direct and indirect airport economic activity on Indiana’s economy was estimated to be more than $5.2 billion. • Airports are responsible for bringing jobs to local communities. At the time of this study, Indiana airports accounted for more than 17,163 jobs and more than $640 million in direct wages. • In addition to the impact of direct airport expenditures (from the airport and airport tenants and lessees), the study identified indirect expenditures (off-airport expenditures resulting from the presence of an airport), as well as induced expenditures (dollar turnover due to airport spending—aka, the spending “multiplier effect”) impacting local communities as a result of airport spending. 3 Indianapolis International Airport Tax Impact Study Objectives of the Study While these and other studies provide a high-level view of the magnitude and trends of economic impacts produced by airports, few speak to the impact of individual airports, such as Indianapolis International Airport (IND), on their surrounding local communities. This study is therefore meant to provide some context as to the economic impact of IND on the local communities within which IND is located, as well as other affected regions. The economic benefit of an individual airport is not easily captured in a single measure because of its broad and dispersed impact. Therefore, rather than attempting to quantify multiple measures, this study is designed to primarily examine the direct economic impact of IND’s on-airport activity in terms of tax revenues generated. This study did not examine the numbers of jobs, operating expenditures, capital expenditures and other impacts, all of which would result in incremental tax benefits to the Benefiting Jurisdictions. Keep in mind that direct impacts are derived from economic activities that would largely not occur in the absence of the airport. This study will also examine the indirect economic impact provided by IND of real property tax revenues generated from surrounding business developments in Marion County, Indiana (Marion County), based on the assumption that such developments likely would not be present (at least in the same form or to the same extent) but for their location and/or economic dependency on IND. In other words, it is presumed the proximity of IND to certain local communities creates opportunities for economic development and impact. Note that taxes other than real property have been excluded from this portion of the study, since there are few independent sources of information from which data could be obtained to measure the tax impact generated by such surrounding developments. Approach and Assumptions Used Information in this report was derived primarily from the following procedures and resources: Initial Information Gathering: This phase of the study was designed to identify: (1) all airport tenants, concessionaires and lessees residing on airport grounds (collectively, IND Entities); (2) the most common and significant types of taxes the IND Entities collect and pay (collectively, Principal Tax Types); and (3) the tax authorities that substantially benefit from such taxes (collectively, Benefiting Jurisdictions). A total of 186 IND entities were identified, 10 principal tax types were selected, and seven Benefiting Jurisdictions were isolated for purposes of this study. In addition, the most prominent airport-related developments within Marion County that are contiguous to IND were identified for inclusion in this study. These include certain logistics companies (including a significant FedEx cargo operation) and other businesses that reside within the business parks of Park Fletcher and Ameriplex (collectively, Off-Airport Developments). Maps delineating the property areas comprising these Off-Airport Developments are provided in the Appendix to this study. Data Collection: In all cases, 2011 data were used to prepare this study. Publicly available sources of data were used whenever possible. Information was collected from a number of sources, including records of the Marion County Treasurer, Indiana Legislative Services Agency, Department of Local Government Finance, Indianapolis Airport Authority, Capital Improvement Board of Managers (of Marion County) and the Marion County Zoning Commission. 