Curriculum Vitae - Allan

advertisement

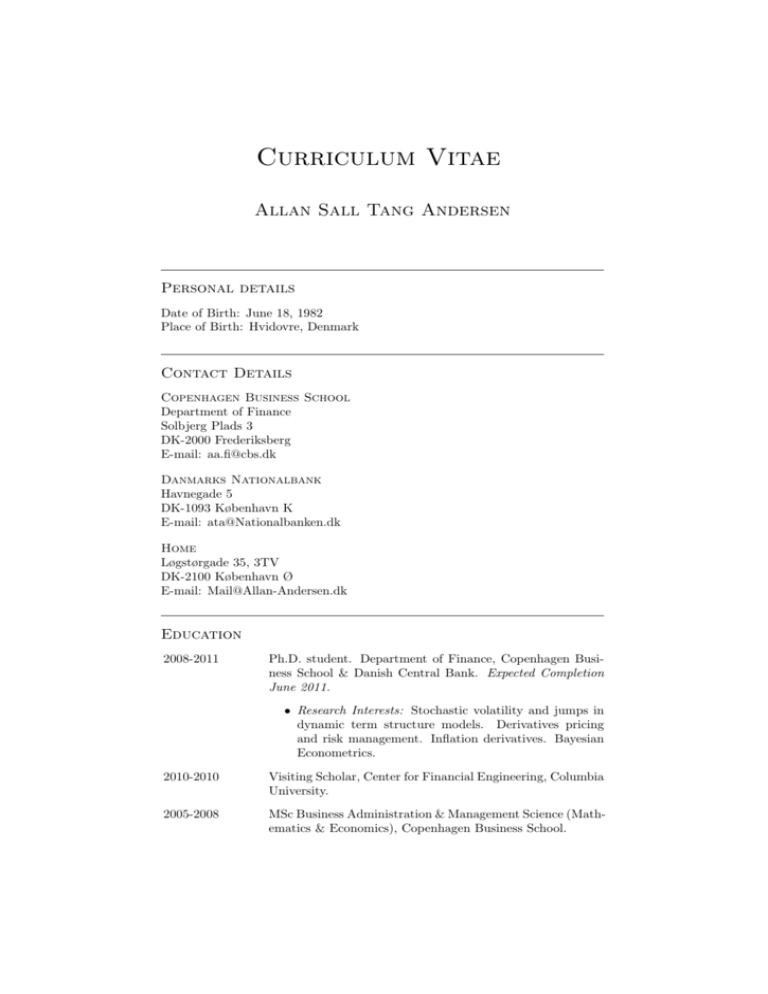

Curriculum Vitae Allan Sall Tang Andersen Personal details Date of Birth: June 18, 1982 Place of Birth: Hvidovre, Denmark Contact Details Copenhagen Business School Department of Finance Solbjerg Plads 3 DK-2000 Frederiksberg E-mail: aa.fi@cbs.dk Danmarks Nationalbank Havnegade 5 DK-1093 København K E-mail: ata@Nationalbanken.dk Home Løgstørgade 35, 3TV DK-2100 København Ø E-mail: Mail@Allan-Andersen.dk Education 2008-2011 Ph.D. student. Department of Finance, Copenhagen Business School & Danish Central Bank. Expected Completion June 2011. • Research Interests: Stochastic volatility and jumps in dynamic term structure models. Derivatives pricing and risk management. Inflation derivatives. Bayesian Econometrics. 2010-2010 Visiting Scholar, Center for Financial Engineering, Columbia University. 2005-2008 MSc Business Administration & Management Science (Mathematics & Economics), Copenhagen Business School. 2006-2007 MSc Financial Mathematics (with Distinction), Cass Business School, City University, London. 2002-2005 BSc Business Administration & Management Science (Mathematics & Economics), Copenhagen Business School. Teaching Experience Fall 2007 Teaching Assistant: Portfolio Theory, MSc Finance, Copenhagen Business School. Masters course in portfolio and investment theory. Curriculum: Elton, Gruber, Brown & Goetzmann: Modern Portfolio Theory and Investment Analysis. Fall 2007 Teaching Assistant: Financial Markets & Instruments, MSc Finance & Strategic Management , Copenhagen Business School. Introductory course in financial markets and products. Curriculum: Elton, Gruber, Brown & Goetzmann: Modern Portfolio Theory and Investment Analysis. Fall 2005 Teaching Assistant: Macroeconomics and International Institutions, BSc Business Administration, Copenhagen Business School. Introductory course in Macroeconomics. Curriculum: Blanchard, Olivier: Macroeconomics. Work Experience 2008-2011 Danish Central Bank : Ph.D. student. 2008-2009 European Central Bank, Economist: Economist in the Capital Markets and Financial Structures division, Directorate Monetary Policy. Worked on briefings and research project on break-even inflation and inflation risk premia. 2007-2007 Merrill Lynch, Analyst: Summer analyst in the Quantitative Research division. Worked on projects in the Interest Rate Derivatives Strategy, Equity Derivatives & Commodities Research teams. 2004-2006 Danish Central Bank, Junior Analyst: Junior Analyst in the Statistics Department. The job consists of the compilation and development of the statistic ’Quarterly Financial Accounts for Denmark’. Computer Experience • MS Office, R, MS Excel VBA, Matlab, LATEX - Very Experienced User. • C++, SQL, Mathematica, SAS (base & IML) - Experienced User. Spoken Languages • Danish - Mother Tongue. • English - Fluent. • Swedish, Norwegian - Conversational. • French, German - Basic. Prizes • Best Graduate from Copenhagen Business School 2008: At the 2009 FUHU convention I was awarded the prize ’Gunnar V. Holms legat’ for obtaining the best grade point average of all graduates in 2008 at Copenhagen Business School. Research Working Papers • A tractable Heath-Jarrow-Morton framework based on time changed Lévy processes, 2008. • Inflation derivatives modelling using time changed Lévy processes, 2009 • Inflation risk premia in the term structure of interest rates: Evidence from Euro area inflation swaps, 2009. Paper Presentations 2010 January Campus for Finance, Vallendar, Germany 2009 December Quantitative Methods in Finance, Sydney. 2009 October Danish Central Bank, Copenhagen. 2009 May Nordic Finance Network Research Workshop, Copenhagen. 2008 August Danish Central Bank, Copenhagen.