Schedule M-3 Update for 2007 By John Ledbetter and Lucinda Van

advertisement

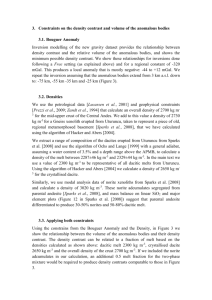

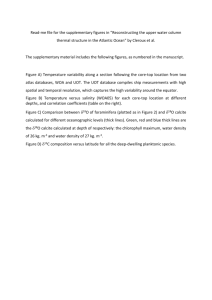

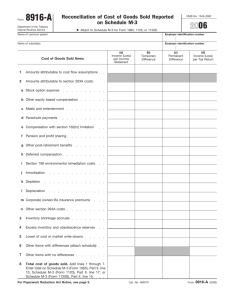

December 2007 Schedule M-3 Update for 2007 By John Ledbetter and Lucinda Van Alst John Ledbetter and Lucinda Van Alst examine Schedule M-3, including its expanded application to other types of entities, and provide a detailed example illustrating the use of Schedule M-3. F or tax years ending on or after December 31, 2004, the Schedule M-3 is a required component of Form 1120 for those corporations with $10 million or more in total reportable assets. The Schedule M-3 replaced the Schedule M-1 that had not been updated in several decades and had been found increasingly inadequate for IRS purposes purposses due to, among other reasons, the growing complexity of business transactions. The ow wing i g co omp ple purpose article is to rev review Schedule M-3 urp pose e of this art ar iew the Schedu developments expanded use evvelop p ents to date, pme e, including di its expande for other or o othe er types types of entities, en ties, and and to provide pro ide a detailed de example mple l with with explanations e pla l ons of o the he Schedule Sc d l M-3 M for illustration i purposes. Background Initial Requirement On January 28, 2004, the IRS issued IR-2004-14 announcing the release of a new proposed draft form, the Schedule M-3, Net Income (Loss) Reconciliation for Corporations with Total Assets of $10 Million or More, for use by certain corporate taxpayers filing the Form 1120. Affected taxpayers would complete the new Schedule M-3 in lieu of completing the much less detailed Schedule M-1, effective with John Ledbetter, Ph.D., CPA, is an Assistant Professor of Accounting at Ball State University in Muncie, Indiana. Lucinda Van Alst, DBA, CPA, is the Chair and Associate Professor of Accounting at Ball State University in Muncie, Indiana. TAXES—THE TAX MAGAZINE © tax years ending on or after December 31, 2004. Smaller businesses and self-employed taxpayers, however, would continue to use the Schedule M-1. The news release stated that the purpose of the new Schedule M-3 was to increase the transparency of corporate return filings, making the differences between financial accounting net income and taxable income more evident. IRS personnel stated that that, in turn, would help agents to determine which returns should be audited and to identify the differences that would matter most for those returns that were audited. They saw benefits accruing to taxpayers and the IRS alike from the new Schedule’s use resulting from a reduction in unnecessary audits udi s and a faster faster identifi de ification cation of of the he differences difference more likely when taxpayers aggressive l kel to aarise rise w n ta xpayers take ake agg gressiv positions or engage in aggressive transactions. IRS Commissioner Mark W. Everson noted that the new Schedule would let the IRS sharpen and improve monitoring of corporate compliance while Treasury Assistant Secretary for Tax Policy Pam Olson stated that the increased transparency would have a deterrent effect. Expanding Usage The IRS increased the use of the Schedule M-3 by requiring three additional entities to file that Schedule rather than the Schedule M-1. First announced in News Release IR-2005-141 in December 2005, the Schedule M-3, when finalized, became required reporting by property and casualty insurance companies filing Forms 1120-PC; 2007 J. Ledbetter and L. Van Alst 39 Schedule M-3 Update for 2007 composed of large and mid-size corporations and life insurance companies filing Forms 1120-L; and partnerships were growing rapidly. The multiple S corporations filing Forms 1120S, providing the criteria would ensure uniform tax accounting disentities had total assets of $10 million or more. closures by entities similar to or related to LMSB The reporting was effective for tax years ending taxpayers. on or after December 31, 2006. In the initial news release, Deborah M. Nolan, IRS Large and Form 8916 Mid-Size Business (LMSB) Division Commissioner, reiterated the Commissioner’s earlier remarks that In early April of 2006, the IRS issued updated drafts the increased disclosure provided by the Schedules of Schedules M-3 for the 2006 tax year and added M-3 would enable the IRS to distinguish returns a new Form 8916, Reconciliation of Schedule M-3 with potentially higher compliance risk from those Taxable Income with Tax Return Taxable Income with lower risk, which, in turn, would lead to refor Mixed Groups, to be filed by certain insuranceduced examination cycle related corporations. The times and increased curpurpose