Inquiry into aspects of the Wrongs Act 1958 (Vic)

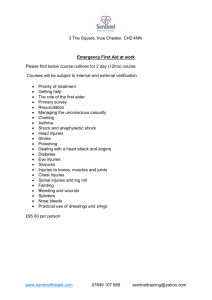

advertisement

Inquiry into aspects of the Wrongs Act 1958 (Vic) To: The Convenor Victorian Competition and Efficiency Commission GPO Box 4379 Melbourne VIC 3001 Email: wrongsactinquiry@vcec.vic.gov.au Cc: Diab.Harb@vcec.vic.gov.au Date: 28 January 2014 Queries regarding this submission should be directed to: Contact person: Irene Chrisafis Ph: (03) 9607 9386 Email: ichrisafis@liv.asn.au © Law Institute of Victoria (LIV). No part of this submission may be reproduced for any purpose without the prior permission of the LIV. The LIV makes most of its submissions available on its website at www.liv.asn.au Table of Contents Introduction ........................................................................................................................................................ 3 Background: ...................................................................................................................................................... 3 3. Access to damages for non-economic loss ................................................................................................... 6 Asymptomatic diseases ..................................................................................................................................... 8 4. Caps on damages for economic and non-economic loss.............................................................................. 9 4.1 Cap on economic loss .............................................................................................................................. 9 4.2 Cap on non-economic loss ...................................................................................................................... 9 5. Discount rate .................................................................................................................................................. 9 6. Other personal injury damages issues .......................................................................................................... 9 6.1 Differences in the treatment of remedial surgery on spinal injuries ......................................................... 9 6.2 Damages for costs of gratuitous attendant care by others .................................................................... 11 6.3 Damages for loss of the capacity to care for others .............................................................................. 11 6.4 Inconsistency arising from the interaction of personal injury Acts ......................................................... 12 6.5 Medical Panels processes ..................................................................................................................... 13 7. Strict liability regime for damage by aircraft................................................................................................. 16 Conclusions and Recommendations ............................................................................................................... 16 Further consultation ......................................................................................................................................... 17 Page 2 Introduction We refer to the draft report released by the Victorian Competition and Efficiency Commission (the Commission) in November 2013: Adjusting the Balance – Inquiry into Aspects of the Wrongs Act 1958 – A draft report for further consultation and input (the draft report). The Law Institute of Victoria (the LIV) makes this further submission in response to the draft report. This submission will first address the Commission’s Background Paper: Modelling Assumptions and Calculations and provide recommendations for matters that in the view of the LIV need to be corrected or contemplated in order for the Commission to obtain an accurate and realistic assessment of the anticipated costs of the potential reforms. The submission will then address some specific issues of the draft report in turn as follows (using the numbering in the draft report): 3 Access to damages for non-economic loss 4 Caps on damages for economic and non-economic loss 5 Discount rate 6 Other personal injury damages issues 7 Strict liability regime for damage by aircraft Background: In finalising its recommendations, in addition to the issues addressed in detail below, the LIV urges the Commission to bear in mind the context and outcomes of the 2003 reforms post the collapse of HIH Insurance. The purpose articulated by policy makers at that time was essentially to reduce the cost of insurance premiums. Based on information in the draft report, there has been a very significant reduction in the cost of insurance, but this has come at great personal cost to some persons injured as a consequence of the wrong doing of others. Justice Ipp was appointed by the Commonwealth Government after the collapse of HIH Insurance to report on comprehensive reforms to the laws of negligence, designed to reduce the cost of injury claims, and hence the cost of public liability insurance. Common law rights were altered in varying degrees following the release of the Ipp report. Amendments to the Wrongs Act 1958 (Vic) led to a substantial reduction in the common law rights of injured Victorians. Graph 1 on page 2 of the submission dated 13 September 2013 made to the Commission by the Insurance Council of Australia indicates that whilst the number of risks written in Victoria has increased by 39.2% from 434,832 in 2003 to 605,214 in 2012, at the same time average premiums have dropped in nominal terms by 37.3% from $1,010 in 2003 to $633 in 2012. This 37.3% has not been adjusted for the impact of CPI to allow a more accurate assessment of the impact of the reforms and a proper comparison of the state of the insurance market. This means that the decline in premiums and increase in risks written is even greater in real terms. There may be debate about how to precisely measure the real terms premium decrease in the cost of insurance. However, taking CPI into account as a base measure, the LIV in consultation with Cumpston Sargeant estimates that in real terms the decrease is around 90% over the 9 year period. Background Paper: Modelling assumptions and calculations – Wrongs Act draft report The LIV considers that some incorrect assumptions or errors have been made in the Commission’s Background Paper: Modelling assumptions and calculations – Wrongs Act draft report (received from the Commission on 27 November 2013) (background paper) that would significantly affect the estimated potential Page 3 average impact on insurance premiums as set out in Table 2 Recommended package on page numbered XXX of the Commission’s draft report. They are as follows: a) Under Table 1.1 Estimating the number of additional claims from changing access to damages on page 2 of the background paper, the Commission indicates in paragraph b that Table 1.1 “Includes impairment assessments at one to five per cent. The Commission has assumed that all these claims are equal to five per cent (based on TAC correspondence).”The LIV submits that this is an incorrect assumption. Without precise figures, assuming a proportionate basis for example, impairment assessments at 5% alone could be 1/5 or 20% of the number of claims i.e. 20% of 30, being 6 claims per annum. The number of claims could be over estimated at 10 per annum as a maximum. The LIV submits that the ratio of TAC claims at 5% impairment in Table 1.1 should therefore be 1% and not 3%. b) In paragraph d under Table 1.1 Estimating