Royal Bank of Canada - Sydney Branch

Paul Hissey (Analyst)

Cameron Klutke (Associate)

+61 3 8688 6512

+61 3 8688 6551

paul.hissey@rbccm.com

cameron.klutke@rbccm.com

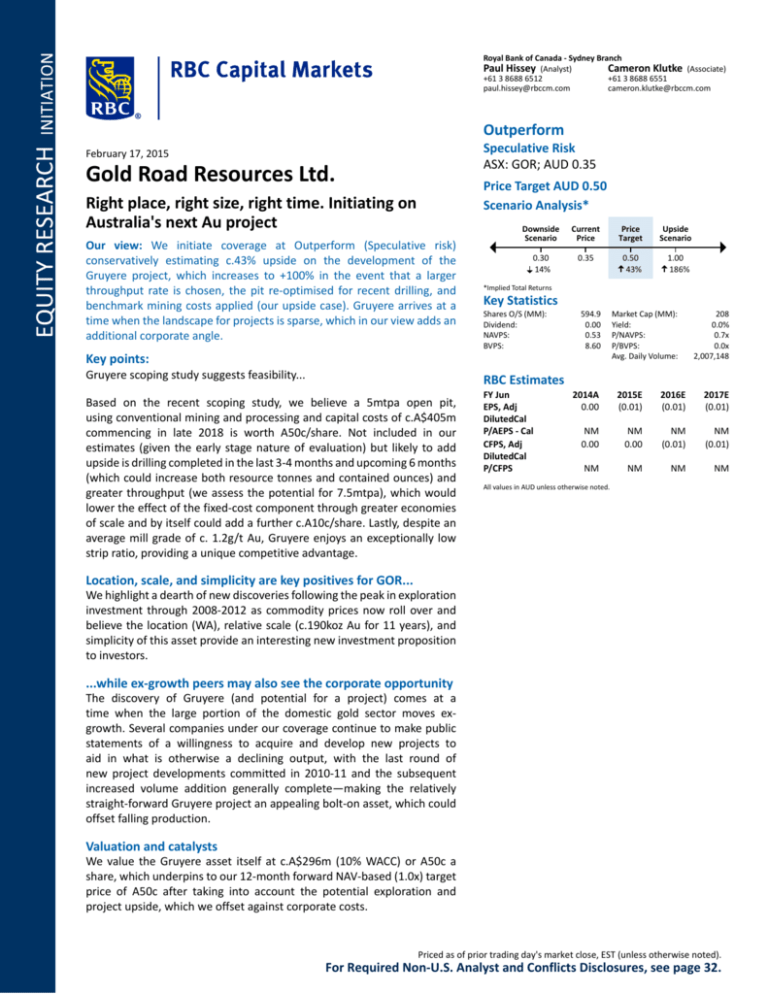

Outperform

Speculative Risk

ASX: GOR; AUD 0.35

February 17, 2015

Gold Road Resources Ltd.

Price Target AUD 0.50

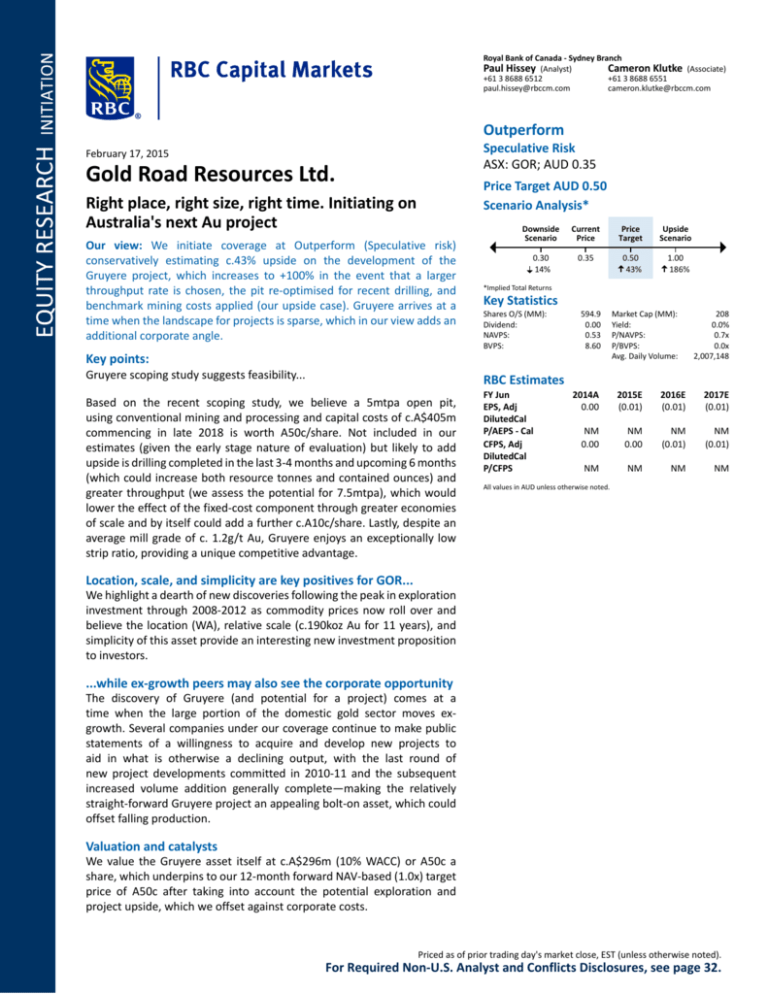

Scenario Analysis*

Right place, right size, right time. Initiating on

Australia's next Au project

Our view: We initiate coverage at Outperform (Speculative risk)

conservatively estimating c.43% upside on the development of the

Gruyere project, which increases to +100% in the event that a larger

throughput rate is chosen, the pit re-optimised for recent drilling, and

benchmark mining costs applied (our upside case). Gruyere arrives at a

time when the landscape for projects is sparse, which in our view adds an

additional corporate angle.

Key points:

Gruyere scoping study suggests feasibility...

Downside

Scenario

Current

Price

Price

Target

Upside

Scenario

0.30

14%

0.35

0.50

43%

1.00

186%

*Implied Total Returns

Key Statistics

Shares O/S (MM):

Dividend:

NAVPS:

BVPS:

594.9

0.00

0.53

8.60

Market Cap (MM):

Yield:

P/NAVPS:

P/BVPS:

Avg. Daily Volume:

208

0.0%

0.7x

0.0x

2,007,148

RBC Estimates

Based on the recent scoping study, we believe a 5mtpa open pit,

using conventional mining and processing and capital costs of c.A$405m

commencing in late 2018 is worth A50c/share. Not included in our

estimates (given the early stage nature of evaluation) but likely to add

upside is drilling completed in the last 3-4 months and upcoming 6 months

(which could increase both resource tonnes and contained ounces) and

greater throughput (we assess the potential for 7.5mtpa), which would

lower the effect of the fixed-cost component through greater economies

of scale and by itself could add a further c.A10c/share. Lastly, despite an

average mill grade of c. 1.2g/t Au, Gruyere enjoys an exceptionally low

strip ratio, providing a unique competitive advantage.

FY Jun

EPS, Adj

DilutedCal

P/AEPS - Cal

CFPS, Adj

DilutedCal

P/CFPS

2014A

0.00

2015E

(0.01)

2016E

(0.01)

2017E

(0.01)

NM

0.00

NM

0.00

NM

(0.01)

NM

(0.01)

NM

NM

NM

NM

All values in AUD unless otherwise noted.

Location, scale, and simplicity are key positives for GOR...

We highlight a dearth of new discoveries following the peak in exploration

investment through 2008-2012 as commodity prices now roll over and

believe the location (WA), relative scale (c.190koz Au for 11 years), and

simplicity of this asset provide an interesting new investment proposition

to investors.

...while ex-growth peers may also see the corporate opportunity

The discovery of Gruyere (and potential for a project) comes at a

time when the large portion of the domestic gold sector moves exgrowth. Several companies under our coverage continue to make public

statements of a willingness to acquire and develop new projects to

aid in what is otherwise a declining output, with the last round of

new project developments committed in 2010-11 and the subsequent

increased volume addition generally complete—making the relatively

straight-forward Gruyere project an appealing bolt-on asset, which could

offset falling production.