of the Form 8916 The Schedule M-3 replaced the rency. She emphasized is reflected in the Form that the end result would title and is to reconcile Schedule M-1 that had not been be reduced taxpayer burtaxable income reported updated in several decades and had den and improved tax on the Schedules M-3 to been found increasingly inadequate the taxable income recompliance. ported on the income tax for IRS purposes due to, among Partnerships returns. The new drafts other reasons, the growing provided the means for One week after excomplexity of business transactions. consolidating and recpanding the use of the onciling taxable income Schedule M-3, the IRS for both insurance comissued yet another news panies and noninsurance companies, or for two release, IR-2005-146, announcing the draft of the ase, IR-20 different types of insurance companies. The same Schedule hedu dule l M-3 M 3 for fo Form 1065 filers. Effective startnews release, IR-2006-51, included a draft Schedule ing years December 31, ng with h tax x ye ars ending ing on or after Decemb M-3 for Form 1065 that added additional report2006, a more detailed 00 06, tthe he Schedule S edu M-3 Sche M- provided vi de ing of net income of other includible entities and reconciliation between eco onciliattion b etw en financial nancial aaccounting countin net additional lines in Part III to report state, local and income and taxable ome e an d tta abl b income come than han was reported in foreign the past. Partnerships meeting any of four different g taxes. The Schedule M-3 that accompanies Forms criteria would be required red to o file e SSchedule Sched dule M-3. M-3. orms 1120S 120S and and 1065 1065 was also changed cha ged to include nc ud separate reporting off gas and oil and o other depletion. The criteria included the partnerhe following: owing: tthe he p artne epa ate re porting o the de pletion For the first time Form 1065 filers were requested ship has (1) $10 million or more in total assets at to provide information in the checkboxes at the top the end of the tax year; (2) $10 million or more of Schedule M-3 to indicate the reason(s) they are in “adjusted total assets” at the end of the year; required to file the Schedule M-3. (3) $35 million or more in total receipts; or (4) a “reportable partner.” A “reportable partner” was Adding Form 8916-A defined as one that is itself required to file Schedule M-3 on its most recent tax return and that owns, After considering many helpful comments from directly or indirectly, 50 percent or more interest stakeholders, the IRS released final drafts of in the income, loss or capital of the partnership on Schedules M-3 and Forms 8916 for the 2006 tax any day of the partnership tax year on or after June year. The IRS also reported the addition of a new 30, 2006. “Adjusted total assets” means total assets Form 8916-A which would be required for cost at the end of the tax year before capital distribuof goods sold. The Form’s purpose is to provide tions, losses and any other adjustments that reduce for a uniform, consistent manner for taxpayers to total partnership capital. The IRS LMSB Division reconcile cost of goods sold reported in Part II of Commissioner, Deborah M. Nolan, was quoted as Schedule M-3. Additional lines were added to the saying that the Schedule M-3 for partnerships was Schedule M-3 for the reporting of inter-company particularly important since complex enterprises dividend adjustments, other statutory adjustment 40 December 2007 and other adjustments, and Part I was renumbered so that all of the Schedules M-3 were consistent with reporting worldwide consolidated financial net income and consolidated net income for the tax group. The new Form would accompany Forms 1065, 1120 and 1120S. Comment Period for More Additions IR-2007-94 was released by the IRS in May 2007 for public comment on draft versions of the revised Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, for tax year 2007, which included the Schedule M-3. Thus, taxpayers with $10 million or more in total reportable assets filing Form 1120-F will be required to file Schedule M-3, effective for tax years ending on or after December 31, 2007. In addition, three other schedules for Form 1120-F are new, as follows: Schedule H, Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8; Schedule I, Interest Expense Allocated Under Regulations Section 1.882-5; and Schedule P, List of Foreign Partner Interest in Partnerships. In all instances, the schedules will provide increased disclosure of information to the IRS and a more consistent reporting format for the taxpayers. Looking o ing ooki gA Ah Ahead When Wh hen the t IRS iss is issued IR-200 IR-2006-71 6-71 in April 20 2006, it stated