4 Indianapolis International Airport Tax Impact Study Property Taxes Property taxes levied for all governmental entities located within Marion County are collected by the Marion County Treasurer. On or before August 1 each year, the Marion County Auditor must submit to each underlying taxing unit a statement of (i) the estimated assessed value of the taxing unit as of March 1 of that year and (ii) an estimate of the taxes to be distributed to the taxing unit during the last six months of the current budget year. The estimated value is based on property tax lists delivered to the Marion County Auditor by the Marion County Assessor on or before July 1. Typically, property tax bills are mailed in April and October of each year and are due and payable by the property owners in May (spring) and November (fall), respectively. Taxes are distributed by the Marion County Auditor to the appropriate governmental entities by June 30 and December 31 of each year. Changes in assessed values of real property occur periodically as a result of general reassessments required by the State legislature, as well as when changes occur in the property value due to new construction, demolition or improvements. The next reassessment is scheduled to be effective as of the March 1, 2012 assessment date and affects taxes payable beginning in 2013. Reassessments are scheduled to occur every five years thereafter. The Marion County Zoning Commission website was used to determine the real property parcels that fall within the scope of this study. Concessionaire and lessee listings provided by the Indianapolis Airport Authority were used to obtain the listing of IND Entities. Real and personal property taxes levies were obtained through the Marion County and Indianapolis invoice Internet portal. This portal provides information regarding spring and fall tax installment billings to property owners. From these billings, the following information was collected: official name and address of taxpayer, property tax address, taxing district, gross assessed value of property, tax rate, gross tax liability, property tax cap savings, abatement/deduction applicable to property, actual property tax liability due and the gross portion of tax for each taxing authority. Income Tax Withholding Actual tax withholding amounts were obtained for the Indianapolis Airport Authority. For the airport-related businesses that operate at IND, there is no direct reporting of wage or income tax withholding amounts except to taxing jurisdictions. In consultation with the Indianapolis Airport Authority, two approaches were established as reasonable methods for determining the wage base of airport-related businesses used in estimating income tax withholding. If sales revenue amounts were available for an IND Entity, wages were estimated to be 25% of annual sales revenues generated. If sales revenue amounts were not available, the wage base was determined by multiplying the average wage of the IND Entity by the number of employees, as agreed by each reporting IND Entity and the Indianapolis Airport Authority. The wage base was reduced by 20%, in order to recognize that one of every five employees may not be a resident of Marion County. 5 Indianapolis International Airport Tax Impact Study Excise Taxes The Indiana Sales/Use Tax, Marion County Food and Beverage Tax, Marion County Innkeeper’s Tax, Indiana Auto Rental Excise Tax and Marion County Supplemental Auto Rental Excise Tax were calculated based upon sales revenues provided by the IND Entities to the Indianapolis Airport Authority. In addition, for IND Entities reporting a mix of services and sales of tangible personal property, industry averages of product sales to service ratios were used to calculate the amount of product sales and, in turn, the sales tax due on the sale of tangible personal property. The Indiana Gasoline Excise Tax and County Motor Vehicle Excise Surtax are based on information provided to the Indianapolis Airport Authority by on-airport car rental agencies; more specifically, the number of car rental transactions and number of vehicles in the car rental fleet, respectively. Analysis: Data information were not available for all IND Entities or all Principal Tax Types. Available information from public resources only captured data relating to 130 of 186 IND Entities. Although information may have been available for a certain tax type, information may not have existed for the same entity for another tax type. Also, certain taxes were not applicable to all entities. For instance, 101 of the 186 IND Entities reported personal property tax filings. However, included among those not reporting personal property were nine exempt governmental entities (including the Indianapolis Airport Authority) that are exempt from both real and personal property tax. Certain Off-Airport Developments also contain some governmental entities. Data were reviewed and tabulated in spreadsheets. Information was then analyzed and summarized by Principal Tax Type, Source Entity Category, i.e., car rental agencies, airlines, restaurants and bars, etc., and Benefiting Jurisdiction. 