1 johdanto

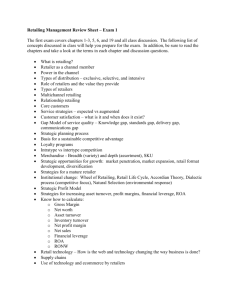

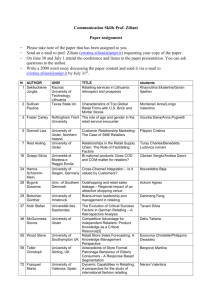

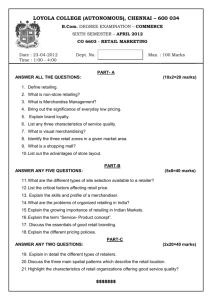

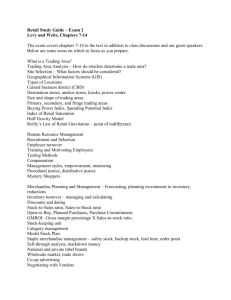

advertisement