Sample Exam: Part II | Chapters 5-7 Butler / Multinational Finance (5e)

advertisement

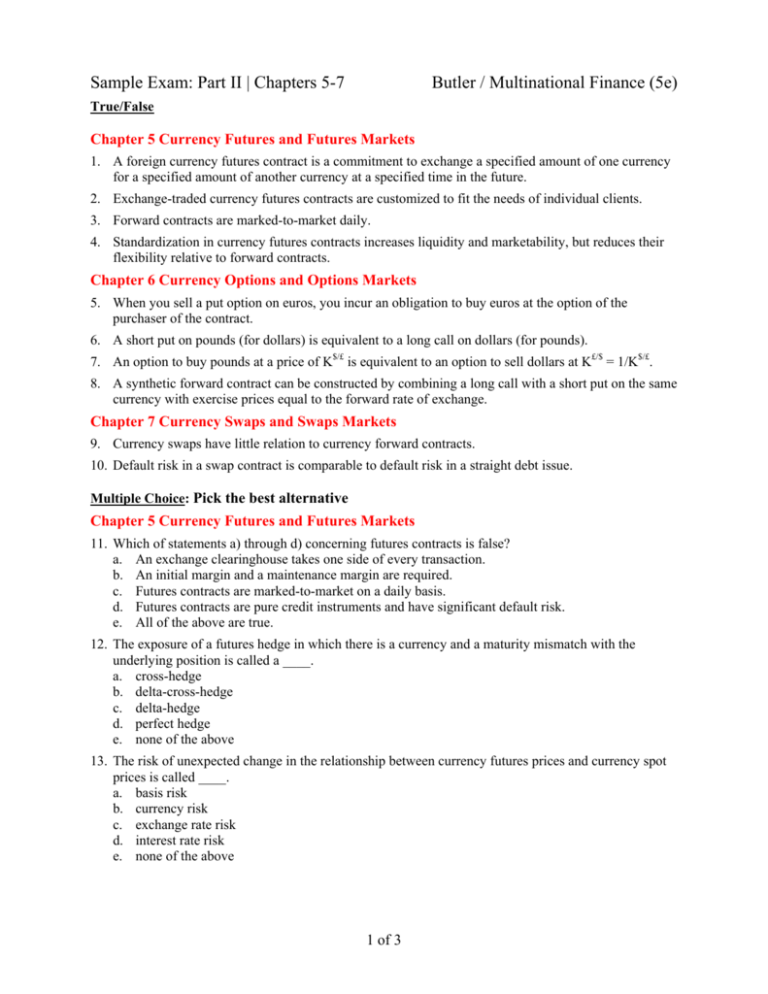

Sample Exam: Part II | Chapters 5-7 Butler / Multinational Finance (5e) True/False Chapter 5 Currency Futures and Futures Markets 1. A foreign currency futures contract is a commitment to exchange a specified amount of one currency for a specified amount of another currency at a specified time in the future. 2. Exchange-traded currency futures contracts are customized to fit the needs of individual clients. 3. Forward contracts are marked-to-market daily. 4. Standardization in currency futures contracts increases liquidity and marketability, but reduces their flexibility relative to forward contracts. Chapter 6 Currency Options and Options Markets 5. When you sell a put option on euros, you incur an obligation to buy euros at the option of the purchaser of the contract. 6. A short put on pounds (for dollars) is equivalent to a long call on dollars (for pounds). 7. An option to buy pounds at a price of K$/£ is equivalent to an option to sell dollars at K£/$ = 1/K$/£. 8. A synthetic forward contract can be constructed by combining a long call with a short put on the same currency with exercise prices equal to the forward rate of exchange. Chapter 7 Currency Swaps and Swaps Markets 9. Currency swaps have little relation to currency forward contracts. 10. Default risk in a swap contract is comparable to default risk in a straight debt issue. Multiple Choice: Pick the best alternative Chapter 5 Currency Futures and Futures Markets 11. Which of statements a) through d) concerning futures contracts is false? a. An exchange clearinghouse takes one side of every transaction. b. An initial margin and a maintenance margin are required. c. Futures contracts are marked-to-market on a daily basis. d. Futures contracts are pure credit instruments and have significant default risk. e. All of the above are true. 12. The exposure of a futures hedge in which there is a currency and a maturity mismatch with the underlying position is called a ____. a. cross-hedge b. delta-cross-hedge c. delta-hedge d. perfect hedge e. none of the above 13. The risk of unexpected change in the relationship between currency futures prices and currency spot prices is called ____. a. basis risk b. currency risk c. exchange rate risk d. interest rate risk e. none of the above 1 of 3 Chapter 6 Currency Options and Options Markets 14. Which of the following is an inappropriate pair when applied to currency options? a. American option early exercise b. call option put option c. exercise price striking price d. long position short position e. option writer option seller 15. Over-the-counter currency options traded by commercial and investment banks ____. a. are customized to fit the needs of the banks’ customers b. have expiration dates and contract amounts that are specified by the banks c. have standardized commissions d. typically give the short side of the contract to the customer e. none of the above 16. An option writer ____ the exercise price on a call option and ____ the exercise price on a put option. a. pays … pays b. pays … receives c. receives … pays d. receives … receives e. none of the above 17. Consider a “SFr Dec 7000 call” selling on the Chicago Mercantile Exchange (CME) at a price of $0.0120/SFr. The current spot rate is $0.7090/SFr? a. intrinsic value = $0.0000/SFr and time value = $0.0090/SFr b. intrinsic value = $0.0000/SFr and time value = $0.0120/SFr c. intrinsic