File

advertisement

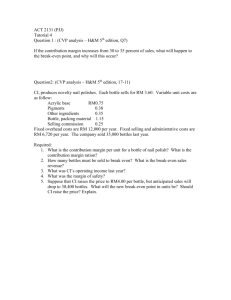

SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 6-1 1. (a) (b) $70 = ($250 – $180) 28% ($70 ÷ $250) 2. (c) (d) $200 = ($500 – $300) 60% ($300 ÷ $500) 3. (e) (f) $1,100 = ($330 ÷ 30%) $770 ($1,100 – $330) BRIEF EXERCISE 6-2 HAMBY INC. Income Statement For the Quarter Ended March 31, 2014 Sales ....................................................................... Variable expenses Cost of goods sold ......................................... Selling expenses ............................................ Administrative expenses ............................... Total variable expenses ......................... Contribution margin .............................................. Fixed expenses Cost of goods sold ......................................... Selling expenses ............................................ Administrative expenses ............................... Total fixed expenses .............................. Net income ............................................................. $2,000,000 $760,000 95,000 79,000 934,000 1,066,000 600,000 60,000 66,000 726,000 $ 340,000 BRIEF EXERCISE 6-3 Contribution margin ratio = [($250,000 – $175,000) ÷ $250,000] = 30% Required sales in dollars = $120,000 ÷ 30% = $400,000 BRIEF EXERCISE 6-4 (a) $400Q = $250Q + $210,000 + $0 $150Q = $210,000 Q = 1,400 units (b) Contribution margin per unit $150, or ($400 – $250) X = $210,000 ÷ $150 X = 1,400 units BRIEF EXERCISE 6-5 X = .60X + $210,000 + $60,000 .40X = $270,000 X = $675,000 BRIEF EXERCISE 6-6 Margin of safety = $1,200,000 – $960,000 = $240,000 Margin of safety ratio = $240,000 ÷ $1,200,000 = 20% BRIEF EXERCISE 6-7 Model A12 B22 C124 Sales Mix Percentage 60% 15% 25% Unit Contribution Margin $10 ($50 – $40) $30 ($100 – $70) $100 ($400 – $300) Weighted-Average Unit Contribution Margin $ 6.00 4.50 25.00 $35.50 BRIEF EXERCISE 6-8 Total break-even = ($213,000 ÷ $35.50*) = 6,000 units *Computed in BE 6-7 Sales Units Units of A12 = .60 X 6,000 = 3,600 Units of B22 = .15 X 6,000 = 900 Units of C124 = .25 X 6,000 = 1,500 6,000 BRIEF EXERCISE 6-9 (a) (b) Weighted-average contribution = margin ratio (.30 X .20) + (.50 X .20) + ( .20 X .45) = .25 Total break-even point = ($440,000 ÷ .25) = $1,760,000 in dollars Birthday $1,760,000 X .30 = $ 528,000 Standard tapered $1,760,000 X .50 = 880,000 Large scented $1,760,000 X .20 = 352,000 $1,760,000 BRIEF EXERCISE 6-10 (a) Sales Mix Bedroom Division $500,000 ÷ $1,250,000 = .40 Dining Room Division $750,000 ÷ $1,250,000 = .60 (b) Weight-average contribution = $575,000 = .46 margin ratio $1,250,000 OR Contribution Margin Ratio Bedroom Division ($275,000 ÷ $500,000) = .55 Dining Room Division ($300,000 ÷ $750,000) = .40 Weighted-average contribution margin ratio = (.55 X .40) + (.40 X .60) = .46 BRIEF EXERCISE 6-11 Contribution margin per unit (a) Machine hours required (b) Contribution margin per unit of limited resource [(a) ÷ (b)] Product A $12.0 2 $ 6 Product B $15 3 $ 5 BRIEF EXERCISE 6-12 Degree of operating leverage (old) = $200,000 ÷ $40,000 = 5 Degree of operating leverage (new) = $240,000 ÷ $40,000 = 6 If Sam’s sales change, the resulting change in net income will be 1.2 times (6 ÷ 5) higher with the new machine than under the old system. BRIEF EXERCISE 6-13 Break-even point in dollars: Logan Co. $60,000 ÷ ($120,000 ÷ $200,000) = $100,000 Morgan Co. $90,000 ÷ ($150,000 ÷ $200,000) = $120,000 Morgan Company’s cost structure relies much more heavily on fixed costs than that of Logan Co. As result, Morgan has a higher contribution margin ratio of .75 ($150,000 ÷ $200,000) versus .60 ($120,000 ÷ $200,000), for Logan Co. Morgan also has much higher fixed costs to cover. Its break-even point is therefore higher than that of Logan Co. BRIEF EXERCISE 6-14 Degree of operating leverage = Contribution margin ÷ Net income Montana Corp. 1.6 = Contribution margin ÷ $50,000 Contribution margin = $50,000 X 1.6 = $80,000 APK Co. 5.4 = Contribution margin ÷ $50,000 Contribution margin = $50,000 X 5.4 = $270,000 BRIEF EXERCISE 6-15 Contribution margin per unit (a) Machine hours required (b) Contribution margin per unit of limited resource [(a) ÷ (b)] Product 1 $ 42 .15 $280 Product 2 $ 35 .10 $350 Product 2 has a higher contribution margin per limited resource, even though it has a lower contribution margin per unit. Given that machine hours are limited to 2,000 per month, Ger Corporation should produce Product 2. PROBLEM 6-1A (a) Sales were $2,000,000 and variable expenses were $1,100,000, which means contribution margin was $900,000 and CM ratio was .45. Fixed expenses were $1,035,000. Therefore, the break-even point in dollars is: $1,035,000 = $2,300,000 .45 (b) 1. The effect of this alternative is to increase the selling price per unit to $31.25 ($25 X 125%). Total sales become $2,500,000 (80,000 X $31.25). Thus, contribution margin ratio changes to 56% [($2,500,000 – $1,100,000) ÷ $2,500,000]. The new break-even point is: $1,035,000 = $1,848,214 (rounded) .56 2. The effects of this alternative are: (1) fixed costs decrease by $160,000, (2) variable costs increase by $100,000 ($2,000,000 X 5%), (3) total fixed costs become $875,000 ($1,035,000 – $160,000), and the contribution margin ratio becomes .40 [($2,000,000 – $1,100,000 – $100,000) ÷ $2,000,000]. The new break-even point is: $875,000 = $2,187,500 .40 3. The effects of this alternative are: (1) variable and fixed cost of goods sold become $734,000 each, (2) total variable costs become $884,000 ($734,000 + $92,000 + $58,000), (3) total fixed costs are $1,251,000 ($734,000 + $425,000 + $92,000) and the contribution margin ratio becomes .558 [($2,000,000 – $884,000) ÷ $2,000,000]. The new breakeven point is: $1,251,000 = $2,241,935 (rounded) .558 Alternative 1 is the recommended course of action using break-even analysis because it has the lowest break-even point. PROBLEM 6-2A (a) (1) Current Year $1,500,000 Sales Variable costs Direct materials Direct labor Manufacturing overhead ($350,000 X .70) Selling expenses ($250,000 X .40) Administrative expenses ($270,000 X .20) Total variable costs Contribution margin Sales Variable costs Direct materials Direct labor Manufacturing overhead Selling expenses Administrative expenses Total variable costs Contribution margin 511,000 290,000 245,000 100,000 54,000 1,200,000 $ 300,000 Current Year $1,500,000 X 1.1 511,000 290,000 245,000 100,000 54,000 1,200,000 $ 300,000 X 1.1 X 1.1 X 1.1 X 1.1 X 1.1 X 1.1 X 1.1 Projected Year $1,650,000 562,100 319,000 269,500 110,000 59,400 1,320,000 $ 330,000 (2) Fixed Costs Current Year Manufacturing overhead ($350,000 X .30) $105,000 Selling expenses ($250,000 X .60) 150,000 Administrative expenses ($270,000 X .80) 216,000 Total fixed costs $471,000 Projected year $105,000 150,000 216,000 $471,000 PROBLEM 6-2A (Continued) (b) Unit selling price = $1,500,000 ÷ 100,000 = $15 Unit variable cost = $1,200,000 ÷ 100,000 = $12 Unit contribution margin = $15 – $12 = $3 Contribution margin ratio = $3 ÷ $15 = .20 Break-even point in units 157,000 units = Fixed costs = $471,000 Break-even point in dollars $2,355,000 = Fixed costs = $471,000 ÷ ÷ Unit contribution margin $3.00 ÷ ÷ Contribution margin ratio .20 (c) Sales dollars required for = (Fixed costs target net income + Target net income) ÷ Contribution margin ratio $3,355,000 = + ($471,000 $200,000) (d) Margin of safety = (Expected sales ratio 29.8% = ($3,355,000 ÷ .20 – Break-even sales) ÷ Expected sales – ÷ $2,355,000) (e) (1) Sales Variable costs Direct materials Direct labor ($290,000 – $104,000) Manufacturing overhead ($350,000 X .30) Selling expenses ($250,000 X .90) Administrative expenses ($270,000 X .20) Total variable costs Contribution margin Current Year $1,500,000 511,000 186,000 105,000 225,000 54,000 1,081,000 $ 419,000 $3,355,000 PROBLEM 6-2A (Continued) Fixed cost Manufacturing overhead ($350,000 X .70) Selling expenses ($250,000 X .10) Administrative expenses ($270,000 X .80) Total fixed costs $245,000 25,000 216,000 $486,000 (2) Contribution margin ratio = $419,000 ÷ $1,500,000 = .28 (rounded) (3) Break-even point in dollars = $486,000 ÷ .28 = $1,735,714 (rounded) The break-even point in dollars declined from $2,355,000 to $1,735,714. This means that overall the company’s risk has declined because it doesn’t have to generate as much in sales. The two changes actually had opposing effects on the break-even point. By changing to a more commission-based approach to compensate its sales staff the company reduced its fixed costs, and therefore reduced its break-even point. In contrast, the purchase of the new equipment increased the company’s fixed costs (by increasing its equipment depreciation) which would increase the break-even point. PROBLEM 6-3A (a) Selling price Less: Variable costs Contribution margin per unit Economy $30 14 $16 Product Standard $50 15 $35 Deluxe $100 46 $ 54 Ignoring the machine time constraint, the Deluxe product should be produced because it has the highest contribution margin per unit. (b) Contribution margin per unit (a) Machine hours required (b) Contribution margin per limited resource (a)/(b) Economy $16 .5 $32 Product Standard $ 35 .8 $43.75 Deluxe $ 54 1.6 $33.75 (c) If additional machine hours become available, the additional time should be used to produce the Standard product since it has the highest contribution margin per machine hour. PROBLEM 6-4A (a) Appetizers Main entrees Desserts Beverages Sales Mix Percentage 15% 50% 10% 25% Total sales required to achieve target net income = Appetizers Main entrees Desserts Beverages X X X X X Contribution Margin Ratio 50% 25% 50% 80% = = = = = Weighted-Average Contribution Margin Ratio .075 .125 .050 .200 .450 ( $1,053,000 + $117,000 ) ÷ .45 = $2,600,000 Sales Mix Percentage 15% 50% 10% 25% X X X X X Total Sales Needed $2,600,000 $2,600,000 $2,600,000 $2,600,000 = = = = = Sales from Each Product $ 390,000 1,300,000 260,000 650,000 $2,600,000 (b) Appetizers Main entrees Desserts Beverages Sales Mix Percentage 25% 25% 10% 40% Total sales required to achieve target net income = *$1,053,000 + $585,000 X X X X X Contribution Margin Ratio 50% 10% 50% 80% = = = = = Weighted-Average Contribution Margin Ratio .125 .025 .050 .320 .520 ( $1,638,000* + $117,000) ÷ .52 = $ 3,375,000 PROBLEM 6-4A (Continued) Thus, sales would have to increase by $775,000 ($3,375,000 – $2,600,000) to achieve the target net income. This increase in sales is driven by the increase in fixed costs. The sales of each product line would be: Appetizers Main entrees Desserts Beverages Sales Mix Percentage 25% 25% 10% 40% X X X X X Total Sales Needed $3,375,000 $3,375,000 $3,375,000 $3,375,000 = = = = = Sales from Each Product $ 843,750 843,750 337,500 1,350,000 $3,375,000 (c) Appetizers Main entrees Desserts Beverages Sales Mix Percentage 15% 50% 10% 25% X X X X X Contribution Margin Ratio 50% 10% 