Valuation and catalysts

We value the Gruyere asset itself at c.A$296m (10% WACC) or A50c a

share, which underpins to our 12-month forward NAV-based (1.0x) target

price of A50c after taking into account the potential exploration and

project upside, which we offset against corporate costs.

Priced as of prior trading day's market close, EST (unless otherwise noted).

For Required Non-U.S. Analyst and Conflicts Disclosures, see page 32.

Gold Road Resources Limited

Target/Upside/Downside Scenarios

Investment summary

Exhibit 1: Gold Road Resources Limited

125 Weeks

26SEP12 - 16FEB15

UPSIDE

TARGET

0.50

1.00

0.50

0.40

CURRENT

0.35

DOWNSIDE 0.30

0.30

0.20

0.10

0.00

30m

20m

10m

2012

2013

2014

S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F

GOR.AU

Rel. AUSTRALIAN ALL ORDINAIRES

Feb 2016

MA 40 weeks

Source: Bloomberg and RBC Capital Markets estimates for Upside/Downside/Target

Target price/base case

Our 12-month target price of A$0.50/share is based on 1.0x

our sum of the parts (SOTP) NAV. In our base case, we assume

only modest exploration upside, allocating c.A$30/oz for those

resource ounces already identified at Gruyere only but not

yet included within the mineral inventory under consideration

in the scoping study. Our base case assumes production of

c.190koz Au for 11 years at an average C1 cash cost of A$851/

oz Au (ex-royalties) or A$953/oz AISC.

Upside scenario

For our upside, we consider firstly that GOR commit to the

7.5mtpa development option and secondly, the potential

for grade and unit costs to be optimised for the life of

the project, such that lower costs are encountered up front

(thereby increasing NAV). In addition, we also assume A$100/

oz (transaction multiple) for the c.1.5moz and a 1.2x P/NAV

multiple to reflect the corporate appeal of the asset. This

combination of outcomes derives an upside valuation of A

$1.00 a share.

Downside scenario

Our downside case assumes an additional 12-month delay to

the commencement of the project, as well as spot pricing into

perpetuity (US$1,230/oz Au and 0.77c AUD/USD), which is

effectively a downgrade to our house forecasts of c.US$1,400/

oz Au and 80c LT currency. Additionally, we assume that in

the event that sentiment toward gold deteriorates, the market

de-rates gold equities, and as such, we lower our P/NAV to

0.8x. These factors combined suggest a downside scenario of

A$0.30/share.

February 17, 2015

Gold Road Resources (ASX: GOR) is an Australian gold

exploration and development company based in West Perth,

Western Australia.

The company has experienced recent success with its

100% owned Gruyere project in the under-explored

Yamarna Greenstone Belt in Western Australia. GOR recently

announced a maiden resource for the project containing

3.8moz Au, with over 5moz Au in total resources throughout

the broader region. We believe the company’s tenement

package is highly prospective with additional drilling targets

currently being tested.

Gruyere the next gold project in an ex-growth market

Compared to our emerging gold coverage universe, we believe

Gruyere to be one of the better undeveloped gold deposits

globally, given project economics, output, scale, and location.

The project is likely to provide production of c.190koz Au

pa (based on our c.5mtpa nameplate plant assumptions) for

at least 11 years, and potentially beyond if both commodity

prices and additional exploration success permit, with an

additional resource (not included in either the company’s

scoping study or our own estimates) of c.1.5moz Au.

With exploration potential remaining among an underexplored belt in Western Australia

Gold Road’s tenement holdings cover an area of approximately

5,000km², covering the majority of the north-west trending

Yamarna Greenstone Belt with the geological feature having

a strike length of greater than 200km. We believe GOR will

remain committed to exploration and ascribe A$16m pa on

exploration expenditure annualised, with the next 12 months

specifically targeting both resource definition and infill drilling

at Gruyere as well as testing additional regional projects.

1HCY15 to provide significant news flow

We expect the company to release results from a new

drilling program at Gruyere (commencing imminently) as well

as finalising proposed throughput rates at Gruyere (GOR is

exploring both 7.5mtpa and 10mtpa options) toward mid-year

2015 as part of the first stage of a 12-month pre-feasibility

study. We believe these elements should provide positive

news flow in the near term.

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

2

Gold Road Resources Limited

Key questions

Our view

1.

What is a likely economic

outcome, and what are the key

sensitivities to this?

Our base case NAV (10%) for the Gruyere project is A$296m. We have generally

conformed to most estimates provided from the recent scoping study by the

company; however, we incorporated our own views on currency and commodity

price. In addition, NAV is also affected by the relatively early nature of the project,

currently in pre-feasibility study (PFS), which should see first production in mid2018.

The key sensitivities toward the project are grade/gold price, unit mining costs,

AUD/USD movements, and assumed upfront capex. Our base case assumes a life of

mine (LoM) average grade of c.1.2g/t Au, with first production in late-2018

underpinning a project-level NAV of A$296m. In a more positive case, higher grades

(1.4g/t Au LoM) and mining costs closer to our expectations of current benchmarks

(A$3.00/t) results in a project valuation of c.A$550m.

2.

What is the likelihood for further

exploration upside?

3.

What is the corporate potential

surrounding the Gruyere

project?

February 17, 2015

In our view, the relative lack of exploration in the Yamarna Greenstone Belt gives us

a sense of optimism about future discoveries, and as such, GOR would get a first

look at any untapped discoveries. Many targets have been derived by the company,

and many are drill ready. The newly discovered Gruyere ore body has produced a

3.8moz Au resource just 10 months after its initial discovery, with c.40% of this

already in the Measured and Indicated categories, with much of the inferred likely

(in our view) to be updated with additional deeper drilling. Much of the prospective

gold bearing greenstones along this belt are shielded by a thin cover of overburden

sediments, which is one of the main factors in this belt being largely underexplored.

With Gruyere also under a thin cover (~1-50m), we believe the probability of further

significant discoveries in GOR’s tenement holding is good.

In our view, Gruyere represents a relatively straightforward, growth option for

several of our Australian-listed producers that are in effect ex-growth. We expect

that most of our coverage group has the expertise to construct an open-pit carbon in

leach (CIL) gold operation, and the Western Australian location must surely make it

more attractive from a risk perspective than other offshore opportunities. The

existing scale of the deposit (excluding any further potential discoveries) could

support an operation well in excess of 10 years at a meaningful output rate of c.180200koz pa.

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

3

Gold Road Resources Limited

Table of contents

Executive summary – Our thesis in a page:................................................................................ 5

Gold Road Resources Limited – Gruyere: The next Australian gold project? ............................ 6

An important undeveloped gold project: Key highlights ........................................................... 7

Introduction ............................................................................................................................... 8

Gruyere the primary key asset – Exploring the project’s potential ........................................... 9

Project Assumptions… Our base case is 5mtpa ........................................................................ 16

…although a move to 7.5mtpa has some additional merit ...................................................... 17

Gruyere has corporate appeal in an otherwise ex-growth landscape ..................................... 19

Sensitivities – grade the key driver .......................................................................................... 21

Exploration upside ................................................................................................................... 23

Global comps – stacking GOR up against other global emerging names ................................. 25

Key Risks and Price Target Impediments ................................................................................. 27

Valuation and Price Target ....................................................................................................... 28

Production and Financial forecasts .......................................................................................... 29

Appendix I – Board and Management ..................................................................................... 30

Appendix II – Key historical events........................................................................................... 31

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

4

Gold Road Resources Limited

Executive summary – Our thesis in a page:

Put simply

The Gruyere project, in our view, is a potential company maker, which could also provide a

relatively straightforward growth project for an otherwise ex-growth domestic peer group,

thereby attracting an additional level of corporate interest.

What’s in our estimates (base case)

Underpinning our valuation of GOR, we have broadly assumed the specific project metrics

(cost and schedule) provided by the company in its scoping study (released 27 January 2015).

While we believe there are aspects of this study that appear conservative (in comparison to

our observations elsewhere across our coverage group—in particular the mining unit rate),

we take a deliberately conservative approach. The key assumptions underpinning our base

case valuation are as follows:

Gruyere conventional 5mtpa open-pit, CIL gold operation, c.190koz annual production

(steady state) for 11 years at c.A$950/oz all in sustaining cost (AISC)=NAV: A$0.50/share.

