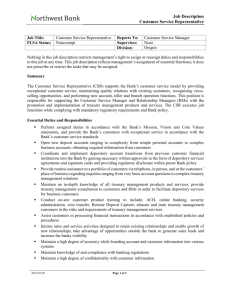

Banking Act 2009 - Legislation.gov.uk

advertisement