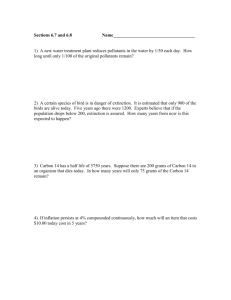

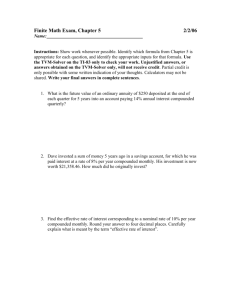

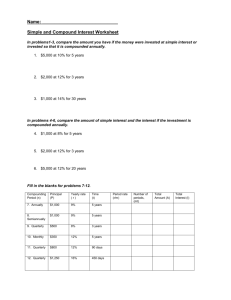

Compound Interest

advertisement