4.2 Financial Statement Basics Exercises1

advertisement

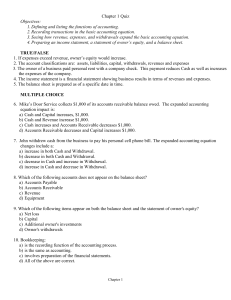

The BASICS of FINANCIAL STATEMENTS For Agricultural Producers EXERCISES Authors: James McGrann Francisco Abelló Doug Richardson Christy Waggoner Department of Agricultural Economics Texas Cooperative Extension Texas A&M University May 19, 2003 The Basics of Financial Statements Exercises Instructions This section contains a series of questions and exercises used to gain a better understanding of the basic concepts behind financial statements. The questions and exercises addressed in this section focus on the four main financial statements: (1) Balance Sheet; (2) Income Statement; (3) Statement of Cash Flows; (4) Statement of Owner’s Equity. Each of these statements combine the tools that can be used to evaluate the performance and provide other useful information to better guide decision making in a farm or ranch business. The first set of exercises is a list of multiple choice and fill in the blank questions that help identify the main components of the four different financial statements. These questions should also allow the user to understand what the differences and similarities are between each of the statements and how this can serve as a basis for communication about the performance of a business. The second set of exercises allow the user to piece together an actual set of financial statements by using the information provided from an example ranch business. The West Texas Ranch, in this case, has a list of accounts associated with each of the four main financial statements. It is required that the user places each account into its proper classification within each financial statement. The last page of this exercise contains the information necessary to calculate the performance ratios of the business. The basic goal of this exercise is to be able to identify proper placement of each of the accounts associated with their respective financial statements. If done properly, the numbers used in calculating the financial ratios should match up with some of the ones generated from the financial statements. Multiple Choice and Fill in the Blank Questions 1) Complete the following sentences. a) What the business has: . b) How much the business owes: ________. c) What the business is worth: _________. 2) Circle each of the following equations that are correct. (A = Assets, L = Liabilities, E = Equity) a) E = A – L b) A = E + L c) A = E – L d) E = A + L e) L = A – E Table 1. Assets Liabilities Current Non-Current Accrued Expenses Long Term Investments. Accrued Interest - Non Real Estate Loans and Notes Raised Breeding Stock Investments in growing and finishing livestock Government Payment Receivable Credit Card/ Oper. Loan/ Curr. Note Payable Purchased Breeding Stock. Prepaid Expenses Crops/Raised Feed for Sale. Cash & Checking Breeding Horses Accounts Receivable. Principal Due - Non Real Estate Loans and Notes Savings and Time Deposits Income Taxes Payable Accounts Payable Principal Balance- Non Real Estate Loans and Notes 3) In the table above, mark which of the accounts are assets or liabilities, and if they are current or non-current. 4) How are assets displayed in the asset section of the balance sheet? a) Ascending order of liquidity b) Descending order of amount c) Ascending order of amount d) Descending order of liquidity e) By order of practicality 2 5) Which account identifies money owed to the business but has yet to be collected. a) Cash and Checking b) Supply, Prepaid Expenses and Leases c) Investments, Bonds and Securities d) Accounts Receivable e) Saving and Time Deposits 6) Circle each of the following that are included as Current Inventory Assets? a) Livestock for Sale b) Crops / Raised Feed for Sale c) Purchased Breeding Stock d) Vehicles, Machinery & Equipment e) Raised or Purchased Feed, intended to be used in livestock production. 