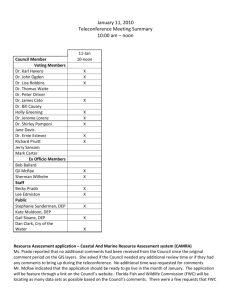

CAMRA Event Playbook 2015

advertisement