50% 80% = = = = = Weighted-Average Contribution Margin Ratio .075 .050 .050 .200 .375 The weighted-average contribution margin ratio computed in part (a) was 45%. With the contribution margin ratio on entrees falling to 10%, that average will now be 37.5% as shown previously. Applying this to the new fixed costs of $1,638,000 and target net income of $117,000 we get: Total sales required to achieve target net income = Appetizers Main entrees Desserts Beverages ($1,638,000 + $117,000) ÷ .375 = $ 4,680,000 Sales Mix Percentage 15% 50% 10% 25% X X X X X Total Sales Needed $4,680,000 $4,680,000 $4,680,000 $4,680,000 = = = = = Sales from Each Product $ 702,000 2,340,000 468,000 1,170,000 $4,680,000 Relative to parts (a) and (b), the total required sales for (c) would increase. It appears that the least risky approach would be for Phil to switch to the new sales mix, but not to incur the additional fixed costs of expanding operations. If the switch in sales mix appears to be successful, then it may be appropriate for him to incur the additional fixed costs necessary for expansion of operations. PROBLEM 6-5A (a) To determine the break-even point in dollars we must first calculate the contribution margin ratio for each company. Viejo Company Nuevo Company Contribution Margin ÷ $220,000 ÷ $320,000 ÷ Fixed Costs $180,000 $280,000 Viejo Company Nuevo Company Viejo Company Nuevo Company (Actual Sales ($500,000 ($500,000 – – – ÷ ÷ ÷ Sales $500,000 $500,000 Contribution Margin = Ratio = .44 = .64 Contribution Margin Ratio .44 .64 Break-even Sales) $409,091) $437,500) ÷ ÷ ÷ Break-even Point = in Dollars = $409,091 = $437,500 Actual Sales $500,000 $500,000 = = = Margin of Safety Ratio .182 .125 (b) Viejo Company Nuevo Company Contribution Margin ÷ $220,000 ÷ $320,000 ÷ Net Income $40,000 $40,000 Degree of Operating = Leverage = 5.5 = 8.0 Because Nuevo Company relies more heavily on fixed costs, it has a higher degree of operating leverage. This means that its net income will be more sensitive to changes in sales. For a given change in sales, the change in net income will be 1.45 (8.0 ÷ 5.5) times higher for Nuevo Company than for Viejo Company. (c) Sales Variable costs Contribution margin Fixed costs Net income *$500,000 X 1.2 **$280,000 X 1.2 ***$180,000 X 1.2 Viejo Company $600,000* 336,000** 264,000 180,000 $ 84,000 Nuevo Company $600,000 216,000*** 384,000 280,000 $104,000 PROBLEM 6-5A (Continued) (d) Viejo Company $400,000* 224,000** 176,000 180,000 ($ 4,000) Sales Variable costs Contribution margin Fixed costs Net income (Loss) Nuevo Company $400,000 144,000*** 256,000 280,000 ($ 24,000) *$500,000 X .80 **$280,000 X .80 ***$180,000 X .80 (e) In part (b) the degree of operating leverage of Nuevo Company was higher than that of Viejo Company, telling us that the net income of Nuevo Company was more sensitive to changes in sales than that of Viejo Company. In part (c) we see that a 20% increase in sales increased the net income of Nuevo Company by $64,000 ($104,000 – $40,000), while the net income of Viejo Company increased by only $44,000 ($84,000 – $40,000). However, in part (d) we see that a 20% decrease in sales resulted in a $64,000 ($40,000 + $24,000) decline in net income for Nuevo Company, while Viejo Company’s net income only declined by $44,000 ($40,000 + $4,000). The increased risk caused by higher operating leverage is also seen in part (a). Nuevo Company has a higher break-even point, and a lower margin of safety ratio than Viejo Company. Thus, while operating leverage can be very beneficial for a company that expects its sales to increase, it can also significantly increase