FIN 614 Financial Management Case Study Cost of Capital at

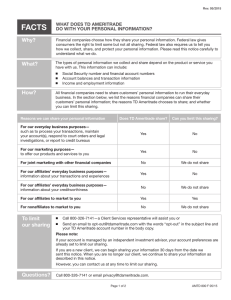

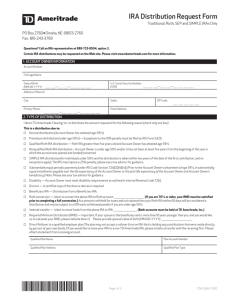

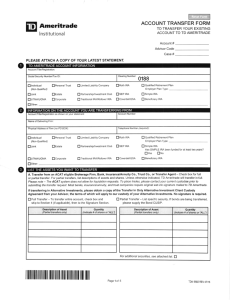

advertisement

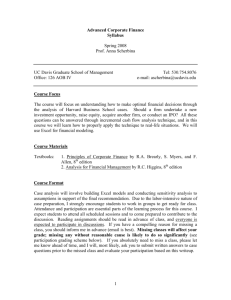

FIN 614 Financial Management Professor Robert B.H. Hauswald Kogod School of Business, AU Case Study Cost of Capital at Ameritrade Ameritrade is, relatively speaking, one of the success stories of the new economy. Having recently completed their IPO, the company is now flush with cash and has to decide how to best compete in the cut-throat market of deep-discount (internet) brokerages. Substantial investments in IT infrastructure, marketing and advertisement are to be undertaken in order to exploit the significant economies of scale on which Ameritrade’s business model is premised. As a pre-requisite for good managerial decision making, the company’s senior management is contemplating the difficulties of capital budgeting in the brave new world of the information economy. In particular, they are unsure what Ameritrade’s appropriate cost of capital should be. You have been called in as a management consultant to help with estimating a firm-specific cost of capital for Ameritrade to be used in their capital budgeting exercises. On the basis of extensive capital market data (see Ameritrade.xls file), capital structure information of competitors, and financial models such as the CAPM, you will propose an estimate of Ameritrade’s cost of capital to the firm’s senior management. Previous estimates reflected either the firm’s borrowing cost or an arbitrary looking corporate hurdle rate. Also, management seemed to be unsure about the appropriate set of comparator firms. However your analysis comes out, one requirement is very clear. Given Ameritrade’s significant finance expertise and, indeed, their very business, senior management expect you to fully document and explain your analysis. A tall order, that! 1. What factors should Ameritrade management consider when evaluating the proposed advertising and technology upgrades? Why? 2. How can one use the CAPM to estimate the cost of capital for real investments such as IT expenditures as opposed to financial investments? 3. As a preliminary step for calculating an estimate of Ameritrade’s cost of capital, map out the various stages of your analysis. What is the appropriate analytic framework? What are the key variables and how are they to be calculated and/or estimated? (a) How would you estimate the appropriate risk-free rate to be employed in the cost of capital calculation? (b) What is a good estimate of the market risk premium? 4. Ameritrade does not really have a beta yet because the firm has only been publicly traded for a short while. With such a limited amount of market data, estimating their beta directly is pointless. (a) What comparable firms would you consider to as the appropriate benchmark in evaluating and pricing the risks for Ameritrade’s planned advertising and technology investments? (b) Using the stock price, return and capital structure data provided in the case (Ameritrade.xls) estimate the betas for comparable firms. Using Excel’s regression function (in the data analysis dialog), run a regression of the form Rit = αi + βi Rmt + εit .1 You can then plot residuals and the regression line to see how well this estimation technique performs. RWJ has more on estimating β and so do our lecture notes. (c) Propose a beta for Ameritrade on the basis of your analysis. 5. Suggest an appropriate cost of capital for Ameritrade on the basis of your analysis and explain the reasoning behind your calculation. (a) How should Ameritrade view your cost of capital estimate? (b) How reliable do you think will your estimate be? List potential pitfalls in your analysis and how they might affect the cost of capital calculation. What is their likely impact on the proposed capital budgeting exercise? (c) Given the various assumptions that went into your analysis, how sensitive are the results to their variation? What is a reasonable range of estimates and how would you choose from them? Please note the following ground rules for the case write-ups: • the maximal group size is 5; every group member gets the same grade • at most 2 pages of analysis and 6 pages of technical appendices; • show your work, staple the pages together and be professional ; • late write-ups will not be accepted for any reason; they are due at the beginning of class for which the discussion is scheduled; • graded write-ups will be available a week later. 1 If we also had the evolution of the risk-free rate rf from, say, a T-bill time series, we would estimate Rit − rf t = βi [Rmt − rf t ] + εit . Since this regression equation does not have an intercept, you would have to check the ‘no intercept’ box in the Excel regression dialog. 2