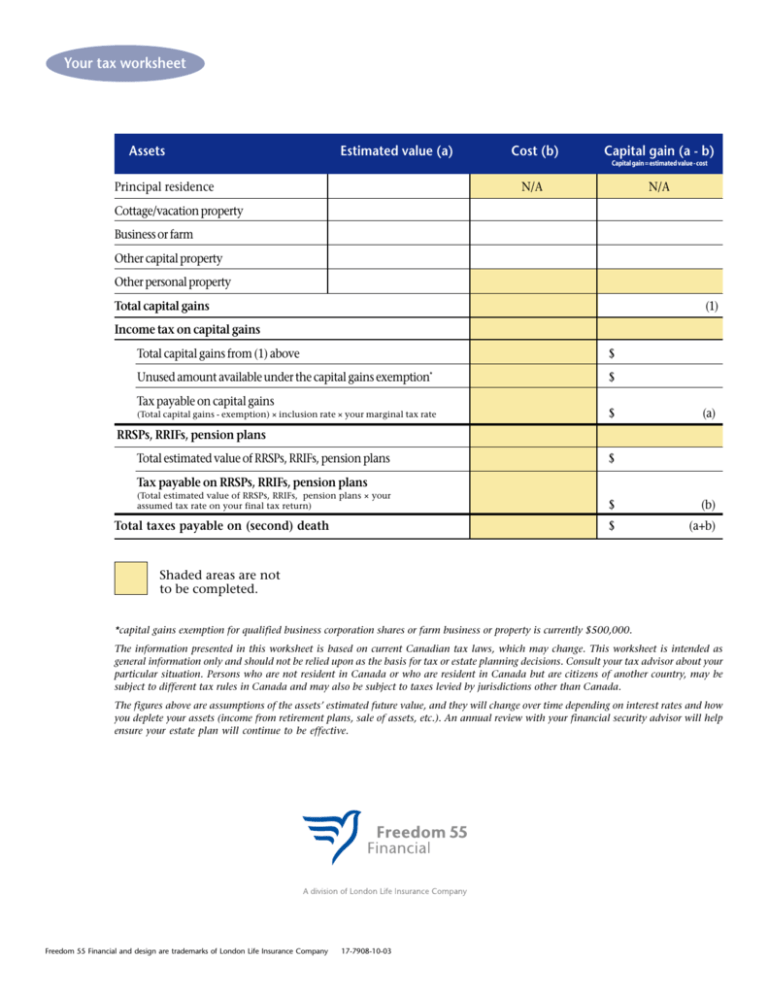

Your tax worksheet - Rusu Financial Inc.

advertisement

Your tax worksheet Assets Estimated value (a) Cost (b) Capital gain (a - b) Capital gain = estimated value - cost Principal residence N/A N/A Cottage/vacation property Business or farm Other capital property Other personal property Total capital gains (1) Income tax on capital gains Total capital gains from (1) above $ Unused amount available under the capital gains exemption* $ Tax payable on capital gains (Total capital gains - exemption) × inclusion rate × your marginal tax rate $ (a) RRSPs, RRIFs, pension plans Total estimated value of RRSPs, RRIFs, pension plans $ Tax payable on RRSPs, RRIFs, pension plans (Total estimated value of RRSPs, RRIFs, pension plans × your assumed tax rate on your final tax return) Total taxes payable on (second) death $ (b) $ (a+b) Shaded areas are not to be completed. *capital gains exemption for qualified business corporation shares or farm business or property is currently $500,000. The information presented in this worksheet is based on current Canadian tax laws, which may change. This worksheet is intended as general information only and should not be relied upon as the basis for tax or estate planning decisions. Consult your tax advisor about your particular situation. Persons who are not resident in Canada or who are resident in Canada but are citizens of another country, may be subject to different tax rules in Canada and may also be subject to taxes levied by jurisdictions other than Canada. The figures above are assumptions of the assets’ estimated future value, and they will change over time depending on interest rates and how you deplete your assets (income from retirement plans, sale of assets, etc.). An annual review with your financial security advisor will help ensure your estate plan will continue to be effective. Freedom 55 Financial and design are trademarks of London Life Insurance Company 17-7908-10-03