the number of additional claims from changing access to damages on page 2 of the background paper, the Commission indicates that Table 1.1 “Includes impairment assessment for musculoskeletal injuries. The Commission has assumed that all claims assessed as musculoskeletal injuries are spinal related (based on TAC correspondence).”The LIV submits that this assumption is not correct. A large proportion of impairment claims are for injuries other than spinal injuries, and some may include spinal injuries as one of a number of injuries. Further, the injury profile for Wrongs Act claims substantially differs from that for impairment claims under the WorkCover scheme, which has a larger proportion of claims for spinal injuries. The LIV suggests that a significant proportion of impairment claims under the TAC scheme would relate to injuries other than spinal injuries. Based on anecdotal reports, the LIV submits that a significant proportion of claims under the Wrongs Act would be for injuries other than spinal injuries. It is therefore submitted that the average ratio across the two schemes (WorkCover and TAC) for impairment claims at 5% could be 12.5% (24% + 1% = 25% ÷ 2 = 12.5%). c) In paragraph e under Table 1.1 Estimating the number of additional claims from changing access to damages on page 2 of the background paper, the Commission indicates that “There are around 600 to 1000 claims made per annum for personal injury or death that would fall under the Wrongs Act (Law Institute of Victoria, sub. 13, attachment B). The upper estimate of this figure is used in the table.” For the purposes of estimating the potential cost of an increased number of claims, the LIV submits that an average of this estimate should be used, i.e. 800 claims, and not the higher figure of 1,000 claims used in the background paper. d) In paragraph f under Table 1.1 Estimating the number of additional claims from changing access to damages on page 2 of the background paper, the Commission indicates that “To determine final estimates of additional claims under a five per cent threshold, the estimated number of Wrongs Act claims is multiplied by the average ratio across the two schemes. i. Calculation: ((24 + 3.1)/2) = 14% x 1000 = 140” The LIV submits that the calculation should be as follows: (24 + 1 ÷ 2) = 12.5% x 800 = 100. e) In paragraph c under Table 1.2 Potential additional cost impacts on insurance markets on page 3 of the background paper, the Commission indicates that “The lower bound figure is based on modelling by Cumpston Sarjeant for the LIV that suggests that average damages for non-economic loss are generally between $30 000 and $50 000 per claim (sub. 13, appendix B). The upper bound figure is based on VWA data that shows that the average award for damages settlements for pain and suffering is around $80 000 (VWA 2013, 5). “ The LIV does not dispute the VWA’s figure but suggests that this figure would very likely be an overestimate of the likely average damages for pain and suffering for Wrongs Act claims. The LIV estimates that the average amount of damages for pain and suffering in Wrongs Act claims would be approximately $50,000.00. The reasons for this are as follows: i. Workers who recover damages under the WorkCover legislation are required to meet a much higher “serious injury” test, being either a 30% impairment threshold or a serious injury narrative test. Since the injuries are in most cases much more serious or severe, the award of damages for pain and suffering is therefore generally much higher. Page 4 ii. f) There is a minimum threshold level for damages for pain and suffering for workers bringing claims under the WorkCover legislation which was $50,440.00 as at 5 July 2011. The effect of this is that if a worker was assessed to have an entitlement to general damages for pain and suffering at less than this, the Court would be prevented from making any award of damages. This in turn means that any awards of damages at less than this figure which would otherwise be included in the overall average cannot therefore be included again, increasing the overall average award of damages for pain and suffering. No such minimum threshold for pain and suffering applies under the Wrongs Act. The LIV submits that the estimated increased cost of common law damages for claims where the impairment is 5% would be 100 x $50,000.00 = $5,000,000.00. g) Under the heading Likely impact of a narrative test (option 3) in paragraph d on page 4 of the background paper, the Commission indicates that “This average is then applied to the total number of Wrongs Act claims. i. Calculation: 19% x 1000 = 190 (rounded to 200).” The LIV submits that the estimate of additional claims under the Wrongs Act under a narrative test is incorrect, based upon the average number of claims per annum under the Wrongs Act being 800 and at the high figure of 1,000. The LIV submits that the figure should be closer to 150, i.e. 19% of 800. h) Under Chapter 4 cap on non-economic loss on pages 4 and 5 of the background paper, the Commission estimates that the impact of increasing the cap for non-economic loss from $497,340.00 to $538,860.00 would be an 8.35% increase in all damages awards for pain and suffering under the Wrongs Act. The LIV submits that this is incorrect, because it is based upon an erroneous assumption that awards or settlements for pain and suffering damages are based upon a scale which is affected by the maximum allowable award for damages for pain and suffering. The LIV submits that in only those very few claims where there would be a settlement or award of damages above the old cap, i.e. above $497,340.00, would there be an increase in general damages up to the new cap of $538,860.00. The LIV suggests that this would likely represent less than 1% of all claims. The LIV submits that the Commission’s assumption is incorrect for the following reasons: i. In Victoria, awards for general damages are based on comparative analysis of a claimant’s injury to the established body of precedent awards by judge and jury for similar injury types. These amounts have remained largely the same for many years. ii. No regard is had to the maximum allowable award of damages for pain and suffering when a Court determines an award for general damages or when parties negotiate a settlement for pain and suffering damages. Further, juries are not permitted to be advised of the maximum award for pain and suffering damages. If a jury makes an award and the award is above the maximum, then the Court in delivering judgment reduces the jury’s award to the statutory maximum. iii. Defendants do not offer any increase in awards of damages for pain and suffering based upon the CPI each year, and would not offer any increase in awards for pain and suffering damages simply because the cap was higher. iv. Awards of damages for pain and suffering across the three schemes are generally assessed by Counsel, parties, and Courts on the same basis, notwithstanding that there are currently three different caps on awards of damages for pain and suffering under the three schemes. v. There is no set ‘scale’ applicable in Victoria for awards of general damages where certain injuries are awarded a certain percentage of the maximum available based upon the nature or severity of the injury. Whilst a system of graduated assessment of damages and a ‘scale’ for awards exists in New South Wales, it does not apply in Victoria. Page 5 i) For the reasons set out above, the LIV submits that the estimated potential average impact on insurance premiums at 3.9% as set out in Table 2 Recommended