Financial Reporting

advertisement

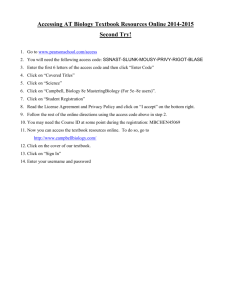

UG 2014-15 Michaelmas Term | Financial Reporting FINANCIAL REPORTING Tomo Suzuki SOLO TAG ug14-15fr Lecturer Tomo Suzuki (Prof. of Accounting and Sustainability Management; Head of Accounting Group; exCPA, Msc, DPhil.) Organisation 1. 2. 3. 4. 5. “Preliminary Exercise” before the first lecture (See below) Lectures (Eight 2-hour lectures in Michaelmas Term [Could be 7 lectures]) Classes and TESTs (Five 1.5 hour classes in weeks 1, 4, 6, 7 and 8) Collections in week zero in Hilary Term (1.5 hours at your college) Examination (Several calculative and conceptual questions, and a few explanatory and critical essay questions, in Trinity Term – 1.5 hours.) Background & Objectives Background: In the last decade or so, the International Financial Reporting Standards (IFRS), which adopt Fair Value Accounting instead of traditional Historical Cost Accounting, have become the internationally dominant accounting standards. This “Global Accounting” is expected to enhance transparency and comparability of financial statements. However, some even suspected the role of IFRS in the recent financial crisis and scandals. Does IFRS help all stakeholders by presenting business realities as they are? Rather than swallowing what standard textbooks say about IFRS and financial reporting in general, we will consider: To what extent, and in what ways, can we utilise this new accounting regime in today’s highly financialized business and society? We do not aim to be an expert accountant, yet, some technical and institutional knowledge of accounting is essential to be a good manager, financial economist, business lawyer, regulator or politician. Indeed it will become the competitive advantage in your career. Let us take Financial Reporting seriously. Objectives: Our objectives are: (1) to understand how modern financial reporting is supposed to theoretically work from a technical (e.g., double-entry system and ratio analysis) and an institutional (e.g., regulations and audit firms) point of view; (2) based on timely case studies, we try to assess the extent to which the roles of financial reporting are achieved in practice; (3) in a fast-changing, global and socially-conscious business environment, we explore new developments of business reporting and disclosure. This course will enable you to (1) read financial sections of business papers and magazines well (i.e., understand the “language of business”), (2) perform primary comparative analyses of many companies, for example, for investment purposes, (3) perform detailed analyses of each individual organisation, for example, for credit analyses or M&A, (4) consider your own organisation’s reporting Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 1 UG 2014-15 Michaelmas Term | Financial Reporting policy and strategy in a CSR conscious environment, beyond these practical benefits, (5) to consider some intellectual and critical issues about the roles of financial reporting in society. Preliminary Reading Those with little or no background in accounting will find this course challenging. The course requires a considerable effort to get to grips with both the vocabulary of accounting and techniques. Officially speaking, the course does not assume any knowledge of accounting in advance of the first lecture (except for the Preliminary Exercise – see below), however some preliminary reading should help. Choose any (short, light and very basic) double-entry bookkeeping and financial accounting book for business people. Or, perhaps it is better to utilise web-based information such as:http://www.freebookkeepinghelp.com/. Some courses here are really good and for free (but it takes a bit of time, and it lacks critical thinking). If you do not have any knowledge of accounting and weak in dealing with numbers, you may wish to go through “Introduction to Financial Accounting.” Preliminary Exercise – Most Important The aim of the Preliminary Exercise is to standardise the minimum knowledge that is required for this course. The point of this exercise is to understand the flow from double-entry bookkeeping to financial statements, and more fundamentally, to get used to accounting terms (such as “assets” and “liabilities”). Where to obtain it: The Preliminary Exercise can be found at the end of this Reading List. you may access it online by clicking here. When and How to complete it: The