Exploration potential (which are resource ounces not in our mine plan and additional

potential within the tenement package) NAV: A$0.08/share

Total capex (development and sustaining) c.A$500m LoM, including A$405m

development;

and net cash and corporate cost: NAV: -(minus) A$0.05/share

What’s not in our estimates (upside)

At a technical level, lower mining costs (as benchmarked) at A$3/t LoM (could add +

A$0.13/share). In addition, we also assume flat costs throughout the project life; when in

reality, we expect lower costs early in the project while the pit is shallower, the strip ratio

lower and haul distances generally are closer. In addition, coarser grinding (studies

underway) could further reduce comminution costs. Optimisation of grade, strip ratio, and

mining costs through the life of the project (we typically run the LoM average flat) are

likely to assist NAV.

With a less conservative pricing of exploration upside (if we assumed an average

industry transaction multiple of A$100/oz, we could value the existing additional

resource at c.A$150m, which could add a further +A$0.25/share onto our valuation).

Premium to account for corporate appeal to existing Australian producers aiming to

address a flat (or declining) production outlook (+A$0.10/share if we assume 1.2x NAV).

A lower WACC (as the project potentially is de-risked, our 10% real WACC would likely

move lower to be more in line with other single-asset, Australian-based producing peers,

for example, at 8%—which could add +A$0.10/share).

What are the risks?

Applying any valuation to exploration potential creates risk; however, in this instance, much

of the value that we include in our base case is underpinned by existing identified resources

that are not in our base-case (explicit) mine plan. We do not specify any funding route in our

base case, but rather, we assume any and/or all capital required for growth would be at our

existing WACC (10% real) regardless of debt and/or equity mix, and any potential equity

raising would be neither dilutive nor accretive, in our view. In the section “Funding strategy

for Gruyere…” we highlight our assumptions for potential funding of the project.

Obviously, the potential capital cost of such a remote project is subject to change, and we

expect existing scoping study estimates to be narrowed with both PFS and definitive

feasibility study (DFS).

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

5

Gold Road Resources Limited

Gold Road Resources Limited – Gruyere: The next Australian gold project?

Introduction

Gold Road Resources (ASX: GOR) is an Australian gold exploration and development

company based in West Perth, Western Australia.

The company has experienced recent success with its 100% owned Gruyere project, in the

underexplored Yamarna Greenstone Belt in Western Australia. GOR recently announced a

maiden resource for the project containing 3.8moz Au, with over 5moz Au in total resources

throughout the broader region. We believe the company’s tenement package is highly

prospective with additional drilling targets currently being tested.

The company recently released a scoping study for Gruyere, which outlined a potential

5mtpa operation, producing c.190koz Au pa with an average AISC of c.A$916/oz Au (our

estimate is c.A$953/oz). The study outlined the mining of both Central Bore and Gruyere

with upfront capital costs of c.A$360m (we take the midpoint of the stated error margin at

A$405m). Under our house view on commodity prices (we assume flat US$1,400/oz Au and

0.80c AUD/USD from 2019 onward), we estimate an in-principle IRR of c.28%.

The project looks financially viable against our estimates as a standalone development. In

addition, we believe there is potential for both lower risk and greater value creation if this

project were to exist as part of a portfolio of producing assets, with existing cash flow and

development expertise, or in the event that additional exploration potential suggests the

resource base could be materially increased.

Gruyere to provide an avenue for cash flow…

We initiate coverage on GOR with an Outperform rating, and a 12-month target price of

A$0.50/share. Our positive views on the project are driven in equal measure by the inherent

potential that we see as a standalone project but also the corporate attraction to the resource in

the relatively attractive Western Australian jurisdiction. The recent Tropicana development

(AngloGold and Independence Group) provides a close analogue (in terms of scale and

geography) to Gruyere, although we believe that an improved market for project development

and/or construction and potentially more conservative development plan could deliver additional

capital cost savings over the aforementioned project. Despite some similarities, the average grade

of the Gruyere resource is lower than that of the Tropicana asset (1.4g/t Au versus Tropicana at

c.2.1g/t Au); however, Gruyere also boasts a materially lower stripping ratio (the proportion of

waste required to access one tonne of ore), which to some degree, offsets this feature.

Compared to our emerging gold coverage universe, we believe Gruyere to be one of the

better undeveloped gold deposits globally, given project economics, output, scale, and

location. The project is likely to provide production of c.190koz Au pa (based on our c.5mtpa

plant assumptions) for at least 11 years, and potentially beyond if both commodity prices

and additional exploration permit, with an additional resource (not included in either the

company’s scoping study or our own estimates) of c.1.5moz Au.

In addition, the exploration upside remains strong throughout this relatively underexplored

region of Western Australia, for which GOR holds a dominant land package with

approximately 5,000km² under investigation. We believe additional discoveries could be

achieved through GOR’s significant tenement holdings among the Yamarna Greenstone Belt.

Target price/base case

In setting our 12-month forward target price, we apply a 1.0x multiple to our estimated asset

level NAV (A$296m or A50c/share post-tax) and incorporate an additional A$50m (or

A8c/share), which equates to c.A$33/oz for gold in resource but not included in our base

case. Netting out cash and corporate costs arrives at our A$0.50c target price.

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

6

Gold Road Resources Limited

An important undeveloped gold project: Key highlights

We believe Gruyere to be one of the more interesting development projects because:

There’s no historical baggage – a new discovery

Firstly, the project is newly discovered and as such does not suffer the legacy of many other

recycled assets that appear to exist as a function of commodity price and the resource cycle.

Coupled with this, we see the rapid discovery of the resource base at Gruyere as an

indication of the potential of what is a new gold province in Western Australia.

Probabilistically, it seems unlikely that a company could discover such a magnitude of gold

ounces in a new area, at such pace, and have exhausted all the potential. Hyperbole aside,

we genuinely believe this district could continue to yield additional exploration success for

many years to come.

Scale

The magnitude of the resource at Gruyere is material. The scoping studies (and our own

estimates) suggest an operation could support production in the order of 190koz Au per

annum for in excess of 10 years. This would provide not only sufficient output to make a

meaningful contribution to domestic production (it would be sixth in a list of the highest

contributing assets within our coverage group and would be larger than IGO’s exposure to

Tropicana, which is c.140koz pa) but also longevity such that there is breathing room

between the completion of a project and the necessity to find another.

Simplicity

The deposit should be mined via open pit and processed using a conventional CIL circuit,

which would be similar to the majority of the deposits in the region and in fact what we

would consider ‘bread and butter’ for many aspiring producers.

Location

The Yamarna Gold Project is located in eastern Western Australia. The project is in a remote

location; however, we consider this to provide a lower-risk alternative to a less-remote

opportunity in recent hotspots such as West Africa. Western Australia is a renowned gold

mining district, and with large modern day projects, such as Tropicana to the south, we

believe this is still a material positive for the company when compared to other undeveloped

global gold deposits. In a global sense, we believe this is appealing not only for investors but

also corporates—particularly when recent declines in local currency are factored in, which

could provide sustained additional margin against a predominantly local cost base.

Sensitivity

As our analysis shows, the project is fairly robust economically, with commodity price,

currency, and grades the key drivers to our estimates of valuation. In particular, our existing

IRR of 28% outlines a solid investment margin—even when taking into account GOR’s

existing size and balance sheet.

Opportunity

Outside of the asset itself, the discovery (and potential for a project) comes at a time when

we observe that the large portion of the domestic gold sector moved ex-growth. Several

companies under our coverage continue to make statements (through presentations,

conferences, and market releases) of a willingness to acquire and develop new projects to

aid in what is otherwise declining output, with the last round of new project developments

committed in 2010-2011 and the subsequent increased volume addition generally complete.

This market ‘pre-condition’ and the potential that we see within GOR provide both the right

timing and exposure for investment, in our view.

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

7

Gold Road Resources Limited

Introduction

Background

Gold Road listed on the ASX in July 2006 under the former name of Eleckra Mines Ltd. The

company listed raising c.A$6m and immediately completed the 100% acquisition of a

significant tenement holding within the Yamarna Greenstone Belt east of Laverton in

Western Australia, named the Yamarna Gold Project.

