Jyoti CNC Automation Private Limited

RATING HISTORY

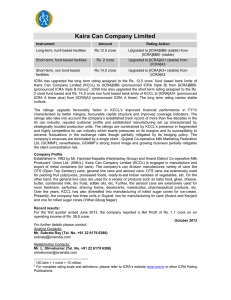

Maturity

date

Rs. 888.90 million Term Loans

Rs. 450.00 million Fund based limit

Rs. 210.00 million Fund based limit

Rs. 160.00 million Non-Fund based limit

ICRA has assigned an LBB+

(pronounced L Double B plus) rating

to the Rs. 888.90 million term loans

and Rs. 450.00 million fund based

limits of Jyoti CNC Automation

Private Limited (JCAPL), indicating

inadequate credit quality†. ICRA has

also assigned an A4+ (pronounced A

Four plus) rating to the Rs. 210.00

million fund based and Rs. 160.00

million non-fund based limits of

JCAPL, indicating risk-prone credit

quality in the short term. JCAPL’s

long term fund based limits (CC and

term loan) up to Rs. 150.00 million

are interchangeable with short term

non-fund based limits (LC), long term

fund based limits (CC) up to Rs.

280.00 million are interchangeable

with short term fund based limits and

short term fund based limits up to Rs.

45.00 million are interchangeable

with long term fund based limits (CC).

The ratings factor in the firm’s healthy

operating margins, moderate gearing

and established track record in the

machine tool industry which is

characterized by significant entry

barriers. However, the firm has

severe liquidity constraints on

account of high inventory and an

increase in export-led receivables

which have resulted in excessive

utilization of working capital limits.

The ratings are also constrained by

the firm’s weak cash flow indicators,

For complete rating scale and

definitions please refer to ICRA's

Website www.icra.in or other ICRA

Rating Publications

†

Rating Outstanding

-

significant contingent liabilities and

risk associated with demand from key

user industries over the short to

medium term.

Rajkot based JCAPL was established

in the year 2001 and is a

manufacturer of CNC metal cutting

machines. JCAPL is promoted by Mr.

Parakramsinh Jadeja, whose family

has a 51% shareholding in the firm.

JCAPL currently manufactures CNC

Turning Lathes, Vertical Machining

Centers (VMC), Horizontal Machining

Centers (HMC) and Special Purpose

Machines (SPM). In FY09, the firm

recorded a net sale of Rs. 1.43 billion

and a net income of Rs. 43.54 million.

JCAPL has demonstrated strong

design and execution capabilities and

has a significant presence in the

domestic machine tool industry. The

ratings draw comfort from the long

track record of the promoters in the

industry. Prior to establishing JCAPL,

Mr. Parakramsinh Jadeja was a

partner in Jyoti Enterprise since 1989

which started off as a manufacturer of

gear boxes for lathe machines and

subsequently

ventured

into

manufacturing CNC Turning and

Milling machines.

In November 2007, JCAPL acquired

Huron Grafenstadden (Huron), a

French company involved in

supplying high end (4 and 5 axes)

CNC milling machines to the

aerospace and general engineering

industry in Europe. A Special

Purpose Vehicle (SPV) was formed

Previous

Ratings

August 2009

LBB+

LBB+

A4+

A4+

by JCAPL in France to acquire 100%

shares of Huron. The ratings are

constrained by the lack of adequate

clarity on the financial strength of

Huron and the conditional liability

arising out of JCAPL’s action of

guaranteeing repayment of a loan

amounting to €11.25 million availed

by its SPV in France to acquire

Huron.

JCAPL

currently

has

three

manufacturing units based in Rajkot

spread over a total area of 3,36,000

sq meters. In order to achieve

backward integration, the firm set up

an in-house foundry, sheet metal

plant and paint shop in FY08.

Backward integration enabled the

firm to reduce the sourcing time for

critical raw materials and increase its

production capacity from 500

machines in FY06 to 1500 machines

in FY08. Significant debt funded

capital expansion undertaken since

FY06 led to an increase in the firm’s

leverage. However, the firm’s ability

to infuse equity on a regular basis

has helped it maintain a moderate

gearing level.

