Marketing Implementation Plan April 1, 2013 to March 31, 2014

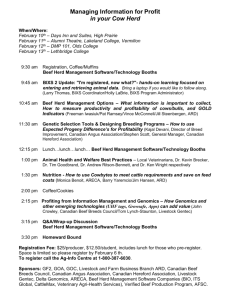

advertisement