a company’s risk. CHAPTER REVIEW Cost-Volume-Profit Income Statement 1. (L.O. 1) The Cost-Volume-Profit (CVP) income statement classifies costs as variable or fixed and computes a contribution margin. Contribution margin is the amount of revenue remaining after deducting variable costs. It is often stated both as a total amount and on a per unit basis. Desossa Music Player Company CVP Income Statement For the Month Ended June 30, 2014 Sales Variable expenses Cost of goods sold Selling expenses Administrative expenses Total variable expenses Total $420,000 Per Unit $120 $200,000 20,000 11,000 231,000 66 Contribution margin Fixed expenses Cost of goods sold Selling expenses Administrative expenses Total fixed expenses Net income 189,000 $ 54 50,000 30,000 19,900 99,900 $ 89,100 Basic Computations 2. 3. 4. (L.O. 2) Desossa Music Player’s CVP income statement shows that total contribution margin (sales minus variable expenses) is $175,000, and the company’s contribution margin per unit is $50. The contribution margin ratio (contribution margin divided by sales) is 45% ($54 ÷ $120). Desossa’s break-even point in units (using contribution margin per unit) or in dollars (using contribution margin ratio) are calculated as follows: Fixed cost $99,900 ÷ ÷ Contribution margin per unit $54 Fixed cost $99,900 ÷ ÷ Contribution margin ratio .45 = = Break-even point in units 1,850 units = Break-even point in dollars = $222,000 Assuming Desossa’s management has a target net income of $108,000, the required sales in units and dollars to achieve its target net income are calculated as follows: (Fixed cost + Target net income) ÷ Contribution margin per unit ($99,900 + $108,000) ÷ $54 = = (Fixed cost + Target net income) ÷ ($99,900 + $108,000) ÷ = Required sales in dollars = $462,000 Contribution margin ratio .45 Required sales in units 3,850 units Desossa’s margin of safety in dollars or as a ratio is calculated as follows: Actual (expected) sales $420,000 – – Break-even sales $222,000 = Margin of safety in dollars = $198,000 Margin of safety in dollars ÷ Actual (expected) sales = $198,000 ÷ $420,000 = Margin of safety ratio 47.1% CVP and Changes in the Business Environment 5. To better understand how CVP analysis works, let’s assume that shipping costs have increased significantly causing the unit variable cost to increase by 10%, what effect will this have on Desossa’s break-even point? Answer: A 10% increase in variable costs increases the per unit variable cost to $72.60 [$66 + ($66 X 10%)]. The new contribution margin per unit is therefore $47.40 ($120 – $72.60). Thus the new break-even point in units is calculated as follows: Fixed cost $99,900 Sales Mix ÷ ÷ Contribution margin per unit $47.40 = = Break-even point in units 2,108 units 6. (L.O. 3) Sales mix is the relative percentage in which a company sells its multiple products. For example, if 80% of Company A’s unit sales are shoes and the other 20% are jeans, its sales mix is 80% shoes to 20% jeans. 7. Break-even sales can be computed for a mix of two or more products by determining the weightedaverage unit contribution margin of all the products. Assume that Seth Inc. sells tables and chairs in a ratio of four chairs for every one table. The sales mix in percentages is 20% (1/5) for tables and 80% (4/5) for chairs. The following is the per unit data for Seth Inc.: Unit Data Tables Selling price $100 Variable costs 60 Contribution margin $ 40 Sales mix-units 20% Fixed costs = $192,000 Chairs $20 10 $10 80% To compute break-even for Seth Inc., we use the weighted-average unit contribution margin as follows: Tables Chairs Unit Sales Unit Sales Contribution X Mix + Contribution X Mix = Margin Percentage Margin Percentage ($40 X .20) + ($10 X .80) = Weighted – Average Unit Contribution Margin $16 Fixed Costs ÷ $192,000 ÷ Weighted – Average Unit Contribution Margin $16 = Break – even Point in Units 12,000 units To break even, Seth must sell 2,400 (12,000 X 20%) tables and 9,600 (12,000 X 80%) chairs. 