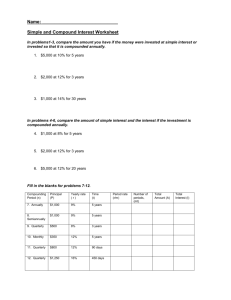

Compound Interest

advertisement