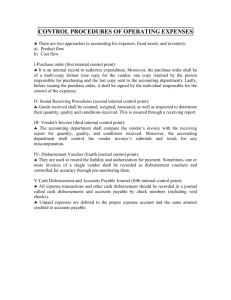

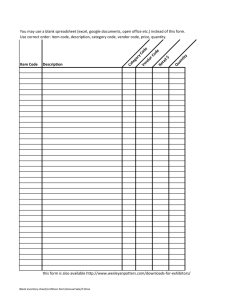

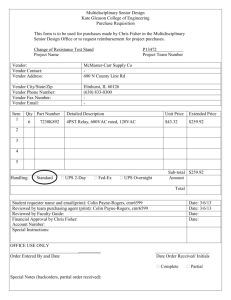

12THE “PURCHASE-TO-PAY” (PTOP) PROCESS

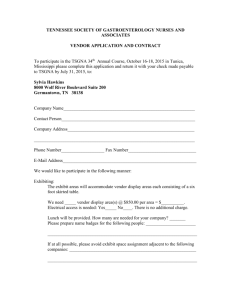

advertisement