package on page numbered XXX of the Commission’s draft report is a significant over-estimate. Further, for the reasons set out in paragraph a) above, the LIV submits that the estimated potential increased impact on insurance premiums for an increased cap on non-economic loss damages would be negligible and not the estimated 1.6% as set out in Table 2. The LIV submits that in the event that the Commission, after reviewing further submissions, maintains the proposed recommendations on Limitations on damages for gratuitous attendant care and Other issues as set out in Table 2 Recommended package on page numbered XXX of the Commission’s draft report, the potential decreased impact on insurance premiums that would result should be addressed in the modelling. The LIV contends that these measures, if adopted, would further reduce the existing number of claims per annum and therefore reduce the overall cost to insurers. The LIV submits that this decrease ought to be taken into account in the Commission’s final analysis. In light of the above, the LIV submits that there is scope to provide a fairer re-balancing of rights in making recommendations for further amendments to the Wrongs Act over and above those already specified in the Commission’s draft report. Those additional proposed changes are set out in this further submission and would, in the LIV’s view, provide a modest and sustainable re-balancing of the rights of injured people without having a material impact on the cost of insurance. 3. Access to damages for non-economic loss In its draft report the Commission recommends that the impairment threshold be amended to: i. 5% or more for spinal injuries; and ii. 10% or more for psychological injuries. For the reasons set out above, the LIV submits that the recommendations for amendment of the impairment threshold should be more inclusive than as set out in the Commission’s draft report. Specifically: a) The LIV maintains that a narrative test should be introduced, being one of the options for amendment of the impairment threshold as set out in Chapter 3 of the draft report. The LIV submits that the introduction of a narrative test as a new threshold will be affordable for the reasons set out above. b) If the Commission maintains its view that the introduction of a narrative test would bring uncertainty and/or would impose an unaffordable increase in the impact on insurance premiums, then the LIV submits that the impairment threshold for physical injuries should be reduced to 5% or more for all injuries, and not just spinal injuries. As set out above, the LIV submits that not only is the data regarding the likely increased number of claims more certain when founded on a 5% threshold, based upon the TAC and WorkCover experience, the estimated potential impact on insurance premiums would be affordable and equal to or less than the current estimate of 1.8%. The LIV submits that this amendment should be made for the following additional reasons: i. Unlike the WorkCover scheme, the injury profile for Wrongs Act claimants is more heavily weighted towards physical injuries other than spinal injuries due to the nature of the injuries, for example medical misadventure, falls, animal attacks. Fractured limbs or internal injuries are more common. The nature of work injuries for example in the context of lifting, bending, twisting, manual handling etc. and motor vehicle injuries e.g. whiplash injuries are such that there are far more spinal injuries. The LIV submits that to reduce the impairment threshold to 5% for spinal injuries only would be unfair and create vertical inequity in that there would be a significantly larger proportion of deserving claimants who would be unable to pursue a claim for pain and suffering damages. Page 6 ii. The Wrongs Act generally captures a much broader section of the community than WorkCover. For example, the victims of medical error are more likely to be children, disabled persons or the retired. This is because these groups are likely to require medical treatment or surgery where medical misadventure may occur. Anecdotal reports suggest that these types of claimants more typically have little or no claims for losses in terms of medical expenses or loss of earnings. Where their impairment fell at 5% for physical injuries other than spinal injuries, they would have no entitlement to general damages or any compensation at all. iii. Persons with an impairment of 5% under the WorkCover or TAC schemes for injuries other than spinal injuries have significant entitlements to no-fault benefits, including impairment benefits in respect of WorkCover claimants as well as weekly payments and medical expenses under both schemes. iv. Examples of physical injuries from the text of the AMA Guides for injuries other than spinal injuries where the impairment is 5%, include amputation of the great toe, ankylosis of the knee (i.e. where the joint is fixed or fused) at 20-29◦ flexion, amputation of the little or ring finger of either hand, serious scarring, and ankylosis of a shoulder at 20-50◦ abduction. These are not minor injuries or impairments. v. Examples of recent claimants with non-spinal physical injuries that have been assessed by AMA qualified medical specialists or the Medical Panel Workers Compensation scheme as suffering a permanent impairment under the AMA Guides at 5% are detailed below. All of these claimants would satisfy the serious injury narrative test under the WorkCover or TAC schemes, but would not reach the threshold to seek non-economic loss damages if the threshold under the Wrongs Act was reduced to 5% only for spinal injuries. Illustrative Example 1: A 45 year old police officer sustained a left knee fracture in a fall. He required surgical treatment including the insertion of a plate and nine screws. He was eventually able to return to work albeit with ongoing pain and difficulties. He continued to experience ongoing pain. He suffered 2.5cm muscle wastage of his left calf. The medical consensus view was that his joint would progressively worsen over the next few years and he would first require surgical removal of the plates and screws but eventually total knee replacement surgery would be necessary. The WorkCover notice of entitlement determined his permanent impairment at 5%. Accordingly, if his injury had been suffered in circumstances to which the Wrongs Act applied he would be denied compensation for noneconomic loss. Illustrative Example2: A 42 year old demolition worker sustained a left knee injury in a fall, including an anterior cruciate ligament rupture. He required reconstructive surgery, ongoing anti-inflammatory medication and physical therapy. He experienced daily pain, discomfort and crepitus. He was unable to hop or run and had limited tolerances for walking, standing and driving. He also experienced an onset of symptoms in his right knee due to altered gait and overuse. His capacities for leisure and exercise activities were significantly limited and he had experienced a 20kg weight gain as a result. He was medically certified as permanently unfit for any work involving kneeling, squatting, climbing or heavy lifting. He attempted a return to work in traffic control but the extended periods of standing aggravated his condition. The WorkCover notice of entitlement determined his permanent impairment at 5%. Accordingly, if his injury had been suffered in circumstances to which the Wrongs Act applied he would be denied compensation for non-economic loss. Illustrative Example 3: A 50 year old truck driver sustained a right elbow injury in a fall. He underwent