Exhibit 2: Tenement map of GOR’s holdings in the Yamarna Belt (showing its location to the

Tropicana deposit to the southeast)

Source: Company reports

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

8

Gold Road Resources Limited

Gruyere the primary key asset – Exploring the project’s potential

Based on a gold price of A$1,350/oz (which is materially below the spot realised AUD price of

c.A$1,580/oz, and our forecast Long-term of A$1750/oz), GOR has released a scoping study

showing an 11-year LoM, exploiting both Gruyere and Central Bore deposits, which the

company has forecasted could produce a net pre-tax, undiscounted cash flow of A$550m.

Scoping study suggests an economic project at 5mtpa throughput, 28% IRR (RBCe)

provides appropriate return

On our estimates, we are able to generate a NAV (using 10% real WACC) of c.A$296m or

A50c per share for the asset, while we believe GOR as a corporate entity (including

exploration upside, corporate costs, and cash position) is worth A53c/share. The key

departures between our estimates and those provided in the scoping study are the

commodity and currency outlooks (we use RBC Capital Market estimates as outlined in

Exhibit 4) and capex (where we assume the midpoint of the tolerance on the company’s

range). We outline the key parameters for both our and the company’s published estimates

in Exhibit 3.

Exhibit 3: Details from the scoping study

Scoping Study

Initial Capex

Peak annual output (Y+3)

$360m

$405m

5.0mtpa

5.5mtpa

Mine strip ratio

Grade (LOM average)

RBCe - 5mtpa base

1.6:1

1.4:1

1.2g/t Au

1.2g/t Au

Recovery

95%

95%

Annual gold production (average)

190koz Au

190koz Au

Total gold production

2.1moz Au

2.1moz Au

Project life

11 years

11 years

Cash Costs (average)

A$838/oz Au

A$851/oz Au

All-in sustaining costs (average)

A$916/oz Au

A$953/oz Au

NPV (10%)

$296m

IRR

28%

Source: Company reports, RBC Capital Markets estimates

Exhibit 4: RBCe commodity and currency forecasts

Scoping Study gold price

RBCe gold price

RBCe Currency

Spot Currency

Spot A$ gold price

2000

0.90

0.86

1500

0.84

0.82

1000

0.80

0.78

500

AUD:USD

Gold Price (A$/oz)

0.88

0.76

0.74

0

0.72

FY15E

FY18E

FY21E

FY24E

FY27E

FY30E

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

Source: Company reports, RBC Capital Markets estimates

February 17, 2015

9

Gold Road Resources Limited

Current mineral resource estimate

The Gruyere deposit, containing 3.8moz Au at 1.23g/t Au, has been outlined in just 10

months following its initial discovery. Gruyere was discovered along the Dorothy Hills Trend

at Yamarna and, along with already reported resources at both Central Bore and Attila,

brings the company’s total mineral resources to more than 5moz Au. Drilling is ongoing at

Gruyere, largely to infill the known deposit; however, we believe that significant exploration

remains at Gruyere and the greater portfolio of exploration projects held by the company.

The initial resource at Gruyere was based on 30,000m of drilling, with a further c.22,000m

that should be completed by June 2015.

Importantly, approximately 41% of the current resource ounces are already in both indicated

and measured resource categories (higher geological confidence). The continuity and

consistency of both the grade and mineralisation at Gruyere have played a large part in

unravelling the understanding of this newly discovered ore body. We believe, due to these

factors, that the majority of the current inferred material at depth, although still within the

current pit shell design, is likely to be upgraded to a higher resource category and is

essentially a function of drill density rather than complexity.

The resource lies beneath between 1m and 50m of overburden cover, with this cover

thickening to the northwest. The relatively shallow nature of the deposit removes the impost

of a large pre-stripping campaign that is sometimes required in instances where the

overlying barren material is considerably thicker. In this case, we incorporate c.A$50m of

pre-strip in the development capital, which assists in lowering the LoM strip ratio from 1.6 to

1.4:1, with this upfront cost capitalised.

Exhibit 5 clearly shows the distribution of drilling along the strike of the deposit, as well as

the current resource category. As evidenced, the inferred material is at depth, rather than

near surface, and reiterates our view that further upgrades are primarily related to sufficient

drilling budget and an effort in exploring the greater depths for a potential open-pit mine.

Exhibit 5: Long section of Gruyere resource illustrating the top 100-150m of the resource in both measured and indicated

categories and the remaining deeper material as inferred. In addition, you can clearly see the grade distribution down hole,

which is generally fairly continuous.

Source: Company reports

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

10

Gold Road Resources Limited

Drilling is currently being conducted by GOR at Gruyere aiming to increase both the volume

of ore and level of confidence of the resource (by promoting material to indicated and

measured levels). This program should see approximately 22,000m drilled over the next five

to six months. We understand some regions of the existing block model contain zero grade,

because blocks have not been interpolated given the scarcity of appropriate drilling data in

the immediate region. Although we cannot predict the likelihood of further high-grade

results being realised (which would obviously add ounces to the deposit), given that the

material inside the conceptual pit shell must be mined, the potential for additional material

to be identified that has sufficient gold value to generate a profit solely over processing costs

is high (as mining costs are effectively sunk), in our opinion.

Any material that can be upgraded in confidence from inferred to measured or indicated has

potential to be upgraded to a maiden ore reserve on the completion of the PFS. (Note: the

principles of reserve estimation do not allow for inferred resources to be included in an ore

reserve.)

Cut-off grade and sensitivity

The varying cut-off grades applied to the Gruyere deposit illustrate the consistency of grade

throughout the known mineralisation. This factor provides us with further confidence in the

resource, especially when upgrading the current inferred material to indicated and

measured. In addition, there is a considerable amount of material (c.1.5moz) that is not

currently outlined in the scoping study (assuming A$1,350/oz Au), but it is contained within

the envelope of the mineral resource (which was assumed at c.A$1,550/oz Au). Clearly, a

greater portion of the resource would appear economic at spot prices (c.A$1,580/oz - at the

time of writing, with all else being equal); however, the initial development would be well

served by these more conservative estimates, which would (on paper at least) deliver greater

margin and returns and inversely less leverage to fluctuations in gold price.

Exhibit 6: Mineral resources totalling over 5moz Au

Tonnes

Grade

Containing Metal

Gruyere

(mt)

(g/t Au)

(koz Au)

Measured

1.4

1.36

62

Indicated

38.8

1.22

1,515

Inferred

56.7

1.24

2,260

Total

96.9

1.23

3,838

Measured

0.0

26.6

36.7

Indicated

0.4

8.7

119

Inferred

0.3

4.1

45

Total

0.8

7.7

201

Measured

8.4

1.4

389

Indicated

9.4

1.2

373

Inferred

7.8

1.2

298

Total

25.5

1.3

1,060

Grand Total

123.3

1.3

5,098

Central Bore

Attila

Note:Gruyere

Gruyere

cut-off

at 0.70g/t

Au;Au;

Central

1.0g/t

Au; and

cut-off

at 0.5g/t

Note:

cut-off

grade

at 0.70g/t

CentralBore

Borecut-off

cut-off at

grade

at 1.0g/t

Au;Attila

and Attila

cut-off

grade Au

at 0.5g/t Au

Source: Company reports

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

11

Gold Road Resources Limited

Exhibit 7: Gruyere resource – changes in cut-off grades show little effect of change in total

ounces, indicating consistency of grades throughout the deposit.

Cut-off grade

Tonnes

Grade

Containing Metal

(mt)

(g/t Au)

(koz Au)

0.0

100.8

1.21

3,917

0.5

100.8

1.21

3,916

0.7

96.9

1.23

3,838

1.0

67.6

1.39

3,013

1.5

18.4

1.85

1,097

Source: Company reports, RBC Capital Markets estimates

Although a topic worthy of greater analysis, we believe it is the overall distribution of grade

within a deposit that has the greatest influence on project economics, and by extension,

mines are inherently sensitive to commodity prices, given the financial effect that it could

have on those marginal areas of mineralisation typically found at the periphery of a deposit.

We believe that the ore is relatively evenly distributed at Gruyere (disseminated), with a

relatively small component of higher-grade material (+1.5g/t Au) among a much larger,

uniform mineralised envelope (Exhibit 7). In our view, while higher grades (or a greater

distribution of high and low grades) may be preferred, because it could accommodate more

aggressive scheduling to increase NAV—the trade-offs are bulk mining and generally lower

strip ratios.

