Pub. KS-1540 Business Taxes for Hotels Motels and Restaurants

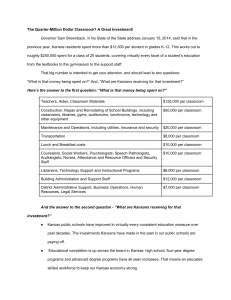

advertisement