JCAPL’s revenue grew at a CAGR of

37% since FY06 primarily on account

of an increase in its production

capacity. The revenue was fairly flat

in FY09 due to a de-growth in the

domestic market as the key user

segments of automobiles and capital

goods experienced a slowdown.

However, the ratings draw comfort

from JCAPL’s recent foray into

component

manufacturing

and

increase in business from the power

and defence sector. The risk of

slowdown in the domestic market

was mitigated to some extent as the

firm gained access to the export

market of Europe through Huron’s

dealer network. While the firm’s

domestic sales in FY09 shrunk by

around 16% as compared to FY08,

export sales grew by around 55%.

The firm derives export revenues

mainly from sale of machines to its

French subsidiary, Huron.

The OPBDITA margins of the firm

have steadily increased since FY06

with an average margin of around

15% from FY06 to FY09. This

increase is primarily driven by a

reduction in sourcing costs due to

backward integration and an increase

in the percentage of high margin

exports. However, the firm’s ROCE

has declined from 22% in FY07 to

11% in FY09 due to a slowdown in

the firm’s revenue growth rate

accompanied by significant capital

expenditure.

An increase in export sales has led to

a subsequent increase in JCAPL’s

debtor days. The firm’s debtor days

increased from around 33 days at the

end of FY07 to around 88 days at the

end of FY09. The firm’s liquidity

position has further worsened due to

a significant increase in its inventory

during the second half of FY09. The

inventory days increased from around

173 days at the end of FY08 to

around 325 days at the end of FY09.

Deferment of delivery of existing

orders during the second half of FY09

led to a significant increase in its

work in progress and finished goods

inventory.

Due

to

a long

manufacturing cycle time of its

product, JCAPL’s ability to generate

cash from operations is highly

contingent on quicker recoveries from

its customers and faster turnaround

of inventory.

About the company

Horizontal Machining Centers (HMC)

and Special Purpose Machines

(SPM). In November 2007, JCAPL

acquired Huron Grafenstadden

(Huron), a French company involved

in supplying high end (4 and 5 axes)

CNC milling machines to the

aerospace and general engineering

industry in Europe. In the year ending

December 2007, Huron reported a

net sale of €33 million. JCAPL

currently has three manufacturing

units based in Rajkot spread over a

total area of 3,36,000 sq meters.

JCAPL

completed

backward

integration in FY08 by setting up an

in-house foundry, sheet metal plant

and paint shop. Currently, the firm

has a manufacturing capacity of 1500

machines per annum.

Recent Results

Rajkot based JCAPL was established

in the year 2001 and is a

manufacturer of CNC metal cutting

machines. JCAPL is promoted by Mr.

Parakramsinh Jadeja, whose family

has a 51% shareholding in the firm

while the Virani family owns the

balance 49%. JCAPL currently

manufactures CNC Turning Lathes,

Vertical Machining Centers (VMC),

Key Past Financial Indicators

In Rs. million

In FY09, JCAPL sold 703 machines

and

recorded

a

net

income(provisional) of Rs. 43.54

million on a net sale(provisional) of

Rs. 1.43 billion.

August 2009

FY05

FY06

FY07

FY08

Audited

Audited

Audited

Audited

Operating Income

224.7

565.4

924.2

1473.7

OPBDIT

32.2

59.4

123.1

247.9

PAT

9.7

19.6

39.4

47.3

94.4

271.4

635.1

1004.5

OPBDIT/Operating Income

92.0

14.35%

196.3

10.51%

298.6

13.32%

659.3

16.82%

PAT/Operating Income

4.32%

3.47%

4.26%

3.21%

Total Debt

Networth

Total Debt/(TNW + Minority Interest) (Times)

1.03

1.38

2.13

1.52

OPBDIT – Operating Profit Before Depreciation Interest & Taxes, PAT – Profit After Tax, TNW – Total Net Worth

For further details please contact:

Analyst Contacts:

Mr. Rohit Inamdar (Tel No. +91-124-4545847)

rohit.inamdar@icraindia.com

Relationship Contacts:

Mr. L. Shivakumar, (Tel. No. +91-22-30470005)

shivakumar@icraindia.com

© Copyright, 2009, ICRA Limited. All Rights Reserved.