Processing

The company released metallurgical test results from the work carried out by ALS Metallurgy

(Perth) and JK Tech (Brisbane) based on 500kg of selected drill core samples from the

Gruyere deposit. Results were highly encouraging, providing confidence for GOR to progress

with a scoping study over the project.

The mineralised host rock, the Gruyere tonalite, at Gruyere has demonstrated properties

amenable to conventional crushing and grinding methods. The test work on the Gruyere ore

has shown total gold recoveries of c.94-98% at grind sizes of 125-75µm. Also, c.50-69% of the

gold was recovered simply through gravity methods, which should provide some confidence

for reduced processing costs. The strong recovery results from 125µm (greater than 94%)

have triggered the company to run further analyses at 150cm to potentially lower processing

costs.

Grind size in the scoping study level test work is assumed at 106µm, which we would

consider to be coarser (therefore lower cost given the energy component of grinding

increases exponentially) than more typical Western Australian gold projects, which are

typically around 75µm (such as the neighbouring Tropicana). Although we have not assumed

such a result in our base case, any potential for a coarser grind size could assist in lowering

the processing cost (on a $/t basis).

Ongoing monitoring (by RBC Capital Markets Research) of new projects shows an average

observed ramp-up time of approximately 7 quarters to reach 90% of operating capacity. The

data set includes 18 projects followed as part of the team’s global coverage. In our view this

is conservative, with an asset like Tropicana (part of the dataset) operating at 103% of its

rd

nameplate capacity within the 3 quarter of operation. Given the comparison with

Tropicana, we also model 3 quarters ramp up to 5mtpa nameplate in our base case, although

we remain comfortable that over a period of time, a plant at Gruyere would move beyond

this level (RBC Capital Markets Research also shows that over 5 years, average throughput

approaches 120% of design capacity).

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

12

Gold Road Resources Limited

Exhibit 8: Likely processing ramp up compared against Tropicana and 17 other projects

followed by RBC. We assume a successful ramp-up, in line with Tropicana, which is more

optimistic than observed projects – and therefore represents some downside risk.

Through/Design Capacity (%)

120%

100%

80%

60%

40%

20%

0%

1Q

2Q

3Q

4Q

Tropicana

5Q

6Q

7Q

8Q

Gruyere - RBCe

9Q 10Q 11Q 12Q

Industry average

Source: RBC Capital Markets estimates

Mining

We have attempted (where possible) to break out the recent actual unit mining costs for

companies under our coverage. While all companies do not report sufficient granularity to

assess changes in unit costs, those outlined in Exhibit 9 show current unit rates materially

below the LoM average outlined by GOR in its scoping study. It is most likely that Gruyere

will benefit from lower costs in the early days of the open-pit mine, experiencing higher costs

than the average toward the end of its LoM as pit depth and haul time increase. Taking these

figures into account provides us with a level of comfort that there is a remaining level of

conservatism in our unit cost assumptions for mining.

Exhibit 9: Benchmark mining costs for similar-scale open-pit operations in Western Australia

(A$/t)

Average

Gruyere

Tropicana

Edna May^

Mt Rawdon

Moolart Well*

Garden Well*

GOR

IGO

EVN

EVN

RRL

RRL

1Q14

2Q14

3.92

0.91

3.05

8.61

1.12

3Q14

4Q14

8.80

2.54

not reported

8.99

3.85

1Q15

2Q15

2.23

0.99

2.63

2.24

2.05

4.40

2.84

2.80

1.91

2.40

2.90

* feasibility study numbers only, ^ discrepancy due to transition to owner mining and pit pushback (capital) decisions.

Source: Company reports

We highlight that the scoping study outlined a LoM strip ratio of 1.6:1, and an additional prestrip component totalling c.A$50m (to move c.14mt of overlying barren material). After

clarification, we have ascertained that this is essentially double-counting that material, and

as such, our forecast of LoM strip ratio of 1.4:1 factors in that this additional 14mt would

have already been removed as part of the pre-development capital for the project.

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

13

Gold Road Resources Limited

Capex

There are two reasonably similar analogues to Gruyere, which have been constructed in the

previous two to three years, which we believe provide end members to a potential

development at Gruyere. The Tropicana project (AngloGold and Independence Group) was

commissioned in 2013, with a nameplate throughput rate of c.5.8mtpa and a capital cost of

in excess of A$850m. In many regards, this is a close replica to what Gruyere may look like,

although we believe higher grades at Tropicana (therefore production and margin) has

allowed additional capital to be spent on items that may not otherwise be considered

essential for other operations. Tropicana was also built in what we believe was a tighter

market for project construction (2011-2012)—during the peak of the investment cycle in

Australia.

At the opposite end of the spectrum is Regis Resource’s (RRL) Garden Well project. This mine

was similarly built during the height of mining investment in 2011-2012 also, but with several

critical differences. RRL effectively ran the build itself, with an experienced in-house project

team, and bespoke design and engineering, which clearly removed the cost of much of the

contingency that large procurement firms will build into any project. In addition, RRL

benefitted from some existing site infrastructure (access roads, camp, etc.), which may have

required incremental upgrades, whereas Tropicana and likely Gruyere are true greenfield

developments. We also believe that there is a significant distinction between the required

specs for an operation, and our observation would be that RRL very much built for purpose,

whereas under the joint venture at Tropicana, construction was built with a strong focus on

quality. Regardless, it is hard to account for the full c.A$600m difference among the projects.

A more detailed study (now that both Tropicana and Garden Well are fully in operation may

reveal additional factors that need to be normalised to account for project specifics—such as

ore hardness, which may require additional grinding capacity, etc.).

What is immediately obvious to us, however, is that Gruyere clearly fits somewhere in

between these two, and as such, we anticipate further analysis to understand better where

the risks (and opportunities) might lie for GOR, given the benefit of two recent and similar

cases in the same jurisdiction.

Exhibit 10: Project comparison (based on feasibility study level announcements) of Tropicana, Gruyere, and Garden Well

Resource

Reserve at BFS

Price assumptions

Strip ratio

Throughput

Mill grade

Recovery

Average annual production (LoM)

Mine life

Capital (pre-production, initial estimate)

Cash cost

Build time

Tropicana

Garden Well

Gruyere

78mt @ 2.12oz Au

(26 July 2011)

61mt @ 1.29g/t Au

(25 November 2011)

96mt @ 1.23g/t Au

(27 January 2015)

48mt @ 2.2 g/t Au

Optimised at A$1210/oz

27.5mt @ 1.52g/t Au

Optimised at A$1000/oz

n.a.

n.a.

5.5:1

5.8mt

2.2g/t Au

90.4%

330-350koz Au

> 10 years

3.5:1

3.8mt

1.46

95%

180koz Au

9 years

1.4:1

5.0mtpa

1.20

95%

190koz Au

11 years

A$690-740m

A$710-730/oz Au (pre-royalty)

A$109m

A$555/oz Au (pre royalty)

A$360m

A$838/oz Au (pre-royalty)

Pre-dev works commenced Dec 2011

Commission Dec 2013

Commence Sept 2011,

Commission Sept 2012

RBCe: 2017-2018

Source: Company reports,

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

14

Gold Road Resources Limited

Timing and news flow

Although timing is not specified within the scoping study (and remains subject to numerous

factors), we estimate the general timetable for development of a potential project at

Gruyere. The critical path items that we believe bring additional risk to our estimated

timetable are:

Permitting,

Native title clearance (started for Central Bore, yet to be started for Gruyere), and

Financing.

In the current climate for resources (and general lack of development) we do not expect

there will be significant lead-times in the acquisition of long-lead items (such as crushers and

milling equipment) or mobile fleet (likely to be delivered by a contractor).

Exhibit 11: RBCe - timetable of major events for GOR leading up to first gold production in 2018.

Calendar Year

Pre-feasibility Study

Definitive Feasibility Study

Financing

Construction

First gold poured

Ramp-up/debottlenecking

2015

St. 1

2016

2017

2018

2019

St. 2

Source: RBC Capital Markets estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

15

Gold Road Resources Limited

Project Assumptions… Our base case is 5mtpa

We generally assumed the LoM and same physical outputs as advised by GOR in its scoping

study, with only minor exceptions: namely RBC Capital Markets commodity and currency

prices and a 10% greater throughput to take into account common observations of

processing plants exceeding nameplate capacity (average).

