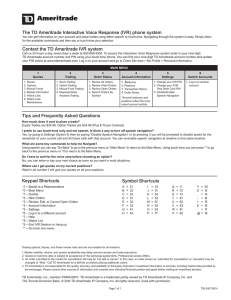

Retirement Plan Solutions

TD Ameritrade

Retirement Plan

Provided by TD Ameritrade Trust Company

A simple, comprehensive solution

designed with advisors in mind.

Requested by advisors.

Designed for your

business.

At TD Ameritrade, we understand that independent

Registered Investment Advisors (RIAs) expect

powerful solutions that serve clients and drive

success. That’s why we’ve created a retirement

plan program that fits the way you do business.

The TD Ameritrade Retirement Plan

brings together the unique retirement

plan and custodial experience of

TD Ameritrade Trust Company

as well as responsive and reliable

recordkeeping, the outstanding

brokerage services of TD Ameritrade,

Inc., and TD Ameritrade Institutional’s

unrivaled focus on supporting

independent RIAs.

More than the sum of its parts, this program

includes the most sought-after features

in one outstanding offering, satisfying

the high expectations of advisors, plan

sponsors, and participants alike.

A vast range of investment options.

A turnkey solution. A trusted and

established brand. And more. Whether

you aim to grow your thriving retirement

plan business or expand your current

practice into the retirement plan arena,

the TD Ameritrade Retirement Plan

combines the best qualities of bundled

and unbundled solutions, delivering

everything you need in one place.

Overview

The TD Ameritrade Retirement Plan

delivers on your expectations and the

expectations of plan sponsors:

■■ The ease of a turnkey solution

■■ A customized Playbook to guide

your business

■■ True open architecture with a broad

selection of investment options

■■ No proprietary fund requirements

■■ Institutional MMDA is included to

enable participants’ access to an

FDIC-insured product*

■■ Exceptional support for advisors,

plan sponsors, and participants

■■ Easy-to-understand, competitive pricing

■■ From a trusted and established brand

with a reputation for service

866-827-5894 | tdaretirementplansolutions.com

1

Advisor-centric design

The TD Ameritrade Retirement Plan was built at the request of independent

advisors. One of the only solutions in the marketplace developed exclusively for

RIAs, the program’s design reflects TD Ameritrade Institutional’s unique insights into

advisors’ business needs, making it stand out in a market full of look-alike solutions.

True open architecture

The program provides access to more than 13,000 mutual funds, approximately

1,100 ETFs, self-directed brokerage accounts, and advisor-managed portfolios.

Our open architecture framework does not have proprietary fund requirements,

giving you freedom, choice, flexibility, and enabling the creation of a customized

investment menu. The Institutional Money Market Deposit Account is included to

enable participants’ access to an FDIC-insured product.*

An innovative solution powered by industry

insight and collective experience

TD Ameritrade Institutional

Provides a proven commitment to the

needs of independent RIAs

TD Ameritrade

Trust Company

TD Ameritrade

Provides the reputation and value

of a trusted and established brand

Provides unique experience

in retirement plan custody

The TD Ameritrade

Retirement Plan

866-827-5894 | tdaretirementplansolutions.com

2

A dynamic way to

boost your business

Building a successful retirement plan business can

be an intimidating process. Whether you are new

to the retirement plan industry or are a seasoned

veteran in the field, the TD Ameritrade Retirement

Plan Playbook is uniquely positioned to support your

specific business goals with easy-to-follow action

items and industry-proven best practices.

From defining your practice structure and pursuing business development

opportunities to setting up and servicing plans, our suite of tools provides

custom-tailored strategies to foster your success at every stage. Our unique

knowledge of both the retirement plan and RIA arenas provides fresh insights

that may help to boost your business. Step-by-step, the Playbook will give

you guidance as you develop a plan for success. Complete with useful

resources, our Playbook is a powerful tool, created with advisors in mind, everevolving to fit your changing needs, and designed to help you master this market.

866-827-5894 | tdaretirementplansolutions.com

3

Playbook Overview

Business

Development

Practice

Structure

TD Ameritrade

Retirement Plan

■■ Business Development: identify

qualified leads, close deals, and

reinforce your value proposition

Playbook

Servicing

the Plan

866-827-5894 | tdaretirementplansolutions.com

■■ Practice Structure: understand the

retirement plan advisor’s role, expand

your investment expertise, and

consider your fee approach

Setting Up

the Plan

■■ Setting Up the Plan: support

retirement plan investment

committees, set up and

convert plans

■■ Servicing the Plan: provide ongoing

support and bring your value

proposition to life

4

A simple, comprehensive

solution

Seamless integration

All aspects of the TD Ameritrade Retirement Plan—from plan design support,

recordkeeping, plan administration, and custodial services to fiduciary resources and

participant education—have been seamlessly integrated to provide you and your

plan sponsors with a turnkey retirement plan program.

