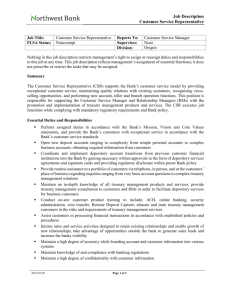

CIT7852 Whitepaper Final 3.indd

advertisement