Preliminary Exercise should be completed in advance of the first lecture. The exercise is very simple but requires some time to repeat and memorise. You can NOT finish in a few days. You must repeat it at least Five Times if you have little background of accounting. You should expect a TEST in the first Lecture. The textbook below provides some double-entry bookkeeping issues. If you repeated the Preliminary Exercise five times and understood well, there is no need to go through them. However, if you wish to know double-entry bookkeeping and the accounting procedure a little better, please utilise it. There are some differences between the two, also in the above on-line accounting courses as well. If you find accounting terminologies confusing, actually, you are doing well. It is the case in the actual financial world (and it is not the disorganisation of the lecturer), and you started getting used to it. Class Work and Arrangement – Important We will have Classes in weeks 1, 4, 6, 7 and 8 (1.5 hours each time). You will be notified with your Class No., day and time at the beginning of Michaelmas term. You will NOT be able to change your Class unless you have an exceptional and legitimate reason (n.b., “sports” - not legitimate reason). In the class room, you are asked to sit exactly the same seat every week so your class teacher can remember you (It is important for the Tutorial Reporting purpose). 1. The first 30 minutes will be spent for a short TEST on the previous week’s topic. The first week TEST will be on the double-entry bookkeeping from the Preliminary Exercise. In the following weeks, you are expected to revise weekly handouts and problem sets, to prepare for the TEST. If you perform very well or very poorly, your College will be notified. 2. The last 60 minutes will be spent for discussions on a few important topics from the lecture of the week. The discussions should form the basis of your essay which should be handed in in the following Class. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 2 UG 2014-15 Michaelmas Term | Financial Reporting 3. Essay: Strictly follow the rules below. Type written on A4 paper. 12-font-size. State your Class number followed by “Surename, First Name” on the top-right corner. The length should be strictly within 850 words. Staple top-left corner. Hand in the Class in person, only. Delayed submission will NOT be accepted under any circumstance – due to the need for the efficient administration for large scale classes. If the above rules are not met, your essay will not accepted, and the score / mark will be zero. Textbook As financial accounting has just gone through the International revolution and Fair Value revolution over the last decade or so, we have not seen a good textbook – authors are just catching up. Also, Oxford accounting courses are short which does not provide candidates with much time to read through a tick textbook. If candidates just skim a textbook, it can be rather confusing. On the other hand, updated teaching/learning materials are increasingly available on-line. Therefore, I thought of not setting a textbook this year for the first time. However, this can cause a “worry” among many students; and therefore I tried to find a relatively concise and updated textbook which covers similar topics as ours. The following textbook (John Dunn, 2010; there could be a new edition, and in such a case, use the new edition.) is recommended. By the time of your purchase, there may be a new edition, which is fine, of course. The textbook sometimes addresses issues which go beyond the scope of this course. In such cases, use your discretion as to whether or not you have time to read beyond topics raised in the lectures. Reasonable judgements and time management, are essential in surviving the Oxford courses. In any case, “Readings” in the Reading List should be done AFTER lectures, unless otherwise advised. In this Reading List, Chapter and page numbers refer to this textbook (2010 version). Financial Reporting and Analysis (1st edition, 2010) John Dunn ISBN 978-0-470-69503-6 January 2010, ©2009 Paperback, 392 pages Search Oxford Libraries Online for this book Alternatively, the following textbook is also good, covering more topics and details. If you are keen to develop your financial reporting knowledge, you may wish to purchase this textbook. (But if you just skim this textbook, it will be more confusing than helping you.) You should always use the newest edition. By using the Table of Contents and Index, you can easily find relevant parts of the textbook to our course. Financial Accounting: An International Introduction, 4/e (April 2010), by David Alexander and Christopher Nobes; Publisher: Financial Times Press/Peasons Education Search Oxford Libraries Online for this book The following textbooks are recommended for advanced and interested students. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 3 UG 2014-15 Michaelmas Term | Financial Reporting For reading Annual Report and Financial Statements line by line (Basics): Interpreting Company Reports and Accounts (2008) 10/e Holmes, Sugden and Gee, FT Prentice Hall, ISBN-13:978-0-27371141-4. Search Oxford Libraries Online for this book For Financial Statements Analysis (Applied): Company Accounts: Analysis, Interpretation and Understanding (2003) 6/e Pendlebury and Groves, Cengage, ISBN-13: 9781861529473 Search Oxford Libraries Online for this book For more advanced and comprehensive (including company valuations): Financial Reporting, Financial Statement Analysis, and Valuation - A Strategic Perspective 6/e (2007) Stickney, Brown, and Wahlen, Cengage, ISBN-13: 9780324302950 Search Oxford Libraries Online for this book Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 4 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 1 – Overall Framework of Financial Reporting The first lecture illustrates the overall workings of Financial Reporting, covering its brief history, the users and uses of accounts, the method of double-entry bookkeeping, basic financial statements, namely Statement of Financial Position (or more commonly, Balance Sheets or BS), Statement of Comprehensive Income (Income Statement or IS; or Profit and Loss Account or PL) and Statement of Cashflow (Cashflow Statement or CF), and issues which go beyond traditional Financial Reporting. (I warned you already that the terminologies are confusing, but this is the reality.) 1.1 Users and Uses of Financial Reporting 1.2 Revision of Preliminary Exercise: Case Study (Lemonade ltd.) 1.3 Basics of BS, IS and CF – accounting “techniques and terminologies” to be understood. 1.4 Annual Report (Nestle, and Oxford BioMedica plc.). Contents to be understood. 1.5 Off-balance-sheet transactions and extended reporting Reading – Textbook and supplement in the lecture Lecture hand-outs will give you precise contents that you are supposed to learn in each week. Use the following readings as supplement to what we study in the lecture. You do NOT need to go through all the details to pass the course. Chapter 1 Chapter 2 Chapter 3 Chapter 4 (Only if you are keen) Annual Reports (In the lecture) Off-balance story provided in Lecture Learn overall background of Financial Reporting Lean overall background of today’s regulation. We will come back to this point in other lectures. Learn the contents of Annual Reports – but use Nestle’s Annual Report for details. Skim this chapter to know the role of academic research. You are warmly invited to consider your career as an academic accountant. Please do speak to me. Read annual reports of Nestle and Oxford BioMedica as much as possible to familiarise the contents of Annual Report. Understand the importance of Off-balance sheet transactions. Additional Reading (only if you are keen to know the details) Zeff, S. (2003) “How the U.S. Accounting Profession Got Where It Is Today Part II” Accounting Horizon. 17(4): 267-286 Greenberg, M. Helland, E., Clancy, N. and Dertouzos, J. (2013) Fair Value Accounting, Historic Cost Accounting, and Systemic Risk Available to download from Rand Center for Ethics and Corporate Governance. Correct at 22/10/2014 The UK is covered by the textbook. So, use this for the US. Do not try to remember the details. Simply use this as a supplementary reading about the accounting profession, which is very helpful as basic knowledge of FR. Read Chapter 2, pages 7-15. This chapter provides an overview of the debate between HCA and FVA. As we progress through the materials this term, consider some of the questions raised in this chapter. Please report broken links to readinglists@sbs.ox.ac.uk 5 UG 2014-15 Michaelmas Term | Financial Reporting Class 1 TEST (Calculation): Double-entry bookkeeping, Gap filling of Financial Statements. For this, repeat Preliminary Exercise. Class 1 Work (Essay): What is FR; How is it used, by whom, and when? Summarise in 100 words for each point. What is the debate of “IS Approach (Historical Cost Accounting) vs BS Approach (Fair Value Accounting)”? Summarise in 250 words. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 6 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 2 – Details of IS In Lecture 1, we learnt the overall framework of financial reporting, however, almost all the figures were “given.” This time, we will see how figures are actually calculated. In order to understand this, we will study some important accounting terms and concepts such as “Realisation,” “Accrual,” “Consistency”, etc… (see below in the table), and we will do this with many examples. Through this process, we will realise how accounting figures can be problematic, rather than neutrally or objectively reflecting reality. We start from IS items in this lecture, followed by BS items and CF items next time (The IFRS approach starts from BS, then IS; but we start from IS then BS, for some good reasons. Details will be explained in the Lecture). 2.1 IS Revenues (or Sales) Cost of Sales Gross Profit General Expenses Depreciation/Amortisation Bad Debt Provision / Allowance Directors’ pay Profit before Tax Tax Profit after Tax Dividends Retained Profit for year Accounting concepts and terms to be learnt with examples On this, the textbook is not strong. But see “Construction contracts” (pp. 221-228. We will come back to this point time and again. Please check the accounting concept of “Realization” on Websites. Chapter 10. Please check the concepts of “Matching,” “Fifo/Lifo” and “prudence”. - (What’s the use of this notion of profit?) “Accrual,” “Expense” e.g., Rent, Water charge, etc… See Lecture handout. Chapter 8 and 9. “Depreciation / Amortisation” e.g., Depreciation of buildings, or Amortisation of Licence. pp. 252-267. Please check the concepts of “Prudence” and “Consistency” See Lecture handout and Websites. e.g., Stock Options. See Lecture handout. - (What’s the use of this notion of profit?) Chapter 6. (But do not go into details) - (What’s the use of this notion of profit?) “Statement of Changes in Equity”, “Corporate Governance”. See Lecture handout. - (What’s the use of this notion of profit?) Below the line, either under the IS or “Statement of Changes in Equity (IFRS, etc)”. The format above is slightly different from IFRS format in relation to the “Other Comprehensive Income” at the bottom of the statement. We will deal with this issue in the lecture. Check the hand out carefully. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 7 UG 2014-15 Michaelmas Term | Financial Reporting Reading – Textbook See the above table. Additional readings will be provided in the lecture. Because the textbook takes a slightly different teaching approach from the Lecture, the reading sections above appear “messy.” If this bothers you, do not spend too much time this week. Wait until Lecture 3, and read through the textbook from Chapters 6 to 11. This should help you understand issues around IS, BS and CF items. Additional Reading McCrum, Dan (14/7/2014) Feeling the WIP and recognizing the law at Quindell, FTAlphaville, FT.com. Registering for FT.com outside Oxford Short article from the Financial Times discussing revenue recognition complications. Class 2 TEST (Calculation): [Class 2 is in week 4] Several IS items. See handouts for details. See also the Selected Exam Questions in “Week 0” file online. Class 2 Work (Essay): Choose one from (1) What are “profits” and how do we determine in the IS?, (2) What are “Realisation,” “Matching,” “Prudence,” “Consistency,” and other Accounting Concepts? 150 words for each. (3) Explain accounting for R&D. (We will come back on these in Lectures 3 and 4). Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 8 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 3 – Details of BS, CF and Consolidation Accounting In Lecture 2, we covered Income Statement items. We now move on to Balance Sheet items, and Cashflow Statements. 