2013/14 business plan - The Tourism Partnership of Niagara

advertisement

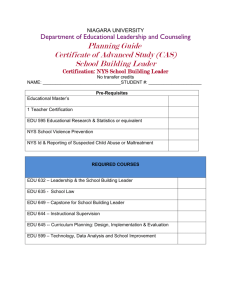

a place of wonders...big and small. THE TOURISM PARTNERSHIP OF NIAGARA 2013/14 BUSINESS PLAN The Tourism Partnership of Niagara 2013-14 Business Plan TABLE OF CONTENTS Executive Summary Page 2 4 5 5 Page 6 6 8 Page 10 10 15 15 Vision, Mission, Mandate Page 16 Target Consumer Page 17 Objectives Page 18 Corporate Strategies, Initiatives & Measures Page 18 19 23 25 27 28 Governance & Organizational Structures Page 31 Budget Page 34 Bibliography Page 35 • • • 2012/13 Key Accomplishments Priorities for the Next Three Years Key Performance Measures Environmental Scan • • Driving Forces Key Trends Background • • • • • • • • 2 Latest Indicators S.W.O.T. Analysis Key Learning Marketing Product Development Investment Attraction Workforce Development Organizational Excellence The Tourism Partnership of Niagara 2013-14 Business Plan I. EXECUTIVE SUMMARY The Niagara region has great potential to grow into a tourism powerhouse for the province and country. The Tourism Partnership of Niagara (TPN) will achieve this through a focused strategy that is aligned with the provincial and national strategies, which will drive results, and build the region’s reputation as an outstanding tourism destination. There are many players in the tourism industry. In order to be successful we will need to work collaboratively, align and coordinate our efforts, minimize duplication, cut through the marketing clutter by synchronizing our efforts, and leverage our collective resources. TPN operates with the principles of reaching where others can’t reach and leveraging partner investments. Our leadership role includes: • Leading brand marketing: broadcast and/or print media, magazine lure, and public relations • Creating packages and itineraries for target consumers: website, seamless reservation system, email • Creating common offers: advertising and website • Attracting blockbuster events In developing our strategy and business plan, five critical success factors were considered; 1. Always put the consumer first; 2. Ensure marketing excellence in everything we do; 3. Nurture effective partnerships to deliver on our strategy; 4. Pursue organizational excellence and build our reputation as an outstanding tourism organization, and; 5. Drive for results and continuously improve. CRITICAL SUCCESS FACTORS Effective Partnerships Marketing Excellence Consumer Focus Ogranizational Excellence TPN SUCCESS Results Driven In its first three years, TPN’s focus was on building a solid foundation of governance, research, strategy, the ‘Niagara Canada’ brand, visual assets, essential marketing vehicles such as the visitniagaracanada.com website and Niagara Travel lure, criteria for our blockbuster event program, and a web-based workforce learning program to help create Niagara Ambassadors and build service pride. 3 The Tourism Partnership of Niagara 2013-14 Business Plan 2012-13 KEY ACCOMPLISHMENTS • Launched the Niagara Canada brand on May 1, 2012 with a TV campaign, Niagara Travel lure, and visitniagaracanada.com website. Pre- and post-launch research showed strong results: o Almost 40% of respondents agreed “the advertising made me feel good about the Niagara region” o 60% of couples strongly agreed the ads “made me feel there’s more to Niagara than the Falls” o 7% increase in the perception that Niagara is “a place with lots to see and do”. • Partnered with Tourism Toronto, OTMPC, Air Canada and GTAA (Toronto Pearson) in a digital campaign in the US leveraging $1.125M with a $125k investment. TorontoEscapes.com was in the top 2 or 3 sources of traffic to our website during the campaign which ran from June to October. • In partnership with OTMPC, ran a radio campaign in Rochester and Buffalo all summer long – leveraged 50% of content on a $400k buy with a $65k investment. • Partnered with OTMPC, Tourism Toronto and Ottawa Tourism in Conde Nast New York City program including 15 insertions across 4 magazines (May to August) – reaching 18.5M affluent Americans, adding over 700 names to our database and leveraging a $1.79M buy with a $100k investment. • Engaged regional participation in TravelZoo eblast reaching 15M consumers and with common offers. • In partnership with OTMPC, hosted Canada AM live at Fort George to launch the War of 1812 Commemorative events – 3.5M national viewers and $4.855M ad value. • Partnered in CTC’s Canada: Just for the Fun of It program with Eric McCormick and Ben Aaron – NBC New York City and Boston (NBC viewership of 9 million households). • Supported Breakfast TV live show in June and Global TV’s nationally broadcasted New Years Eve event with over 2 million viewers tuned in. • Hosted Masterchef France in partnership with CTC and OTMPC with 4.6M viewership – best-watched show on Oct 11th. • Supported Welland Flatwater Festival in August with 641 participants from 36 countries, 1250 rooms booked, and $3M economic impact. • Supported the blockbuster Red Bull Crashed Ice event bringing in 35,000 new visitors to Niagara during the shoulder season from Nov 30 – Dec 1st. • Following on the heels of the spectacular wire walk across the Falls by Nik Wallenda, continued to attract significant international media attention with summer long shows by Jay Cochrane Skywalker. • Reached meeting planners through high profile sponsorships with ASAE, CSAE, PCMA, MPI and at international events IMEX, EIBTM, and ICCA. • In partnership with Landscape Ontario, Hamilton Halton Brant (RTO3) and others, secured sanction for an International Horticultural Exhibition – Flora Niagara 2017. • Partnered with the Niagara regional government on a feasibility study for air service to the Niagara District Airport. 4 The Tourism Partnership of Niagara 2013-14 Business Plan FINAL RESULTS: • Leveraged $3.46M in media value through partnerships with a $338.5k investment … a 10:1 ratio • 310,273 unique visitors to visitniagaracanada.com with 82.5% new visitors (May-Nov) • 72,149 leads generated to partner sites (May-Nov) • • SEM is outperforming the industry average for impressions, clicks and CTRs. As of December 2012, industry average ‘Open Rates’ was 26.30%, CTR rate was 26.70% compared to TPN’s 28.38% and 18.03% respectively. Over 30,000 in our consumer database • Occupancy in Niagara was up 3.6 points over last year, ahead of the provincial average of 0.5 (Jan-Dec). PRIORITIES FOR THE NEXT THREE YEARS The next three years will leverage the foundational work now in place and expand the reach of the Niagara Canada brand through events, advertising, digital media, public relations, and Niagara Ambassadors trained in our “Welcome to Niagara” program. TPN will also work with industry and government partners to develop signature experiences and improve access. We will build a reputation for organizational excellence by measuring the effectiveness of our programs and continuously improve. KEY PRIORITIES: • Build the brand and implement targeted marketing to high prospect consumers • Feature packages and common offers in our advertising and through our web portal • Pursue blockbuster events that will motivate travel, build the