Welcome to Accounting 101 - Tacoma Community College

advertisement

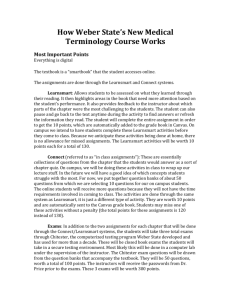

Accounting 101 Fall 2014 1200 ACCT PRACTICAL ACCOUNTING 1 Fall 2014 M-TH 9:30-10:20 AM 5 credits Building16-309 Instructor Sylvia Summers Office location: Adjunct Faculty Center Bldg 18-202 Office hours: Mon-Thurs 12:30 -1:15 p.m. Contact Information (253) 460-4399 ssummers@tacomacc.edu Course Description Introduces students to basic accounting concepts and procedures, emphasizing sole proprietors. Topics include analysis of business transactions and completion of the accounting cycle, including preparation of financial statements. Students will be introduced to computers. PREREQUISITE(S): MATH 085 with a minimum grade of C or better or placement at MATH 090 RECOMMENDED PREPARATION ENGL/ 095 and CU 103 concurrent or prior enrollment or CU 105 concurrent or prior enrollment Welcome to Accounting 101 This course is an exploration of the language of business, accounting. Together we will investigate the inner workings of the field of accounting and in the process, fine tune critical thinking skills to enhance deeper understanding. A variety of instructional methods will be used throughout the course to engage all types of learners and learning styles including: lecture, hands-on activities, group work, and computer assisted learning. Additionally, this class is combined with another Acct 101 class to provide additional teaching and individual support. We pledge to do everything in our power to make this class interesting, relevant, and empowering for you. To this end, we ask for your equal commitment to work hard and be open to learning. Summers – Fall 2014 Accounting 101 1 Upon successful completion of the degree, the student will be able to: Program Learning Outcomes & Degree Learning Outcomes 1. Core of Knowledge (COK) Demonstrate a basic knowledge of each of the distribution areas (Written Communication, Humanities, Quantitative Skills, Natural Sciences and Social Sciences; or, as applicable, specific professional/technical programs), integrate knowledge across disciplines, and apply this knowledge to academic, occupational, civic and personal endeavors. 2. Communication (COM) Listen, speak, read, and write effectively and use nonverbal and technological means to make connections between self and others. 3. Critical Thinking and Problem Solving (CRT) Compare, analyze, and evaluate information and ideas, and use sound thinking skills to solve problems. 4. Information and Information Technology (IIT) Locate, evaluate, retrieve, and ethically use relevant and current information of appropriate authority for both academic and personal applications. 5. Living and Working Cooperatively / Respecting Differences (LWC) Respectfully acknowledge diverse points of view, and draw upon the knowledge and experience of others to collaborate in a multicultural and complex world. 6. Responsibility & Ethics (RES) Demonstrate and understanding of what constitutes responsible and ethical behavior toward individuals, the community, and the environment. Upon successful completion of the program, the student will be able to: 1. Generate accurate financial statements for a company and communicate a company's financial position (COK, COM, CRT). 2. Simulate an accounting department (group process) to prepare accounting documents using automated software to record business transactions for an entity or tax agency, and integrate current regulations (COK, IIT, LWC). 3. Demonstrate analysis of existing documentation to verify the accuracy of information for an entity and perform necessary reconciliations (COK, CRT, IIT, RES). Upon successful completion of the course, the student will be able to: 1. 2. 3. 4. 5. 6. 7. 8. 9. Outline the steps in the accounting cycle. Explain how accounting relates to business and its information needs. Define and apply basic accounting terminology. Illustrate the effects of transactions on the accounting equation. Analyze & interpret source documents to formulate journal entries that record business. Post entries and maintain a ledger of accounts. Prepare a 10-column worksheet and reconcile any differences. Prepare a balance sheet and income statement. PLO: 1 Explain the effects of accrual accounting on the financial statements and the need for adjusting entries. PLO: 3 10. Generate and post-closing entries. 