Use the following checklist as a guide when explaining universal life

advertisement

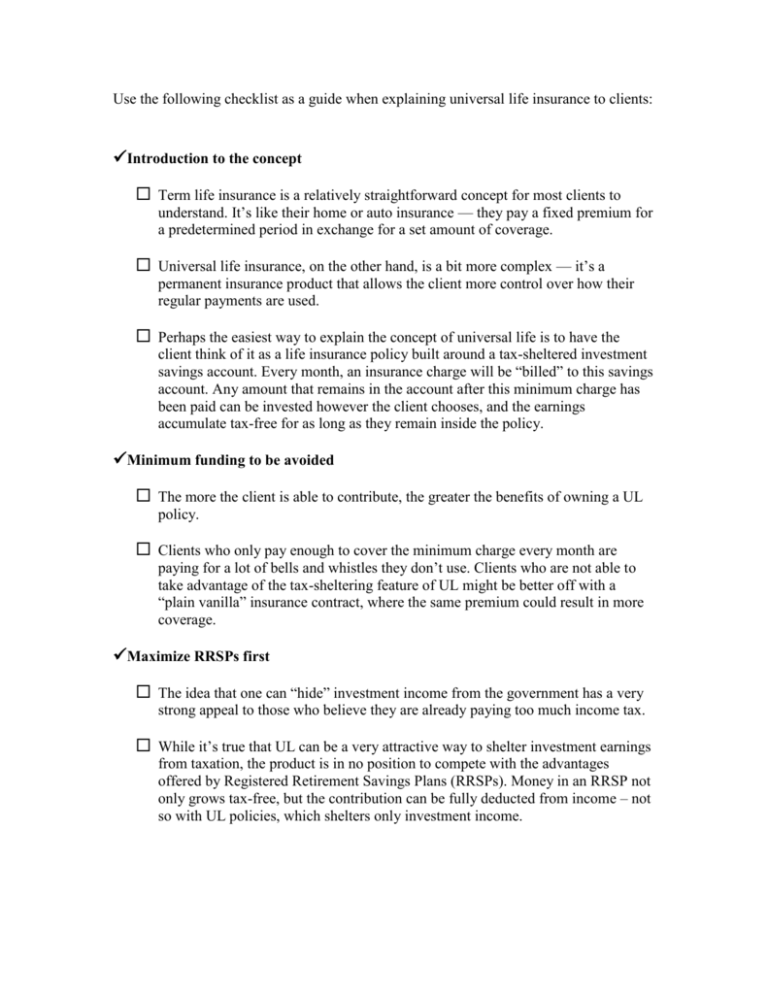

Use the following checklist as a guide when explaining universal life insurance to clients: Introduction to the concept Term life insurance is a relatively straightforward concept for most clients to understand. It’s like their home or auto insurance — they pay a fixed premium for a predetermined period in exchange for a set amount of coverage. Universal life insurance, on the other hand, is a bit more complex — it’s a permanent insurance product that allows the client more control over how their regular payments are used. Perhaps the easiest way to explain the concept of universal life is to have the client think of it as a life insurance policy built around a tax-sheltered investment savings account. Every month, an insurance charge will be “billed” to this savings account. Any amount that remains in the account after this minimum charge has been paid can be invested however the client chooses, and the earnings accumulate tax-free for as long as they remain inside the policy. Minimum funding to be avoided The more the client is able to contribute, the greater the benefits of owning a UL policy. Clients who only pay enough to cover the minimum charge every month are paying for a lot of bells and whistles they don’t use. Clients who are not able to take advantage of the tax-sheltering feature of UL might be better off with a “plain vanilla” insurance contract, where the same premium could result in more coverage. Maximize RRSPs first The idea that one can “hide” investment income from the government has a very strong appeal to those who believe they are already paying too much income tax. While it’s true that UL can be a very attractive way to shelter investment earnings from taxation, the product is in no position to compete with the advantages offered by Registered Retirement Savings Plans (RRSPs). Money in an RRSP not only grows tax-free, but the contribution can be fully deducted from income – not so with UL policies, which shelters only investment income. Discuss investment risk With more control also comes more responsibility. Since the savings component of a UL policy may be linked to the stock or bond market, it’s important for the client to understand that, depending on his or her investment choice, there is a very real possibility for loss. Unlike traditional whole life insurance, the cash value of a UL policy is not guaranteed. Is the client comfortable with the short-term ups and downs of the market, or will he or she panic and withdraw money during a downturn? Explain penalty charges Universal life insurance is just that — life insurance. It’s not a short-term savings account. Depending on the terms of the contract, withdrawing money during the early years of the policy could trigger significant penalty charges. UL is well suited to someone who has both a clear permanent insurance need and the ability to leave his or her money invested for at least 10 to 15 years.