brand and leave a legacy • Nurture relationships with industry to develop effective partnerships and secure sustainable funding • Build our reputation for organizational excellence with an effective governance structure that facilitates decision-making and, a scorecard of performance measures that fosters continuous improvement. PERFORMANCE MEASURES TPN will work with Ministry colleagues to implement standardized performance measures currently under development. In addition, TPN will continue to report on the following performance measures as key indicators of the effectiveness of our strategy: • Advertising awareness • Number of consumers in our database • Number of leads generated to partners • Dollars leveraged through partnership • Partner satisfaction 5 The Tourism Partnership of Niagara 2013-14 Business Plan II. ENVIRONMENTAL SCAN DRIVING FORCES 1. Emerging Nations The economic powers of today will not be the powers of tomorrow. China is set to overtake the U.S. to become the largest economy as early as 2017. Middle class spenders are emerging in developing countries such as Brazil, Russia, India and China. “The coming decade will be the first in 200 years when emerging-market countries contribute more growth than the developed ones” Trendwatching; Trend Report 2011 We must find ways to engage in these markets for our long-term growth, look to OTMPC & CTC for partnership opportunities. 2. Customer-Centricity In the future, successful organizations will be the ones who understand how their brand, products and services fit into their customers’ lives. They will no longer focus solely on product attributes, but rather they will position their products and services within the context of their customers’ lives. Visionary organizations are becoming publishers, storytellers, entertainers and curators of relevant customer content, wrapping their product in an aspirational envelope that creates a desire to purchase. We must focus on the visitor/customer and deliver on Niagara best in class experiences. 3. Connect, Collaborate and Converse The customer’s decision-making journey is no longer linear. It has become a circular, continuous process that is informed by multiple touch points and influences. The digital world has given rise to a new breed of consumers who want to connect with organizations and with larger communities. This new consumer has a point-of-view and they want to contribute, so organizations need to join the conversation and accept that they are no longer in complete control of their brands. Organizations must identify and prioritize key touch points and effectively engage customers whenever and wherever they interact with the brand. We need to dial up our participation in social media. 4. Customer Empowerment Retailers have held the balance of power over manufacturers and customers for the last quarter century, but this power has shifted dramatically. Widespread access to tools and technology is shifting the balance of power to customers, who will increasingly dictate what they want, where they want it and at what price. “One-size-fits-all” solutions no longer apply. Fast, accessible Internet is the leveler of information and liberator of consumer power. We need to deliver authentic visitor-centric experiences, nothing less will do. 6 The Tourism Partnership of Niagara 2013-14 Business Plan 5. Mobile as the new Enabler By 2015, mobile devices will be the primary enablers of shopping engagement. In a world where time is limited and the consumer’s attention span is measured in seconds, the battle for consumer dollars will begin way before consumers complete a transaction - physical or virtual. By 2015, smartphones will be the primary enabler of shopper engagements. Smartphones are ubiquitous and they are changing the way the world functions and behave. Mobile will become the new vehicle through which organizations will need to engage, influence, empower and transact with customers. We need to be leaders in mobile in Niagara. Mobile will contribute to engaging our younger consumers for the future 6. Luxury and Frugality The last financial crisis and resulting recession has taught consumers that they are personally responsible for their own consumption patterns, and that consequences matter. The post-recession consumer is more cautious, more rational and more aware. Every purchase decision is now weighed against a wide set of personal criteria, and trade-offs are made on a continuous basis. The consumer does not sacrifice luxury; they choose when to be frugal and save for life’s luxuries. The experience becomes central to our customers’ life and travel and tourism is central to this. 7. No Compromise Customers today demand it all. Whereas they used to forgo some important characteristics to get others (i.e. taste vs. health), they are no longer willing to do so. In a global market where people have all the information they need at their fingertips – and where there is an overabundance of services to choose from, visitors feel they should not have to compromise on anything. Customer service, value for money and superior experiences will need to form the basis of our offering. 8. Simplicity, Agility and Speed to Market Doing business is undoubtedly becoming more complex. In a fast-paced, highly competitive world where customers hold the biggest end of the stick, customer-driven innovation, speed to market and operational efficiency will be what differentiates the winners from the losers. In the long run, organizations that are finding and building on trends are better off than the ones always managing costs. We must deliver visitor solutions & experiences that align with customer trends. 7 The Tourism Partnership of Niagara 2013-14 Business Plan KEY TRENDS 1. Economic Trends Even though overall consumer confidence is on the rise, the Great Recession of 08/09 has shaken people to the core. Consumers are still feeling cautious about the future. Financial pressures such as inflation, record levels of household debt, job (in)security and declining savings rate – any increase in interest rates could be catastrophic. 2. Lifestyle & Attitude Trends Consumers don’t want stuff; they want meaning. They are looking for experiences rather than possessions. Adventure days, exotic destinations, or simply trying something new and exciting are now part of life’s luxuries. Serving up a little peace in a busy lifestyle is also perceived as a luxury, as happiness is becoming a bigger touchstone of a rich life. Time has also become a luxury as life continues to accelerate at an exponential pace. Email, mobile phones and the surge of the Internet cemented Time Compression as a 21st century phenomenon. Although all these innovations which were meant to save time actually resulted in consumers having less disposable time than ever before. There is a powerful desire for authenticity. Customers are more cautious about their spending and showing a greater resistance to over-marketing. Skepticism and distrust towards advertising is rising as consumers have more and more access to information from sources other than from the retailers such as through peer reviews, recommendations and social networks. 