a surgical debridement of the joint. He experienced constant nagging pain and altered sensation in the elbow and upper arm. He suffered joint stiffness and swelling. He was unable to continue his hobby of playing golf or lift his young grandchildren. He was unable to drive for extended periods and was experiencing difficulties continuing with his employment as a result. His sleep was significantly affected by pain and he required daily analgesics. The WorkCover notice of entitlement determined his permanent impairment at 5%. Page 7 Accordingly, if his injury had been suffered in circumstances to which the Wrongs Act applied he would be denied compensation for non-economic loss. Illustrative Example 4: A 64 year old teaching chef sustained an injury to her left shoulder requiring surgical repair of the supraspinatus tendon. She underwent extensive physical therapy and rehabilitation programs. She suffered constant aching pain in the shoulder, restricted movement and altered sensations extending to her elbow. She was unable to return to work. Due to ongoing pain and limitations she then developed an adjustment disorder requiring counselling and daily medication. She experiences daily difficulties with self-care and domestic duties. The WorkCover notice of entitlement determined her permanent impairment for physical injuries at 5%. Accordingly, if her injury had been suffered in circumstances to which the Wrongs Act applied she would be denied compensation for noneconomic loss. Asymptomatic diseases The LIV maintains that the limited category of additional exemptions as detailed in the LIV’s earlier submissions is an essential and affordable step to rectify the existing inequity within the Wrongs Act. The LIV notes the Commission’s draft report does not support broadening the list of exceptions advocated in the LIV’s original submission, however further information is sought regarding a possible reform to address the difficulties in the current system of dealing with cases of asymptomatic blood-borne diseases. The LIV does not accept that amendment of the Limitations of Actions Act would be an appropriate course to address this category of claims. The current limitation period is a three-year limitation period for adults from the date of discoverability pursuant to Part IIA of the Limitation of Actions Act 1958. This makes adequate provision for a claimant to commence a claim within three years of an injury manifesting itself. The LIV submits that creating additional time limit amendments would unnecessarily complicate the existing time limit provisions. Rather, the LIV submits that the alternative approach suggested of amending section 28LF(1) of the Wrongs Act to except ‘the contraction of a significant infectious disease’ from the thresholds is the preferable approach. In the LIV’s view, such a course is unlikely to result in ‘compensation being sought for events that may occur in the future’. The LIV submits that such assessments of risk are common place in damages law and pose no particular difficulty. It becomes a matter for the affected claimant to determine whether to (a) wait and see whether the feared risk manifests before commencing a claim, or (b) conclude the matter now on the basis of compensation comparative to risk. The LIV submits that there is no reason for the legislature to impose itself on this choice. It is one that is personal to the claimant and influenced by the individual facts and circumstances of the case. This approach also allows for compensation when the extreme treatment regime of such conditions warrants compensation. In light of the Australian Institute of Health and Welfare Report Public and private sector medical indemnity claims in Australia 2011-2012 data that blood/blood product-related claims are the least common, each making up less than 1% of injury claims, the LIV submits that this amendment would have a negligible impact on the price and availability of public liability and professional indemnity insurance. Page 8 4. Caps on damages for economic and non-economic loss 4.1 Cap on economic loss The LIV supports the Commission’s draft recommendations that the Wrongs Act be amended to provide that: - the cap on damages for economic loss applies to the gap between pre- and post-injury earnings; and that in claims of loss of expectation of financial support the deductions for the deceased person’s expenses are to be made before applying the cap on economic loss. 4.2 Cap on non-economic loss The LIV supports the Commission’s draft recommendation to increase the maximum amount of damages that may be awarded to a claimant for non-economic loss to align with the cap under the Accident Compensation Act. The consistency across schemes from the implementation of this recommendation will achieve horizontal equity for all Victorians severely injured by negligent acts and rectify the current inequity. However, the LIV does not agree that implementing this reform would “be likely to proportionately increase all awards of damages for non-economic loss” for the reasons outlined above in this submission. 5. Discount rate The LIV notes that the Commission has not recommended a reduction in the discount rate to 4% on the basis of a preliminary assessment that such a change would not meet the test of “not having an unduly adverse impact on insurance premiums”. The LIV repeats its submission that maintaining the 5% discount rate that currently applies under the Wrongs Act is a fundamental inequity and should be reviewed. Wrongs Act claimants should be differentiated from claimants whose injuries were sustained as a result of transport and workplace accidents in this regard, as claimants under the WorkCover and TAC schemes are entitled to ongoing coverage for any reasonable and related medical expenses on a “no fault” basis. Severely injured persons whose claims fall under the Wrongs Act are most prejudiced by this inequity as they must currently carry both the risk of predicting what further treatment may be required and the burden of the management of funds for their future treatment needs. In the LIV’s view, a more equitable alternative would be to provide that a 4% discount rate applies to claims for future medical and related expenses under the Wrongs Act. Introducing such a change would require only a simple adjustment in the calculation applied by solicitors and counsel to assess claims, but would address the existing inequity. 6. Other personal injury damages issues 6.1 Differences in the treatment of remedial surgery on spinal injuries The Commission recommends in its draft report that the assessment of impairment be conducted on the post-surgical condition of the claimant and not the pre-surgical condition of the claimant, which is now the position under both the WorkCover and TAC schemes. This would change the current method of assessment of impairment under the Wrongs Act, which is currently conducted on the pre-surgery condition of the claimant. Page 9 Notwithstanding the desirability of appropriate consistency between the three schemes, the LIV submits that for Wrongs Act claimants, the assessment of impairment should be maintained in its current form, i.e. on the pre-surgical state, for the following reasons: a) The Wrongs Act scheme is significantly different to the WorkCover and TAC scheme in that there is no provision under the Wrongs Act for no-fault benefits, and the entitlement to compensation for Wrongs Act claimants is limited to common law damages, be that for pain and suffering or economic loss, if the claimant establishes negligence on the part of the