worksheet demo: Gulf oil spill

advertisement

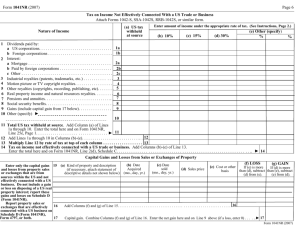

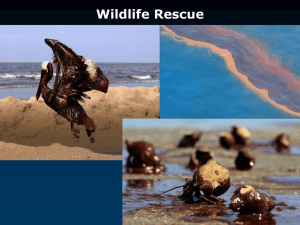

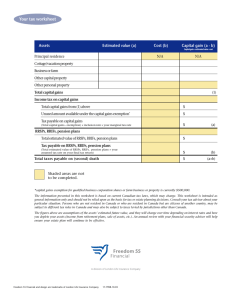

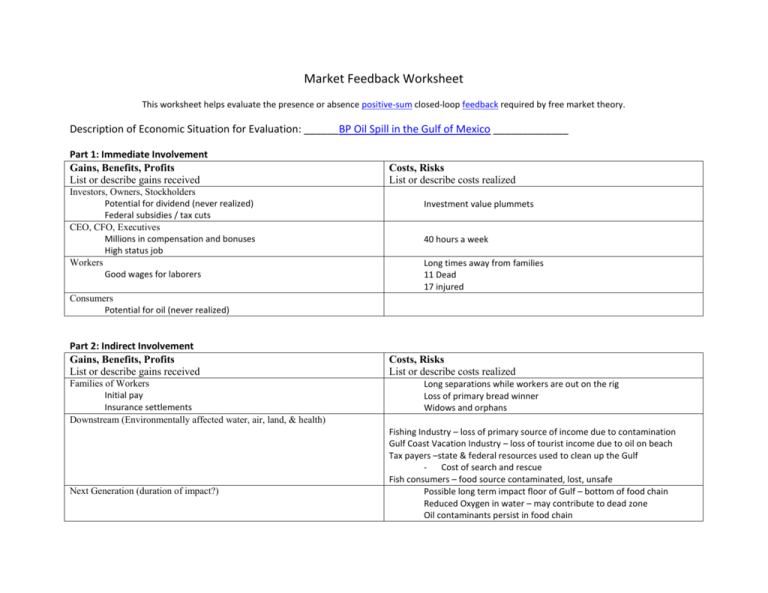

Market Feedback Worksheet This worksheet helps evaluate the presence or absence positive-sum closed-loop feedback required by free market theory. Description of Economic Situation for Evaluation: ______BP Oil Spill in the Gulf of Mexico _____________ Part 1: Immediate Involvement Gains, Benefits, Profits List or describe gains received Investors, Owners, Stockholders Potential for dividend (never realized) Federal subsidies / tax cuts CEO, CFO, Executives Millions in compensation and bonuses High status job Workers Good wages for laborers Costs, Risks List or describe costs realized Investment value plummets 40 hours a week Long times away from families 11 Dead 17 injured Consumers Potential for oil (never realized) Part 2: Indirect Involvement Gains, Benefits, Profits List or describe gains received Families of Workers Initial pay Insurance settlements Downstream (Environmentally affected water, air, land, & health) Next Generation (duration of impact?) Costs, Risks List or describe costs realized Long separations while workers are out on the rig Loss of primary bread winner Widows and orphans Fishing Industry – loss of primary source of income due to contamination Gulf Coast Vacation Industry – loss of tourist income due to oil on beach Tax payers –state & federal resources used to clean up the Gulf Cost of search and rescue Fish consumers – food source contaminated, lost, unsafe Possible long term impact floor of Gulf – bottom of food chain Reduced Oxygen in water – may contribute to dead zone Oil contaminants persist in food chain Part 3: Source of Resource & Impact Value Added Value Taken List work for which the producer owners should rightfully be paid List value derived from sources other than the producer Drilling, transporting, refining Pre-existing resource The oil existed long before BP existed. BP did not produce it. Resources derived from other properties The oil is derived from public lands. As such it naturally belongs to those nations and their citizens. Depletion rate vs. replenishment rate Oil is non-renewable. To use it now leaves future generations without it. Evaluation In a perfect free market, profit is made by those who do the actual work and take the risks, and all parties involved are properly compensated. All person’s and properties affected are appropriately compensated for their involvement. The further an economic situation deviates from these relationships the less the market is functioning according to the free market ideal. If entries in the profit and cost columns (Parts 1 & 2) correlate strongly the transaction is working close to the market ideal. If they are highly different the transaction does not represent a free market. If the producer is appropriately compensated for value added and value is only taken with consensual agreement and compensation (part 3) then the market is working as a free market. If value is taken without consensual agreement and compensation then the transaction does not represent free market action. Is this situation strongly characteristic of a free market, or not characteristic of free market ideals? (i.e.: do the profit columns and cost columns highly correlate? The BP oil spill does not characterize free market ideals. Those who paid the costs received relatively low gains or no gains at all. Many of those who paid the costs were not consensually involved. They were not given a chance to negotiate appropriate compensation for their involvement. Those who received the primary gains were not involved in any of the major costs or risks. The primary value of the oil was derived from public property and existed independent of the