3. Digital Trends Today’s consumer is connected. Social media is at the forefront of consumer’s lives. It is imperative that brands have the ‘F-FACTOR’ – Friends, Fans and Followers who influence consumers’ purchasing decisions in very powerful and sophisticated ways. F-Discovery: Consumers discover new products by relying on their social networks F-Rated: Consumers increasingly rely heavily on ratings, reviews and recommendations from their social networks. F-Feedback: Consumers can validate their purchasing decisions through their friends and followers. This creates the opportunity for the rise of the E-Fluencers. As in any communities, some members have a powerful influence on others. E-Fluencers are the 21st century’s most valued customers. If Facebook and Twitter were countries 2012 Updates: As of May 2012, Facebook now has over 900 million active users and 50% of them use Facebook on mobile devices. As of March 2012, Twitter now boasts 140 million users. ‘Myspace’ numbers have been declining. 8 The Tourism Partnership of Niagara 2013-14 Business Plan 5. The Female Economy Nearly 80% of women say that their opinion determines their families’ financial decisions and more than 50% of women are the primary person paying the household bills. They are plugged in and connected. Approximately 80% of women use social media including Facebook, Twitter and blogs, at least once a week. They are responsible for managing the household’s social calendar. 6. The LGBT Economy The LGBT market is estimated to account for about 5-10% of the Canadian population. They are overindexing in consumption in many categories. They are over-developed in Internet usage, they tend to display extreme brand loyalty and they are relatively easy to reach thanks to geographic clustering. LGBT consumers enjoy a higher median income and have more discretionary time. Consequently, they consume at a significantly higher rate than the national average in three major categories: entertainment travel and leisure. LGBT are more likely to go to bars, fine restaurants, attend concerts or go to the theatre. Over 80% of them are online, and they spend more time and more money than any other demographic group, and 64% of gay Americans are more likely to purchase from companies that market directly to them in gay media. 7. Mobile As online transactions mature, mobile devices present a huge opportunity for growth. Mobile devices worldwide are set to grow from 470 million in 2010 to 2.5 billion by 2015. Mobile informs, rewards and entertains. The percentage of consumers who use an online retailer’s site from their mobile phone jumped 18% in 2 years, from 10% in 2008 to 28% in 2010. The younger consumers are the ones buying products online with their mobile devices. Mobile email, instant messaging and social networking provide a quick and easy way to share comments – good or bad – about their visitor experience in real time. By 2015, 1 in 8 mobile subscribers (+750 million users) will use m-ticketing for airline, rail and bus travel, festivals, cinemas and sports events. Ticket delivery will be by SMS, bar codes, mobile, web, smartphone apps or NFC (Jupiter Research. March 2011). Additionally, travellers are starting to use mobile information more frequently to share experiences & source relevant travel information in real-time – location based services and smart phones are driving this trend. Source: fubiz.net/2011/05/27/digital-life-today-tomorrow 9 The Tourism Partnership of Niagara 2013-14 Business Plan III. BACKGROUND LATEST INDICATORS Laflamme, Jérôme (M…, 13-3-7 11:43 AM In 2012 US border crossings to Ontario were up by 2.6% in January to October 2012 (Stats Canada). US same-day crossings were up 2.5% and overnight crossings were down 1.1%. Overseas border crossings grew 3.4% in January to October 2012. In 2011 visits to Ontario increased by 1.3% (to $104.4M). Visits from the US & other Canadian provinces declined, while visits from overseas countries and Ontario increased. Visitor spending increased by 3.6% (to $18.3B) led again by Ontarians and overseas countries. Tourism receipts increased by 4.3% to $23.6 billion. Total employment generated by tourism receipts in Ontario increased by 1% to 334,069 jobs. GDP generated by tourism receipts throughout the Ontario economy increased by 3.9% to $21.1 billion. Tourism is Ontario's 9th largest international export industry. For every $1 million in overnight visitor spending in Ontario, the Ontario economy generates 16 jobs, $903,000 in GDP and $179,000 in provincial tax revenues. An important part of the Ontario tourism economy, Niagara represents 10% of provincial tourism receipts and our growth outpaced the provincial average. 90.00% 80.00% 70.00% 60.00% 50.00% 40.00% Occ % 2012 30.00% Occ % 2011 20.00% 10.00% 0.00% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $160.00 $150.00 $140.00 $130.00 ADR 2012 $120.00 ADR 2011 $110.00 10 Dec Oct Nov Sep Aug Jul Jun Apr May Mar Jan $90.00 Feb $100.00 Comment [1]: What is the source of these stats and graphs? Stats Canada? The Tourism Partnership of Niagara 2013-14 Business Plan $145.00 $125.00 $105.00 RevPAR 2012 $85.00 RevPAR 2011 $65.00 $45.00 $25.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source – STR Global Reports TRIP & TRAVEL CHARACTERISTICS In 2011, research conducted by YPartnership revealed that: • 69% of leisure travelers have taken a trip with their spouse or significant other without children • 42% have taken one or more trips with children and their spouse or another adult • 31% have taken a general sightseeing trip in the past 12 months • In line with Niagara’s offerings, 41% have taken some type of naturalistic trip, whether it be a beach/lake vacation or an outdoors type trip – hiking, camping, fishing etc. • 51% of travelers who are interested in Niagara took a vacation to visit friends and relatives • 43% took a family vacation • 25% took a city vacation • 22% took a theme park vacation • 19% a gambling vacation • 90% of travellers go online to obtain travel information for one or more trips during the past 12 months • 26% own a smartphone and 19% of them have downloaded a travel-related app to their device • 88% use the Internet to make a travel reservation • 70% travelers use an online travel agency such as Expedia or Travelocity to make travel reservations. Of those travelers who are interested in the Niagara Region, the top four desirable travel attributes were: Beautiful scenery 89% Safety of the destination 86% Having just enough time to relax and unwind 85% A place I have never visited before 83% NIAGARA’S STRATEGIC ASSETS (unique selling propositions) 1. 2. 3. 4. 11 The Falls: the global icon, including parks, boat/helicopter tours, etc. Other public parks and recreation, including beaches Clifton Hill area activities (i.e. not the Falls, casinos, or meeting space) Fallsview area activities and shopping (not the Falls, casino, or SCC) 5. 6. 7. 8. 9. 10. 