tated tthat hat it soon so oon planned nn to introduce in ce a new Form 1120-C replace 990-C, which 12 20-C C to rep lacce Form orm 99 0-C, wh ch is filed by cooperative Form 1120 1120-C operaati tivee associations. ass cia i s Fo C would also be filed b by Subchapter T cooperatives that had previously filed Form 1120. O Once again, the taxpayers e again n, th e tax xpayyers affected would be those wit with total year end otal aassets sets aat ye ear en d of $10 million or more. With the increased usage of the Schedule M-3, it would seem that the IRS has gathered at least some evidence that the Schedule is, indeed, providing more transparency and, thus, compliance assistance. Boynton et al. (2006)1 provide statistical information about 2004 reporting on Schedule M-3, but they do not present any conclusions about the transparency provided by Schedule M-3. Interestingly, they report unusually large proportions of total differences for the “other income items with differences” category (Part II, line 25 on the 2007 form). businesses/corporations/article/0,,id=119992,00. html. The page contains links to a lengthy FAQ page, a link to subscribe to a Schedule M-3 e-mail service, and a form for submitting questions about the schedule to the IRS. IRS also provides a listing of draft tax forms (which can be sorted by form number or date) at www.irs.gov/taxpros/lists/0,,id=97782,00. html. The most recent 2007 drafts at this writing are as shown in Table 1. Example for Schedule M-3 (Form 1120) As an example, consider an affiliated group which files consolidated financial statements with the SEC and consolidated returns with the IRS. The affiliated companies include a publicly traded U.S. parent corporation (“US”) and the following additional entities: A 90 percent owned U.S. subsidiary (“US1”) A wholly owned foreign subsidiary (“FORN1”) A 60 percent owned U.S. subsidiary (“US2”) An 80 percent owned U.S. subsidiary (“US3”) that does not meet the requirements for financial statement consolidation Consolidated financial statements filed with the SEC include US, US1, FORN1 and US2, but do not include US3. The consolidated tax return includes US, US1 and US3, but does not include FORN1 or US2. Exhibit 1 presents a consolidating spreadsheet for the group. The spreadsheet initially consolidates US and US1, the companies included in both the book and consolidation eliminates nd tax a cconsolidations. onso dations This his co nsol d tion eli mi ate $100,000 US1 service revenue from US) $100 ,000 of US 1 se r e re venue ((derived d rived fr om U and other expenses of US. Another entry eliminates the $32,320 minority interest in US1’s earnings. The spreadsheet then consolidates FORN1 and US2 to complete the financial statement consoli- Table 1. Form “As of” Release Date Schedule M-3 (Form 1120) July 25, 2007 Schedule M-3 (Form 1065) July 10, 2007 Schedule M-3 (Form 1120S) July 25, 2007 Schedule M-3 (Form 1120-F) June 15, 2007 Schedule M-3 (Form 1120-L) July 17, 2007 Available Resources Schedule M-3 (Form 1120-PC) July 17, 2007 IRS maintains a Web site dedicated to Schedule M-3; the main page is currently located at www.irs.gov/ Form 8916 June 14, 2007 TAXES—THE TAX MAGAZINE Form 8916-A August 20, 2007 41 Schedule M-3 Update for 2007 Exhibit 1. Consolidated Spreadsheet Consolidated for Book and Tax 90% US Sales 5,280,000 Cost of goods sold 3,416,000 Gross profit 1,864,000 Consolidated for Book Only US/US1 Included US1 Elim US Book FORN1 US2 80% Elim Total Book 5,280,000 3,000,000 1,000,000 3,416,000 2,400,000 0 0 1,864,000 Service revenue 300,000 800,000 (100,000) 1,000,000 Interest income 215,000 215,000 Dividend income 220,000 Equity in earnings of investees Tax Only 60% 600,000 600,000 400,000 US3 Total Tax 9,280,000 5,280,000 6,416,000 3,416,000 0 2,864,000 0 1,864,000 (150,000) 850,000 40,000 1,040,000 415,000 215,000 220,000 220,000 220,000 200,000 200,000 200,000 200,000 Gain on sales of assets 225,000 225,000 225,000 225,000 Other income 400,000 400,000 400,000 400,000 3,424,000 800,000 (100,000) 4,124,000 800,000 400,000 (150,000) 135,000 125,000 140,000 Total income Compensation 415,000 550,000 200,000 5,174,000 40,000 4,164,000 815,000 550,000 Repairs and maintenance 60,000 60,000 60,000 60,000 Bad debts 50,000 50,000 50,000 50,000 Interest expense 40,000 40,000 40,000 40,000 Charitable contributions 20,000 20,000 20,000 20,000 Depreciation and amortization 55,000 55,000 55,000 Pension, on, etc. 80,000 80,000 80,000 80,000 725,000 410,000 Other theer expenses exp pensees 350,000 160,000 (100,000) 410,000 32,320 32,320 Minority interest Min ority intere est in income n in ncomee 400,000 65,000 (150,000) 100,000 49,920 82,240 Total expenses ota al expe ensess 