11. Prepare a bank reconciliation, analyze reconciling items, agree to the G/L and review G/L accounts after posting corrections. PLO: 3 Summers – Fall 2014 Accounting 101 2 YOUR STEPS TO SUCCESS To properly learn the discipline of accounting takes a combination of preparation and practice. PREPARE – before class a. Read the assigned chapter. b. Take notes (note-taking guides available in Canvas). c. Meet with a (BEC) tutor in 16-308 to “preview” a topic. d. Make a list of new terms. e. Write down any questions for class. BE PRESENT – physical and mentally a. Attend class. b. Put phones away. c. Bring chapter notes to class. d. Participate in class & group discussions. e. Ask questions. PRACTICE – touch the material often f. Complete all the assigned homework. g. Use available resources at the BEC or WTC (Writing & Tutoring Center) REVIEW – touch the material again h. Review for the test the night before review day. i. Review the material again after the class review. Student Resources BUSINESS EDUCATION CENTER (BEC) .................................... (253) 460-4411 WRITING & TUTORING CENTER (WTC) .................................. (253) 566-6032 MATH LAB ............................................................................. (253) 566-5142 CAREER CENTER .................................................................... (253) 566-5027 COUNSELING CENTER ........................................................... (253) 566-5122 JOB ASSISTANCE CENTER ...................................................... (253) 566-5191 EMPLOYMENT SECURITY SERVICES ...................................... (253) 566-5146 CHILDREN’S CENTER .............................................................. (253) 566-5180 Required Textbooks & Supplemental Materials COLLEGE ACCOUNTING, A Contemporary Approach by Haddock, Price, Farina 3rd edition CONNECT software by McGraw-Hill Irwin Note: You can start using CONNECT’s Free 21-day Trial right away, but you must purchase the software before the expiration date to retain your work. Option 1: e-Textbook Purchase the required CONNECT software online and receive full access to class materials plus the e-Textbook. Option 2: Hardbound & e-textbook Purchase a new hardbound textbook at the TCC bookstore and receive a CONNECT registration code for full access to class materials and the e-textbook. Option 3: Used hardbound & e-Textbook Purchase a used hardbound textbook (with no registration code). Additionally purchase the software from the CONNECT website for full access to class materials and an e-textbook. Summers – Fall 2014 Accounting 101 3 Supplies Calculator (printing calculators are best), ruler (straight-edge), USB Drive, and binder for in-class company forms. Each project group will need one binder for submitting the project (one binder per team). This course requires internet access and the use of a computer. Computers for your use are available in the Info Commons (Bldg 16) along with receive software assistance. Technology Avoid problems = use FIREFOX BROWSER!!!! Canvas CANVAS is an online classroom management program through which you will complete your PRECHAPTER QUIZES, and HOMEWORK. It is where I will post your grades weekly. Additionally Canvas contains vital information (syllabus, schedule, assignments, and supplementary materials) and allows you to contact your classmates and/or instructor. CONNECT You will use CONNECT to complete and submit your homework and take tests. McGraw-Hill’s CONNECT is a web-based assignment and assessment software. It is required supplement for this course. Getting started with CONNECT 1. Open website shown below http://connect.mheducation.com/class/s-summers-sylvias-acct-101-fall-2014 2. Click REGISTER NOW 3. Enter your email address (personal or TCC) and click SUBMIT 4. Enter your registration code*. Note: You can start using CONNECT’s Free 21-day Trial right away, but you must purchase the software before the expiration date to retain your work. Support CONNECT Support & Tips: If you have any issues while registering or using CONNECT, the McGraw-Hill CARE team is available to help (see below) “Student Quick Tips” guide is available in Canvas under the Resource tab Summers – Fall 2014 BE WISE - Avoid unexpected technical issues by completing assignments early. Visit: http://mpss.mhhe.com/ Call: (800) 331-5094 Visit Troubleshooting and Customer Service links on the bottom of every page in Connect for immediate help. Accounting 101 4 Class Format This class brings together traditional and hybrid-online students into one learning environment for the purpose of giving students the greatest flexibility with learning and time. Class lectures will be presented by your instructors, Sylvia Summers, and the hybrid-online instructor, Annalee Rothenberg. Students from both classes will work together in class and may even chose to team together. Assignments READ – To be properly prepared to engage in discussions, it is necessary for you to read the assigned chapter before coming to class. Read the assigned chapter before class on Mondays. COMPLETE LEARNSMART study module including the quiz: This is due before coming to class on Monday. TAKE THE IN-CLASS WEEKLY QUIZZES Typically quizzes will be taken on Mondays and will be based on information gained from the assigned chapter. It is important that you complete read the assigned chapter and complete LearnSmart before the taking the quiz. PARTICIPATE – While not graded, your participation is