6 Indianapolis International Airport Tax Impact Study Results of Study Many businesses operate at IND delivering products and services to airlines and the flying public. Businesses collect and pay taxes as prescribed by State of Indiana laws and regulations. Individual taxes are also levied and distributed according to statutory direction. Direct Economic Impact from Tax Revenues Generated A review of 52 possible taxes impacting the IND Entities yielded the following 10 Principal Tax Types and the respective 2011 tax revenues generated from the IND Entities. 2011 Tax Revenues by Principal Tax Type Indiana Auto Rental Excise Tax $3,200,375 7.12% Marion County Supplemental Auto Rental Excise Tax $3,200,375 7.12% Marion County Food and Beverage Tax $486,930 1.08% County Income Tax Withholding $4,886,222 10.87% Indiana Gasoline Excise Tax $337,883 Marion County .75% Innkeeper’s Tax $248,622 .55% County Motor Vehicle Excise Surtax $15,000 .03% Indiana Income Tax Withholding $12,731,272 28.34% Indiana Sales/Use Tax $8,525,460 18.97% Personal Property Tax $11,311,799 25.17% 7 Indianapolis International Airport Tax Impact Study Each of the Principal Tax Types is described in more detail below. • Employers are required to withhold Indiana Income Tax at 3.4% from employees’ wages after applicable deductions. The tax is applied to the adjusted gross income, as defined under Indiana statutes, of all resident individuals and to the part of the adjusted gross income derived from sources within Indiana of all nonresident individuals. • Personal Property Taxes are imposed on certain types of personal property. Tangible personal property subject to assessment includes the following: office equipment, machinery and equipment, advertising devices, such as billboards located on real property not owned by the owner of the devices, and airplanes not subject to the Aircraft Excise Tax. Property tax payments are based on the net assessed value (AV) of property and tax rates. Business Personal Property Tax returns are filed annually. Before 2002, assessed value was equal to 33 1/3% of the true tax value of property. Currently assessed value equals 100% of true tax value. The Department of Local Government Finance reviews and certifies budgets, tax rates and levies of all Indiana political subdivisions. • The Indiana Sales/Use Tax is imposed on all retail transactions made in Indiana. The person acquiring property in Indiana is liable for the tax, but retail merchants are responsible for collecting the tax. The Indiana Sales/Use Tax is imposed, at the time of sale, on the amount of gross receipts received by the retail merchant. • The County Option Income Tax is imposed on the Indiana adjusted gross income of individual resident and nonresident county taxpayers of each county with the applicable rate varying by county. • Indiana Auto Rental Excise Tax is imposed on the rental of vehicles for periods of less than 30 days and weighing less than 11,000 pounds. The tax rate is 4% of rental charges. • Since 1997, a 2% Marion County Supplemental Auto Rental Excise has been imposed on the rental of certain passenger motor vehicles and trucks at a rate equal to 2% of the gross retail income received by a retail merchant for the rental. Certain exclusions apply. The Marion County Supplemental Auto Rental Excise Tax was increased in 2005 by an additional 2%. The tax rate imposed is 4%. • Since 1981, a 1% Marion County Food and Beverage Tax has been imposed on the gross retail income received by a retail merchant from any transaction within Marion County in which food or beverage is furnished, prepared or served. However, it does not apply to transactions exempt from Indiana Gross Retail Tax, as defined under Indiana statutes. The Marion County Food and Beverage Tax was increased in 2005 by an additional 1%. The tax rate imposed is 2%. • Indiana Gasoline Excise Tax is added to the selling price of gasoline. It is imposed on gasoline distributors, but is passed through to consumers. The current tax rate per gallon is $0.18. 8 Indianapolis International Airport Tax Impact Study Indianapolis International Airport Tax Impact Study • Since 1997, a 6% Marion County Innkeeper’s Tax has been levied on every person engaged in the business of renting or furnishing, for periods of less than 30 days, any lodgings in any hotel, motel, inn, tourist camp, tourist cabin or any other place in which lodgings are regularly furnished for a consideration. This tax is applied in addition to the Indiana Sales/Use Taxes imposed under these circumstances. The Marion County Innkeeper’s Tax was increased in 2005 by an additional 3% and again in 2009 by an additional 1%. • The County Motor Vehicle Excise Surtax is imposed on vehicles with a gross weight less than 11,000 pounds. Adopting counties may impose the Surtax at rates ranging between 2% and 10% or at a specific amount of at least $7.50 and not more than $25.00. While the number of Principal Tax Types may seem small, the number of tax paying entities is large. During 2011, tax revenues were levied, collected and paid by at least 130 IND Entities according to statutes governing their activities and locations. It is important to note that these 130 IND Entities produce economic benefits for their owners, employees and surrounding communities well beyond the impact of the tax revenues they generated. 