7) Which describes prepaid expenses? a) Supplies Received b) Bills paid, but services not yet received c) Current Assets that can be turned into cash 8) Complete the following sentences that describe the Current Asset Cycle. a) Inventory when sold becomes _______. b) Accounts receivable upon collection becomes _________. c) Cash buys inputs that produce ________. 9) Which of the following is the main characteristic that describes a non-current asset? a) Represent a great amount of money for the business. b) Converted into cash in less than 12 months. c) Not converted into cash during the normal course of the business. d) Assets that are intended for sale. 10) How is a non-current asset reported on the balance sheet? a) Non Current Asset at cost – Year depreciation b) Non Current Asset at market value – Year depreciation c) Non Current Asset at market value – Accumulated depreciation d) Non Current Asset at cost – Accumulated depreciation 11) Complete the following definitions. a) ________ depreciation (on the balance sheet) is the _________ of all the depreciation charges taken since the asset was _______ . b) Depreciation charges taken in a period ________ profits for the period, but do not _________ cash. 3 12) How are liabilities categorized for presentation on the balance sheet? (Circle all that apply) a) To whom the debt is owed. b) Ascending order of liquidity c) Descending order of liquidity d) By order of practicality 13) Complete the following sentences. (Use increase or decrease) a) Current liabilities decrease, and/or current assets increase, when working capital ________ in the normal course of the business. b) Current assets decrease, and/or current liabilities increase, when working capital ________ in the normal course of the business. 14) Which of the following are components of owner’s equity? (Circle all that apply) a) Retained Earnings b) Capital Contributions c) Land d) Cash 15) Which of these equations is correct for Retained Earnings (RE)? a) RE = Sum of all profits + Capital contributions – Capital Distributions b) RE = Sum of all profits – Sum of all dividends or withdrawals c) RE = Equity + Sum of all dividend d) RE = Sum of all profits + Sum of all dividends or withdrawals 16) Complete the following sentences. (Use increase or decrease) a) The value of owner’s equity ________ when the business makes a profit, thereby increasing retained earnings; or assets ________ more than liabilities. b) The value of owner’s equity ________ when the business has a _________ , thereby lowering retained earnings; or assets _______ more than liabilities. 17) Which of these statements are true about the income statement? a) It includes cash and non-cash values. b) Is calculated after taxes. c) Used to measure the change of Owner Equity. d) Used to measure Net Income. e) Government payments would not be included f) It enables the farm operator to know the sources of income. 18) How do we organize the income statement? a) Assets and liabilities. b) Currents and non current assets, and current and non-current liabilities. c) Cash for operations, cash for investments and expenses. d) Revenues and expenses 4 19) Complete the following equation. (Using +, - or =) What is sold in the period ( ) What it cost to make ( ) General & Administrative expenses for the period ( ) Income for the period 20) Which of these items belong to the Cash Receipt Account? (Circle all that apply) a) Inventory & Accounts Receivable Change b) Raised Livestock Products c) Steers transferred out to another business entity d) Cash received from the sale of products e) Vet services f) Gain (Loss) on Sale/Death of Breeding Livestock g) Agricultural Program Payments h) Crops/Raised Feed Sales. 