Applications_assignm..

advertisement

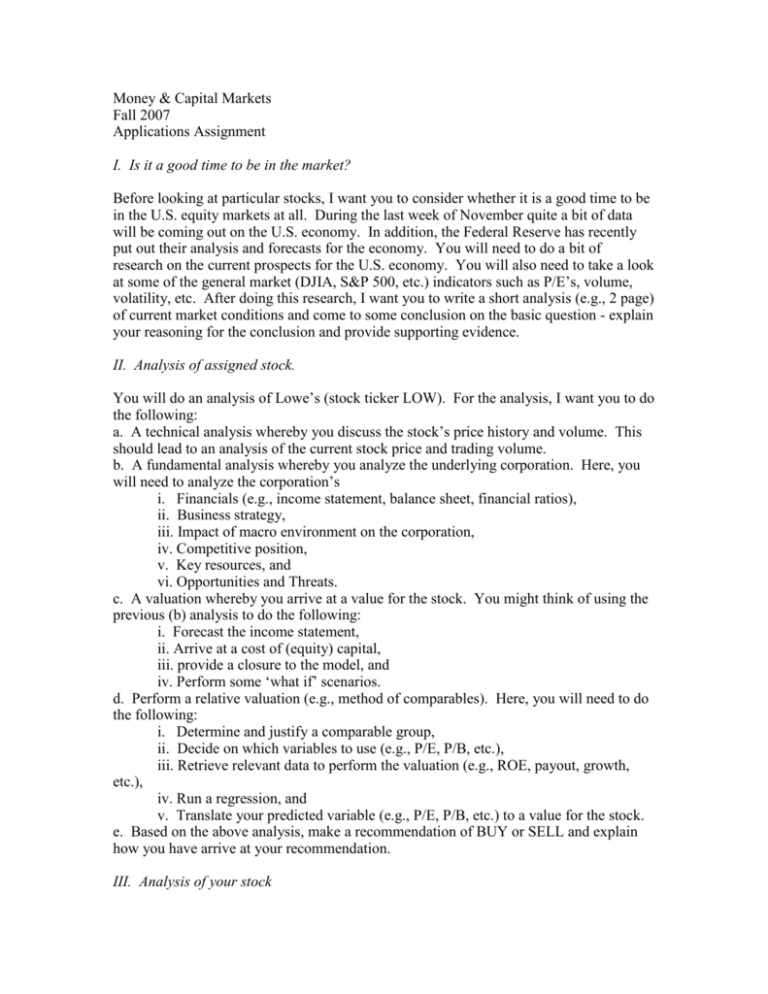

Money & Capital Markets Fall 2007 Applications Assignment I. Is it a good time to be in the market? Before looking at particular stocks, I want you to consider whether it is a good time to be in the U.S. equity markets at all. During the last week of November quite a bit of data will be coming out on the U.S. economy. In addition, the Federal Reserve has recently put out their analysis and forecasts for the economy. You will need to do a bit of research on the current prospects for the U.S. economy. You will also need to take a look at some of the general market (DJIA, S&P 500, etc.) indicators such as P/E’s, volume, volatility, etc. After doing this research, I want you to write a short analysis (e.g., 2 page) of current market conditions and come to some conclusion on the basic question - explain your reasoning for the conclusion and provide supporting evidence. II. Analysis of assigned stock. You will do an analysis of Lowe’s (stock ticker LOW). For the analysis, I want you to do the following: a. A technical analysis whereby you discuss the stock’s price history and volume. This should lead to an analysis of the current stock price and trading volume. b. A fundamental analysis whereby you analyze the underlying corporation. Here, you will need to analyze the corporation’s i. Financials (e.g., income statement, balance sheet, financial ratios), ii. Business strategy, iii. Impact of macro environment on the corporation, iv. Competitive position, v. Key resources, and vi. Opportunities and Threats. c. A valuation whereby you arrive at a value for the stock. You might think of using the previous (b) analysis to do the following: i. Forecast the income statement, ii. Arrive at a cost of (equity) capital, iii. provide a closure to the model, and iv. Perform some ‘what if’ scenarios. d. Perform a relative valuation (e.g., method of comparables). Here, you will need to do the following: i. Determine and justify a comparable group, ii. Decide on which variables to use (e.g., P/E, P/B, etc.), iii. Retrieve relevant data to perform the valuation (e.g., ROE, payout, growth, etc.), iv. Run a regression, and v. Translate your predicted variable (e.g., P/E, P/B, etc.) to a value for the stock. e. Based on the above analysis, make a recommendation of BUY or SELL and explain how you have arrive at your recommendation. III. Analysis of your stock For this part, you will choose a stock to analyze. You will need to repeat the process of II for your stock. In addition, I want you to provide an explanation of how you arrived at your choice. This is an important step. I don’t want you to simply use one of the many Internet sites (e.g., stock picker) or television pundits (e.g,. Jim Cramer). Rather, I want you to really think about how to arrive at a stock to analyze. For example, Darmodaran provides plenty of historical information that might lead you to consider a class of stocks (e.g., low P/E, various growth stocks, etc.), then you can use a stock screener to arrive at a particular stock. Your report for this stock should begin with a detailed account of how you arrived at your stock pick. Grading and due dates. Part I. 20 points. Due December 4 by the beginning of class. Part II. 40 points. Due December 6 by the beginning of class. Part III. 40 points. Due December 11. The due dates for the first two parts are firm deadlines - nothing late will be accepted!!! We will spend part of class time discussing each of these, which is why the due dates are important. You may choose to work in a small group for the first two parts. However, the third part must be your own work. If you choose to work together, then please hand in the results as a group.