2011 Principal Tax Types paid by the latter are summarized in the table below by Source Entity Category. Graphical presentations of the Principal Tax Types and number of IND Entities by Source Entity Category also follow. Source Entity Category Average Tax Dollar per Source Entity Category Total 2011 Taxes by Source Number of IND Entities $13,186,633 9 29.34% $1,465,181 Logistics 12,585,965 4 28.00% 3,146,491 Services 5,183,506 35 11.53% 148,100 Airlines 5,174,782 17 11.52% 304,399 Government 3,916,442 2 8.71% 1,958,221 Food/Beverage 2,412,166 21 5.37% 114,865 Retail 1,220,568 32 2.72% 38,143 Hotel 617,151 2 1.37% 308,576 Indianapolis Airport Authority 516,881 1 1.15% 516,881 Contractors 129,844 7 0.29% 18,549 Car Rental $44,943,938 130 Percentages 100.00% 9 Indianapolis International Airport Tax Impact Study 2011 Tax Revenues by Source Entity Category Hotel $617,151 Food/Beverage $2,412,166 Indianapolis Airport Authority $516,881 Retail $1,220,568 Contractors $129,844 Government $3,916,442 Airlines $5,174,782 Car Rental $13,186,633 Logistics $12,585,965 IND Entities by Source Entity Category Number of Entities 80 76 70 60 50 36 40 2 7 or ct ity on tra dp ls .A irp C tA or s 1 el H ot l ai et en t nm er G 7 1 2 ov ev er ag e ne rli Ai ic es 2 rv ic s st al Total IND Entities 8 4 Lo gi en t R ar 21 In 9 0 C 17 4 Se 10 32 22 R 9 Fo od /B 20 21 ut ho r 35 30 IND Entities with Reported Data 10 Indianapolis International Airport Tax Impact Study As noted previously, this study identified seven Benefiting Jurisdictions that are the primary recipients of the direct economic impacts that result from the tax revenues generated from existing IND Entities. A breakdown of the aggregate dollar impact on each Benefiting Jurisdiction of the Principal Tax Types included in this study follows. 2011 Tax Revenues by Benefiting Jurisdiction Capital Improvement Board $3,935,927 Wayne Township $845,318 Metropolitan School District of Wayne Township $241,223 Decatur Township $4,660,400 Marion County $6,434,461 State of Indiana $21,594,616 Metropolitan School District of Decatur Township $7,231,993 11 Indianapolis International Airport Tax Impact Study IND-based tax revenues may represent a very small portion of some Benefiting Jurisdictions’ total tax revenues or a significant portion of others. For instance, note below the impact of personal property taxes generated by IND Entities on the total property tax levies of applicable Benefiting Jurisdictions. Property Taxes by Benefiting Jurisdictions as a Percentage of 2011 Property Tax Levy 2011/Pay 2012 Personal Property Tax Revenues Benefiting Jurisdiction 2010/Pay 2011 Property Tax Levy Percentages $7,231,993 $22,851,961 31.65% Decatur Township 2,132,944 5,749,007 37.10% Marion County 1,656,351 862,776,181 0.19% 241,223 40,660,657 0.59% 49,289 19,806,309 0.25% $11,311,800 $951,844,115 Metropolitan School District of Decatur Township Metropolitan School District of Wayne Township Wayne Township As one might expect, Source Entity mix within a given Benefiting Jurisdiction largely determines the types of taxes that will be generated, as well as the direct economic impact resulting therefrom, as shown in the graphs that follow for each Benefiting Jurisdiction and in aggregate for all Benefiting Jurisdictions. State of Indiana - $21,594,616 $7,000,000 $337,883 $6,000,000 Income Taxes Sales/Use Taxes Excise Tax $- $544,065 Car Rental Logistics $3,341,380 $543,994 $1,000,000 $2,924,805 $2,000,000 $2,835,584 $3,000,000 $4,793,947 $4,000,000 $5,600,655 $5,000,000 $350,078 $322,225 Airlines Government Food/Beverage, Retail & Hotel Indianapolis Airport Authority Services & Contractors 12 Indianapolis International Airport Tax Impact Study Metropolitan School District of Decatur Township - $7,231,993 $4,000,000 Property Taxes $3,500,000 $3,000,000 $2,000,000 $2,968,417 $3,862,533 $2,500,000 $1,500,000 $1,000,000 $310,279 $54,115 $500,000 $- $36,649 Car Rental Logistics Airlines Food/Beverage, Retail & Hotel Services & Contractors Marion County - $6,434,461 $3,000,000 $861,212 $2,500,000 