1,070,000 70, 295,000 95, (67,680) 1,297,320 67 1 525,000 205,000 (100,080) 1,927,240 100,000 Income ome b before f e income taxes e ta axes 2,354,000 505,000 (32,320) 2,826,680 275,000 195,000 3,246,760 (60,000) 847,440 181,800 81,80 1,029,240 , 96,250 96,25 0 70,200 , 1,506,560 560 323,200 3,200 (32,320) (32, 2 ) 1,797,440 ,797,4 0 178,750 78,750 124,800 12 4,800 Income tax expense Net income dation. Here, one entry eliminates $150,000 of US1 service revenue (derived from FORN1) and other expenses of FORN1. This consolidation also eliminates the $49,920 minority interest in US2’s earnings. After consolidating FORN1 and US2, the spreadsheet reports $2,051,070 of net income. This equals the net income reported by the group in Form 10-K. The spreadsheet shows a loss of $60,000 for US3. US3 is not included in the financial statement consolidation, so the spreadsheet shows no eliminating entries related to US3. The final column of Exhibit 1 reports the book income for entities included in the consolidated U.S. income tax return. This column combines the consolidated amounts for US and US1 plus the amounts for 42 (49,920) 32,320 1,195,690 , , (49,920) (49 92 2,051,070 2,0 1,070 155,000 1,397,320 2,766,680 1,029,240 ((60,000) 0,000) 1,737,440 1,737,44 US3. For example, consolidated net income for the entities included in the tax return is $1,737,440; this is the sum of consolidated net income for US and US1 ($1,797,440) and the net loss for US3 ($60,000). Schedule M-3, Part I Exhibit 2 illustrates the completion of Schedule M-3, Part I for the group. Since US files Form 10-K with the SEC, Line 4 reports that consolidated net income ($2,051,070). Line 5a subtracts the net income of FORN1 ($178,750) since it is a foreign corporation not includible in the consolidated U.S. tax return. Line 6a subtracts the net income of US2 ($124,800) because US does not own the 80 percent of US2’s stock required for U.S. tax consolidation. Line 8 adds back the net income effect of eliminating entries to December 2007 Schedule M-3, Part II Exhibit 2. 2007 Form 1120—Schedule M-3, Part I Net Income Reconciliation Line Description 1 Questions to identify source income statement 2 Income statement period and restatement questions 3 Publicly traded common stock symbol & CUSIP 4 Net income from line 1 source income statement 5a Net income from nonincludible foreign entities Sch 2,051,070 yes 5b Net loss from nonincludible foreign entities yes 6a Net income from nonincludible U.S. entities yes (178,750) (124,800) 6b Net loss from nonincludible U.S. entities yes 7a Net income (loss) of other includible disregarded entities yes 7b Net income (loss) of other includible corporations yes (60,000) 8 Adjustment to eliminations yes 49,920 9 Adjustment to reconcile to tax year yes 10 a Intercompany dividend adjustments yes 10 b Other statutory accounting adjustments yes 10 c Other adjustments yes 11 Net income per income statement (add 4-10) 1,737,440 consolidate on nsolidatee FO FORN1 ORN and nd US2 ($49,920). $49,920). The n net loss (60,000), tax purof US3 U (60 ,000 0), which ch is consolidated ns ed for ta poses appears 7.. Boynt Boynton Wilson oses only, o app pears on n line 7 on and W (2006) 00 06)2 suggest sugggestt that t att IRS may ma be b particularly partic l interested i t in the income and expenses of these loss entities, since their losses are included for tax purposes, forr x purpo oses, but not fo financial statement purposes. 11,, ne nett iincome ose Line ne 1 nco ome fforr entities included in the tax return, is consistent with Exhibit 1 ($1,737,440). Exhibit 2 and the following exhibits include a “Sch” column. Each line with “yes” in the Sch column requires the taxpayer to attach a supporting schedule for that item. This example does not provide these details, but provides this column to identify items which will require additional reporting. The group files only one consolidated Schedule M-3, Part I. However, the group files five Schedules M-3, Parts II and III and Forms 8916-A: one for each included corporation (US, US1 and US3), one for eliminating entries, and one for the consolidated group. The remainder of the example illustrates the reporting for the parent corporation; the group’s actual tax return would also contain the other four sets of this information. TAXES—THE TAX MAGAZINE Exhibit 3 illustrates Schedule M-3, Part II, Income (Loss) Items for US, the parent corporation. Item 6(a) reports $200,000 book income from equity method U.S. corporations, which represents US’s $209,000 share of taxable income less its $9,000 share of nondeductible fines. US reports a $9,000 positive difference in column (c) and a $209,000 negative difference in column (b). US