21) Which of these accounts would be included in calculating the total Operating Expense? (Circle all that apply) a) Inventory change (Expenses). b) Gains or Losses from breeding stock. c) Repairs and Maintenance. d) Feed. e) Depreciation f) Accounts Receivable 22) Which of these equations is correct? a) Net income from operations = Gross Revenue – Operating Expenses + Interest b) Net income from operations = Gross Revenue – Operating Expenses + Capital Gain or Losses – Taxes c) Net income from operations = Gross Revenue – Operating Expenses – Interest d) Net income from operations = Gross Revenue – Operating Expenses + Interest + Capital Gain or Losses – Taxes 23) Which of these equations is correct on the Statement of Cash Flows? a) Net cash from financing = New borrowings – Debt Payments – Interest Expense b) Net Cash from operations = Receipts – Expenses – Interest Expenses – Taxes c) Net Cash from investing = Sales – Purchases – Expenses d) Net Cash from investing = Sales – Purchases – Depreciation 24) Complete the following equation with (+ / –) signs that are missing. Cash on hand at the start of the period ( ) Cash received in the period ( Cash spent during the period = Cash on hand at the end of the period. 5 ) 25) In which financial statements do non-cash transactions have an effect? (Circle all that apply) a) Balance Sheet b) Income Statement c) Statement of Cash Flows d) Statements of Owner’s Equity 26) Based on the Statement of Cash Flows, label each of the followings as a source of Cash Inflows (CI) or Cash Outflows (CO). a) Receiving payments from customers. _____ b) Borrowing money. _____ c) Paying interest and principal on debt. _____ d) Paying for Supplies and employees. _____ e) Making major capital investment in long-lived productive assets like breeding stock or farm machinery. _____ f) Paying Income Taxes. ______ g) Sales of breeding stock. ______ 27) Cash receipts, cash expenses, cash interest expenses and cash tax expenses on the Statement of Cash Flow must match data with which other financial statements? a) Balance Sheet b) Income Statement c) Statement of Owner Equity 28) Complete the following sentence. The Statement of Owner’s Equity reconciles the _______ and _______ owner’s equity through determining the changes in _______ , and net change in capital contributions and distributions. 29) “Beginning owner equity” on the Statement of Owner’s Equity must match data with which other financial statements? a) Balance Sheet b) Income Statement c) Statement of Cash Flows 30) The ending owner’s equity on the Statement of Owner’s Equity could be compared to the owner’s equity calculated from the …. a) Balance Sheet b) Income Statement c) Statement of Cash Flows 6 31) From which of the main financial statements give the data required to calculate the following ratios? a) Current Ratio _____. b) Return on Equity _____. c) Debt-to-Asset Ratio _____. d) Equity-to-Asset Ratio _____. e) Return on Assets _____. 