11. Convention center Gaming / Casinos / Horse racing Attractions and waterparks (gated) Golf/Outdoor sports and recreation Theater Wineries Festivals and events NIAGARA CANADA BRAND RESEARCH TNS conducted research using on-line surveys, pre and post the launch of the new Niagara Canada brand campaign to track awareness and measure brand health. Highlights: Campaign Ad Recall Levels %$Recalling$Ad$ Total$$ Families$ Couples$ %$ %$ %$ (n=303)$ (n=171)$ (n=103)$ 48%$Recall$Any$Campaign$Element$ %$Recall$Specific$Campaign$Elements$ TV 12 Globe & Mail 9 Niagara Travel 15 12 Food & Drink Niagara Website 16 13 10 4 19 10 Yes, I Definitely Saw/Visited 28$ 26$ 27$ 24$ 23$ 21$ 25$ 27$ 22$ 29$ 28$ 27$ 14$ 13$ 10$ I Think I Saw/Visited The$Tourism$Partnership$of$Niagara$ 30 Cross Media Exposure of Niagara Campaign Ads Among Those Aware of Any Ad Print# (includes#Globe#&#Mail,#Food#&# Drink#Magazine,# &#Niagara#Travel#Magazine) # 34%# 5%# 3%# Website# 20%# 1%# 28%# 9%# TV# The$Tourism$Partnership$of$Niagara$ The Tourism Partnership of Niagara 2013-14 Business Plan Claimed Impact of Advertising Among those recalling any of the executions %$Among$ %$Among$ Families$ Couples$ Percent$$StaBng$…..$$ The advertising made me more interested in travelling to the Niagara Region, but currently I am not planning a trip there 30 The advertising left me with a favourable impression of the Niagara Region, but did not really make me more interested in taking a trip there 27 The advertising influenced my decision to travel to the Niagara Region 19 I recall seeing the advertising, but it did not have any impact on my feelings about, or interest in the Niagara Region 12 32$ 36$ 28$ 28$ 25$ 19$ 7$ 6$ I recall seeing the advertising, but I cannot remember if it had any impact on my feelings about, or interest in the Niagara Region 5 3$ 6$ I had already decided to travel to the Niagara Region, the advertising did not have any influence on my travel plans 5 3$ 2$ 2$ 2$ 3 Don't Know Agreement with Advertising The$Tourism$Partnership$of$Niagara$ Statements Among those recalling any of the executions %$Sta5ng$Agree$Very$Much$ Total$ %$ Percent''sta*ng........' The advertising contained information that is meaningful to me 25 62 The advertising made me want to learn more about the Niagara Region 34 45 The advertising made me more interested in traveling to the Niagara Region 33 49 The advertising made me feel good about the Niagara Region The advertising made me think of the Niagara Region in a new way The advertising made me feel that there's more to the Niagara Region than 'The Falls' 39 6 3 5 14 11 56 25 19 50 Agree Very Much Disgaree Very Much 45 Agree Somewhat Don't Know 25$ 30$ 25$ 34 34$ 41$ 42$ 25 33$ 42$ 36$ 39$ 48$ 37$ 25$ 30$ 25$ 50$ 56$ 60$ 311 48 Families*$ Couples* %$ %$ 3 5 222 Disgaree Somewhat The$Tourism$Partnership$of$Niagara$ 13 The Tourism Partnership of Niagara 2013-14 Business Plan Influence$of$AdverEsing$on$Niagara$Brand$ By campaign recall Average Rating Among GTA Travellers Who Recall/ Do Not Recall Any Niagara Advertising (1-10 Scale) Recall$Any$Ad$$ (n=149)$ Do$Not$Recall$ (n=154)$$ One$of$my$top$choices$for$a$quick,$restoraEve$ getaway$ 7.6$ 7.0$ An$exciEng$desEnaEon$for$a$family$getaway$ 8.2$ 7.7$ A$fun$getaway$desEnaEon$for$couples$or$friends$ 8.3$ 7.9$ A$place$with$lots$to$see$and$do$$ 8.3$ 7.9$ There's$so$much$to$see$and$do,$I$need$to$stay$ overnight$$ 7.8$ 7.4$ Improvement$In$Score$ With$Campaign$Recall:$ +0.6$ +0.5$ +0.4$ +0.4$ +0.4$ STRATEGIC IMPLICATIONS FROM TNS CANADA: • The creative was effective and should be retained in future campaigns. The$Tourism$Partnership$of$Niagara$ The mix of broadcast media and print chosen for this campaign appears to have delivered good return on investment. One might consider optimizing website traffic and somewhat reducing the number of print vehicles in future campaigns (though Food & Drink should be retained). • While greater weight behind television would be beneficial, the heavy investment involved would have to be assessed relative to budget realities. • The role of online advertising and the website should be expanded with a focus on reaching these target groups. This could include customized and directed calls-to-action with linkage to other media. • Future campaigns should be sensitive to the wider advertising context for Niagara. Efforts might be made to achieve some creative alignment with major attractions. One could also contemplate dialing up couples messaging and somewhat dialing-down family themes in light of the weight of the former that already exists in the marketplace. • 14 The Tourism Partnership of Niagara 2013-14 Business Plan S.W.O.T. ANALYSIS STRENGTHS • • • • • • • • • • The Falls! World-wide product recognition Wealth of world-class experiences Superior anchor attractions Financial stability with government funding Strong suppliers with exceptional product knowledge Creative excellence Strong tourism partnerships (OTMPC & CTC Agri-tourism trend & culinary tours popularity growing Marketing assets in our tool-kit (segmented and growing database and new website) Skilled staff WEAKNESSES • • • • • • • • • • Bucket list perception Lack of regional product awareness Weak region-wide public transportation Confusion in the marketplace – many stakeholders market themselves as “official” Potential visitor experience is inconsistent Lack of financial resources Lack of human resources to implement plan Heavy reliance on domestic market CSRs lack pride in the region and eagerness to welcome visitors Price gouging perception could negatively affect the area’s reputation OPPORTUNITIES • • • • • • Continue to align Niagara’s destination marketing efforts One-stop shopping for consumers Region-wide packages Partnerships for marketing Partnerships for product development (e.g. events, packages) MOUs with DMOs to deliver & resource region-wide projects THREATS • • • • • • • • Brand USA Slow & fragile economy Strong Canadian dollar Job insecurity Strict passport regulations 12 RTOs competing for core target share of wallet Tourism Excellence Niagara (regional duplication) Multiple booking engines KEY LEARNING Our brand marketing has been effective at generating awareness and interest. A heavier weight (TV) and sustained effort are necessary to build the momentum that will lead to conversion. Our website, magazine lure and eblasts provide compelling content that generates leads for partners. A seamless link to booking will help maximize conversion. Blockbuster events motivate travel and attract significant media attention helping to animate Niagara and build our brand as a vibrant and fun destination. 15 The Tourism Partnership of Niagara 2013-14 Business Plan IV. VISION, MISSION, MANDATE Vision Become the #1 international tourism destination in North America by creating a Niagara discovery experience that is so naturally awe-inspiring, so vibrant, and so much fun that visitors can’t wait to be a part of it. Mission Enhance and grow a highly competitive tourism region through visitor-centric strategies. Build a strong relevant brand that maintains Niagara’s reputation as a world-renowned destination for leisure and MC&IT travel. Mandate TPN’s mandate is to provide leadership and coordination to attract more visitors, generate more economic activity and create more jobs across the Niagara region. 