reported $220,000 of dividend income from cost-method investments in its income statement, and reports this amount on line 7(a). Of this amount, $10,000 was not received by the end of the year, and will be reported in taxable income next year. Accordingly, US reports a ($10,000) temporary difference in item 7(b) and income per tax return in item 7(d) of $210,000. Interest income includes $5,000 of exempt interest on state bonds. US reports $215,000 on line 13(a) of Schedule M-3, Part II; line 13(c) reports a ($5,000) permanent difference, and line 13(d) reports $210,000 interest income per tax return. Form 8916-A, Part II (Exhibit 4) reports (line 1) that the $5,000 difference is in tax-exempt interest income; lines 2 through 5 provide opportunities to report other book/tax differences in interest income. Other income of $400,000 includes $60,000 of gains from hedging transactions; these gains were reported in the previous year for tax purposes. Accordingly, line 15 of Schedule M-3, Part II reports $60,000 income in column (a) and an offsetting temporary difference in column (b). Cost Co s of ggoods sold so d appears pears in in item item 17 7 of SchedSched M-3, Column book cost of ule MM 3, Part art III.. C o n ((a) a) rreports epor s bo ook co st o goods sold of $3,416,000. Temporary differences of $120,000 and permanent differences of ($20,000) create a tax cost of goods sold of $3,516,000. Form 8916-A, Part I (Exhibit 5) provides details of the book/tax differences in cost of goods sold. Line 1 of Form 8916-A, Part I shows that differences in LIFO pooling produce a temporary difference of $85,000 in cost of goods sold related to cost flow assumptions. Line 2c shows a ($20,000) permanent difference for nondeductible meals and entertainment flowing through cost of goods sold. Line 4 shows $140,000 of book cost of goods sold for excess inventory and obsolescence reserves in column (a); column (d) reports $175,000 of deductions for excess and obsolete inventory disposed of during the year, creating a $35,000 temporary book/tax difference. 43 Schedule M-3 Update for 2007 Exhibit 3. 2007 Form 1120—Schedule M-3, Part II Income (Loss) Items Line Description Sch 1 2 3 4 5 6 7 8 9 Income (loss) from equity method foreign corporations Gross foreign dividends not previously taxed Supbart F, QEF, and similar income inclusions Section 78 gross-up Gross foreign distributions previously taxed Income (loss) from equity method U.S. corporations U.S. dividends not eliminated in tax consolidation Minority interest for includible corporations Income (loss) from U.S. partnerships yes yes yes yes yes yes yes yes yes 10 11 12 13 14 15 16 17 18 19 0 20 21 22 yes yes yes 23 g 24 25 26 27 28 29 a 29 b Income (loss) from foreign partnerships Income (loss) fom other pass-through entities Items relating to reportable transactions Interest income (from 8916-A) Total accrual to cash adjustment Hedging transactions Mark-to-market income (loss) Cost of Goods Sold (from 8916-A) Sale versus lease (for sellers and/or lessors) SSection Sectio on 4 481(a) adjustments U Unea arned/ d//d Unearned/deferred revenue IIncome Incom me re cogg from lon -term co tra recognition long-term contracts O Origi nal is ssue discount ou and oth ed interes Original issue other imputed interest IIncome Incom me sta ate gain n ssale, exchange, ha statement gain/loss on aabandonment, aband donm me t,, w hlessness or other disposition isposition of worthlessness, aassets ssetss othe h inventory and pass-through entities other than Gross capital gains from Schedule D, excluding amount ties from pass-through entities om SSchedule dule D ng amo un s Gross capital losses from D, exclud excluding amounts d d from pass-through entities, abandonment losses, and worthless stock losses Net gain/loss reported on Form 4797, line 17, excluding amounts from pass-through entities, abandonment losses, and worthless stock losses Abandonment losses Worthless stock losses Other gain/loss on disposition of assets other than inventory Capital loss limitation and carryforward used Other income (loss) items with differences Total income (loss) items (combine lines 1-25) Total expense/deduction items (Part III, line 36) Other items with no differences Sum lines 26 - 28 (mixed groups, see instructions) PC insurance subgroup reconciliation totals 29 c 30 Life insurance subgroup reconciliation totas Reconciliation totals (combine lines 29a - 29c) 23 a 23 b 23 c 23 d 23 e 23 f 44 (a) (b) (c) (d) Income (Loss) per Income Statement Temporary Difference Permanent Difference Income (Loss) per Tax Return 200,000 220,000 (209,000) (10,000) 9,000 215,000 0 (5,000) 60,000 (60,000) (3,416,000) (120,000) 210,000 0 20,000 235,000 225,000 