3.1 BS Accounting concepts and terms to be learnt with examples Fixed Assets (Tangible) Chapter 8 “Historical Cost,” “Revaluation” e.g., Land. (Intangible) Chapter 9 “Historical Cost,” “Revaluation” e.g., Goodwill (Lecture 4) Chapter 10. e.g., Inventories, Cash, etc…“Current/non-current distinction” Current Assets Biological Assets (IAS 41). See Lecture handout. Schuetze, W. (1993) “What is an asset?” Accounting Horizons, 7(3):66-70. Total Assets [This is an Additional Reading] Liability Chapter 11 e.g., Contingent Liability, Off-balance sheet Equity Share Capital Chapter 1 Retained Profit Chapter 1 Other components of See lecture handout, and also Fixed Assets and Revaluation. Eq Equity and Liabilities - 3.2 CF - See Lecture handout for Cashflow Statement Reading – Textbook For BS, see the above table. Additional readings will be provided in the lecture. For CF, the textbook is not strong. Use Lecture handout. Reading Biondi, Y. & Suzuki, T. (2007) “Introduction: the socio-economic impacts of international accounting standards” Socio-Economic Review, 5(4):585-602. Dichev, I.D. (2008) “On the Balance SheetBased Model of Financial Reporting” Accounting Horizons, Dec, 22(4):453-470. Correct at 22/10/2014 Learn Fair Value accounting and the difference from Historical Cost accounting. The Socio-Economic Review, Vol. 5, No. 4. covers different impacts of Fair Value Accounting on wider issues including financial crisis, fair trade, etc… Read as much as you can. Learn the difference between Income Statement Approach and Balance Sheet Approach. Please report broken links to readinglists@sbs.ox.ac.uk 9 UG 2014-15 Michaelmas Term | Financial Reporting 3.3 Consolidation Accounting In the second half of the lecture, we will introduce the issues of Business Combination. So far, we assumed that we account for one legal entity’s financial performance and positions. However, large companies usually have many group companies. In order to know the group’s performance and financial positions, we will introduce “group accounting”. We use cases from Nestle, Coca Cola, Enron and others. Reading - Textbook Chapter 12 and 13 Learn usefulness and difficulty of group accounting. Learn also basic methods of consolidation, but do not go into details. Learn the nature and meanings of “Goodwill,” “Minority Interest” and other key notions. For Segment Reporting, see Chapter 7. Additional Reading Henry, B. (1999) “What constitutes control?” Journal of Accountancy, 187(6):39-43. Hermann, D. & Thomas, W.B. (2000) “An analysis of segment disclosures under SFAS No.131 and SFAS No.14” Accounting Horizons, 14(3):287-302. McCrum, Dan. (26/8/2014) Quindell and an industry deaf to its assumptions FTAlphaville, FT.com. Registering for FT.com outside Oxford Indap, Sujeet. (11/3/2014) The pool is closed FT.com Registering for FT.com outside Oxford Learn the difficulty of consolidation in relation to determination of the “to-be-consolidated” entities. If you are very busy, just scan the article. We learnt the necessity of consolidation, but what about the necessity of segment (i.e., breakdown) information? Shareholders and Stakeholders keep demanding more information. If you are very busy, just scan the article. Short article from the Financial Times relevant to class discussion of consolidation accounting and goodwill. Three part series explaining pooling-of-interest and purchase accounting and the history and politics of the standards. TEST Preparation (Calculations): Balance Sheet items; Cashflow statement (partial). Calculation of Goodwill and Minority Interests. TEST Preparation (Concepts and Essays): (1) “Cash is fact. Profit is someone’s opinion” What does this mean? (2) Explain the recent shift from the “Income Statement Approach” to the “Balance Sheet Approach” in Financial Accounting. We touched upon it in Lecture 1. (3) How should we account for Goodwill? (4) Would IASB’s “Management Approach” to Segment Reporting help? Short essay in 300-400 words for each question. Class 2 TEST (Calculation): [Class 2 is in week 4] Several IS and BS items. Cashflow calculation. See handouts for details. See also the Selected Exam Questions in “Week 0” file online. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 10 UG 2014-15 Michaelmas Term | Financial Reporting Class 2 Work (Essay): Choose one from (1) “Profit is someone’s opinion, Cash is fact” – what does this mean? (2) Critically review the Management Approach of Segment Information. You have to choose only one essay title from Lecture 2 and 3 topics. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 11 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 4 – Financial Statement Analysis 4.1 Financial Statement Analysis 1 - Trend Analysis (Horizontal analysis) Lecture 1 covered the overall framework of financial reporting. Lectures 2 and 3 covered many accounts in the IS, BS, CF and Consolidation. Having studied details of each account, this time, we now move on to analysis of actual financial statements. Based on a simple Trend Analysis, we will establish a basis of detailed analysis of an organisation. Case Study 1: Network Communication plc. (No preparation is required) Case Study 2:Traditional ltd. (No preparation is required) Reading – Textbook and Annual Report (Chapter 7) Annual Reports The textbook is not strong on Financial Analysis. Learn Trend analysis based on the case studies in the lectures. The textbook covers some critical pints of the use of financial analysis. Go back to the Annual Reports we have already seen and try to read Financial Statements as much as possible. 4.2. Financial Statement Analysis 2 – Ratio Analysis Following Trend Analysis, we now move on to Ratio Analysis which will enable us to perform comparative analysis of many companies. XBRL (Extensible Business Reporting Language) may appear useful in the globalised markets and businesses. However, the danger of the over reliance on the ratio analysis will also be emphasised. Case Study 3: Nestle, Henkel and Sany (Critical Case – including “XBRL”) Reading - Textbook Chapter 7 The textbook is not strong on Financial Analysis. Use the Lecture handout. For basic calculations, you must use actual financial statements to practice. Reading Brown, P. (1998) “A model for effective financial analysis”, Journal of Financial Statement Analysis, 3(4):60-63. Brashear, Jim. (2009) SEC Mandates Interactive Data Financial Reporting. Corporate Governance Advisor, 17(3):2730 See Reference textbook above Buffett, M. and Clark, D. (2008) Warren Buffett And The Interpretation of Financial Statements, Search Oxford Libraries Online for this book Correct at 22/10/2014 This is one of traditional ways of doing financial analysis. Critically evaluate the model proposed here and combine it with the model proposed in the textbook. Learn how XBRL should work; but also critically evaluate risks associated with it. Some more details on ratio analysis. Learn the basics of reading and interpreting financial statements Please report broken links to readinglists@sbs.ox.ac.uk 12 UG 2014-15 Michaelmas Term | Financial Reporting Additional Reading Graham, Benjamin (2006). The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition) This is a classic financial text that outlines the basics of value investing. Search Oxford Libraries Online for this book TEST Preparation (Calculations): Trend Analysis and Ratio Analysis – exercise provided in Lec. TEST Preparation (Concepts and Essays): (1) Evaluate usefulness and risks of ratio analysis; (2) Evaluate usefulness and risks of XBRL. (3) Under the current business environment where financial data are readily available on line, what aspects of financial reporting should you be careful about? 200 words each. (4) More intellectually oriented question would be “Would the faster the better in financial information market?” You can write a dissertation on this. Anyone who wants to do D.Phil with me? Preparation for Lecture 5: Read the following three case studies. You do not need to calculate anything but think about doubleentries (without numbers) and their implications to a wide range of stakeholders. (1) Matsumoto, D and Bowen, R. 2000 Microsoft's Financial Reporting Strategy HBSP Case 9100027 (Questions and Data for this Case Study. But follow the instruction given at the lecture) Please store Questions and Data in appropriate drives and link (2) Oxford BioMedica Case Study (No preparation required in advance). (3) IFRS (IAS 41), Plantation and Sustainable Development Case Study (No preparation required in advance) Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 13 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 5 – Financial Statement Analysis 2 - Ratio Analysis; Regulation. Following Trend Analysis in Lecture 4, we now move on to Ratio Analysis which will enable us to perform comparative analysis of many companies. XBRL may appear useful in the globalised markets and businesses. However, the danger of the over reliance on the ratio analysis will also be emphasised. 5.1 Risks of Ratio Analysis – Cases from Nestle, Henkel and Sany (a Chinese company). 