Outline

advertisement

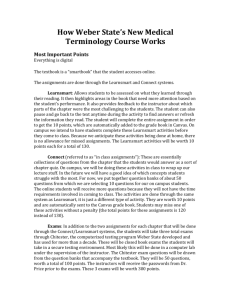

1 Outline Course Introduction to Finance (2FA3) Professors Dr. Arshad Ahmad, AVP Teaching & Learning (arshad@mcmaster.ca) Kevin Brewer, Sessional Lecturer, DSB (kbrewer@mcmaster.ca) Why This Course Is Super-Important Our culture rewards those who create value. The promise of value can raise lots of money instantly, multiply growth opportunities, and generate real cash flows for you and for others. What if you learned the basics of how to value everything? What if you also learned the flip side – how value is destroyed? And deeply understood why the marketplace values some things more than others? In the next 6 weeks, you have a chance to explore issues in financial management that change lives and immerse you in applied settings. Through videos and cases, we will use powerful conceptual frameworks in finance to sort out real (messy) situations and simulate decisions that help each of us to develop a deep understanding of how financial managers think. This might change you and those you care about in ways you never imagined. Welcome to Intro Finance! Goals (Learning Outcomes) This course will enable you to: ● relate an important financial concept or issue to experiences in your daily life or the real world (through blogs, documentaries, animations and music) ● use financial tools to understand how value is created and measured ● communicate with industry professionals who use financial jargon such as a banker or financial manager to evaluate a financial product ● engage with news that matters to you by linking it to value creation (or destruction) through a personal blog ● apply basic concepts to problem-solve individually and collaboratively ● help your peers when they are stuck (and get help when you need it) ● enjoy and have fun with finance! DBS Introduction to Finance (2FA3) – Summer, 2015 2 Grades Coursework Value Practice 25% Due Date Learnsmart Questions (McGraw-Hill Connect) [5%] Noon on class days Knowledge Self Check (best 5 out of 8) [10%] 6:00 pm each class Collaborative Mid-Term [10%] In Class on July 16 Assignments 45% Personal Blog [15%] June 30, July 7, July 14, by noon on class days Interview an Expert [15%] In Class Aug 4 Case Study [15%] In Class July 21 Final exam 30% Total In Class August 6 100% NOTE: Postcard Presentations (No grade but part of the final class celebration on August 4) Schedule ***Important*** Read one chapter in advance for the in-class Quiz and practice Learnsmart Questions where assigned. Date Content June Value Creation (Part I) 23 Introduction Prep/Due Dates Read Ch. 1 9 pm: 30 minute blog set up workshop after class 25 Time Value 9 pm: 30 minte calculator workshop after class Read Ch. 5 Learnsmart Questions K Self Check 1 DBS Introduction to Finance (2FA3) – Summer, 2015 3 June Value Creation (Part I continued) 30 Cash Flows Read Ch. 6 Note: In-Class Blog Group Work Session Learnsmart Questions 9 pm: 30 minute calculator workshop after class K Self Check 2 Blog Post Due 2 Bonds Read Ch. 7 9 pm: 30 minute calculator workshop after class Learnsmart Questions K Self Check 3 7 Stocks Read Ch. 8 Note: In-Class Blog Group Work Session Learnsmart Questions K Self Check 4 Blog Post Due Value Creation (Part II) 9 14 Investment Techniques Optional tutorial for additional help Read Ch. 9 Learnsmart Questions Online learning Capital Invest. Decisions Read Ch. 10 Note: In-Class Blog Group Work Session Learnsmart Questions K Self Check 5 Blog Post Due 16 Review problem solving K Self Check 6 Collaborative Mid-Term + Case Study Prep 21 Case study K Self Check 7 Case Study Due DBS Introduction to Finance (2FA3) – Summer, 2015 4 Value Creation (Part III) July 23 Market Efficiency 28 Optional tutorial for additional help Read Ch. 12 Learnsmart Questions Online learning Risk Read Ch.13 Learnsmart Questions K Self Check 8 30 Options Read Ch 24, 25 Learnsmart Questions Online learning Optional tutorial for additional help August Review 4 The big picture (All Chapters) Interview an Expert Due + Blog Post Due + Postcard Presentations (optional) 6 Final Exam Online Learning Notes: 1. No classes at Mac on July 9, 23 & 30 (learn online). 2. All Quizzes begin at 6:00 sharp. Problem solving in tutorial until 7:00 3. Lectures are between 7:00 – 9:00. 4. You must pass the final to pass the course. Textbook: Fundamentals of Corporate Finance / S. A. Ross ... [et al] - 8th Canadian edition. ISBN 978-0-07-105160-6. McGraw-Hill Ryerson. Case Study: The Super Project, Harvard Business Case. DBS Introduction to Finance (2FA3) – Summer, 2015