32) The following definitions describe either profitability, liquidity or solvency. Label each of the following definitions with the correct performance measure. a) Ability of the business to generate sufficient cash to meet cash demands without disturbing the on-going operation of the business. _______ b) Ability of the business to generate income in excess of expenses. _______ c) Ability to repay all financial obligations if all assets were sold and ability to continue operations as a viable business after a financial adversity. _______ 7 The West Texas Ranch BASIC BALANCE SHEET ASSETS Current Assets A B C D A+B+C+D=E $ - Net Non-Current Assets F G H (F - G) + H = I $ - Total Assets E+I=J $ - K L M N K+L+M+N=O $ - LIABILITIES Current Liabilities P Q Non-current Liabilities P+Q Total Liabilities O+P+Q=R $ - J-R=S $ - R+S=T $ - EQUITY Owner's Equity Total Liabilities & Equity Accounts Payable Accounts Receivable Accrued expenses Inventory Non Current Liabilities Land Debt Current Portion of debt Non Current Assets at cost Cash Accumulated Depreciation Prepaid expenses Land Income Taxes Payable West Texas Ranch $ $ $ $ $ $ $ $ $ $ $ $ $ 8 1,700.00 1,000.00 2,900.00 10,000.00 176,371.00 9,737.00 496,380.00 77,526.00 71,870.00 2,000.00 1,500,000.00 - BASIC INCOME STATEMENT GROSS REVENUE TOTAL Gross Revenue A B C A+B+C=D $ - E F G H I J K E+F+G+H+I+J+K=L $ - M D - (L + M) = N $ EXPENSES Total Operating Expense Net Income from Operations - O P NET INCOME N+O-P=Q $ - West Texas Ranch Total Utilities Depreciation Non Cash Transfer out Capital Gains (Losses) Labor Veterinary Taxes $ $ $ $ $ $ $ 10,193.00 32,870.00 48,000.00 (13,364.00) 48,000.00 5,825.00 10,500.00 Inventory Change (Expenses) Interest Expense Repairs and Maintenance Cash Receipts Feed Inventory & Accounts Receivable Change $ $ $ $ $ $ 5,470.00 18,454.00 38,629.00 175,838.00 23,400.00 2,900.00 9 BASIC STATEMENT OF CASH FLOWS CASH FROM OPERATIONS TOTAL Net Cash From Operations A B C D A-B-C-D=E $ - F G F-G=H $ - I J I-J=K $ - $ - CASH FROM INVESTING Net Cash From Investing CASH FROM FINANCING Net Cash From Financing L M NET CASH FLOW E+H+K-L+M=N West Texas Ranch Total Purchases Debt Payments Interest Expenses Cash Contributions Taxes Cash Withdrawals Sales Expenses $ $ $ $ $ $ $ $ 28,000.00 8,933.00 18,464.00 10,500.00 34,636.00 131,517.00 New Borrowings Receipts $ $ 175,838.00 10 BASIC STATEMENT OF OWNER'S EQUITY RETAINED EARNINGS TOTAL A B A-B=C $ - E F G E+F+G=H $ - Total I J K I+J+K=L $ - Net Change in Capital H-L=M $ - N C+M=O N+O=P $ $ - Net Change in Retained Earnings CAPITAL CONTRIBUTIONS Total CAPITAL DISTRIBUTIONS OWNER EQUITY RECONCILIATION Total Equity Change Ending Owner Equity - West Texas Ranch Total Withdrawals Beginning Owner Equity Capital Distributions Cash & Investment $ $ $ - Building, Machinery & Equipment Land Capital Contribuitons Cash & Investment Building, Machinery & Equipment Land $ $ - $ $ $ 30,000.00 - Net Income $ 20,033.00 11 1,760,095.00 RATIOS RETURN ON ASSETS (ROA) Return on Assets A B C (A + B) / C = D $ - A E A/E=F $ - G H G/H=I $ - J C J/C=K $ - E C E/C=M $ - $ $ $ $ $ $ $ Total 83,426.00 11,437.00 197,808.00 2,007,936.00 1,810,128.00 80,897.00 18,454.00 RETURN ON EQUITY Return on Equity CURRENT RATIO Current Ratio DEBT-TO-ASSET RATIO Debt-to-Asset Ratio EQUITY-TO-ASSET RATIO Equity-to-Asset Ratio West Texas Ranch Total Current Assets Total Current Liabilities Total Liabilities Total Assets Total Equity Net Income from Operations Interest Expenses 12 The BASICS of FINANCIAL STATEMENTS For Agricultural Producers ANSWERS 13 14 Answers Multiple choice and fill in the blank questions. 