16 The Tourism Partnership of Niagara 2013-14 Business Plan V. TARGET CUSTOMER Primary Core To be maintained MC&IT Market Growth & Opportunity Market 17 Adults who are day/overnight visitors to Niagara Canada, 25-45 years of age, with an annual household income >$50,000, have attended college or graduate school. GTA and NY state. Opportunity to expand in Quebec, Ottawa. Boomers and Matures, who are empty nesters, 45- 64 years of age, and are looking for a getaway weekend to relax and unwind from the stresses of everyday life, enjoy natural beauty, walks and fine dining; GenXers and Boomer couples, 35-54, want to experience as much as they can. Some travel with kids and some don’t. The younger target segments want to see & do. The older segments have seen & done, but would like to re-visit and/or share special places and moments. GTA and NY state. Opportunity to expand in Quebec, Ottawa. Retail travel agents, professional meeting and event planners, tour operators and groups, and convention and meeting delegates who reside in the same geographic markets. Generation Y. Also known as Millennials/Echo Boomers. 20-35. It is expected that Gen-Y will replace the Boomer as the most influential market movers. Confident and open to change, Gen-Y is on course to becoming the most educated generation in history. They are totally connected and it is a badge of generational identity. By virtue of their age, they are less “established” than their older counterparts. They are more likely to be single, likely to be renters, buy things on impulse and love novelty. LGBT. Although the age group is broad 25-64 the profile is similar. They tend to display extreme brand loyalty and they are relatively easy to reach thanks to geographic clustering. On average enjoy a higher median income and more likely to go to bars, fine restaurants, attend concerts or go to the theatre. International – Partner with CTC & OTMPC to leverage these markets. The Tourism Partnership of Niagara 2013-14 Business Plan VI. OBJECTIVES 1. Continue to build the Niagara Canada Brand identity 2. Increase occupancy and average daily rates (ADR) for the accommodations industry 3. Continue to build product awareness and experiences across the region 4. Improve economic development in Niagara through tourism-centric initiatives 5. Expand Niagara’s product offer by animating wine, culinary, cycling, golf and garden experiences 6. Build awareness and drive traffic to our MC&IT product 7. Encourage certification in the Niagara Ambassador program to help industry provide visitors with extraordinary experiences 8. Increase awareness and engagement through effective industry communications 9. Pursue organizational excellence 10. Pursue sustainable funding VII. CORPORATE STRATEGIES MARKETING PRODUCT INVESTMENT WORKFORCE ORGANIZATIONAL DEVELOPMENT ATTRACTION DEVELOPMENT EXCELLENCE Build a strong relevant brand that creates a desire in our visitor to keep exploring and rediscovering Niagara Canada. Animate the destination with events and develop packages featuring wine, culinary, cycling, golf, and garden experiences. Work with government, industry and community groups to attract worldclass tourism opportunities. Build awareness and implement a workforce learning program to promote service pride. Build a reputation for organizational excellence that fosters continuous improvement. 18 The Tourism Partnership of Niagara 2013-14 Business Plan 1. Marketing: Build a strong relevant brand that creates a desire in our visitor to keep exploring and rediscovering Niagara Canada. MARKETING 1. BRAND 2. DISCOVER 3. CONNECT 4. PARTNER 5. MEET STRATEGY 1: BRAND Build a strong, compelling, relevant and respected brand that creates a strong emotional connection with our visitors / customers by providing inspiring & memorable experiences with our Brand. Continue to build a brand that represents the region as a whole: A brand that will establish an emotional connection with visitors and drive profitable growth by being relevant, respected, connected and enduring 1. Continue to build the foundational assets that incorporate all seasons. 2. Begin to develop a Brand communication and implementation plan that ensures alignment and rallies regional stakeholders behind the brand. Continue to employ consistency in all communications 1. Informed by the brand guidelines, develop a consistent voice that is conversational, approachable and friendly for all visitor communications including magazines and external advertising. The voice positions TPN as a trusted friend and guide. 2. Continue to develop a branded TV campaign that showcases the region in a consistent, yet exciting way. Build a Media Bank 1. Begin to develop a digital image bank and leverage our participation in OTMPC’s DAM program. 2. Collect and build a media relations contact base. Create a Brand Dashboard. Set benchmarks and drivers to evaluate brand health and grow brand equity 1. Create a tracking system to deliver ongoing measurement and feedback of key drivers of brand health, both tangible and intangible. MEASUREMENT: 1. Increase customers in the database 2. Increase number of stakeholders using the Niagara Canada brand 3. Brand awareness research results 19 The Tourism Partnership of Niagara 2013-14 Business Plan STRATEGY 2: DISCOVER Create a desire in our visitors to want to keep exploring and re-discovering our region, making Niagara the couple, friend & family ‘getaway’ of choice, again and again. Engage visitors in a discovery experience of all Niagara’s diverse activities 1. Re-issue the Niagara Travel magazine that consolidates all of Niagara’s offerings and promotional activity, within the year, into a highly sought after piece: A piece that compels visitors to imagine themselves in a place like Niagara. 2. Develop its potential to become a revenue generation source in the long-term. 3. Create & promote best in class visitor solutions (i.e. packages) that inspire, guide & delight the customer to explore all Niagara has to offer – leveraging the “let’s get away” positioning statement. 4. Create promotional opportunities (i.e. eBlasts) that de-seasonalize and maximize the year-round appeal of product categories. Develop common offer promotions 1. Continue to evaluate and develop common offer partnership to entice the customer to visit Niagara through on-brand, value-based messaging. Develop exclusive online offers 1. Create exclusive online packages to give the Niagara Canada database customer value for belonging to our database. Promote Niagara culinary experiences 1. Build awareness of Niagara’s culinary experiences by implementing the recommendations of our culinary tourism strategy. Promote festivals and events 1. Build awareness of Niagara’s festivals & events 2. Develop packages and offers 3. Integrate target festivals/events into contesting to grow our consumer database MEASUREMENT: 1. Increase customers in the database 2. Brand awareness research results 3. Increase common offer partners 4. Increase booking results 5. Above industry average eBlast analytics 20 The Tourism Partnership of Niagara 2013-14 Business Plan STRATEGY 3: CONNECT “ Create a ‘connected world’ for Niagara visitors to make it easy to choose Niagara; utilizing the latest technology to continue the dialogue to ensure repeat visits. Continue to build an engaging, dynamic, content-rich website. 