MRF Limited

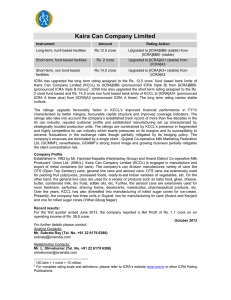

Instrument

Non Convertible Debenture (NCD)

NCD – Proposed

Amount (Rs. Crore*)

500.0

100.0

Rating action

[ICRA]AA+ (Stable) Re-affirmed

[ICRA]AA+ (Stable) Re-affirmed

ICRA has re-affirmed the [ICRA]AA+ (pronounced ICRA double A plus) rating outstanding on the Rs.

500.0 Crore Non-Convertible Debenture (NCD) and Rs. 100 crore proposed NCD programmes of MRF

Limited (“MRF”/ “the Company”)†. The outlook on the rating is stable.

The re-affirmation of the rating considers the healthy financial profile of the company aided primarily by

robust demand from the replacement and export segments and the company’s sustenance of its

dominant market position in the Indian Tyre industry despite the weak domestic OE demand.

Supported by strong volumes and benign rubber prices, the Company’s profit margins witnessed sharp

expansion in the last six quarters, leading to significant improvement in MRF’s cash accruals. Driven

by these factors, the Company’s financial profile is presently characterised by healthy capital structure

(gearing of 0.7x as on 31.03.2013) and large cash balances and investments totaling over Rs. 700

crore as of March 2013.

The Company’s consistent track record of large scale operations, its competitive positioning, strong

brand loyalty and dominant market share across different segments continue to support the ratings.

With a well diversified product portfolio and large share of revenues from replacement markets (over

70%, greater than peers), MRF’s volumes are insulated from cyclicality in the domestic markets to a

considerable extent. That said, MRF also enjoys stable and healthy relationships with all major

domestic OEMs, which is expected to support future volumes given the expected long term favourable

demand outlook for the auto industry.

The rating, however, also considers the vulnerability of the Company’s margins to volatility in raw

material prices - notably that of natural rubber, synthetic rubber and oil derivatives. With average

landed cost of natural rubber (both domestic and international) on the rise over the last few months,

ability of the Company to enact positive pricing actions would remain crucial to sustain the current high

levels of profitability. Further, the highly capital intensive nature of the business, while acting as a

strong entry barrier, necessitates significant large re-investments in the business. With the industry

going through a period of cyclical oversupply currently, pricing flexibility of domestic manufacturers is

also expected to be under pressure. Therefore, MRF’s ability to rapidly ramp up operations, whilst

maintain its margins would be crucial to sustain its healthy credit profile.

Company Profile

Incorporated in 1960, MRF Limited (“MRF” / “The Company”) was initially started as a small

manufacturing unit producing balloons, latex cast squeaking toys and industrial gloves. Established as

a partnership firm under the name Madras Rubber Factory in 1949 at Chennai, the business was later

taken over and converted into a public limited company in 1960 and the company began manufacture

of tyres in technical collaboration with Mansfield Tyre and Rubber Company, USA. Currently, the

company has three subsidiaries - MRF Corp Limited, MRF International Limited, and MRF Lanka

Private Limited. MRF is currently managed by Mr. K.M. Mammen; and the promoters collectively hold

~27.0% stake (as on March 31, 2012) in the company. With an annual production capacity of 35.7 (as

on March 2012) million tyres, MRF has its manufacturing plants spread across eight locations in Tamil

Nadu, Kerala, Andhra Pradesh and Goa. MRF has a strong R&D support and marketing team with a

wide distribution network comprising over 100 sales offices and 400 field officers, and more than 4,000

dealers in India.

*

100 lakhs = 1 crore = 10 millions

For complete rating scale and definitions, please refer to ICRA’s website (www.icra.in) or other ICRA rating

publications

†

Recent Results

During the nine month period ended 30th June 2013, the company’s operating income and net profit

(standalone) stood Rs. 8,983.5 crore (corresponding previous nine month period ended 30th June

2012, Rs. 8,876.6 crore) and Rs. 618.1 crore (corresponding previous nine month period ended 30 th

June 2012, Rs.407.6 Crore) respectively.