Some discrepancies arise on our cost estimates as a result of the profile of changes in

throughput rate and cost assumptions. We show our production profile for Gruyere in Exhibit

12.

Exhibit 12: Production profile for the 11 year mine life at Gruyere

Grade

Gold Production (koz Au)

250

2.0

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

200

150

100

50

0

Gold Grade (g/t Au)

Gold Production

Source: RBC Capital Markets’ estimates

Given that Gruyere is the sole asset under consideration at this stage, the fortunes of GOR

are (in our view) directly tied to the outcomes of this project. In addition, corporate costs

and other cash expenditure must also in effect be borne by the development project. As a

result, we consider the cash flow profile of GOR as a consolidated entity in assessing the

valuation of the project and by extension the target price. Our cash flow profile is outlined in

Exhibit 13, below.

Exhibit 13: Aggregate LoM cash flow

Base 5mtpa nameplate

A$m annual free cash flow

400

200

0

FY15E

FY18E

FY21E

FY24E

FY27E

FY30E

-200

-400

Source: RBC Capital Markets’ estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

16

Gold Road Resources Limited

…although a move to 7.5mtpa has some additional merit

In the scoping study, the company also identifies the potential to increase the throughput of

the processing plant in order to minimise overall unit cost rates for the operation. In theory,

this is a logical step: given the remote nature of the business, there are fixed components of

the capital works program which will be required regardless of the overall scale of the

operation. As an example, the project will require access infrastructure (such as a road

upgrade, an airstrip) and accommodation and services (camp, site administration), which are

largely fixed cost expenses. There is a smaller variable component to such purchases if extra

workers are required to be housed, but this represents only an incremental provision in our

view. Similarly in the processing plant, a move to 7.5mtpa is likely to require incrementally

larger crushing and grinding components (which we believe would be the key drivers of

overall higher capex cost suggested for 7.5mtpa at A$435-480m – we assume $500m),

however, other items (such as the elution circuit and gold room, as well as tankage for the

tail-end of the circuit) are likely to be only marginal increases on a proposed 5mtpa plant.

Also, there is likely to be an improvement in the fixed cost unit rate for the build-ownoperate turnkey power solution as well.

From an operating perspective, clearly a 7.5mtpa throughput rate is going to consume

greater absolute quantities of cyanide, diesel and electricity; however, given the variable

consumption of such items, each additional tonne of gold ore is likely to cover the costs –

further demonstrating the benefits of scale. In Exhibit 14, we include a snapshot of our

estimates at:

5mtpa nameplate (which we think could treat 5.5mtpa), for 11 years assuming

treatment of only the material assumed in GOR’s scoping study (c.2.1moz out of the

3.8moz Au total resource);

7.5mtpa for 6-7 years, exploiting the same identified resources as those assumed in

the 5mtpa case,; and

7.5mtpa, de-bottlenecked to 8.5mtpa, for 11 years, exploiting additional material

not considered in the Scoping Study, but still within the recognised mineral

inventory.

Exhibit 14: RBCe summary of potential move to 7.5mtpa

Scoping Study

Initial Capex

Peak annual output (Y+3)

Mine strip ratio

Grade (LOM average)

Recovery

RBCe - 5mtpa base

RBCe - exp to 7.5mtpa, same

resource

RBCe - de-bottleneck to

8.5mtpa, incl lower grade and

inf material

$360m

$405m

$500m

$500m

5.0mtpa

5.5mtpa

7.5mtpa

8.5mtpa

1.6:1

1.4:1

1.4:1

1.4:1

1.2g/t Au

1.2g/t Au

1.2g/t Au

1.1g/t Au

95%

95%

95%

95%

Annual gold production (average)

190koz Au

190koz Au

257koz Au

240koz Au

Total gold production

2.1moz Au

2.1moz Au

2.1moz Au

2.9moz Au

11 years

11 years

7 years

11 years

Cash Costs (average)

A$838/oz Au

A$821/oz Au

A$780/oz Au

A$1009/oz Au

All-in sustaining costs (average)

A$916/oz Au

A$953/oz Au

A$910/oz Au

A$1153/oz Au

$296m

$363m

365m

28%

32%

32%

Project life

NPV (10%)

IRR

Source: Company reports, RBC Capital Markets estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

17

Gold Road Resources Limited

Obviously the expansion represents additional value to the company, and stands a

reasonable chance of becoming the base case in the event that additional drilling improves

the confidence of material at the base of the pit (also likely in our view). This is driven by the

generally consistent nature of the ore body, which sees no real change in grade or strip ratio

at depth (meaning the waste mining cost remains at the same rate) at depth. The pullforward of production ounces offsets the increased capital requirement, although this would

have less impact on valuation if using a less conservative WACC (we use 10% real). Lastly, the

ability to spread the fixed costs over a larger volume has a positive effect on cash costs,

aided by an increase in production ounces.

However, this also carries potentially higher risks, given higher volume, capex and

potentially lower feed grades

Obviously, any move to treat greater volumes would increase the absolute cost base, and as

such, the business would become more exposed to gold price and currency. As outlined in

Exhibit 14, the addition of lower-grade material beyond the initial six- to seven-year mine life

of an expanded case has a dilutionary effect on cash costs, and it is this period when the

company could become more exposed to volatility in commodity price. Granted, this is

beyond the horizon of many investors, and in the event the project is constructed at

7.5mtpa, capital costs become sunk, and from that point on, the economic decision-making

changes to that of maximising leverage to the installed capacity.

Our assumption of an 11-year life at the greater 8.5mtpa throughput rate still does not

incorporate the complete mineral inventory, which has already been reported (in the

absence of any additional exploratory drilling). In adding this material into our upside case,

we effectively assume lower grades to account for the greater degree of uncertainty

presented by the largely inferred material—which clearly demonstrates economic feasibility.

There is of course some likelihood that the material at the base of the pit (currently classified

as inferred) is in fact the same grade as the remainder of the ore body, and as such, further

drilling would not only confirm this but also increase the confidence levels.

In essence, even attempting to allow for the increased risks in an expanded project, we

believe there is considerable value uplift available in a potential 7.5mtpa project. Given the

lack of any clearly identifiable high grade zones, Gruyere is likely to be a throughput driven

asset.

Exhibit 15: comparison of cumulative cash flow

Base 5mtpa nameplate

Upside 7.5mtpa nameplate

1250

Additional life requires resource upgrade

A$m cumulative free cash flow

1000

750

500

250

0

FY15E

FY18E

FY21E

FY24E

FY27E

FY30E

-250

-500

-750

Source: Company reports, RBC Capital Markets estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

18

Gold Road Resources Limited

Gruyere has corporate appeal in an otherwise ex-growth landscape

The discovery (and potential for a project) comes at a time when we observe the large

portion of the domestic gold sector move ex-growth. Several companies under our coverage

continue to make statements (through presentations and conferences as well as market

releases) of a willingness to acquire and develop new projects to aid in what is otherwise a

declining output, with the last round of new project developments committed in 2010-11

and the subsequent increased volume addition generally complete. This market “precondition” as well as the potential we see within GOR itself provides both the right timing

and exposure for investment in our view.

Exhibit 16: Our take on the potential for Gruyere development under peers within our coverage group

What if the project was owned by… (we consider potential ownership by companies under our coverage larger than GOR)

Proposed capex as a % of

FY16+17 OpCF

(ex Sus Capex)

Proposed capex as a % of

current mkt cap/EV

Contribution to Growth

(impact of c.190koz on RBCe

FY18 attrib. Au production)

Newcrest

The verdict:

22%

5%/3%

10%

Although NCM has not built an open pit operation recently, we believe the company's scale and IP

would easily facilitate development of a project of this nature. We do not believe NCM has a

mandate to grow through acquisition at this stage, but we could see the benefits of broadening

the equity base to acquire and develop this asset (which would also assist in lowering D/D+E

gearing metrics). In addition, a company like NCM may be able to fast-track a development,

bringing production forward such that Gruyere may be up and running prior to Golpu.