Leveraging service contracts with leading recordkeeping firms, the program will

provide recordkeeping services that meet plan and participant needs and support

a continuous experience of quality for you and your clients.

Exceptional support for plan sponsors & participants

The program features a suite of robust tools and materials. It enables streamlined

account management for plan sponsors, participants, and advisors—including

resources, enrollment support, retirement readiness planning tools, and even IRA

rollover assistance.**

Clear, competitive pricing

We know clear pricing has never been more critical. TD Ameritrade is known for

competitive, easy-to-understand pricing, and you can rest assured that, regardless

of plan size or investment type, our fees are structured to help you work with plan

sponsors as they seek to understand and uphold their fiduciary responsibilities.

Please see information under separate cover for detailed plan fees.

Strength, reputation, experience

As an advisor, your confidence in us can go much deeper than our name.

TD Ameritrade Institutional has a singular and established commitment to supporting

independent RIAs, helping advisors build business, and advocating for the RIA model.

In addition, TD Ameritrade Trust Company and its employees have a long and robust

history of providing custodial and trustee services in the retirement plan arena.

866-827-5894 | tdaretirementplansolutions.com

6

The benefits of the TD Ameritrade Retirement Plan:

For advisors

For plan sponsors

For participants

■■ A dedicated sales force

■■ Plan design support

■■ Enrollment support and materials

■■ Easy access to an experienced

and knowledgeable support team

■■ Plan documents and supporting

forms

■■ Retirement planning tools, including

an online resource center

■■ A Playbook with advisor tools to

help you build your business, sell

and service retirement plans

■■ Full-service recordkeeping and

plan administration

■■ Rollover assistance when participants

leave the plan**

■■ Compliance testing

■■ Easy access to account information

online or by phone

■■ Extensive materials, including tools,

a comprehensive plan proposal,

and educational opportunities

■■ An open-architecture framework

that provides you with great

flexibility to create and monitor

your clients’ investment menus

■■ Form 5500 preparation

■■ Daily valuation of accounts

■■ Downloadable reports

■■ Guaranteed timely payment of mutual

fund revenue sharing

■■ Custodial services

■■ Directed trustee services

(may be available)

■■ Easy access to plan information

online or by phone

■■ Seamless conversion and

transition processes

866-827-5894 | tdaretirementplansolutions.com

8

Designed with advisors

in mind

Take the broad investment selection of true

open architecture, and combine it with the ease

and simplicity of a turnkey solution. Then add

outstanding service, robust tools, and the trust

that comes with the TD Ameritrade name.

The result is the TD Ameritrade Retirement Plan—

a solution specifically designed for you, plan

sponsors, and participants.

1

Key benefits of bundled solutions

■■ Simplify your business process

2

Key benefits of unbundled solutions

■■ Access true open architecture—

with one of the broadest

investment selections available

3

■■ Enjoy a complete solution

from a single provider

■■ Avoid proprietary fund

requirements in our open

architecture framework

The strength of a trusted brand

■■ Leverage our experience and

our respected national brand

■■ Inspire confidence in plan

sponsors and participants

■■ Trust in our stability

866-827-5894 | tdaretirementplansolutions.com

9

Learn more or request a proposal today.

CALL

866-827-5894

VISIT

tdaretirementplansolutions.com

EMAIL RPS@tdameritrade.com

The innovative TD Ameritrade Retirement Plan—

services are provided by TD Ameritrade, Inc., member FINRA/SIPC.

designed with advisorsBrokerage

inAmeritrade

mind

TD

Trust Company and TD Ameritrade, Inc., are separate but affiliated

*The TD Bank USA, N.A. Institutional Money Market Deposit Account (Institutional

MMDA) is included as an investment option in your plan menu. The Institutional

MMDA enables participants to have access to an FDIC insured product. In addition

to the Institutional MMDA, the plan sponsor may select other cash or money market

options for the plan menu.

**Advisors should seek independent legal counsel regarding potential conflicts of interest

in connection with rollovers from plans that they advise.

Custody, directed trustee, recordkeeping, plan design support, and plan administration

are provided by TD Ameritrade Trust Company, a non-depository trust company.

tdaretirementplansolutions.com

subsidiaries of TD Ameritrade Holding Corporation (“TD Ameritrade”). TD Bank USA,

N.A., TD Ameritrade, Inc., and TD Ameritrade Trust Company are affiliated through their

parent companies. Business development support, guidance, and tools are provided

to independent registered investment advisors by TD Ameritrade Institutional, a division

of TD Ameritrade, Inc. TD Ameritrade is a trademark jointly owned by TD Ameritrade

IP Company and The Toronto-Dominion Bank. © 2016 TD Ameritrade IP Company, Inc.

All rights reserved. Used with permission.

T 440415 01/31/2018

TDTC 4299 BR 01/16