defendant or tortfeasor. b) Under the WorkCover and TAC schemes, when a person requires surgery for the claimed injury the cost of the surgery may be approved by and paid for by WorkCover or TAC, and the claimant can proceed to have the surgery effectively as a private patient, and usually in a much timelier manner. This allows for earlier assessment of the post-surgical state. Under the Wrongs Act however there is no scheme to approve or fund the cost of surgery when it is required. Claimants under the Wrongs Act are left to fund the cost of surgery themselves and/or claim the cost through their private health insurer, if they can afford it. Claimants who do not hold health insurance cover may not to be able to afford to pay for the cost of any required surgery. Such claimants are left to seek the surgery under the public health system and are subject to the usual elective surgery public hospital waiting lists. This can result in extensive delays of 1-2 years. c) This in turn means that assessment of the claimant’s impairment may be delayed for more than 1-2 years until the stable post-surgical state is achieved, which would result in significant delay in finalisation of the claim. This would probably result in increased legal costs for both parties. d) Under the current system it is open to claimants to decide to resolve their claim prior to the surgery and then use their compensation to pay for the surgery. Should the proposed amendment be implemented, this option would be removed which could in turn cause delay in the performance of surgery for those plaintiffs. Often when treatment is delayed, the outcome of surgery for the claimant is less than optimal. Such an outcome is extremely undesirable because the claimant’s recovery may be permanently hampered leading to greater pain and suffering, and as a result the cost of the claim to the insured is unnecessarily increased. Further, this delay would also result in delay for the claimant in accessing not only their compensation, which could include loss of earnings and medical expenses, but also delays in the administration of justice generally which would be contrary to the principles set out in the Civil Procedure Act 2010 (Vic). e) An assessment of impairment of the post-surgery state does not take into account any pain suffered by the claimant which is not permitted, by reason of the restricted use of the AMA Guides in assessing the impairment, as regulated by the Wrongs Act. f) Anecdotal reports suggest that generally a claimant who requires surgery in a WorkCover or TAC setting would be considered to have a serious injury under the narrative test. This is significant for two reasons: a. It allows the parties’ legal representatives in Workcover or TAC claims to make an early assessment of a claim’s viability and initiate evidence collection for the eventual negotiation of the liability and assessment of damages issues notwithstanding the need to await the outcome of surgery. This means that settlement discussions on the claim are often immediately ready to proceed following the post-surgery stabilisation period. As the AMA Guides impairment assessment for a Wrongs Act claim is the only threshold gateway, such preparations would not be possible. The parties’ legal representatives would not be able to determine the potential viability of a claim until after the post-surgery stabilisation period was complete, and then they could initiate evidence collection for the eventual Page 10 negotiation of the liability and assessment of damages, resulting in longer delays and greater legal costs. b. Requiring the assessment of impairment for claims under the Wrongs Act to be conducted on the post-surgical condition of a claimant, in the absence of introducing a narrative test, would effectively abolish the rights of claimants with surgically treated spinal injuries when the significant injury threshold sits at greater than 5% (due to the AMA Guides’ application of 5% increments to spinal injuries), creating a significant horizontal inequity between the schemes. This proposal could avoid such an unjust consequence if it was coupled with the introduction of a narrative test and/or reduction of the significant injury threshold to 5%. 6.2 Damages for costs of gratuitous attendant care by others The LIV notes the draft recommendation in the draft report that the time thresholds that limit access to damages for gratuitous attendant care be cumulative, rather than alternative, that is, the care is required for at least six hours a week and for at least six months. The LIV maintains that the status quo of alternative thresholds is a more equitable approach for the reasons set out in the LIV’s previous submissions, and submits that given the current state of strong financial health of the scheme there is no justification for imposing such a restriction of existing rights at this time. 6.3 Damages for loss of the capacity to care for others The LIV notes that the Commission has not recommended providing a limited entitlement to damages for loss of the capacity to care for others on the basis of a preliminary assessment that such a change “could place significant upward pressure on insurance premiums”. The LIV maintains that the existing inequity in this regard represents a defacto discrimination against some of the most vulnerable members of our community – those who dedicate themselves to their own detriment (loss of wages and free time) to care for the children and disabled persons in the community. The LIV suggests that this most profoundly discriminates against women, who commonly assume these carer roles. The Commission has requested further information on the likely impacts on the price and availability of public liability and professional indemnity insurance of adopting the New South Wales approach to provide a limited entitlement to damages for loss of the capacity to care for others. Firstly, it is important to note that these claims are generally for a limited period of time (as they most often relate to the period of time that a claimant is engaged in caring for children, which naturally reduces as the children mature, and that by their nature these claims have either no or a significantly reduced claim for economic loss. The LIV refers the Commission to sub-section 60(2)(c) of the Transport Accident Act 1986 (Vic). Pursuant to that sub-section the TAC is liable to pay for child care services for a maximum of 40 hours per week for a period of 5 years after the accident provided the person was mainly engaged in the care of a child prior to the accident. The Transport Accident Act also provides a scale for those engaged in employment and the care of a child, and provides that a woman who was pregnant at the time of her injury would be deemed to be mainly engaged in the care of a child. The LIV suggests that the Commission contact the TAC to obtain data regarding the proportion of claims that have received a childcare payment under s 60(2)(c) compared with the total number of claims. The LIV suggests that such a proportionate analysis could be reasonably extrapolated for the modelling of the potential impact of the proposed reform to the Wrongs Act. However, the LIV would caution the extrapolation of the amounts or duration of such payments under the Transport Accident Act due to the generally more severe injury profile of claimants under that scheme. Page 11 6.4 Inconsistency arising from the interaction of personal injury Acts The LIV notes the Commission's draft recommendation that the Wrongs Act be amended to provide that common law claims arising from the ‘use of’ a motor vehicle are subject to the limitations of the Wrongs Act in regards to caps, thresholds and the prescribed discount rate. The LIV opposes this course. The creation of this category of claims was a deliberate and well considered policy decision that distinguished between injuries occurring in the course of transportation as distinct from injuries caused by accidents not directly related to transportation. The policy makers devising the TAC scheme considered the issue and decided to retain common law rights and not confer “no fault” benefits for this category of claims. The Transport Accident Act is the sole Act that governs the powers and responsibilities of the TAC, including the precise situations when the TAC is to exercise its power of indemnity – ie, ‘use of’ claims. Section 94 of the Transport Accident Act provides that the TAC will indemnify the negligent owner/driver of a registered motor vehicle, tram or train in respect of any liability in respect of an injury or death caused by or arising out of the use of a motor vehicle. In the LIV’s view the proposed amendment, if enacted, is likely to result in considerable confusion regarding the interplay of the Wrongs Act and the Transport Accident Act causing additional complexity, use of court time and resources and lack of certainty and predictability for claimants and insurers alike. Section 94 of the Transport Accident Act is a clear and deliberate construction of an alternative category of claims. The Act deliberately separates the entitlements for injuries that arise from a vehicle being used as a mode of transportation (all those claims that fall into the definition of having arisen ‘directly from the driving’ of a motor vehicle and are entitled to no fault benefits) and those that arise from events associated with a motor vehicle but not through transportation (the ‘use of’ category). There are sound public policy reasons for the demarcation. The compulsory levy of premiums for injury cover on motor vehicles was to ensure a sustainable scheme of support and compensation for all those in our society injured in serious motor vehicle accidents, irrespective of the cause of the accident. The policy imperative and justification for the removal of common law rights was balanced by fundamental supports of medical and related expenses, loss of earnings benefits and in the case of permanent and serious injuries, compensation for non-economic loss to injured persons irrespective of the circumstances in which the transport accident occurred. Such policy imperatives did not exist for the ‘use of’ class of injuries, which are generally more minor in nature and often arise from a person’s own error (for example, when someone closes a vehicle door on their own hand). To have brought such injuries within the no fault scheme of the Transport Accident Act may have jeopardised its viability. There are occasions when ‘use of’ injuries are caused by the negligence of the vehicle owner or driver, and claims for damages properly arise. The existence of this category of claim recognises the inherent danger associated with the use of motor vehicles and ensures appropriate insurance exists when their negligent use causes injury to another. The LIV considers that the following are examples of when a right to claim for damages arises resulting from the negligent use of a motor vehicle: Facts of Hynes v Hynes (2007) 15 VR 475:The plaintiff was injured when her husband released the radiator cap of his vehicle and hot water erupted and caused injuries to the plaintiff, including burns on her back, left shoulder, left side of her face and scalp, resulting in residual scarring and disfigurement and psychological upset. It is probable that these injuries would have satisfied the serious injury narrative test in the WorkCover or TAC schemes but would not satisfy a 5% or >5% whole person impairment threshold. Accordingly, if her injury had been suffered in circumstances to which the Wrongs Act applied she would be probably denied compensation for non-economic loss. Case Example: The plaintiff, a 43 year old quadriplegic, was intending to undertake some shopping. He ordered a taxi and was taken by taxi to his local shopping centre. When the taxi arrived, the plaintiff’s wheelchair was being lowered to the ground by a hoist operated by the taxi driver. Due to the driver’s negligence the plaintiff was not securely locked into place during the lowering process. As the wheelchair was being lowered, the wheelchair rolled backwards and tipped onto the ground. Page 12 This resulted in the plaintiff hitting his head on the asphalt ground surface. The plaintiff suffered a mild, closed head injury, ongoing headaches and psychological trauma directly as a result of the incident. If the injury had been suffered in circumstances to which the Wrongs Act applied he would probably be denied compensation for non-economic loss. The preservation of unrestricted common law rights for this category of claims was deliberate. This is appropriate because these claims are made in a public insurance not private insurance context – those on risk for these claims have no choice on whether to insure or to choose between competing policies – they must insure with the TAC at the set rate. It was open to the legislature at the time of the enactment of the Transport Accident Act to separate the risks covered, and create a scheme where only injuries arising from transport accidents were covered under the scheme, leaving owners and drivers free to decide for themselves whether or not to insure in respect of ‘use of’ claims and if so with what insurer and at what rate. The legislature did not take this approach. The LIV submits that if the proposed recommendation was implemented, an anomaly and inequity would be created: a class of claimants whose common law rights have been effectively removed on unjustifiable grounds. If any amendment to the ‘use of’ class of claims is deemed appropriate, the proposal should be properly considered and be the subject of further consultation. Anecdotal reports suggest that many claims within this category would not meet a 5% or greater whole person impairment threshold. This could include minor brain injuries and life-long scarring. The proposed reform, if enacted, would essentially be stripping these claimants of their rights entirely, without providing them with any of the other associated no fault benefits that other TAC claimants receive. The LIV submits that this issue therefore warrants a much more careful and comprehensive analysis before any recommendation about it is put to government. If enacted, it would create an anomaly and create an unjustifiable vertical inequity. 6.5 Medical Panels processes The LIV thanks the Commission for the opportunity to consider and provide feedback on the Medical Panel’s processes and the matters raised by various stakeholders both in written submissions and at the round-table convened on 17 December 2013. We note that as part of the Commission’s terms of reference, regard is to be had to the possible impacts of any recommendations on Medical Panels and the Courts. 