Independence

The verdict:

102%

45%/47%

137%

Taken at face value, the Gruyere project appears to provide a strategic fit to IGO, who have

publicly claimed it is looking to grow. The company has a strong balance sheet, and a proven

exploration track record in the emerging eastern WA gold belt. IGO has not directly built any of

its current operations, however, the relative simplicity makes potential development tangible.

Regis Resources

The verdict:

134%

49%/48%

69%

RRL has also publicly spoken of intentions to grow its business (in quarterly announcements and

also conference presentations), and in our opinion, a potential development would be a good fit

for this company. Gruyere would be almost identical to RRL's existing Garden Well mine, with

similar mining and processing rates, and therefore capex requirements. RRL has a track record of

delivering such projects on a modest capital budget (which would increase Gruyere's project

value), owing to the internal IP surrounding project management and construction.

Northern Star

The verdict:

98%

51%/56%

64%

NST has rapidly grown ints production base through 2014, however this had been through the

acquisition of existing underground operations from much larger companies. As such, we believe

that the acquisition of an open pit development project (regardless of jurisdiction) would be both

unlikely and also depart from the strategy which has brought the entity to its current production

status. While we believe that an open pit, CIL gold project should be one of the easier projects to

build, in our view this does not fit NST's business model and core competence (underground

mining).

Source: RBC Capital Markets estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

19

Gold Road Resources Limited

Exhibit 16 (continued): Our take on the potential for Gruyere development under peers within our coverage group

Evolution Mining

The verdict:

Beadell Resources

The verdict:

Proposed capex as a % of

Proposed capex as a % of

Contribution to Growth

FY16+17 OpCF

current mkt cap/EV

(impact of c.190koz on RBCe

(ex Sus Capex)

FY18 attrib. Au production)

136%

95%/75%

60%

This project would comfortably fit within EVN's skill set (in our opinion) given not only the recent

development of the Mt Carlton open pit in Queensland, but also an excellent track record

operating the remaining four mature assets in what has been a tough operating environment for

Australian producers. The company's executive chairman continues to state ambitions to grow,

and we believe a project like Gruyere would make sense for a company in EVN's position.

484%

259%/191%

103%

A move to acquire Gruyere would add significant ounces to BDR, however, we would not consider

BDR to be in a position financially at this stage for such a move. The company recently

restarted/developed the Tucano project in Brazil (which we expect has been significantly more

difficult than Gruyere), however, we see the funding hurdle as prohibitive at this stage.

Source: RBC Capital Markets estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

20

Gold Road Resources Limited

Sensitivities – grade the key driver

Since it is still early days for Gruyere, the company may elect to undergo a slightly different

strategy for bringing Gruyere into production versus our assumptions and the Scoping Study,

whether in terms of scale for production or timing; however, we believe the proposed plans

seem logical given the size and style of deposit. Our estimated upfront capital costs of

c.A$405m (for our assumed 5mtpa plant) are also likely to vary considering examples such as

Regis Resources’ Garden Well plant (4mtpa) had an estimated cost of c.A$110m, whereas

Anglo’s Tropicana plant (5.8mtpa nameplate) total cost was c.A$700m.

In order to demonstrate sensitivity, Exhibit 16 highlights the impact a range of scenarios has

on the company’s NAV (all assumed against our 5mtpa nameplate base case).

Exhibit 17: We outline the sensitivity on movements in gold grade, capex, discount rate,

processing cost and AUDUSD at Gruyere against our base case assumptions

Discount Rate

Grade

FX

Capex

Processing cost

450

A$m NPV

400

350

300

250

200

-10%

Base

10%

Source: RBC Capital Markets’ estimates

Fundamentally, grade is the key driver of the project. As a result, any potential to front-end

the grade profile to maximise near-term cash flow would provide additional risk mitigation to

project valuation (Exhibit 17). Fortunately, we would expect only marginal dilution in

physically mining the ore blocks in the pit, given that the nature of the mineralisation seems

to be wide-spread and disseminated, more so than smaller discrete zones which can be

difficult to blast (while minimising heave or throw of the rock laterally) and secondly mine

(without mis-classifying ore as waste and vice versa). Our base case assumption of ore feed

grade at Gruyere is already materially below the company's global resource grade of 1.23g/t

Au (factoring in c.7% dilution). Similarly, it is unlikely mining costs would remain flat

throughout the LoM, with earlier years significantly cheaper than the final stages as the strip

ratio changes (on a $/t ore mined level).

Exhibit 18: Gruyere shows significant leverage if we vary the grade over the first 3 years,

while maintaining LoM averages (effectively high-grading the deposit)

…on 5mtpa

Scenario

Base (LoM average)

Grade first 3 years (g/t Au)

1.6

1.2

Project NPV (A$m)

362

315

Source: RBC Capital Markets’ estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

21

Gold Road Resources Limited

Funding strategy for Gruyere – we expect the company would consider a range of

options….

Should GOR choose to develop the project in its own right, funding is likely to be the key risk

(in our view). We believe a robust project will generate sufficient market interest in providing

the capital, with Gruyere likely to support both debt and equity funding (based on project

physicals, and commodity price environment aside).

The primary risk is the overall scale of capital required, particularly in the event the company

considers the larger development option we discuss in our upside case (7.5-10mtpa, which is

likely to cost in excess of A$500m), particularly given the company’s current market

capitalisation.

At this stage, we make two key assumptions regarding project funding - namely; any

additional capital has the same cost as our existing WACC (10% real), and that any capital

raised in the market through the issue of shares would be neither accretive nor dilutionary at

the time it is raised. We take this approach in order to avoid conjecture on the likely price at

the time equity is raised, and/or any potential discounts which may be realised in doing so.

Of course, we would expect that as project studies are completed and announced to the

market, the project would be considered de-risked and as such the market may be willing to

pay fuller value for stock.

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

22

Gold Road Resources Limited

Exploration upside

Proven Geology

The geology at the Yamarna Gold Project, as part of the Eastern Goldfields in Western

Australia, is host to Archaean greenstones and within the famous part of the Yilgarn Craton.

The greenstone succession at Yamarna trends northwest/southeast and is in part contact

with Archaean plutonic igneous rocks, composed of quartz diorite to granite. The lithologies

are steeply east dipping within the project area. The greenstone belt held by GOR is both

exposed at surface to partial cover from the glacial sediments of the Paterson Formation

(largely to the south). Aeromagnetic data has interpreted the greenstone sequence at

Yamarna to extend over 200km with most of the belt (largely to the north) covered by a

veneer of Quaternary sand and lake deposits. This is evident at Gruyere with the deposit

beneath a thin sedimentary cover of approximately 1-50m.

The typical greenstone sequence at Yamarna is dominated by three distinct units which

include: Middle – interbedded mafic and felsic extrusives, Lower – ultramafics and mafic

intrusives, and Upper – felsic volcaniclastics and sediments. The deposit geology differs from

that of traditional “Eastern Goldfield” deposits around Kalgoorlie, in that it appears to be a

large accumulation of disseminated gold mineralisation between 1-1.5g/t Au, whereas the

common deposit style would typically see narrow intersections of much higher grades (1020g/t Au). The obvious differentiation is therefore one of scale and volume, which in turn is

likely to make a potential project at Gruyere all about economies of scale, more so than

protecting the high grade ore from dilution and minimising overall material movement.

Exploration upside aplenty…

Gold Road’s tenement holdings cover an area of approximately 5,000km², covering the

majority of the north-west trending Yamarna Greenstone Belt with the geological feature

itself having a strike length of greater than 200km.

As shown in Exhibit 2, the green coloured tenements make up the South Yamarna JV with

Sumitomo Metal Mining Oceana earning 50% interest in the tenements by funding A$8m of

exploration until Dec 2016. Exploration activities commenced in May 2013 with the minimum

spend of A$3.5m (which was achieved in Aug 2014). Sumitomo will acquire a 30% interest in

the projects upon spending A$5m.

The northern portion of tenements, (Exhibit 2, in red), are 100% owned holdings. All the

company’s existing resources, including Gruyere (part of the Dorothy Hills Trend), Central

Bore and Attila are all contained within this northern portion.

High-priority exploration targets (shown in Exhibit 2) include:

1.

2.