necessary to be successful. It is through discussing accounting principal that a solid understanding is gained. TAKE NOTES –for your personal use and are not turned in. OPTIONAL LEARNING ACTIVITIES –Various learning exercises are available in Canvas to provide you with a deeper understanding of the material. Please enjoy them. They just for your use and not graded. COMPLETE HOMEWORK – To understand how accounting works, it takes more than just reading about it. The more you “touch” accounting, the easier it will become to understand. You will complete your homework using the CONNECT program. Weekly homework is due on Thursdays by 11:55 p.m. Late work is not accepted. SAVE - If you want to do more work later, click SAVE. SUBMIT - If you are finished, click SUBMIT. TAKE EXAMS – Tests are not intended to “get you.” Rather they are helpful a way of measuring your understanding. Because accounting builds on itself, you need to know you have a solid understanding of the current concept before moving on to the next concept. Exams may be taken early but they may not be taken late Unfortunately, there are no makeup exams Traditional Exams (Sylvia’s) students will take their exams in class on Fridays. Hybrid Exams (Annalee’s) students will take their tests online by Friday 11:55 PM. Summers – Fall 2014 Accounting 101 5 COMPLETE MINI-PRACTICE Set 1: Service Business Accounting Cycle located in the textbook between Chapters 6 and 7. Each 3-person group is responsible for creating and maintaining ONE Team Project Binder. Please note you will need to use a basic Excel spreadsheet to complete this project. This project will be mostly completed outside of class. FINAL= A JOB SHADOW – Job shadowing provides an opportunity for you to go to get a “real-life” look into the field of accounting. Additional information regarding this assignment can be found Canvas starting Week 4. This assignment is your final for this class. It is due in Week 11. Evaluation Criteria & Grading Standards The table below shows how points are assigned to each graded element of the class. Quantity 9 1 9 9 1 1 1 1 5 1 1 Assignment In-class quizzes LearnSmart – Chapter 1 LearnSmart – Chapters 2-10 Chapter Homework Group Project (Practice Set) Exam-1 Exam-2 Exam-3 Exams (4, 5, 7-10) Midterm Final = Job Shadow Total points Points 20 5 20 50 100 50 60 75 100 200 100 = = = = = = = = = = = Total points 180 5 180 450 100 50 60 75 600 200 100 2000 Grades are calculated based on how many of the 2,000 points available have been earned by the completion of the course. (see the Extra Credit section regarding earning additional points) Letter grades are assigned based the percentage of the total points earned. The table below shows the grade assigned to each range of percentages. For example if a student earns 1,730, their grade would be calculated as follows: 1,730 2,000 = .865 = 87% = B+ 95-100% = A 90-94.9 % = A- Extra Credit 87-89.9% = B+ 84-86.9% = B 80-83.9% = B- 77-79.9% = C+ 74-76.9% = C 70-73.9% = C- 67-69.9% = D+ 64-66.9% = D 64-below = E We want you to be successful! If you are finding you are not able to grasp one or more of the concepts being presented in this class, don’t panic. This is NOT a reflection upon your intelligence, but rather an indication more support or time is needed. Accounting is a skill and like any other skill, it comes easy to some and more difficult to others. With the right help you and anyone else can master accounting skills. We believe this so strongly Summers – Fall 2014 Accounting 101 6 that we award extra credit points to those who seek out the help of the excellent tutors in the BEC or WTC (Writing and Tutoring Center.) Each time you visit a tutoring center (BEC or WTC), you will earn one extra credit point. There is no limit to the number of extra credit points you can earn. These points will be recorded based on your Tutor Trak attendance – be sure to sign in each time you visit one of the TCC tutoring centers. Instructor support is available before class on Tues & Thurs from 8:20-9:20 a.m. in the Business Education Center (BEC) Policies Academic Dishonesty & Student Conduct Withdrawal Policy: The College provides for withdrawal without the signature of the instructor up until 10th calendar day. While faculty permission is not required, a completed add/drop form must be submitted to Registration and Records to complete drops from the 11th instructional day through the 55th calendar day of the quarter” Before considering taking a “W” grade, please discuss other possible options with me. If you are on financial aid, it is also strongly advised that you talk with the Financial Aid Office before making any changes in the number of credits in which you are enrolled. TCC Students are expected to be honest and forthright in their academic endeavors. Academic dishonesty is inconsistent with the values and mission of Tacoma Community College. Cheating, plagiarism, and other forms of academic dishonesty are violations of the Code of Student Conduct. Sanctions for acts of academic dishonesty committed in this course are as follows: As stated in the TCC Catalog, ‘Students are expected to be honest and forthright in their academic endeavors. Cheating, plagiarism, fabrication or other forms of academic dishonesty corrupt the learning process and threaten the educational environment for all students.