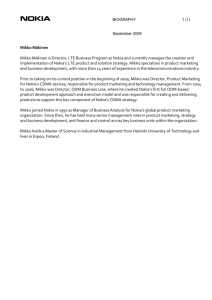

Nokia in 2010

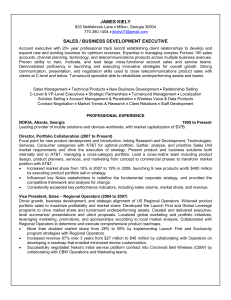

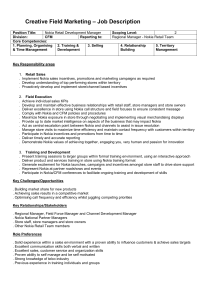

advertisement