Contents may be used freely with due acknowledgement to ICRA

ICRA ratings should not be treated as recommendation to buy, sell or hold the rated debt instruments. The ICRA

ratings are subject to a process of surveillance which may lead to a revision in ratings. Please visit our website

(www.icra.in) or contact any ICRA office for the latest information on ICRA ratings outstanding. All information

contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although

reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as is’

without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or

implied, as to the accuracy, timeliness or completeness of any such information. All information contained herein

must be construed solely as statements of opinion and ICRA shall not be liable for any losses incurred by users from

any use of this publication or its contents

You can reach us at any of our offices:

Registered Office

ICRA Limited

1105, Kailash Building, 11th Floor, 26, Kasturba Gandhi Marg, New Delhi 110001

Tel: +91-11-23357940-50, Fax: +91-11-23357014

Corporate Office

Mr. Vivek Mathur

Mobile: 9871221122

Email: vivek@icraindia.com

Building No. 8, 2nd Floor, Tower A, DLF Cyber City, Phase II, Gurgaon 122002

Ph: +91-124-4545310 (D, 4545300 (B) Fax; +91-124-4545350

Mumbai

Mr. L. Shiva Kumar

Mobile: 9821086490

Email: shivakumar@icraindia.com

Kolkata

Ms. Anuradha Ray

Mobile: 9831086462

Email: anuradha@icraindia.com

3rd Floor, Electric Mansion, Appasaheb Marathe Marg,

Prabhadevi, Mumbai - 400 025

Ph : +91-22-2433 1046/ 1053/ 1062/ 1074/ 1086/ 1087 Fax :

+91-22-2433 1390

A-10 & 11, 3rd Floor, FMC Fortuna, 234/ 3A, A.J.C. Bose Road,

Kolkata-700020.

Tel: +91-33-2287 0450/ 2240 6617/ 8839/ 2280 0008 Fax: +91-3322470728

Chennai

Mr. Jayanta Chatterjee

Mobile: 9845022459

Email: jayantac@icraindia.com

Bangalore

Mr. Jayanta Chatterjee

Mobile: 9845022459

Email: jayantac@icraindia.com

Mr. M.S. K. Aditya

Mobile: 9963253777

Email: adityamsk@icraindia.com

2 nd Floor. ,Vayudhoot Chambers, Trinity Circle, 15-16 M.G.Road,

Bangalore-560001.

Tel:91-80-25597401/ 4049 Fax:91-80-25594065

5th Floor, Karumuttu Centre, 634 Anna Salai, Nandanam,

Chennai-600035.

Tel: +91-44-2433 3293/ 94, 2434 0043/ 9659/ 8080, 2433 0724,

Fax:91-44-24343663

Ahmedabad

Mr. L. Shiva Kumar

Mobile: 9821086490

Email: shivakumar@icraindia.com

Pune

Mr. L. Shiva Kumar

Mobile: 9821086490

Email: shivakumar@icraindia.com

907 & 908 Sakar -II, Ellisbridge,

Ahmedabad- 380006

Tel: +91-79-26584924, 26585494, 26582008,26585049

TeleFax:+91-79- 2648 4924

5A, 5th Floor, Symphony, SNO 210, CTS 3202, Range Hills Road,

Shivajinagar,Pune-411 020

Tel : (91 20) 2552 0194 - 5; Fax : (91 20) 2553 9231

Hyderabad

Mr. M.S. K. Aditya

Mobile: 9963253777

Email: adityamsk@icraindia.com

301, CONCOURSE, 3 rd Floor, No. 7-1-58, Ameerpet,

Hyderabad 500 016.

Tel: +91-40-2373 5061 7251 Fax: +91-40- 2373 5152