3.

4.

5.

6.

South Dorothy Hills (100%)

Minnie Hill (JV)

Corkwood (100%)

Wanderrie (100%)

Smokebush (JV)

Beefwood (JV)

GOR has generated these priority targets based on the interpretation of both geological and

geophysical data sets. Each target has a 15-25km target strike length providing the company

with a large scope for drilling for coming months to years, and with the recent success

obtained from the Gruyere discovery, turning initial discovery to resource in 10 months, the

company would likely built upon its already +5moz Au resource.

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

23

Gold Road Resources Limited

We also see further optimism for untouched gold resources due to the shallow cover

material (~1-50m) over the gold bearing host rocks, shielding any discoveries from walk-up

surface sampling, which is one of the reasons for this whole Yamarna Greenstone Belt being

relatively unexplored in comparison to the adjacent belts, such as the Laverton and

Kalgoorlie-Norseman Gold Belts. We believe GOR will remain committed to exploration and

ascribe A$16m pa on exploration expenditure before tapering off once Gruyere is nearing

production (JunQ’18).

Exploration program

Over the next 12 months, GOR has identified three priority exploration programs:

1.

Gruyere (Dorothy Hills Trend): Both RC (reverse circulation) and diamond drilling is

planned within and around the Gruyere deposit, which intends to not only infill drill the

defined pit shape (which may in itself add ore tonnes as regions of the model currently

not interpolated are drilled out), but also test the vertical extensions which may add

vertically to the potential pit limits. This is expected to be completed by May and should

bring the majority of the material outlined in the scoping study into an indicated

resource category, at a cost of A$3.5-4.0m.

Exhibit 19: Long section of conceptual pit shells at Gruyere. The current drill program is intended to not only infill data spacing

in the lower extents of the pit, but also test the vertical potential. As it stands, drill results released on 20 Jan 2015 have already

identified mineralisation beyond the limits defined

Recent drilling (20 Jan 2015) suggests this area is

mineralised and is NOT included in the published scoping

study, but will be included in the PFS (currently underway)

1H 2015 target

Source Company reports, RBC Capital Markets estimates

February 17, 2015

2.

North Yamarna: GOR is planning to execute an initial 1250m of RC drilling to test existing

anomalies at this prospect approximately 35km away from Gruyere. Air core sampling

has previously identified results such as 7m @ 9.6g/t Au from 44m and 15m @ 1.5g/t Au

from 60m. The company has allocated additional metres in 2Q further to assess any

potential from this program.

3.

South Yamarna JV (with Sumitomo Metals): This program is being completed by GOR but

fully funded by Sumitomo under the JV agreement, which requires c.A$8m to be spent in

order to reach the 50:50 ownership, which GOR believe is likely to commence in mid2016 at current activity rates. Aircore results from Riviera-Smokebush included 12m @

0.96g/t Au from just 28m downhole.

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

24

Gold Road Resources Limited

Global comps – stacking GOR up against other global emerging names

RBC Capital Markets Research covers a further 22 companies which we classify as ‘emerging’

globally. Of this group, GOR sits generally mid-pack on P/NAV around the sector average at

0.66x, and has an EV/Resource (Measured & Indicated) of US$58/oz, compared to the sector

average at US$48/oz. It is a slightly smaller company (measured by market cap) than the

peers identified in this list. Whilst it is not our intention to broadly compare exploration

potential and risks within this larger global group, we are comfortable that GOR would rank

favourably against the peer group in both areas owing 1) to the generally under explored

nature of the region and 2) the project’s relative simplicity and location.

Exhibit 20: RBCe global emerging companies comparison table

Emerging Gold Producers - Valuation Summary

RBC Estimates

Company

Asanko

Aureus

Continental Gold

Gabriel Resources

Gold Road Resources

Gryphon Minerals

Guyana Goldfields

Lydian International

Midas Gold Corp.

Midway Gold

NovaGold Resources

Orbis Gold

Orezone

Phoenix

Pilot Gold

Premier Gold Mines Ltd.

Pretium

Probe Mines

Romarco Minerals

RoxGold

Sabina Gold & Silver Corp.

Torex Gold

True Gold

Global

Ticker

AKG

AUE

CNL

GBU

GOR

GRY

GUY

LYD

MAX

MDW

NG

OBS

ORE

PXG

PLG

PG

PVG

PRB

R

ROG

SBB

TXG

TGM

Rating

O - Spec

O - Spec

O - Spec

SP - Spec

O - Spec

SP - Spec

O - Spec

SP - Spec

O - Spec

O - Spec

SP - Spec

O - Spec

SP - Spec

O - Spec

O - Spec

O - Spec

SP - Spec

O - Spec

R

O - Spec

O - Spec

O - Spec

O - Spec

Price

1.94

0.19

1.91

0.77

0.35

0.069

3.3

0.51

0.51

0.87

4.94

0.71

0.58

0.095

1.1

2.45

8.06

5.24

0.58

0.7

0.41

1.21

0.22

Target

(12m)

3.20

0.50

4.50

1.50

0.50

0.15

4.50

0.70

0.75

1.75

4.30

0.85

0.90

0.20

1.50

4.00

10.00

4.00

R

1.30

0.60

2.00

0.75

Implied

Upside

75%

191%

136%

95%

43%

117%

36%

37%

47%

101%

-13%

20%

55%

111%

36%

63%

24%

-24%

R

86%

46%

65%

241%

74%

Mineralization

Reserve Resource

(P&P)

(M&I)

5.2

0.9

0.0

10.1

0.0

0.7

3.5

0.0

0.0

0.9

19.7

0.0

0.0

1.2

0.0

0.0

7.3

0.0

R

0.8

0.0

4.1

0.9

7.0

1.1

2.8

17.1

2.5

2.7

6.8

2.3

6.5

3.7

28.5

1.2

1.3

2.3

0.9

5.8

9.7

5.2

R

0.8

6.5

4.8

1.9

Valuation

NAV

3.82

0.54

3.68

1.52

0.53

0.33

4.65

0.91

0.55

1.87

4.28

1.18

1.07

0.25

1.17

4.23

10.37

3.85

R

1.44

0.71

1.93

0.76

P/NAV

0.51x

0.35x

0.52x

0.51x

0.66x

0.21x

0.71x

0.56x

0.93x

0.47x

1.15x

0.60x

0.54x

0.38x

0.74x

0.58x

0.78x

1.36x

R

0.49x

0.57x

0.63x

0.29x

0.61x

EV/

Rsrv

26

143

n.m.

25

n.m.

-7

99

n.m.

n.m.

122

64

n.m.

n.m.

17

n.m.

n.m.

97

n.m.

R

141

n.m.

157

-8

73

EV/

Rsrc

20

115

47

15

58

-2

50

35

5

28

44

103

31

8

78

45

73

52

R

131

6

134

-4

48

Shares

(MM)

Mkt Cap

(US$M)

172

310

127

384

595

400

126

239

114

131

317

229

87

370

107

147

117

75

R

286

189

783

448

246

265

89

192

234

162

21

330

97

46

90

1239

124

40

27

93

286

746

312

R

158

61

751

78

251

Priced as of market close AEDT February 13, 2015

Source: IRESS, RBC Capital Markets estimates

February 17, 2015

Paul Hissey

+61 3 8688 6512; paul.hissey@rbccm.com

25

Gold Road Resources Limited

Catalysts

February 17, 2015

With what we believe to be good exploration upside in this underexplored gold region of

Western Australia, we believe that a major catalyst for the company remains a material

exploration result. Either the addition of a new prospect, or the increase in confidence

and/or volume within the existing Gruyere deposit is likely to provide support for the

stock. Exploration in the coming 6 months will be focussed on the company’s six priority

targets (as outlined in Exploration upside above) and we would expect ongoing news

flow commencing early in 2QCY15 with any results.

Based on our view around the scoping study (in particular the mining unit rate, the

potential to expand to 7.5mtpa and a coarser grind size - which would reduce processing

costs), we believe further commentary with the release of Stage One of the PFS

(1H1CY15) surrounding potential improvements in the project economics could provide

additional interest in GOR. At present, the company is guiding towards a fully completed

pre-feasibility study (PFS) by the end of 2015.

We believe the newly discovered Gruyere deposit should be on the radar of several