DEG Home Entertainment Supply Chain Study

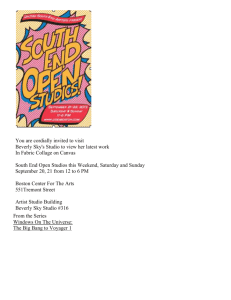

advertisement