Exhibit: F - Nevada Legislature

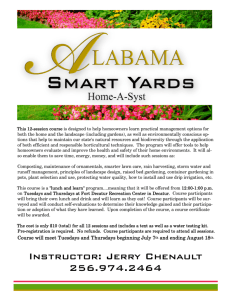

advertisement

From: Barbara Holland [mailto:bholland@hlrealty.com] Sent: Wednesday, March 18, 2015 6:23 AM To: Assembly Judiciary Exhibits Subject: FW: Opposition Statement to A.B. 240- please use this revision Please use this revised opposition. thanks Barbara Holland, CPM President H & L Realty and Management Co. 2560 S Montessouri St, Suite 206 Las Vegas, NV 89117 Mailing Address: P.O. Box 80360, Las Vegas, 89180 P: 702-385-5611 F: 702-385-3759 bholland@hlrealty.com Please visit us on Facebook, Twitter, and H & L Realty. To Honorable Assemblywoman Seaman, Chair of the Committee on Judiciary Subcommittee 1. The financial impact upon homeowner associations and homeowners who pays their monthly assessments is catastrophic. 2. Associations do not have the financial resources either in time or money to file judicial foreclosure actions against delinquent homeowners in District Court. 3. Do the sponsors of this bill realize that if an association were to file a judicial foreclosure action in District Court that not only would the delinquent homeowner have to be named but also the lenders, and anyone else with security interest in that home ? Do you really think that the average association has enough money to fight that battle? 4. Assuming that neither the homeowner nor the lenders filed an opposition to the association’s judicial foreclosure, according to attorneys that we contacted, the association would spend from $5000 to $ 6000 in attorney fees and another $2000 to $ 3000 in the various court costs and certificate. 5. Let’s do the math. Suppose an association of 100 members paying $ 50 a month had 5 cases to file in District Court. And let’s assume that it would only cost $3500 per case- the 5 cases would total $ 17,500 for the initial filing in District Court. This is a new operating expense as the collection companies and attorneys involved in collections currently advance the foreclosure expenses. With this new law, no collection company is going to advance these funds. They will have to come from the pocketbooks of Assembly Committee: Judiciary Exhibit: F Page: 1 of 3 Date: 03/19/15 Submitted by: Barbara Holland the average tax paying homeowner. The $ 50 a month assessment will now be increased to $ 64.58 or an increase by 29.16% in assessments ($ 17,500 divided by 100 homeowners divided by 12 months). 6. Now let’s assume that cost would be closer to the estimate given to us by the attorneys of $ 7,000 per case (again assuming that neither the delinquent homeowner nor the lenders opposed the action)…5 cases would now cost $ 35,000. That same 100 member association would see their assessments increase from $ 50 to $ 79.17 or an increase of 58.33% in assessment ($ 35,000 divided by 100 homeowners divided by 12). 7. Now there are 3- catch “22s”…first, the association is already losing income because the 5 homeowners are not paying their assessments. Second, just how quickly do you think that foreclosure case will be heard in District Court, one year, two years or more? A delinquent homeowner could be sitting in the comfort of his home for years before the case would be heard and decided. Who picks up the tab for the association’s operating expenses? I would not be surprised if it were you members of the Assembly Judiciary Committee who also live in homeowner associations that would feel the brunt of the financial impact of this bill if passed. (not quite sure whether your neighbor would still be friendly with you). Third, would the increases in assessments cause other homeowners who are just barely making it become delinquent…and so a vicious loop would be created. 8. What happens if this law pushes the weaker associations to the brink, associations which could no longer afford to maintain the streets, pay water, sewer fees, property taxes, associations that would have to file bankruptcy? Will the State of Nevada pick up the tab? 9. How about a little twist with this foreclosure scenario. Your association can only afford to take the 5 cases to judicial foreclosure out a total 11 homes that could have been sent to District Court if the association had the funds and staying powers. Your home is one of the 5 selected- you file a claim with the Court that you have been discriminated because the other 6 homes were not sent to District Court. A situation that could easily happen. 10. Do you really think that an already over- loaded District Court system wants these foreclosure cases to clog up the courts’ calendars? What will be the financial impact upon the Courts? The County governments that support the Courts? 11. Judicial foreclosures include a one (1) year right of redemption. Thus, individuals acquiring title at judicial foreclosure sales are less likely to improve the property during the one (1) year right of redemption. They also tend not to pay assessments because they have no certainty that they will own the property at the end of the year. 12. This proposed law rewards the bad-faith behavior of the banks- Just read some of the District Court cases where banks were chastised because the banks had opportunities that they did not take in order to protect their investment. F-2 13. In 2013, the Nevada legislature passed a bill that would allow banks to impound assessments in the similar way that the banks impound property taxes and insurance. Assembly members, ask the lenders who support this AB 240 bill, which one of their banks started impounding assessments? I believe you will find none. 14. SB 260 would require banks as of January 1, 2016 to impound assessments. This is a more equitable way to protect the banks’ underlying loans. 15. Let’s drop the other bomb…the 9 month lien vanishes from Nevada law…Do you sincerely think that the associations can absorb this financial hit too? Do you really think that homeowners who live next to vacant abandoned homes are happy people, especially the ones who keep asking why have the banks not taken action? Banks who have not taken action for years. Why don’t you all take the time and contact the major community management companies and go for a tour of the associations and see first- hand. 16. Go to section 4 of this AB 204 bill- it states association may not record a notice of a lien unless the assessments are more than 90 days past dueGUESS WHAT…CHECK FHA AND VA FINANCING REGULATIONS, HOMEOWNERS WOULD NOT BE ABLE TO PROCURE ANY FEDERAL GOVERNMENTAL LOANS OR REFI LOANS IF AN HOA CANNOT TAKE ANY ACTION UNTIL AFTER 90 DAYS…You just impacted homeowners’ ability to buy or to refi under these programs…check it out. 17. This bill includes the “oath” that someone has to make as to the validity of the foreclosure- this was the same kind of oath that the legislature passed onto the banks and then removed that requirement from the banks- so now you want to include a bad law that you removed from the banks and make it “good law” for associations. This is such a bad bill. Your Assembly Judicial Sub-committee needs to stand up to the paid lobbyist and let this bill die in committee. It’s time to think about your constituents and protect them from a law that would significantly raise their monthly assessments. F-3