1. Develop a robust visitor facing web-based online booking platform. 2. Develop an annual ‘Conversation Calendar’, with relevant and dynamic content that will continually deepen engagement with the Niagara region. Bring selected content developed for the customer publication to life thought digital channels. 3. Collect and build a customer base. Define & develop a more robust social media strategy 1. Explore adding new ‘social’ channels to engage visitors through a consistent conversation and through involvement in relevant communities. 2. Engage with our visitors through relevant positioning of the brand in our customers’ day-to-day life via their ‘digital landscape’. 3. Develop programs for visitors to share their adventures and memories on our media channels and influence others to visit. 4. Continue building our audience. Continue refining a SEM strategy. 1. Continue to improve efforts to maintain top position and improve our organics. Develop a mobile strategy. 1. Create a mobile application that engages visitors before, during and after their visit, designed to provide inspirational content with robust mapping functionality for nearby products. MEASUREMENT: 1. Increase customers in the database 2. Increase booking results 3. Social network & web analytics 4. Mobile downloads & analytics 21 The Tourism Partnership of Niagara 2013-14 Business Plan STRATEGY 4: PARTNER Develop strategic partnerships with stakeholders and local, provincial & national tourism organizations to ensure Niagara tourism dollars are well leveraged. Build 1. 2. 3. 4. strategic, visitor-focused partnerships Work closely with OTMPC to leverage opportunities that may present themselves. Develop strategic partnerships with other like-minded organizations. Partner and develop packages with key Ontario destinations such as Toronto/Ottawa. Develop partnerships & packages for the LGBT target Select partnership programs that reach where we can’t 1. Evaluate and select best-aligned OTMPC & CTC partnerships that target our growth markets. Create revenue generating marketing programs for region participation 1. Develop partnership packages and opportunities that target our markets and augment the current government funded budget. MEASUREMENT: 1. Increase ratio of partner dollars leveraged 2. Increase number of stakeholder partnerships 3. Increase / leverage media dollars earned STRATEGY 5: MEET Develop a reputation as a world-class, diverse and exciting destination for MC&IT. Showcase all Niagara’s meeting possibilities targeting meeting planners and decision makers. Continue to build the Niagara Canada Meetings brand that represents the whole region 1. Renew the MOU with the SCC to ensure our foundational efforts are being deployed on a consistent and best in class level. 2. Continue to execute marketing initiatives that support increasing the international awareness of the Niagara Canada Meetings brand. 3. Create and engage in strategic partnerships with associations that are high profile, industry leaders. Leverage their industry reputation and credibility to position our brand as a premier destination for meetings, conferences, sporting events and special events. Continue to employ consistency in all communications 1. Informed by the brand guidelines, develop a consistent MC&IT voice that is conversational, credible and trusted. Develop an MC&IT social media strategy 1. Create a Meetings Niagara Canada ‘social’ channel to engage industry & decision makers through consistent conversation and participation in relevant communities. 2. Continue building our MC&IT audience. Develop a Convention Development Fund strategy 1. Create a funding plan that will support and position us to compete with key competing markets. MEASUREMENT: 1. Increase leads generated through website portable 2. Positive monthly activity reports 22 The Tourism Partnership of Niagara 2013-14 Business Plan 2. Product Development: Animate the destination with events and develop packages featuring wine, culinary, cycling, golf, and garden experiences. PRODUCT DEVELOPMENT 1. PACKAGES 2. EVENTS STRATEGY 1: PACKAGES Develop packages featuring wine, culinary, cycling, golf, and garden experiences Develop culinary experiences 1. Make progress on implementing the recommendations of the Culinary Strategy. 2. Partner with Niagara College to host a Culinary & Wine Tourism Summit to ignite the interest of farmers, artisans producers, wineries, chefs, restaurateurs and accommodators to work together to expand Niagara’s culinary and wine tourism offerings. 3. Provide consumer insights and learning from best practices to help develop signature culinary experiences that only the Niagara region can provide. 4. Promote Niagara’s culinary and wine experiences, festivals and events. Work with industry partners, especially DMOs, to develop packages featuring wine, culinary, cycling, golf and garden experiences 1. Feature compelling packages on visitniagaracanada.com. 2. Feature content in Niagara Travel magazine. MEASUREMENT: 1. Number of attendees at the Culinary & Wine Tourism Summit 2. Packages posted on visitniagaracanada.com STRATEGY 2: EVENTS Pursue events that animate our destination, attract significant media attention and motivate overnight travel. A) BLOCKBUSTERS: Support Blockbuster events that are on strategy, operating budgets over $1M, national or international reputation that attracts significant media exposure, region-wide benefits, build the brand and leave a legacy. Consider multi-year support with diminishing contribution over a 3-year period. 1. GranFondo cycling event (September 12-15, 2013) 2. Canoe Niagara flatwater sports (July 26 to August 4, 2013) 3. Red Bull Crashed Ice – Review results of 2012 event and consider multi-year support with diminishing 23 The Tourism Partnership of Niagara 2013-14 Business Plan 4. contribution over 3 year period. Explore additional blockbuster events and communicate event criteria through TPN website and at stakeholder events. B) SPORTING: Support sporting events that are on strategy, build the brand, have the ability to draw significant overnight stays, especially international competitors and have an economic impact of over $1M. 1. Work in partnership with the Niagara Sports Commission to identify new events. 2. Explore annual national golfing event. C) SIGNATURE: Identify existing signature events that are uniquely Niagara and create promotional campaigns that give consumers a reason to visit year round (e.g. Icewine festival promotion to attract consumers to these major signature events in the shoulder season). 1. Solicit DMOs to identify and submit applications for signature events for promotion 2. Streamline the application and approval process to support signature events MEASUREMENT: 1. Number of participants and attendees 2. Media reach and ad value 3. Packages sold 4. Increase in number of consumers in our database 5. Leads generated to partners 24 The Tourism Partnership of Niagara 2013-14 Business Plan 3. Investment Attraction: Work with government, industry and community groups to attract world-class tourism opportunities. INVESTMENT ATTRACTION 1. ACCESS 2. ECONOMIC DEVELOPMENT STRATEGY 1: ACCESS Work with the regional government to explore the feasibility of air flights to the Niagara District Airport. Partner with the Regional Municipality of Niagara Economic Development Division to evaluate the feasibility and impact of flight service to the Niagara District Airport. 