1.1 Commencement of claim by claimant There is no doubt that the process for the service of the certificate of assessment and prescribed information can be strengthened to provide for greater consistency of information being provided to the Respondent and ultimately the Medical Panel. Section 28LT(2) of the Wrongs Act provides that the “…certificate of assessment must be accompanied by the prescribed information (if any) in the prescribed form (if any)…” Section 28LT(3) provides that the information prescribed may include information relating to the identity of the claimant, the nature of the claim, the injury, the incident out of which the alleged injury arose and any medical practitioner who has treated the injury. Furthermore, Regulation 6 of the Wrongs (Part VBA Claims) Regulations 2005 lists information which is prescribed for the purposes of section 28LT(2) of the Wrongs Act. As discussed at the round-table, the Department of Justice website provides a template by way of a guide to claimants which incorporates all of the prescribed information referred to in Regulation 6. However, neither the legislation nor the regulations provide for a “prescribed form”. The lack of a prescribed form and the listing of prescribed information in both the Wrongs Act and the Regulations may contribute to Page 13 the quality of the information provided to respondents and ultimately the Medical Panel being variable and inconsistent. The LIV agrees that reform is needed to ensure that all practitioners and claimants provide consistent information to respondents to maximise uniformity and ensure that relevant information is provided. This should in turn result in respondents being better positioned to consider the claim and whether a referral to the Medical Panel is required. The LIV proposes that a prescribed form be introduced into the Wrongs (Part VBA claims) Regulations 2005 incorporating the prescribed information set out at s.28LT(3) and Regulation 6. The form currently on the Department of Justice’s website seems to adequately address all of the requirements. The LIV does not support a requirement that claimants be obliged to obtain and provide all medical records relating to the injury. Such a requirement would result in an onerous and unnecessary front-loading of claims in terms of both costs and delay. 1.2 Referral of claim by a respondent The LIV considers that a requirement that the respondent should pass on to the Medical Panel the prescribed information provided by the claimant is necessary. 1.3 Interaction with Courts There is no time by which a certificate of assessment must be served, and in certain instances a delay on the part of the claimant attending to service of a certificate of assessment would frustrate the progress and resolution of a claim. The LIV agrees that this issue needs to be addressed, but opposes any legislative requirement that a certificate of assessment be served before proceedings are commenced, particularly in circumstances where a “hard gate” is likely to be introduced for the provision of prescribed information in a prescribed form as discussed above. Requiring a certificate of assessment to be served prior to proceedings being commenced may give rise to difficulties in certain cases where there is an impending time limit. Section 28LV of the Wrongs Act provides that the limitation period is suspended for a certain period when a certificate of assessment is served. However, this suspension only runs once a certificate of assessment is served. The difficulty that claimants may face is securing a certificate of assessment prior to the expiry of the limitation period. This problem would be further exacerbated if the Commission’s proposal that the assessment of impairment be conducted on the post-surgical condition of the claimant is adopted. The current limitation period is a three-year limitation period for adults from the date of discoverability pursuant to Part IIA of the Limitation of Actions Act 1958 (Vic). In some cases, particularly medical negligence matters, a claimant may not immediately seek legal advice, particularly if they are continuing to receive medical treatment for the injury resulting from the alleged negligence. In addition, once legal advice is sought, a number of enquiries need to be made before a recommendation can be made to a claimant to pursue a claim. These enquiries extend to issues of liability including establishing whether there has been a departure from reasonable medical care and whether the negligent treatment has caused an injury and, if so, what injury. It is only once the injury resulting from the alleged negligent treatment is identified that the question of significant injury can be addressed. These investigations unfortunately can take a considerable period of time. Similar problems arise in circumstances where a claimant’s injuries can take a considerable period of time to stabilise, such as in the cases where surgical procedures are undertaken well after the date of injury or where there has been nerve damage or soft tissue injuries. In those cases the three year time limit already presents difficulties, so the imposition of a requirement to serve a certificate prior to issuing would create an unfair and unnecessary burden on some claimants. Furthermore, a requirement to serve a certificate prior to issuing would be nonsensical in those cases where a claimant does not seek non-economic loss damages. Page 14 In addition, requiring service of a certificate of assessment before commencing proceedings would have the same effect of unnecessarily front-loading some claims. The LIV therefore strongly opposes a requirement that a certificate of assessment be served prior to proceedings being commenced. The LIV proposes that the service of a certificate of assessment be incorporated in the Court timetables providing for the conduct of claims. Both the County and Supreme Courts actively case manage claims, and the incorporation of an order for service of a certificate of assessment in the usual Court timetable would present little difficulty. The Court Practice Notes could incorporate reference to the significant injury issue being addressed prior to the matter proceeding to mediation. This would provide the necessary incentive for a claimant to serve a certificate of assessment sooner rather than later in the litigation. If necessary, consideration could be given to orders being made that a trial date not be set until such time as the issue of significant injury is addressed. 1.4 Causation and the form of the medical question Typically, medical negligence cases often give rise to complex issues of causation. Section 28LL of the Wrongs Act provides that impairments from unrelated injuries or causes are to be disregarded in making an assessment. The phrase “medical question” is defined as “a question as to whether the degree of impairment resulting from injury to the claimant alleged in the claim satisfies the threshold level”. The LIV submits that this definition ensures that the medical question is to be limited to an assessment of the degree of impairment resulting from the injury claimed. The LIV agrees with the position of the Medical Panels that the potentially compensable injury needs to be identified, and unrelated causes and injuries disregarded. The LIV also agrees with the Medical Panel that the parties should be able to make submissions regarding whether or not the alleged injury is potentially compensable. The LIV submits that any review must remain mindful of ensuring that the burden of filing the certificate of assessment does not become prohibitive. It is crucial to ensure that the Medical Panel’s involvement is properly limited to the threshold question and does not become a de facto hearing of the causation and assessment of damages questions. 1.5 Other issues 1.5.1 Multiple respondents The LIV understands that the Commission is unlikely to make recommendations in relation to multiple respondents. This issue is fraught with difficulties. The LIV’s position is that a medical panel determination should not be able to bind multiple respondents, as this would have the potential of retrospectively stripping a claimant of rights in cases where a respondent had previously accepted the pain and suffering damages claim. 