220 INSURANCE COMPANIES

advertisement

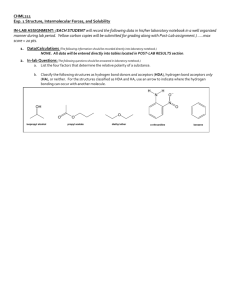

NATIONAL INSURANCE SERVICES PRACTICE INSURANCE TAX SERVICES experience ideas // Insurance companies face a variety of issues when it comes to maintaining surplus while adding value for shareholders and policyholders. You need professional services providers who can offer quality, personalized service. BKD can help. Our advisors can help you effectively plan for and comply with complex insurance tax laws and regulations, evaluate and monitor internal controls and develop and implement technology solutions. Experience how our ideas can help you create value. TAX PROVISION SUPPORT SERVICES • Evaluating and documenting management’s assessment of UTPs and VAs under GAAP and SAP guidance BKD assists companies in calculating, documenting and disclosing their tax provisions under generally accepted accounting principles (GAAP) and statutory accounting principles (SAP). Our advisors can work closely with management to identify key inputs and develop solutions to streamline the tax provision process. Companies want a methodology that requires as few human touches as possible to manage the risk of misstatement and allows for real-time adjustments to tax accounts as underlying financial statement values change. Areas involving judgment, such as assessment of uncertain tax positions (UTP) and valuation allowances (VA), require special attention and robust documentation. • Evaluating and documenting tax planning strategies used for GAAP and SAP and reversal pattern assumptions for SAP deferred tax asset admissibility We can help manage timing and quality of information flowing between management and outside auditors. Our seasoned tax professionals can provide insight and assistance in the following: • Testing that the tax provision reflects the most up-to-date trial balance information and that permanent items are identified and considered in light of relevant insurance tax law • Reconciling tax-related balance sheet accounts rather than rolling forward prior-year balances • Assisting with proper allocation of changes in tax balance sheet accounts to the income statement (capital gains/losses and operations) and surplus or other comprehensive income • Reviewing and analyzing effective tax rates and other metrics to identify potential issues • Assisting with footnote disclosures, including UTPs, VAs and tax-planning strategies TAX PREPARATION & REVIEW By efficiently using technology to help prepare and review GAAP and SAP financial statements, BKD can spend more time working to identify potential tax issues and opportunities. Our insurance tax team can: • Act as Electronic Return Originator (ERO) and facilitate the electronic filing process where allowable. Currently, companies that file a federal consolidated or standalone Form 1120-L (for life insurance companies) or 1120-PC (for nonlife insurance companies) cannot file electronically. We continue to monitor tax developments for compliance with e-filing requirements. We also remain current on state electronic filing requirements so you don’t have to. More and more states have electronic filing requirements, and staying current with these requirements can be burdensome on insurers. BKD prepares thousands of state income tax returns for insurers and noninsurance group members. 220 INSURANCE COMPANIES Experience a clear point of view from a firm that works with approximately 220 insurance and insurance services companies and has professionals trained in the industry. bkd.com INSURANCE TAX SERVICES Our tax professionals also can assist with: • Help manage exposure and provide peace of mind that necessary forms and disclosures have been filed. Tax return disclosure requirements can be confusing and create significant penalty exposure, but BKD can help. For instance, UTPs and reportable transactions generally require the inclusion of additional forms or statements with the tax return filing. The recently adopted Form M-3, which reconciles financial statement and taxable income, is relatively simple to complete on a separate company basis but increases in complexity in a consolidated group setting. • Due diligence and deal structuring stemming from anticipated mergers and acquisitions • State tax planning, including state income, excise and premium taxes WHY BKD? BKD National Insurance Services Practice provides services to life, accident, health and property and casualty insurance companies ranging in size from $5 million to $3 billion in written premiums. A.M. Best ranks BKD as the seventh-largest assurance provider for insurance companies. We also work with numerous insurance agencies and third-party administrators throughout the U.S. Our insurance team includes tax professionals dedicated to the industry who are members of the Insurance Accounting & Systems Association (IASA) and speak at IASA’s annual conference. • Analyze the advantages and disadvantages of tax return elections, such as the election by property and casualty companies to discount loss reserves based upon their own claims payment history. • Assist in preparing the return-to-provision adjustments so balance sheet accounts (current and deferred) can be trued up and any effect on the subsequent year’s effective tax rate is anticipated. TAX PLANNING With a partner-to-staff ratio lower than the average for national firms, you’ll have access to partners and experience personal communication. BKD THOUGHTWARE® // articles // emails // presentations // videos // webinars 1 1 Thomas Wheeland // Partner twheeland@bkd.com // 314.231.5544 : 1:6 PARTNER:STAFF BKD’s unmatched client service is provided by approximately 2,400 CPAs, advisors and dedicated staff serving clients in all 50 states and internationally. Beyond our knowledgeable solutions, BKD clients experience expertise, insight, ideas and attention to help them achieve their financial goals. Our professionals offer practical advice, ethical solutions and results with integrity. offices and subsidiaries, visit bkd.com or contact: Our advisors understand GAAP and SAP accounting issues and can help identify tax planning strategies and actions along with their financial reporting and regulatory consequences. We look for structuring opportunities and available credits to potentially help reduce cash taxes. FOR MORE INFORMATION // For a complete list of our BKD, LLP is a national CPA and advisory firm delivering its experience and service with a deep understanding of your business, your needs and what it takes to improve your business performance. bkd.com © 2016 BKD, LLP 1/16