2011 Annual Report and 10-K

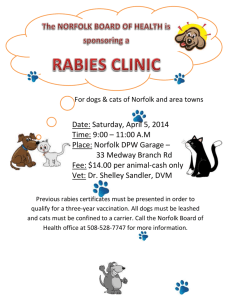

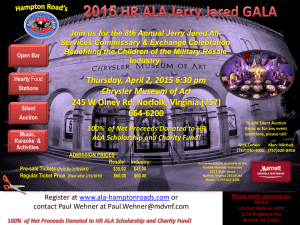

advertisement