8. At any level of units sold, net income will be greater if more high contribution margin units are sold than low contribution margin units. An analysis of these relationships generally shows that a shift from lowmargin sales to high-margin sales may increase net income, even though there is a decline in total units sold. 9. The calculation of the break-even point computed in units works well if a company has only a small number of products. When a company has a large number of products, it’s more useful to compute the break-even point in terms of sales dollars. The formula for computing the break-even point in dollars is fixed costs divided by the weighted-average contribution margin ratio. To compute a company’s weighted-average contribution ratio, multiply each division’s contribution margin ratio by its percentage of total sales and then sum these amounts. Seth Inc’s contribution margin ratio for sales of tables is .40 ($40/$100) and for chairs is .50 ($10/$20). The weighted-average contribution margin ratio is calculated as follows: Tables Chairs Contribution Sales Mix MarginRatio X Percentage (.40 X .20) Weighted - Average Contribution Sales Mix X + = MarginRatio Percentage ContributionMarginRatio + (.50 X .80) = .48 The break-even point in dollars is calculated as follows: Fixed Costs ÷ $192,000 ÷ Weighted – Average Contribution Margin Ratio .48 = = Break – even Point in Dollars $400,000 Sales Mix with Limited Resources 10. (L.O. 4) When a company has limited resources (e.g., floor space, raw materials, direct labor hours), management must decide which products to make and sell in order to maximize net income. Assume that Seth Inc. has limited machine capacity which is 2,600 hours per month. Relevant data consist of the following: Contribution margin per unit Machine hours required per unit Tables $40 .8 Chairs $10 .16 The contribution margin per unit of limited resource is calculated as follows: Tables Chairs Contribution margin per unit (a) $40 $10 Machine hours required (b) .8 .16 Contribution margin per unit of limited resource [(a) (b)] $50 $62.50 If Seth Inc. increases machine capacity hours by 400 hours per month, it would be better to use the hours to produce more chairs. Machine hours (a) Contribution margin per unit of limited resource (b) Contribution margin [(a) X (b)] Tables 400 Chairs 400 $ 50 $20,000 $ 62.50 $25,000 Cost Structure and Operating Leverage 11. (L.O. 5) Cost structure refers to the relative proportion of fixed versus variable costs that a company incurs. In most cases, increased reliance on fixed costs increases a company’s risk. When sales are increasing, profits can increase at a high rate, but when sales decline, losses can also increase at a high rate. Companies can change their cost structure by using more sophisticated robotic equipment and reducing it later, or vice versa. The equipment would increase the fixed costs whereas labor increases variable costs. 12. Operating Leverage refers to the extent to which a company’s net income reacts to a given change in sales. The degree of operating leverage provides a measure of a company’s earnings volatility and can be used to compare companies. The formula is: Contribution Margin ÷ Net Income = Degree of Operating Leverage