Income Taxes Property Taxes Excise Taxes $2,000,000 $145,542 $15,000 $10,716 $- Logistics $59,265 $202,133 $202,159 Car Rental $1,241,565 $500,000 $579,617 $1,000,000 $1,053,625 $1,781,296 $1,500,000 Airlines Government $162,600 $119,731 Food/Beverage, Retail & Hotel Indianapolis Airport Authority Services & Contractors 13 Indianapolis International Airport Tax Impact Study Decatur Township - $4,660,400 $3,000,000 $2,500,000 Income Taxes Property Taxes Excise Taxes $2,502,845 $2,000,000 $1,500,000 $500,000 $875,397 $1,139,076 $1,000,000 $5,444 $- $1,045 Car Rental $15,959 $9,204 Logistics $11,010 $1,044 Airlines $840 $91,500 $6,417 $619 Government Food/Beverage, Retail & Hotel Indianapolis Airport Authority Services & Contractors Capital Improvement Board - $3,935,927 $3,500,000 $3,000,000 Excise Taxes $2,000,000 $1,500,000 $3,200,375 $2,500,000 $1,000,000 $735,552 $500,000 $0 Car Rental Food/Beverage, Retail & Hotel 14 Indianapolis International Airport Tax Impact Study Wayne Township - $845,318 $800,000 $700,000 $600,000 Income Taxes Property Taxes Excise Taxes $400,000 $697,530 $500,000 $300,000 $- $4,181 Car Rental $855 $36,941 $25,675 $2,476 $36,835 Logistics $3,363 $21,789 $100,000 $4,180 $11,493 $200,000 Airlines Government Food/Beverage, Retail & Hotel Indianapolis Airport Authority Services & Contractors Metropolitan School District of Wayne Township - $241,223 $120,000 Property Taxes $100,000 $114,051 $80,000 $90,369 $60,000 $20,000 $0 $36,698 $40,000 $105 Car Rental Logistics Food/Beverage, Retail & Hotel Services & Contractors 15 Indianapolis International Airport Tax Impact Study In aggregate, one can see the significance of the tax revenue benefits produced for the Benefiting Jurisdictions from the operations of car rental agencies, logistics companies and airlines. Other businesses tend to not generate the same level of impact from a tax perspective. All Benefiting Jurisdictions - $44,943,938 $14,000,000 Income Taxes Property Taxes Excise Taxes Sales/Use Taxes $5,964,683 $10,000,000 $6,753,633 $12,000,000 $8,000,000 $698,313 $6,000,000 $80,895 $- $144,477 $751,450 Car Rental Logistics $4,615,037 $2,000,000 $2,924,805 $3,916,442 $4,423,431 $6,621,282 $4,000,000 $5,600,655 $735,552 $751,351 Airlines Government $445,051 Food/Beverage, Retail & Hotel Indianapolis Airport Authority $516,881 Services & Contractors 16 Indianapolis International Airport Tax Impact Study Real Property Tax Impact from Off-Airport Developments This section examines one of the more significant economic benefits impacting the Benefiting Jurisdictions. Certainly one may conclude that there are countless benefits to be derived from the collateral developments that often spring up around an airport, particularly in terms of jobs and local spending. These benefits often multiply in number and impact when an airport maintains a large cargo operation. IND is ranked the eighth largest cargo facility in the nation and 22nd in the world. Its ranking is derived primarily from being home to a major FedEx special hub for global operations. This and other factors combine to make IND an important contributor to central Indiana’s growing economy, especially in the life sciences, technology and logistics sectors. Therefore, it may be reasonable to conclude that much of the Off-Airport Developments are the result of a desire to be in close proximity to an airport cargo operation of this nature and magnitude. It may also be reasonable to conclude that, were it not for IND, some of the Benefiting Jurisdictions would not have been able to create (or at least would have had difficulty creating) the number of job opportunities that exist today within their locality, thus leading to fewer and lesser positive economic impacts. This study examines only one of these positive impacts: the impact on real property tax growth in the adjoining communities to IND from the previously defined Off-Airport Developments. While the incremental impact of such collateral development resulting from the existence of IND is difficult to quantify, the nature of the businesses that have grown up around IND seems to suggest that the airport is a significant driving force behind the establishment, growth and sustainability of the Off-Airport Developments. A graph of the number of business parcels and dollar amount of real property taxes generated within each Off-Airport Development is shown below. The Outer Ring Represents the 2011/Pay 2012 Real Estate Taxes 57 $5,836,291 Business Parcels $6,664,803 190 Ameriplex Park Fletcher 17 Indianapolis International Airport Tax Impact Study Of course, with the onset and evolution of these and other Off-Airport Developments, the real property tax base (among other