value = $0.0090/SFr and time value = $0.0000/SFr d. intrinsic value = $0.0090/SFr and time value = $0.0030/SFr e. intrinsic value = $0.1200/SFr and time value = $0.0090/SFr Chapter 7 Currency Swaps and Swaps Markets 18. In its most general version, a swap is a derivative instrument in which counterparties ____. a. exchange debt securities b. exchange debt or equity securities c. exchange interest payments d. exchange one stream of cash flows for another e. trade identities for a arranged length of time 19. A fixed-for-floating nonamortizing currency swap is called a ____. a. commodity swap b. coupon swap c. currency coupon swap d. debt-for-equity swap e. swaption 20. A swap with one or more options attached is called a ____. a. commodity swap b. coupon swap c. currency coupon swap d. debt-for-equity swap e. swaption 21. A bank’s swap portfolio is called its ____. a. difference check b. indication pricing schedule c. notional principal d. swap book e. swap contract 2 of 3 Chapter 5 Currency Futures Problem It is the third week in April. British Aerospace (BA) expects to receive 8 million Mexican pesos (P) from a Mexican customer in sixty days, which happens to be the same day in June that London International Financial Futures Exchange futures contracts expire. The Mexican peso futures price for June delivery is £0.1400/P, with a contract size of P500,000. The current spot exchange rate is £0.1450/P. a. How many futures contracts should BA buy or sell in order to hedge its forward exposure? b. What is BA’s net profit or loss on the futures contract if the spot rate in sixty days is £0.1200/P? c. What is the hedge quality of this futures hedge? Chapter 6 Currency Option Problem You write a call option on pounds and give it to Scrooge McDuck to compensate him for some consulting work on risk management. The contract size is £125,000 and the exercise price is £0.6344/$. If the option expires when the spot rate is £0.6285/$, will Scrooge’s treasure chest of dollars grow larger or smaller? By how much? (Assume Scrooge McDuck takes any profit in dollars). What is your profit or loss on this transaction? Chapter 7 Currency Swap Problem Consider this indication pricing schedule for currency coupon swaps of yen and euros. Present value interest factors for annuities based on the midrate i€ and number of periods T also are shown. Currency Coupon Swap Indication Pricing Schedule (yen/euro) Maturity Midrate (in euros) 5 years 6.400000% Deduct 5 bps if the bank is paying a fixed rate. Add 5 bps if the bank is receiving a fixed rate. All quotes are against one-year yen LIBOR flat. LIBOR is quoted as a 360-day money market yield. Fixed-rate euro-denominated Eurobonds are quoted as a 365-day bond equivalent yield. Yield curves are flat in both yen and euros. The euro is selling at a 2.184278% annual forward discount against the yen. The yen midrate is found from (F1¥/€ / S0¥/€) = (1+i¥) / (1+i€) => i¥ = (F1¥/€/S0¥/€) (1+€) - 1 = (1-0.02184278) (1.0640) - 1 = 4.075928 percent. The following annuity factors are provided for your convenience: PVIFA (4.075928%/year, 5 years) = 4.44234250. PVIFA (6.40000%/year, 5 years) = 4.16691905 a. Power Ippon, Inc. (PI) has five-year yen debt at a floating-rate money market yield of one-year LIBOR + 100 bps. PI wants fixed-rate euro debt to fund its German operations. What is PI’s all-in cost of capital for a fully covered yen-for-euro currency coupon swap? b. Macht Punkt, A.G. (MP) has five-year fixed-rate euro debt at a bond equivalent yield of 7.32 percent. MP wants floating-rate yen debt to fund its expansion into Japan. What is MP’s all-in cost of capital for a fully covered euro-for-yen currency coupon swap? c. What does the swap bank gain from these transactions? 