(pg. 33) In this course, sanctions for academic dishonesty will be as follows: If a student in this class is caught cheating on an exam, test, assignment, or project, that student will receive a 0 for that assignment. If the student cheats a second time he/she will receive an E for the course. Admission to Tacoma Community College carries with it the expectation that the student will conduct himself/herself as a responsible member of the academic community and observe the principles of mutual respect, personal and academic integrity and civility. The Code of Student Conduct establishes rules governing academic and social conduct of students, including due process rights. Violations of the Code may result in dismissal from class for the day and/or referral to the Student Conduct Administrator for sanctions. Accommodations Students with Disabilities: If you need auxiliary aids or services due to a disability, please contact the Access Services office in Building 7 (253-566-5328). Accommodations are not retroactive; please act promptly to make sure your letter of accommodation is in place. Students with Special Needs: All students are responsible for all requirements of the class, but the way they meet these requirements may vary. If you need specific auxiliary aids or services due to a disability, please contact the Access Services office in Building 7 (253566-5328). They will require you to present formal, written documentation of your disability from an appropriate professional. When this step has been completed, Summers – Fall 2014 Accounting 101 7 arrangements will be made for you to receive reasonable auxiliary aids or services. The disability accommodation documentation prepared by Access Services must be given to me before the accommodation is needed so that appropriate arrangements can be made. Classroom Policies Assignments, quizzes, & exams are due on the day indicated in the calendar Late submissions, make-up tests and incompletes grades (“I”) are not available. Etiquette for Classroom Dispute Resolution If you have questions or concerns about this class or me, please come to talk with me first. If we are unable to resolve your concerns, you may talk next with the Dean Krista Fox, at 253-566-5147 or kkfox@tacomacc.edu. The Dean can assist with information about additional steps, if needed. Students who believe they have received a final course grade that has been awarded improperly or in an arbitrary or capricious manner may grieve or appeal the grade. Details of the process are located on the TCC Portal at : https://my.tacomacc.edu/uPortal/p/StudentForms.ctf9/max/render.uP?pCm=view&pP_N SHistoryParam=21426%2C21435%2C21435%2C26224&pP_struts.portlet.action=%2Fview %2Findex&pP_ticket=ST-215398-bcm1AKn0zYfxmqTwgrVm-portalsvr2.tccnet.edu Caveats Inclement Weather This syllabus and schedule are subject to change in the event of extenuating circumstances. If you are absent from class, it is your responsibility to check for announcements made while you were absent. This syllabus and schedule are subject to change in the event of extenuating circumstances. If you are absent from class, it is your responsibility to check for announcements made while you were absent. If you are absent from class, it is your responsibility to check with your teammates on announcements made while you were absent. If you are unsure if classes are being held due to inclement weather, please call the campus operator (253) 566-5000, or go to www.tacomacc.com and click on Weather Closure Information. If the College is closed for any reason, no classes will be held. Tacoma Community College Fall 2014 Academic Calendar Summers – Fall 2014 Accounting 101 8 THE BOTTOM LINE College is the beginning of wisdom, not the end; Learning how to learn is a life-long endeavor An Outstanding Student The “A” Student Attendance: “A” students have virtually perfect attendance. Their commitment to the class resembles that of the teacher. Preparation: “A” students are always prepared for each class. They always read the assignments. Their attention to detail is such that they occasionally catch the teacher in a mistake. They often serve as leaders of the activities of the group Curiosity: “A” students show interest in the class and in the subject. They look up or dig out what they don’t understand. They often ask interesting questions or make thoughtful comments. Retention: “A” students have retentive minds. They are able to connect past learning with present and apply theory to reality on