210,000 (3,516,000) 235,000 (225,000) 305,000 305,000 yes yes (2,496,000) (972,440) 4,975,000 1,506,560 (84,000) 9,540 24,000 519,740 (74,460) 543,740 (2,556,000) (443,160) 4,975,000 1,975,840 1,506,560 (74,460) 543,740 1,975,840 December 2007 assets sold was $80,000 higher for tax purposes than for book purposes. Schedule M-3, Part II reports the book gains in item 23a(a), with an offsetting amount in item 23a(b). Assuming that all the gain is ordinary, US reports $305,000 on line 23d as a temporary difference in column (b) and as income per the tax return in column (d). The bottom section of Schedule M-3, Part II summarizes the amounts reported for US on this US entered into a three-year lease on an unused building in December. The lease period begins January, 2008. US received advance rental payments of $235,000 at the signing of the lease, none of which is included in 2007 book income. US reports this item on Schedule M-3, Part II line 20 with $235,000 in columns (b) and (d). Book income for US includes a $225,000 gain from the sales of assets. Accumulated depreciation on the Exhibit 4. Line Description 1 2 3 4a 4b 5 6 2007 Form 1120—Form 8916-A, Part II Interest Income (a) (b) Income (Loss) per Income Temporary Sch Statement Difference Tax-exempt interest income Interest income from hybrid securities Sale/lease interest income Intercompany interest income—from outside tax affiliated group Intercompany interest income—from tax affiliated group Other interest income Total interest income 5,000 210,000 215,000 (c) (d) Permanent Difference Income (Loss) per Tax Return (5,000) 0 (5,000) 210,000 210,000 Exhibit 5. Line Description nee De escription p n 2007 Form 1120—Form 8916-A, Part I Cost of Goods Sold (a) (b) Income (Loss) per Income Temporary Sch Statement Difference 1 2 2a Amounts Am moun nts aattributable to cost flow assumptions Amounts attributable to: Stock option expense 2b 2c 2d 2e 2f 2g 2h 2i 2j 2k 2l 2m 2n 3 4 5 6 7 8 Other equity based compensation Meals and entertainment Parachute payments Compensation with section 162(m) limitation Pension and profit sharing Other post-retirement benefits Deferred compensation Section 198 environmental remediation costs Amortization Depletion Depreciation Corporate owned life insurance premiums Other section 263A costs Inventory shrinkage accruals Excess inventory and obsolescence reserves Lower of cost or market write-downs Other items with differences Other items with no differences Total cost of goods sold TAXES—THE TAX MAGAZINE 2,800,000 (c) (d) Permanent Difference Income (Loss) per Tax Return 85,000 40,000 2,885,000 (20,000) 140,000 35,000 436,000 3,416,000 120,000 20,000 175,000 yes (20,000) 436,000 3,516,000 45 Schedule M-3 Update for 2007 and other forms. First, line 26 totals the items presented in Part II. Line 27 subtracts the total expense/deduction items reported in Schedule M-3, Part III. Line 28 reports the $4,975,000 net income or loss from items with no book/tax differences. Finally, lines 29a and 30 report the sum of lines 26 through 28. Column (a) of lines 29a and 30 reports book net income for US of $1,506,560 (consistent with the consolidating worksheet). Column (d) reports the taxable income of $1,975,840 for US. Two features of this section are noteworthy. First, line 26 reports negative totals for income (loss) items, although the firm has over $3 million of total income on the consolidating worksheet. The negative total occurs because line 17 reports total cost of goods sold (if book/tax differences exist therein), while sales are not separately reported in Part II unless book/tax Exhibit 6. 2007 Form 1120—Schedule M-3, Part III Expense/Deduction Items Line Description 1 2 3 4 5 6 7 8 9 10 11 1 12 2 13 3 14 4 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 46 U.S. current income tax expense U.S. deferred income tax expense State and local current income tax expense State and local deferred income tax expense Foreign current income tax expense (other than foreign withholding taxes) Foreign deferred income tax expense Foreign withholding taxes Interest expense (from 8916-A) Stock expense Sto ock option opt o Other compensation Otther equity-based e equity yMeals Me eals and a entertainment eente nt Fines Fin nes and an nd penalties peena Judgments, awards, and similar costs Jud dgme ents damages, ents, dam d aw Parachute Parachu ute payments p pa aymen Compensation with Code Sec. 162(m) limitation Co ompe ensat Pension and profit-sharing Other post-retirement benefi enefits Deferred compensation Charitable contribution of cash and tanible property Charitable contribution of intangible property Charitable contribution limitation/carryforward Domestic production activities