3 of 3 Key 1. True. 2. False. Exchange-traded futures contracts are highly standardized instruments. 3. False. Futures contracts are marked-to-market daily. 4. True. 5. True. 6. False. The option writer has an obligation to sell pounds and to buy dollars. 7. True. 8. True. 9. False. Swaps are in fact a bundle of forward contracts of different maturities. 10. False. The risk and consequences of default are far less than for straight debt. 11. d. Futures contracts are pure credit instruments and have significant default risk. 12. b. delta-cross-hedge 13. a. basis risk 14. d. long position short position 15. a. are customized to fit the needs of the banks’ customers 16. c. receives … pays 17. d. $0.009/SFr intrinsic value + $0.003/SFr time value = $0.012/SFr option value 18. d. exchange one stream of cash flows for another 19. c. currency coupon swap 20. e. swaption 21. d. swap book Currency Futures Problem a. BA will need P8,000,000 / P500,000/contract = 16 futures contracts to cover their forward exposure. Since the underlying position is long P, BA should sell 16 contracts. b. If the spot rate closes at £0.1400/AP on the expiration date, then the profit accumulated over the two months of the futures contract will be (£0.1200/AP£0.1400/AP)(£8,000,000) = £160,000. This will offset the loss at maturity on the underlying long exposure. c. The forward exposure and the futures hedge are denominated in pesos and mature on the same date, so hedge quality is very high. The total profit (loss) on the futures hedge exactly offsets the loss (profit) on the underlying position. The remaining difference between the two positions is the fact that the futures contract accumulates gains (losses) with daily marking-to-market, whereas the forward contract receives its loss (gain) at expiration. Currency Option Problem This is an option on pounds, so it is convenient to use the dollar price of the pound. Scrooge’s call is an option to buy pounds at (£0.6344/$)1 = $1.5763/£. The spot rate at expiration is (£0.6285/$)1 = $1.5911/£. Scrooge’s gain at expiration is ($1.5911/£-$1.5763/£) = $0.0148/£, or (£125,000)($0.0148/£) =$1,850. Scrooge is long the option and you are short the option, so Scrooge’s gain is your loss. Currency Swap Problem a. Step (1): The BEY corresponding to the 100 bps MMY spread to LIBOR is (100 bps)(365/360) = 101.3889 bps, or 1.013889 percent. Step (2): The BEY in euros that corresponds to this BEY in yen is r€ = r¥ PVIFA(i¥,T) / PVIFA(i€,T) = (101.3889 bps)(4.44234250/4.16691905) = 108.0905 bps. Step (3): The all-cost of this financing alternative is the swap ask rate + the spread to fully cover the 100 bps (MMY) yen premium to LIBOR: (6.45% + 1.080905%) = 7.530905%. b. Step (1): MP is paying a premium of (7.32% - 6.35) = 0.97% (or 97 bps) to the swap bid rate in BEY on the fixed rate euro side of the swap. Step (2): The BEY in yen that corresponds to this BEY in euros is r¥ = r€ PVIFA(i€,T) / PVIFA(i¥,T) = (97 bps)(4.16691905/4.44234250) = 90.9860 bps, or 0.9087% per year. Step (3): The MMY that corresponds to MP’s 90.9860 bps spread (BEY) is (90.9860 bps)(360/365) = 89.7397 bps. MP’s all-in cost of floating rate debt is LIBOR + 89.7397 bps (MMY). 4 of 3 c. The swap bank’s net gain is the 10 bp spread on the notional principal. 5 of 3