a daily basis, not just during testing. Attitude: “A” students have a winning attitude. They consistently demonstrate determination and self-discipline for success. They show initiative and do things they have not been told to do in order to master the material. Talent: “A” students demonstrate something special call it insight, intellect, foresight, etc. – they make their creativity, organizational skills and motivation evident to the teacher and to their group members. Results: “A” students both participate and make positive, insightful and analytical contributions to the class and in their groups. Their work is a pleasure to grade, and is often a source of group pride. An Average or Adequate Student The “C” Student Results Attendance: “C” students miss class three or more times a month. They put other priorities ahead of academic work. Their other diversions (work, sports, socializing, family activities, etc) render them physically or intellectually unable to keep up with the demands of high level performance. Preparation: “C” students prepare their assignments fairly consistently, but in a perfunctory manner. Their work is sloppy or careless. At times it is incomplete or late. They generally rely on others in their group to do most of the work, contributing their opinions and a small degree of preparation and forethought. Attitude: “C” students are not visibly committed to the class. They participate without enthusiasm. Their body language often expresses boredom. Their group participation is replete with socializing, small talk and opinion rather than focus and analysis. Talent: “C” students vary enormously in talent. Some have exceptional ability, but show undeniable signs of poor self-management or bad attitudes. Others may be very diligent, but just adequate in mastering material or learning in this setting. A*” students are secure in their accounting knowledge and are ready to move on to higher level classes. They know they are capable of learning at college-level and posses the fortitude necessary to be successful in attaining their goals. They are confident in themselves knowing they have accomplished a goal that took hard work and determination. Their sense of pride has more to do with a feeling of empowerment than being an “A” student. They are now ready to set their sights on even greater accomplishments understanding that success breeds success. *While it is important to always strive to do your best, it is equally important to remember grades are one element of achievement and not the sole measure of course mastery or your true commitment to learning. Summers – Fall 2014 Accounting 101 9 ACCOUNTING 101 FALL 2014 CALENDAR Chapter reading & LearnSmart due Mondays before class*. CONNECT homework due Thursdays by 11: 55 PM *except Week 1 Weeks Dates 9-22 WEEK 1 9-23 The Language of Business 9-24 9-29 LearnSmart & Ch 2 In-Class Quiz 10-1 WEEK 4 WEEK 5 Adjustments and the Worksheet WEEK 6 Closing Entries & Post-closing Trial Balance WEEK 7 Accounting for Sales, AR,& Cash Receipts LearnSmart & Ch 1 In-Class Quiz Ch 1 test – in class 9-30 Analyzing Business Transactions Read Ch 1 before arriving to class 9-26 WEEK 2 Analyzing Business Transactions using T Accounts Additional Assignments/Notes 9-25 Analyzing Business Transactions WEEK 3 Assignments Orientation to class 10-2 Ch 2 homework by 11:55 p.m. 10-3 Ch 2 test – in class 10-6 LearnSmart & Ch 3 In-Class Quiz SEE CONNECT 10-7 10-8 10-9 Ch 3 homework 10-10 Ch 3 test SEE CONNECT 10-13 LearnSmart & Ch 4 In-Class Quiz Job Shadow opens in Canvas 10-14 10-15 10-16 Ch 4 homework 10-17 Ch 4 test 10-20 LearnSmart & Ch 5 In-Class Quiz Begin work on Mini-Practice set—group project. Meet outside of class 10-21 10-22 EDUCATIONAL PLANNING-NO SCHOOL 10-23 Ch 5 homework 10-24 Ch 5 test 10-27 LearnSmart & Ch 6 In-Class Quiz 10-28 10-29 10-30 Ch 6 homework 10-31 Mid-term test 11-3 LearnSmart & Ch 7 In-Class Quiz 11-4 11-5 11-6 11-7 Summers – Fall 2014 Ch 7 homework Ch 7 test Accounting 101 10 WINTER 2014 Accounting 101 Calendar ~continued~ WEEK 8 Accounting for Purchases, AP,& Cash Payments WEEK 9 Cash WEEK 10 Payroll Computations, Records & Payments GROUP PROJECT DUE 11-10 LearnSmart & Ch 8 In-Class Quiz 11-11 VETRANS’ DAY HOLIDAY- NO CLASS 11-12 11-13 Ch 8 homework 11-14 Ch 8 test 11-17 LearnSmart & Ch 9 In-Class Quiz 11-18 11-19 11-20 Ch 9 homework 11-21 Ch 9 test 11-24 NO CLASS –WORK ON JOB SHADOW 11-25 NO CLASS –WORK ON JOB SHADOW 11-26 THANKSGIVING 11-27 CAMPUS CLOSED 11-28 12-1 LearnSmart & Ch 10 In-Class Quiz 12-2 12-3 WEEK 11 12-4 Ch 10 homework 12-5 Ch 10 test 12-8 Final - Job Shadow Paper Due by 9:30 a.m. on OR before DECEMBER 8 in Canvas please. Final ACCOUNTING 101 AMNESTY CARD Name: ____________________________________________________ Check one chapter you wish to omit. ______ 2 _______ 3 _________ 4 ______ 7 _______ 8 _________ 9 ________ 5 Submit during: Week 10 Summers – Fall 2014 Accounting 101 11