deduction Current year acquisition or reorganization investment banking fees Current year acquisition or reorganization legal and accounting fees Current year acquisition/reorganization other costs Amortization/impairment of goodwill Amortization of acquisition, reorganization, and start-up costs Other amortization or impairment write-offs Code Sec. 198 environmental remediation costs Depletion Depreciation Bad debt expense Corporate owned life insurance premiums Purchase vs. lease (for purchases and/or lessees) Other expense/deduction items with differences Total expense/deduction items (combine lines 1-35) (a) (b) (c) (d) Income (Loss) Income per Income Temporary Permanent (Loss) per Sch Statement Difference Difference Tax Return 588,500 141,240 94,160 23,540 (588,500) (141,240) (6,000) (23,540) 40,000 0 30,000 88,160 25,000 65,000 (15,000) 15,000 200,000 200,000 15,000 5,000 20,000 40,000 15,000 55,000 972,440 (9,540) yes (519,740) 443,160 December 2007 Exhibit 7. 2007 Form 1120—Form 8916-A, Part III Interest Expense (a) Expense per Income Line Description Sch Statement 1 Interest expense from hybrid securities 2 Lease/purchase interest expense 3 a Intercompany interest expense—paid to outside tax affiliated group 3 b Intercompany interest expense—paid to tax affiliated group 4 Other interest expense 40,000 5 Total interest expense 40,000 differences exist. In circumstances where significant income items are the same for book and tax, negative totals on line 26 will be common. Second, the “no difference” total reported on line 28 likely combines a host of income and deduction items. The firm may wish to prepare and retain a worksheet which proves this “no difference” total. Exhibit 8 provides such an example. Schedule M-3, Part III Exhibit 6 continues the example to Schedule M-3, Part III, Expense/Deduction Items for US. Income tax expense off $84 $847,440 se o 47,4 comprises U.S current income tax of $588,500, deferred income tax of $141,240, state 58 88 50 88,50 00 U.S. 00, US d and local nd d loca al current cu urren nt income i me tax of o $94,160, $94,16 , and state sta and local deferred income M-3, Part oca al de eferreed in co tax ax of $23,540. ,5 Schedule edule M IIII re reports eporrts these theese amounts aam mou s in column column (a) of o lines 1 through t 4. The T U.S. Th U.S. S income iinco e tax t items ems appear a ear as permanent differences iin column (c). State and local current income tax of $6,000 is not deductible year, ucti e until next n year and and is is reported in column (b) of line 3; the remainder remainder appears aappeea s in column (d). The state and local deferred income tax is reversed as a temporary difference in column (b). Book interest expense of $40,000 does not include $25,000 of tax interest deductions on hybrid securities. Schedule M-3, Part III line 8 reports $40,000 in column (a), a $25,000 permanent difference in column (c), and $65,000 total deductions in column (d). Form 8916-A, Part III (Exhibit 7) reveals on line 1 that the $25,000 book/tax difference relates to interest on hybrid securities; lines 2 through 4 provide other explanations for book/tax differences in interest expense. Book other expenses includes $30,000 of meal and entertainment expenses which are 50 percent deductible. Schedule M-3, Part III reports $30,000 book expense in column (a) of line 11, a negative permanent difference of $15,000 in column (c), and a deduction of $15,000 in column (d). TAXES—THE TAX MAGAZINE (b) (c) Temporary Difference 0 (d) Deduction Permanent per Tax Difference Return 25,000 25,000 0 0 0 40,000 25,000 65,000 Exhibit 8. Proof of “No Difference” Total Book Income Sales Cost of goods sold Gross profit Service revenue Interest income Dividend income Equity in earnings of investees Gain on sales of assets Other income Total income Compensation Repairs and maintenance Bad debts Interest expense nter st ex pense Charitable Char table contributions b Depreciation and amortization Pension, etc. Other expenses Minority interest in income Total expenses Income before income taxes Income tax expense Net income 5,280,000 3,416,000 1,864,000 300,000 215,000 220,000 M-3 Sep line M-3 Sep amt Other II 17 3,416,000 (3,416,000) II 13 II 7 215,000 220,000 5,280,000 0 5,280,000 300,000 0 0 200,000 II 6 200,000 0 225,000 400,000 3,424,000 415,000 II 23 II 15 60,000 50,000 40,000 40,0 0 IIII 8 225,000 0 60,000 340,000 (2,496,000) 5,920,000 415,000 40,000 40,0 0 20,000 55,000 80,000 350,000 20,000 III 26, 31 55,000 III 11 30,000 0 80,000 320,000 125,000 945,000 1,070,000 2,354,000 847,440 1,506,560 60,000 50,000 0 III 1-4 (2,621,000) 4,975,000 847,440 0 (3,468,440) 4,975,000 US claims a $200,000 domestic production