1.5.2 Authority of the Panel to return non-complying referrals The LIV opposes the Medical Panel being given the power to return referrals to respondents where the referral is unclear. This would require legislative change and a process developed by which disputes about whether a referral is compliant are resolved. Rather, the LIV is of the view that the Medical Panel should request further information and make clear that a Medical Panel will not be convened until such time as further information is provided. This will provide the respondent with the necessary incentive to provide such further information and to seek it from the claimant should it be required. The LIV submits that there is no need for legislative reform in this regard as, should it need to, the Medical Panel already has power to request documents from the respondent (section 28LZA of the Wrongs Act), the Claimant (section 28LZC of the Wrongs Act) and even directly from a registered health practitioner (section 28LZE of the Wrongs Act). Page 15 Codification of the decision in Mitchell v Malios &Ors [2013] VSC 480 The LIV agrees with the position put by the Medical Panel at the round-table that a Medical Panel should be convened in relation to a physical impairment where a certificate of assessment relating to physical injury is served and a Medical Panel should be convened in relation to psychiatric impairment where a certificate of assessment for primary psychiatric injury is served. The LIV agrees that there should be no requirement that a certificate of assessment be obtained for every injury claimed. 7. Strict liability regime for damage by aircraft The LIV maintains its support for the existing strict liability regime in respect of damage by aircraft under section 31 of the Wrongs Act.The LIV considers that the regime as it stands remains appropriate in circumstances where it offers a high degree of consistency with the Federal legislative regime and the regimes provided by other Australian States. The LIV supports the submissions contained in the Department of Infrastructure and Transport’s submission to the Commission, and does not favour the proposed change set out in the draft report, namely, to remove the entitlement for injured persons to recover for pure mental harm without accompanying personal or property damage that was also caused by the aircraft. To remove such an entitlement would effectively create a sub-class of disentitled victims within the wellestablished personal injuries common law and legislative regimes. What is plainly evident and acknowledged from submissions made as well as a review of the case law, is that the class of claimants provided for by the existing legislation in Victoria is very small and as such, represents an extraordinarily small class of potential claimants. In this respect the need for any change is driven by a modest number of interested stakeholders in circumstances where their interests are seen to be greater than any prospective claimant who suffers pure mental harm. It is submitted that the restrictions imposed generally by the Wrongs Act in terms of the impairment threshold requirement and the safeguards provided by the Medical Panel will ensure that only the most serious psychological injuries will attract an entitlement. These restrictions, when coupled with the fact that only a very small class of claimants might seek to claim compensation under the strict liability regime, makes the proposed change unnecessary and unjust, particularly in circumstances where such claimants would be largely blameless and not in a position to protect themselves against such unforeseeable accidents in all but the most unusual scenarios. In that regard the strict liability regime ensures that those best placed to assume the risk of an accident have the incentive to take efficient safety precautions and take out appropriate insurance cover. Conclusions and Recommendations The LIV supports the Commission’s draft recommendations listed below because they will go some way towards restoring balance and addressing barriers that clearly disadvantage significantly injured claimants: reduce the significant injury threshold to 10% for all psychiatric injuries amend the cap on damages for economic loss so that it applies to the gap between pre- and post-injury earnings amend the cap in claims for loss of expectation of financial support so that the deductions for the deceased person’s expenses are to be made before applying the cap increase the maximum amount of damages that may be awarded to a claimant for non-economic loss to align with the cap under the Accident Compensation Act 1985 (Vic). Page 16 The LIV notes that the Commission's existing impairment recommendation of 5% or more relates to spinal injuries only. Whilst this will reduce inequity for some claimants with permanent spinal injuries, the LIV maintains that each of the matters identified in its prior submissions must be addressed to restore equity for claims under the Wrongs Act and to address unduly harsh consequences of the 2003 reforms. In the LIV’s view, the highest priorities for action are: reduce the significant injury threshold to 5% whole person impairment for all physical injuries; and the LIV maintains its long standing submission that a threshold based solely on the AMA Guides is too inflexible and narrow to produce reliably just results. The LIV submits that the 5% physical and 10% psychiatric AMA thresholds should be complemented by a limited narrative test in order to achieve vertical and horizontal equity; and the LIV maintains that the limited additional exemptions to the significant injury threshold proposed in its earlier submissions are warranted and appropriate; and remove the recommendation to require that the assessment of impairment be conducted on the postsurgical condition of the claimant (reversing the decision in Mountain Pine Furniture v Taylor [2007] VSCA 146). The LIV contends that if the recommendation was adopted it would have harsh consequences that may not have been intended, particularly for claimants with limited financial means and who must rely on the public health system, or injured people whose injuries require several surgeries or surgery some years into the future; and remove the recommendation that common law claims arising from the ‘use of’ a motor vehicle are subject to the limitations of the Wrongs Act in regards to caps, thresholds and the prescribed discount rate. In the LIV’s view, if this recommendation was adopted it would significantly reduce rights for people injured in these types of accidents and would create a stark new anomaly in the scheme. Given the magnitude of the reduction of insurance premiums following the 2003 reforms as outlined above, the LIV suggests that action on these priorities will constitute small steps in beginning to rectify an overreach in the initial reforms without making a material difference to the cost of insurance. Further consultation The LIV is committed to working with the Commission and government in the development of any reforms that will facilitate prompt and affordable access to justice for all Victorians. The LIV is available to consult during the Commission’s preparation of the final report if required, and looks forward to conferring with government in its deliberations regarding the final report in due course. Page 17