1. Evaluate the demand for flight service to the Niagara District Airport in the context of other modes of transportation such as rail, bus and auto. Take into account the possibility of improvements to these other modes of transportation e.g. year-round GO Train service. Determine the possible impact and effect on these ground transportation services if flight service is offered. 2. Analyze the potential for flight use to the Niagara District Airport from airports within an 800 km radius. Initial target markets include Ottawa, Montreal and New York. 3. Evaluate the tourism industry’s capacity to support flight service including visitor services such as ground transportation; compelling experiences; and marketing. Implement the recommendations of the feasibility study in partnership with the Niagara Regional government, the Niagara District Airport and industry (Phase 2 in year 2). 1. Develop logistical plan 2. Develop marketing plan 3. Recruit partners 4. Recruit airline(s) 5. Roll out program MEASUREMENT: 1. Complete feasibility study 2. Complete logistical and marketing plans 3. Successful launch 4. Flight loads 5. Packages sold 25 The Tourism Partnership of Niagara 2013-14 Business Plan STRATEGY 2: ECONOMIC DEVELOPMENT Work with governments, industry and community groups to attract an International Horticultural Exhibition – Flora Niagara. Work with Landscape Ontario, Hamilton Halton Brant Tourism (RTO3) and other partners to attract an International Horticultural Exhibition – Flora Niagara. 1. Participate on the Flora Niagara Steering Committee. 2. Continue to meet with federal, provincial and municipal government officials, business leaders, industry operators, associations, and community groups to gain support and funding for Flora Niagara. Assuming funding is raised, TPN will work on garden tourism product development and marketing 1. In partnership with RTO3, identify existing garden events and gaps to improve garden tourism products 2. Recruit partners 3. Recruit MC&IT garden related events 4. Develop garden tourism marketing strategy and plan 5. Launch campaign(s) MEASUREMENT: 1. Successful fundraising for International Horticultural Exhibition 2. Signature garden tourism experiences 3. Packages sold 26 The Tourism Partnership of Niagara 2013-14 Business Plan 4. Workforce Development: Build awareness and implement a workforce-learning program to promote service pride. WORKFORCE DEVELOPMENT 1. LEARNING STRATEGY 1: LEARNING Implement a workforce-learning program to improve the quality of the labour force by building service pride and love for the destination & to anticipate guest needs rather than just reacting to guest requests. Implement “Welcome to Niagara” web-based learning program 1. Work together with the established Advisory Group to develop industry communications to adopt the program 1. Highlight program on TPN industry website 2. Create and send out Eblasts 3. Market program at local events, BIAs, Chambers, etc. 4. Solicit Ambassadors to help promote 5. Establish industry sector “Champions” 6. Create link with both local college and university 7. Create link with local job placements agencies 2. Undertake annual program maintenance to ensure the program is up to date 3. Analyze and create improvement plan based on survey results. MEASUREMENT: 1. Number of people certified 2. Number of industry sectors involved 3. Analysis and improvement plan based on survey feedback 27 The Tourism Partnership of Niagara 2013-14 Business Plan 5. ORGANIZATIONAL EXCELLENCE: Build reputation for organizational excellence that fosters continuous improvement. ORGANIZATIONAL EXCELLENCE 1. COMMUNICATIONS 2. FUNDING 3. GOVERNANCE 4. OPERATIONS STRATEGY 1: COMMUNICATIONS Effective communication and engagement with partners Raise awareness of TPN strategy, plans, partnership opportunities and success 1. Invite industry to join TPN emailing list 2. Communicate TPN strategy, plans, partnership opportunities, media relations, in-market campaigns, workforce development programs, consumer research etc. on the NiagarasRTO.com website 3. Communicate and engage industry at stakeholder meetings 4. CEO meetings and speaking engagements with industry and government representatives to broaden awareness of TPN strategy and engage partnership 5. Seek media coverage for our activities to build our reputation for organizational excellence 6. Undertake partnership satisfaction survey to evaluate awareness and satisfaction of TPN strategy and partnership programs 7. Use results of satisfaction survey to develop action plan for improvement MEASUREMENT: 1. $ leveraged 2. # partners in programs 3. Partner satisfaction 4. # attendees at industry events 5. # contacts in our industry database STRATEGY 2: SUSTAINABLE FUNDING Secure long-term sustainable funding Secure matching funding from the Ministry’s partnership program to: 1. Support the RTO as the leader in regional tourism 2. Encourage strong partnerships and expand the breath and diversity of funding partners 3. Engage industry partners to broaden TPN’s financial base to extend reach 4. Support a coordinated approach that aligns planning, marketing, product development, investment attraction, and workforce development in the region Create advertising opportunities such as Niagara Travel lure magazine 28 The Tourism Partnership of Niagara 2013-14 Business Plan Create pay-to-play programs such as print and online experiential campaigns (e.g. wine & culinary free standing insert) Communicate criteria for partnership funding and seek additional opportunities that deliver on TPN strategy MEASUREMENT: 1. Dollars raised STRATEGY 3: GOVERNANCE Develop and build reputation for organizational excellence by establishing a strategy, performance measures, sound policies and procedures, and an effective governance structure that facilitates decision-making and fosters continuous improvement. Ensure a high-function Board 1. Implement an annual Board survey to evaluate and identify areas for improvement: a. Peer-to-peer b. Board effectiveness 2. Ensure committees meet regularly to develop and provide effective advice for the Board 3. Review Board attendance records annually 4. Develop and implement a Board appreciation plan to increase positive engagement 5. Hold a minimum of quarterly Board meetings 6. Continue to revise General By-Laws as required 7. Review Board Committees, mandates, committee composition, terms of reference, where required 8. Develop a policy to clearly define the role of management and the Board 9. Remain current and involved with the development of provincial RTOs within Ontario Develop a scorecard with performance measures that are key indicators of the effectiveness of TPN strategy 1. Work with Ministry colleagues to implement standardized performance measures 2. In addition, continue