positive economic impacts) within certain Benefiting Jurisdictions grows. The following tables provide a breakdown by Benefiting Jurisdiction of the real property tax revenues derived from Off-Airport Developments in 2011. Ameriplex Allocation of Property Taxes Decatur Township $1,139,879 Metropolitan School District of Decatur Township Marion County 3,722,579 973,833 $5,836,291 Park Fletcher Allocation of Property Taxes Wayne Township $1,692,276 Metropolitan School District of Wayne Township 3,450,203 Marion County 1,522,324 $6,664,803 The impact of real property taxes generated from Off-Airport Developments in Marion County is further apparent when presented as a percentage of each Benefiting Jurisdictions’ total property tax levy, as shown below. 2011 Pay/2012 Total Property Tax Revenues Tax Levy 2010 Pay/2011 Appropriations Percentage $1,139,879 $5,749,007 19.83% Metropolitan School District of Decatur Township 3,722,578 22,851,961 16.29% Wayne Township 1,692,276 19,806,309 8.54% Metropolitan School District of Wayne Township 3,450,203 40,660,657 8.49% Marion County 2,496,158 862,776,181 .29% Benefiting Jurisdiction Decatur Township 18 Observations and Conclusions Based on the analysis of the data gathered in connection with this study, a number of observations and conclusions can be drawn: • As reported in other studies, IND and other airports provide substantial economic benefit in a variety of forms. More specifically, this study demonstrates that IND and the companies and businesses located at IND annually provide more than $44 million in direct economic benefits in the form of state and local tax revenues to the State of Indiana and six local tax jurisdictions. This amount includes tax revenues that had readily available measures or that could be reasonably estimated. • Car rental operations and logistic companies (primarily FedEx) provide the largest direct economic impacts to the Benefiting Jurisdictions from tax revenues. Aside from income taxes, these businesses generate a substantial portion of all the Principal Tax Types identified in this study. • With the exception of the State of Indiana and Marion County, the Benefiting Jurisdictions receive direct economic impacts primarily from the personal property taxes and various excise taxes that are generated from the operations of the IND Entities, most notably, car rental agencies, logistics companies (primarily FedEx) and airlines. Other types of businesses produce far less impact on these same Benefiting Jurisdictions from a tax perspective. • The existence of IND has spurred incremental Off-Airport Developments that have provided economic impact to certain Benefiting Jurisdictions, including the generation of more than $12.5 million in real property tax revenues. While other surrounding Off-Airport Developments, such as the Plainfield (Indiana) Business Park, are not included in the scope of this study, it is appropriate to acknowledge that such developments are likely providing similar benefits to their local communities. • The amount of tax revenues generated within neighboring jurisdictions varies dramatically, both in amount and type. Tax revenues are generally “earned” according to the location of the transaction, the location where services are performed or the location of property. Therefore, the resulting tax benefit to a given Benefiting Jurisdiction is the result of combined effects of the size, nature and applicable tax laws, and is not based on the determination, participation or actions of IND or any of the IND Entities, except to the extent such entities choose to operate within a particular Benefiting Jurisdiction. • The overall tax impact of IND is substantial. While it is difficult to assess what the tax impact on Benefiting Jurisdictions would be without the existence of IND, it may be fair to assume that few of the logistics, car rental and airline companies would reside within these Benefiting Jurisdictions. IND is the nation’s eighth largest cargo facility. Approximately 50,000 packages are sorted daily, annually equating to about 18 million packages. The logistics industry located within IND’s footprint accounts for more than $12 million in tax revenues, some or all of which would be lost without IND. Additionally, without a substantial concentration of car rental agencies, the resulting taxes produced from such businesses would be considerably less, if nonexistent, than the more than $13 million they generated in 2011. Finally, the more than $5 million in tax revenues generated from the airlines would likely be zero if IND did not exist. 2012 19 appendix 20 ameriplex property map park fletcher property map Indianapolis International Airport Tax Impact Study