August 2013

For further details please contact:

Analyst Contacts:

Mr. Subrata Ray (Tel. No. +91 22 61796386)

subrata@icraindia.Com

Relationship Contacts

Mr. Jayanta Chatterjee, (Tel. No. +91-80-43326401)

jayantac@icraindia.com

© Copyright, 2013, ICRA Limited. All Rights Reserved.

Contents may be used freely with due acknowledgement to ICRA

ICRA ratings should not be treated as recommendation to buy, sell or hold the rated debt instruments. The ICRA

ratings are subject to a process of surveillance which may lead to a revision in ratings. Please visit our website

(www.icra.in) or contact any ICRA office for the latest information on ICRA ratings outstanding. All information

contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although

reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as is’

without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or

implied, as to the accuracy, timeliness or completeness of any such information. All information contained herein

must be construed solely as statements of opinion and ICRA shall not be liable for any losses incurred by users from

any use of this publication or its contents

Registered Office

ICRA Limited

1105, Kailash Building, 11th Floor, 26, Kasturba Gandhi Marg, New Delhi 110001

Tel: +91-11-23357940-50, Fax: +91-11-23357014

Corporate Office

Mr. Vivek Mathur

Mobile: 9871221122

Email: vivek@icraindia.com

Building No. 8, 2nd Floor, Tower A, DLF Cyber City, Phase II, Gurgaon 122002

Ph: +91-124-4545310 (D), 4545300 / 4545800 (B) Fax; +91- 124-4050424

Mumbai

Mr. L. Shivakumar

Mobile: 9821086490

Email: shivakumar@icraindia.com

Kolkata

Mr. Jayanta Chatterjee

Mobile: 9845099459

Email: jayantac@icraindia.com

3rd Floor, Electric Mansion, Appasaheb Marathe Marg,

Prabhadevi, Mumbai - 400 025

Ph : +91-22-30470000, 24331046/1053

/1062/1074/1086/1087, Fax : +91-22-24331390

Chennai

Mr. Jayanta Chatterjee

Mobile: 9845099459

Email: jayantac@icraindia.com

A-10 & 11, 3rd Floor, FMC Fortuna, 234/3A, A.J.C. Bose

Road Kolkata—700020

Tel: +91-33-22876617/8839 22800008/22831411

5th Floor, Karumuttu Centre, 498 Anna Salai, Nandanam,

Chennai-600035.

Tel + (91 44) 45964300, Fax + (91 44) 9434 3663

'The Millenia',

Tower B, Unit No. 904, 9th Floor, Level 9, 19-14, 1 & 9,

Murphy Road, Bangalore - 560 008

Tel:91-80- 43396400 Fax:91-80-43396409

Ahmedabad

Mr. L. Shivakumar

Mobile: 989986490

Email: shivakumar@icraindia.com

Pune

Mr. L. Shivakumar

Mobile: 989986490

Email: shivakumar@icraindia.com

907 & 908 Sakar -II, Ellisbridge,

Ahmedabad- 380006

Tel: +91-79-26585049, 26585494, 26584924,

Tele Fax: +91-79-25569231

Hyderabad

Mr. Jayanta Chatterjee

Mobile: 9845099459

Email: jayantac@icraindia.com

5A, 5th Floor, Symphony, S.No. 99, CTS 3909, Range Hills

Road, Shivajinagar,Pune-411 090

Tel: + 91-20-25561194-25560196; Fax: +91-20-25561231

4th Floor, SHOBHAN, 6-3-927/A&B. Somajiguda, Raj

Bhavan Road, Hyderabad—500083

Tel:- +91-40-40676500

Bangalore

Mr. Jayanta Chatterjee

Mobile: 9845099459

Email: jayantac@icraindia.com

![Rating of [ICRA]AA(stable)](http://s3.studylib.net/store/data/008897864_1-997f5bded17492c22f64602061b0ebeb-300x300.png)