to report on the following measures as key indicators: • Advertising awareness • Number of consumers in TPN database • Number of leads generated to partners • Dollars leveraged through partnerships • Partner satisfaction Communicate scorecard results 1. Quarterly reports to Board and Ministry 2. Semi-annual results shared at stakeholder meetings Identify areas for improvement 1. Analyze key performance measures and identify opportunities for improvement MEASUREMENT: 1. Board evaluation undertaken annually 2. Action plan for improvements developed 3. Scorecard developed 4. Scorecard results reported 29 The Tourism Partnership of Niagara 2013-14 Business Plan STRATEGY 4: OPERATIONS Establish a sound and well functioning operation through the development of corporate policies and procedures to ensure organizational excellence. Establish a sound and well-functioning operation through the continued development/revision of corporate policies and procedures 1. Ensure compliancy with all Health & Safety regulations 2. Continue to add new policies and procedures as required Produce and maintain records to present up to date and accurate financial statements 1. Issue month-end financial reports by the 15th of the following month 2. Continue to engage a bookkeeper to complete month-end reconciliations and financial reports for auditing 3. Ensure the timely engagement of Auditors to complete their independent audit to comply with the TPA 4. Meet all TPA financial reporting deadlines 5. Ensure accurate and timely submission of Corporate Tax returns, HST returns, payroll returns etc. 6. Advocate for improved cash flow from the Ministry 7. Annually review contracts for Board approval where required 8. Annually review all insurance contracts to ensure adequate coverage 9. Review and amend cheque-signing authorities when required MEASUREMENT: 1. Financial information produced accurately and timely to provide adequate information for decisionmaking and to meet budget targets 2. Tax Returns completed on time 3. TPA audits completed on time and submitted to the Ministry 4. Insurance policies reviewed at annually, as a minimum 30 The Tourism Partnership of Niagara 2013-14 Business Plan VIII. GOVERNANCE & ORGANIZATIONAL STRUCTURES Governance Structure BOARD GOVERNANCE EXECUTIVE FINANCE & AUDIT MARKETING STRATEGY & DEVELOPMENT COMMUNICATIONS & ENGAGEMENT MC & IT REGION-WIDE INPUT BOARD COMMITTEES The TPN’s role in tourism in the Niagara region is to coordinate the development and growth of tourism in the Niagara region. The TPN will work with local, provincial, and federal tourism organizations to ensure that the Niagara region is well represented at all levels. To facilitate this, the TPN has established the following committees: Executive Committee Mandate – To act for the Board on urgent matters arising between regular Board meetings in cases where it is not possible to convene a meeting of the Board, and to do other things as delegated by the Board to the committee. Corporate Governance Mandate – To periodically review and, on that basis, make to the full Board of Directors for its consideration, specific recommendations on the means and methods of the systems and structures for the governance of TPN. 31 The Tourism Partnership of Niagara 2013-14 Business Plan Finance and Audit Mandate – To supervise and review the financial management of TPN including, without limitation, the review of TPN’s processes for Internal control, accounting and financial reporting and auditing. The Audit Committee shall ensure that appropriate policies and practices are articulated and adhered to and, if deemed necessary in the opinion of the Audit Committee, amended from time-to-time to meet the then current needs and reasonable expectations of TPN and its Board of Directors. Marketing Mandate –To recommend for approval by the Board of Directors, an annual marketing plan (“Marketing Plan”) for TPN. The Marketing Plan will be updated by the Marketing Committee not less frequently than annually and will be projected over a “medium term”, usually of three years duration unless otherwise agreed to by the Board of Directors. The Marketing Plan will provide the details for the allocation of TPN’s available resources against identified business opportunities with a view to optimizing the benefit to TPN resulting from the application of such resources. The Marketing Committee will, on its own volition or upon request from the Board of Directors, report periodically to the Board of Directors on the implementation of the Marketing Plan(s) of which the Board of Directors has approved. Staff is responsible for the operating plan including the creative of all marketing materials. Strategy and Development Mandate – To ensure that the TPN strategic direction meets the goals and objectives of the TPN, and that the strategic direction is still consistent and appropriate with the current market place. The Strategy & Development Committee will be responsible for choosing and directing TPN’s consultants and for the review of all events, opportunities and programs brought to the TPN keeping in light the strategic directions of the TPN, the financial resources available to the TPN, and the relative importance of the opportunity or program in comparisons to other opportunities. Communications and Engagement Mandate – To ensure that communication between the TPN and their tourism partners is done in an effective and efficient manner and to ensure that the TPN has a robust and meaningful web site. MC & IT Committee Mandate – To recommend for approval by the Board of Directors, an annual marketing plan that will provide the details for the allocation of TPN’s available resources against identified business opportunities with a view to optimizing the benefit to TPN resulting from the application of such resources. 32 The Tourism Partnership of Niagara 2013-14 Business Plan Organizational Structure BOARD OF DIRECTORS CEO DIRECTOR OF MARKETING DIRECTOR OF CORPORATE SERVICES STAKEHOLDER RELATIONS / EA CEO A key business leader, promoter and visionary, and is the public face of the Tourism Partnership of Niagara. S/he is dedicated to the promotion and marketing of Niagara as a premier destination for business and leisure travel. Director of Marketing The key driver to develop and implement a marketing, sales, and business strategy that will launch the Tourism Partnership of Niagara’s successful destination marketing strategy and make it a leader in promotion and marketing. Director of Corporate Services The liaison with the Ministry of Tourism, Culture and Sport who is responsible for all financial transactions, statements and reports and who ensures implementation of all governance-related activities affecting TPN including supporting the Board, and the Governance, and Finance and Audit committees. Stakeholder Relations Coordinator/EA The key person responsible for developing content and maintaining the industry website as well as developing and maintaining regular communications to stakeholders and partners to update them on our activities and gather content and packages for the consumer website while supporting committees and office activities. 33