activities deduction for tax purposes. Schedule M-3, Part III reports this amount on line 22 as a permanent difference in column (c) and the deduction in column (d). Book expenses include $15,000 impairment of goodwill and $40,000 depreciation. Tax amor- 47 Schedule M-3 Update for 2007 tization of goodwill over 15 years is $20,000, producing a $5,000 temporary difference for goodwill on Schedule M-3, Part III, line 26. Similarly, tax depreciation of $55,000 produces a $15,000 temporary difference on line 31. Comparison of Schedule M-3 for Other Entities The general information required by Schedule M-3, Part I for Forms 1065 and 1120S is quite similar to the Form 1120 version, but there are two notable differences. First, the top of Schedule M-3 for Form 1065 requires the partnership to identify which filing criterion (see “Partnerships, too” earlier) led to completion of the schedule. Second, the Form 1120S version omits Form 10-K from the hierarchy for determining which income statement to use as book income. The detail of reconciling items required by Schedules M-3, Parts II and III for Forms 1120S and 1065 is quite similar to that of the schedule for Form 1120, but some differences exist. The flow-through versions do not include the items not calculable at the flow-through level; examples include capital loss limitations, charitable contributions limitations, and the dom domestic mes production activities deduction. In addition, the ow-through versions do not include dd di i n, th dition h flow he items tem em ms unique u uniqu ue to t C corporations. orporations. Also, Also, the taxable ta income reconciled and corporanco omee rec conc cile by y partnerships rs nd S co tions on ns includes in nclud des separately se epa p tely stated stated items, items, in addition ad to ordin ordinary income page one of th the ttax return. dinary iinco me from m pag Schedule l M-3 M for partnerships reconciles to the net income (loss) reported in “Analysis An ysis of Net Income” ncome on n page four of Form 1065; the schedule hedu e for fo S corporaco orpor tions reconciles to the “Income/Loss Reconciliation” amount on line 18 of Form 1120S, Schedule K. The insurance company versions contain items unique to the insurance industry; a complete discussion of these items is beyond the scope of this article. Schedule M-3 for Form 1120-F is quite different from the other versions. First, the 1120-F version is the only Schedule M-3 to list gross receipts as a separate item on Part II, Income (Loss) Items. Also, the 1120-F version does not require completion of Form 8916-A for cost of goods sold, interest income, and interest expense, but requires a schedule to be attached for cost of goods sold. This version also decomposes mark-to-market income into four components (Part II, line 14) and decomposes interest expense into four components (Part II, line 26). Conclusion The ongoing expansion of the use of the Schedule M-3 and related Forms 8916 and 8916-A supports the IRS’s desire for increased transparency of return filings so differences between financial accounting net income and taxable income are more readily evident. According to the IRS, the additional information, in fact, provides about 20 percent of the on-site audit work the IRS would otherwise have to perform, reducing the on-site audit time by as much as 20 percent. The reduction supports the IRS’s goal of reducing the time required to examine tax returns and being in a position to examine the most recent tax returns. As was the case with the initial Schedule M-3, tax advisors will need to familiarize themselves with the additional disclosures required as the IRS expands the requirement for preparing the Schedule and its related forms and the information requested. They will also have to be prepared to advise client firms about effective ecti e means to gather ga he the he required equired d information. nformation. ENDNOTES DNOTES 1 2 Boynton, DeFilippes and Legel, A First Look at 2004 Schedule M-3 Reporting by Large Corporations, 112 TAX NOTES 11 (Sept. 11, 2006), at 943–81. Boynton and Wilson, A Review of Schedule M-3, the Internal Revenue Service’s New Book-Tax Reconciliation Tool, 25 PETROLEUM ACCOUNTING AND FINANCIAL MANAGEMENT J. 1 (Spring 2006), at 1–16. This article is reprinted with the publisher’s permission from the TAXES–THE TAX MAGAZINE, a monthly journal published by CCH, a Wolters Kluwer business. Copying or distribution without the publisher’s permission is prohibited. To subscribe to the TAXES–THE TAX MAGAZINE or other CCH Journals please call 800-449-8114 or visit www.CCHGroup.com. All views expressed in the articles and columns are those of the author and not necessarily those of CCH. 48