VA Handbook H26-94-1 Veterans Benefits

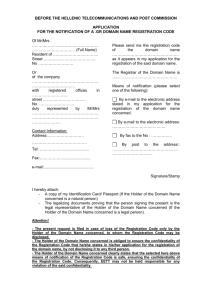

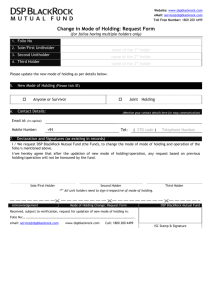

advertisement