1) a) assets b) liabilities c) equity 2) a, b, e 3) Assets Accrued Expenses Long Term Investments. Accrued Interest - Non Real Estate Loans and Notes Raised Breeding Stock Investments in growing and finishing livestock Government Payment Receivable Credit Card/ Oper. Loan/ Curr. Note Payable Purchased Breeding Stock. Prepaid Expenses Crops/Raised Feed for Sale. Cash & Checking Breeding Horses Accounts Receivable. Principal Due - Non Real Estate Loans and Notes Savings and Time Deposits Income Taxes Payable Accounts Payable Principal Balance- Non Real Estate Loans and Notes 4) 5) 6) 7) 8) d d a, b, e b a) Accounts Receivable b) Cash c) Inventory 9) c 10) d 11) a) Accumulated; sum; first acquired b) decrease; decrease 12) a, c 13) a) increase b) decrease 14) a, b 15) b 16) a) increases; increase b) decreases; decrease 17) a, b, d, f 15 Liabilities x Current x x x x x x x x Non-Current x x x x x x x x x x x x x x x x x x x x x x x x x x x 18) d 19) (-), (-), (=) 20) b, d, g, h 21) a, c, d, e 22) c 23) b 24) (+), (-) 25) a, b, d 26) a) CI b) CI c) CO d) CO e) CO f) CO g) CI 27) b 28) Beginning; ending; retained earnings; contributed capital; distributed capital 29) a 30) a 31) a) Balance Sheet b) Balance Sheet and Income Statement c) Balance Sheet d) Balance Sheet e) Balance Sheet, Income Statement 32) a) Liquidity b) Profitability c) Solvency 16 The West Texas Ranch BASIC BALANCE SHEET ASSETS Cash Accounts Receivable Inventory Prepaid expenses Current Assets $ $ $ $ $ Non Current Assets at cost Accumulated Depreciation Land Non Current Assets Total Assets $ 496,380.00 $ 71,870.00 $ 1,500,000.00 $ 1,924,510.00 $ 2,007,936.00 LIABILITIES Accounts Payable Accrued expenses Current Portion of debt Income Taxes Payable Current Liabilities $ $ $ $ $ 1,700.00 9,737.00 11,437.00 Non-Current Liabilities Land Debt Total Liabilities $ $ $ 10,000.00 176,371.00 197,808.00 Owner´s Equity Total Liabilities & Equity $ 1,810,128.00 $ 2,007,936.00 17 77,526.00 1,000.00 2,900.00 2,000.00 83,426.00 BASIC INCOME STATEMEMT GROSS REVENUE Cash Receipts Non Cash Transfer out Inventory & Accounts Receivable Change Gross Revenue $ $ $ $ 175,838.00 48,000.00 2,900.00 226,738.00 EXPENSES Inventory Change (Expenses) Repairs and Maintenance Labor Feed Depreciation Veterinary Utilities Total Operating Expenses $ $ $ $ $ $ $ $ 5,470.00 38,629.00 48,000.00 23,400.00 32,870.00 5,825.00 10,193.00 164,387.00 Interest Expense Net Income from Operations $ $ 18,454.00 43,897.00 Capital Gains (Losses) Taxes NET INCOME $ $ $ (13,364.00) 10,500.00 20,033.00 18 BASIC STATEMENT OF CASH FLOWS CASH FROM OPERATIONS Receipts Expenses Interest Expenses Taxes Net Cash From Operations $ $ $ $ $ 175,838.00 131,517.00 18,464.00 10,500.00 15,357.00 CASH FROM INVESTING Sales Purchases Net Cash From Investing $ $ $ 34,636.00 28,000.00 6,636.00 CASH FROM FINANCING New Borrowings Debt Payments Net Cash From Financing $ $ $ 8,933.00 (8,933.00) Cash Withdrawals Cash Contributions NET CASH FLOW $ $ $ 13,060.00 19 BASIC STATEMENT OF OWNER EQUITY RETAINED EARNINGS Net Income Withdrawals Net Change in Retained Earnings $ $ $ 20,033.00 20,033.00 CAPITAL CONTRIBUTIONS Cash & Investment Building, Machinery & Equipment Land Total $ $ $ $ 30,000.00 30,000.00 CAPITAL DISTRIBUTIONS Cash & Investment Building, Machinery & Equipment Land Total Net Change in Capital $ $ $ $ $ 30,000.00 OWNER EQUITY RECONCILIATION Beginning Owner Equity Total Equity Changes Ending Owner Equity $ 1,760,095.00 $ 50,033.00 $ 1,810,128.00 20 RATIOS RETURN ON ASSETS (ROA) Net Income from Operations Interest Expenses Total Assets Return on Assets $ 43,897.00 $ 18,454.00 $ 2,007,936.00 3.1% RETURN ON EQUITY Net Income from Operations Total Equity Return on Equity $ 43,897.00 $ 1,810,128.00 2.4% CURRENT RATIO Total Current Assets Total Current Liabilities Current Ratio $ $ 83,426.00 11,437.00 $7.29 DEBT-TO-ASSET RATIO Total Liabilities Total Assets Debt-to-Asset Ratio $ 197,808.00 $ 2,007,936.00 10% EQUITY-TO-ASSET RATIO Total Equity Total Assets Equity-to-Asset Ratio $ 1,810,128.00 $ 2,007,936.00 90% 21