5.2 Revision of Trend Analysis – Vodafone Case Reading - Textbook Chapter 7 The textbook is not strong on Financial Analysis. Use the Lecture handout. For basic calculations, you must use actual financial statements to practice. Reading Brown, P. (1998) “A model for effective financial analysis” Journal of Financial Statement Analysis, 3(4):60-63. Brashear, Jim. (2009) “SEC Mandates Interactive Data Financial Reporting” Corporate Governance Advisor, 17(3):2730 See Reference textbook above This is one of traditional ways of doing financial analysis. Critically evaluate the model proposed here and combine it with the model proposed in the textbook. Learn how XBRL should work; but also critically evaluate risks associated with it. Some more details on ratio analysis. 5.3 Accounting Regulation – Critically evaluating the Global Accounting Regulation Read Chapter 5. IFRS by International Accounting Standards Board (IASB) is generally regarded as “progress” towards more efficient financial markets. Is it the case? If so, in what ways, is it so; and is it not so? We evaluate effectiveness of IFRS in the globalized business world based on some examples such as IAS 41 “Agriculture”. Class 4 TEST (Calculations): [Class 4 is in Week 6] Financial Ratios and their interpretation. Class 4 Work (Essay): Choose one from (1) In the era of internet and XBRL, how would such readily available data work in our business and society?, and (2) “How should financial reporting be regulated in the globalised era?” Demonstrate balanced arguments based on good examples. Preparation for Lecture 6: You can also find the copy on the Weblearn. (1) Read Microsoft Case Study Matsumoto, D and Bowen, R. 2000 Microsoft's Financial Reporting Strategy HBSP Case # 9100027 (Questions and Data for this Case Study. (You can disregard the Questions and Data for now). (2) Oxford BioMedica Case Study (No in-advance preparation). (3) IFRS (IAS 41), Plantation and Sustainable Development Case Study. Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 14 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 6 – Creative Accounting, Audit and Regulation. Lecture 5 pointed out that accounting figures and ratios are utilised in our highly globalised and automated financial world. Under such conditions then, how would management of multinational firms behave? Let us examine managements’ behaviour based on the cases from Microsoft, Oxford BioMedica, Enron and Satyam. How, should accounting regulation and auditing, prevent excessive creative accounting and accounting scandals? For the preparation for the case studies below, see page 8. 6.1 Case Study 1: Microsoft’s Creative Accounting 6.2 Case Study 2: Oxford BioMedica plc. 6.3 Case Study 3: IFRS (IAS 41), Plantation and Sustainable Development Case Study. 6.4 Auditing and Audit Firms – Cases of Satyan (India) and others. Reading - Textbook Chapter 7 Revise again how financial analysis is done and where trick may be hidden. Reading Collingwood, H. (2001) “The earnings game: Everyone plays, nobody wins”, Harvard Business Review, 79 (6), pp. 6574. Search BSC AN= 4552729 Sharma, E. Kumar. (4/5/2009) “Run Open Fraud.exe”. Business Today, Vol. 18 Issue 7, p90-92. Bazerman, Max H.; Loewenstein, George; Moore, Don A. (2002) “Why Good Accountants Do Bad Audits”. Harvard Business Review, Vol. 80 Issue 11, pp. 96-103. Consider the effects of earnings management. Learn some details of recent accounting scandal at Satyam which was listed at NYS and also received the Corporate Governance Award. You know theoretically what auditors are supposed to do. But then let us learn why they do bad audits. Search: BSC AN= 7720821 Barry, Kevin (2009) “Healthsouth’s Corporate Accounting Scandal: A Case Study in Fraudulent Financial Reporting” Broad overview of the Healthsouth case. Covers the methods and DR/CR entries used to commit a nearly 3 billion dollar fraud in the US. The case study also briefly discusses why the audits were ineffective. Sunder, S., (2010). “IFRS monopoly: the Pied Piper of financial reporting.” Accounting and Business Research. 41(3): 291-306. Class 4 TEST (Calculations): [Class 4 is in Week 6] Review double-entries of creative accounting. Class 4 Work (Essay): Choose only one from the questions in Lecture 6 and (3) “What is Creative Accounting? Is it always wrong or bad? What is the role of Auditors in this context? Are they playing the expected roles under the current institutional arrangements?” Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 15 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 7 – CSR Reporting, Environmental Accounting, and Accounting for NPOs. So far, we have looked at Financial Reporting of for-profit organisations. However, Oxford candidates are often more socially conscious than those in the other top business schools, and many of them will become a social entrepreneur, work for NPOs, governments and international organisations such as the UN. How could these organisations be best accounted for? In addition, even if you are working for a commercial company, you will need to be aware of impacts of CSR Reporting which has become an increasingly important means of communications with stakeholders. Let us understand the state of arts of these new reporting practices, and consider the future and the strategy for emerging business reporting issues. 7.1 CSR Reporting 7.2 Environmental Accounting (including Accounting for Nuclear Power Plants) 7.3 Accounting for NPOs 7.4 Designing Accounting for Sustainable Growth – Experimental Research Perspective Reading (No good textbooks are readily available) Class TEST Preparation (Calculations): None. Class TEST Preparation (Concepts and Essays): (1) “Accounting should simply reflect the reality.” Or, “Financial Reporting can be designed for Sustainable development.” If so, how can it be done effectively? (2) What is the institutional design of financial reporting? (3) “By creating a new accounting framework, you can make a lot of money!” How? Use the Business Source Complete database for browsing relevant articles to serve your interests. Ballou, Brian; Heitger, Dan L.; Landes, Charles E. (2006) The Future of Corporate Sustainability Reporting. Journal of Accountancy, Vol. 202 Issue 6, p65-74. Available from Business Source Complete. NPO Accounting http://www.muridae.com/nporegulation/accounting.html Correct at 22/10/2014 We are now almost at the end of the course. Also, today’s topics are fast changing. Please actively search the relevant literature, articles, data, etc… which serve your interests. Lean the evolution and future of CSR reporting. But read it critically, because CSR reporting should be different depending on “for whom, what, and when.” Some accounting for NPOs. If you are very keen on this point, use as a reference point. Please report broken links to readinglists@sbs.ox.ac.uk 16 UG 2014-15 Michaelmas Term | Financial Reporting Lecture 8 – Summary: Account-ing for what and how? This is the last lecture of our Financial Reporting course. Throughout the course, various problematic features of accounting were identified. Once caught up in the busy business life, however, we tend to forget these problematic features of accounting. Accounting shifts our focus quite exclusively on numbers themselves, which, in turn, creates new social realities. At the end of this course, let us recapitulate what we have studied, and remind us what we are accounting for and in what ways. We will use two case studies. 8.1 Case Study 1: Japanese Banking Industry - Institutional and socio-economic need. 8.2 Case Study 2: Enron Scandal – Personal need (or greed). (For these Case Studies, no preparation is required. For the Enron case, DVD will be played.) Essential Reading The whole textbook No new issue this week. It is time to re-read the textbook for revision. Do not worry about the details, but try to understand the overall framework of Financial Reporting. Additional Reading (only if you are keen to know the details) Special Issue on Enron. Journal of Accounting and Public Policy, 21(2). Particularly: Benston, G.J. & Hartgraves, A.L. (2002) “Enron: what happened and what we can learn from it” Journal of Accounting and Public Policy, 21(2):105127. Learn what happened with Enron. Do not worry about the details of accounting techniques, but know how creative accountings might have happened. Class 5 TEST (Calculations): [Class 5 is in week 8.] None. Class 5 Work (Essays): Choose only one from the question in Lecture 7 and (2) Consider an effective social mechanism in which accountants and accounting practices are appropriately disciplined. Epilogue: Thank you for learning Financial Reporting with me. This course is too short, but I hope you learnt something from this course. Financial reporting is much more powerful than usually thought, in many different senses. If you are interested in learning financial reporting more, please contact me. I am on Facebook and Linkedin (please make friends .). I hope we have a chance to meet again. Thank you. Tomo Suzuki Correct at 22/10/2014 Please report broken links to readinglists@sbs.ox.ac.uk 17