Chapter 9, Part 2 Time Value of Money 1. Present Value of a Single

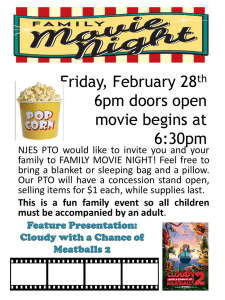

advertisement

Chapter 9, Part 2 Time Value of Money 1. Present Value of a Single Amount 2. Present Value of an Annuity 3. Future Value of a Single Amount 4. Future Value of an Annuity Introduction The value of a dollar today will decrease over time. Why? Two components determine the “time value” of money: – interest rate (i) for discounting and compounding. – number of periods (n) for discounting and compounding. For external financial reporting, we are concerned primarily with present value concepts. For investment decisions, we are also concerned with future value concepts. Introduction Future Value concepts: – What amount do we need to invest today to accumulate a specific amount at retirement? – What yearly amounts do we need to invest to accumulate a specific future amount in an education fund? Present Value concepts: – What is the value today of a payment coming some time in the future? – What is the value today of a series of equal payments received each year for the next 20 years? Present Value Concepts To record activities in the general ledger dealing with future cash flows, we should calculate the present value of the future cash flows using present value formulas or techniques. Types of activities that require PV calculations: – investment decisions – long term notes payable and notes receivable – bonds payable and bond investments Types of Present Value Calculations PV of a single sum (PV1): discounting a future value of a single amount that is to be paid or received in the future. PV of an annuity (PVA): discounting a set of payments, equal in amount over equal periods of time, where the first payment is made at the end of each period. 1.Present Value of a Single Sum (PV1) All present value calculations presume a discount rate (i) and a number of periods of discounting (n). There are 4 different ways you can calculate PV1: 1. Formula: PV1 = FV1 [1/(1+i)n] 2. Tables: see page 370, Table 9-2 PV1 Table PV1 = FV1( ) i, n 3.Calculator (if you have time value functions). 4.Excel spreadsheet. (Note: we will use tables in class and on exams.) Illustration 1: Long Term Notes Payable May be interest bearing or non-interest bearing (we will look at non-interest bearing). May be serial notes (periodic payments) or term notes (balloon payments). We will look at balloon payments here (serial payments, or annuities, later). Illustration 1: On January, 2, 2008, Pearson Company purchases a section of land for its new plant site. Pearson issues a 5 year non-interest bearing note, and promises to pay $50,000 at the end of the 5 year period. What is the cash equivalent price of the land, if a 6 percent discount rate is assumed? Illustration1 Solution See page 370, Table 9-2 PV1 Table PV1 = FV1( ) i, n PV1 Table PV1 = ( ) i=6%, n=5 Journal entry Jan. 2, 2008: Illustration1 Solution, continued Journal entry, December 31, 2008, assuming Pearson uses the straight-line method to recognize interest expense (12,650 / 5): Carrying value on B/S at 12/31/2008? Carrying value on B/S at 12/31/2012? Illustration 2: Investment Holliman Company wants to accumulate $500,000 at the end of 10 years. What amount must it invest today to achieve that balance, assuming a 6% interest rate, compounded annually? PV1 Table PV1 = ( ) = i=6%, n=10 What if the interest is compounded semiannually? PV1 Table PV1 = ( ) = 2. Present Value of an Annuity (PVA) An annuity is defined as equal payments over equal periods of time. (Specifically, we are using an ordinary annuity, which assumes that each payment occurs at the end of each period.) PVA calculations presume a discount rate (i), where (A) = the amount of each annuity, and (n) = the number of annuities (or rents), which is the same as the number of periods of discounting. There are 4 different ways you can calculate PVA: 1. Formula: PVA = A [1-(1/(1+i)n)] / i 2. Tables: see page 372, Table 9-4 (We will use this.) PVA Table PVA = A( ) i, n 3.Calculator (if you have time value functions). 4.Excel spreadsheets. Illustration 3: Long Term Notes Payable Illustration 3: On January, 2, 2008, Pearson Company purchases a section of land for its new plant site. Pearson issues a 5 year non-interest bearing note, and promises to pay $10,000 per year at the end of each of the next 5 years. What is the cash equivalent price of the land, if a 6 percent discount rate is assumed? Illustration 3 Solution See page 372, Table 9-4 PVA Table PVA = A ( ) i, n PVA Table PVA = ( ) i=6%, n=5 Journal entry Jan. 2, 2008: Illustration 4: Annuity Income Illustration 4: On January, 2, 2008, Donna Smith won the lottery. She was offered an annuity of $100,000 per year for the next 20 years, or $1,000,000 today as an alternative settlement. Which option should Donna choose. Assume that she can earn an average 4 percent return on her investments for the next 20 years. Solution: calculate the present value of the annuity at a discount rate of 4%. Illustration 4 Solution See page 372, Table 9-4 PVA Table PVA = A ( ) i, n PVA Table PVA = ( ) i=4%, n=20 Which should she choose? At approximately what interest (discount) rate would she choose differently? (Based on whole percentage rate.) Types of Future Value Calculations FV of a single sum (FV1): compounding a future value of a single amount that is to be accumulated in the future. Example: – projected future value of a savings bond. FV of an annuity (FVA): compounding the future value of a set of payments, equal in amount over equal periods of time, where the first payment is made at the end of the first period. Examples: – projected balance in a retirement account. – amount of payments into retirement fund. 3.Future Value of a Single Sum (FV1) There are 4 different ways you can calculate the FV1: 1. Formula: FV1 = PV1 [(1+i)n] 2. Tables: see page 369, Table 9-1 FV1 Table FV1 = PV1( ) i, n 3.Calculator (if you have time value functions). 4.Excel spreadsheet. (Note: we will use tables in class and on exams.) Illustration 5: Investment Holliman Company wants to invest $200,000 cash it received from the sale of land. What amount will it accumulate at the end of 10 years, assuming a 6% interest rate, compounded annually? FV1 Table FV1 = PV1 ( ) i, n FV1 Table FV1 = ( ) = i=6%, n=10 4.Future Value of an Annuity (FVA) FVA calculations presume a compound rate (i), where (A) = the amount of each annuity, and (n) = the number of annuities (or rents), which is the same as the number of periods of compounding. There are 4 different ways you can calculate FVA: 1. Formula: FVA = A [(1+i)n - 1] / i 2. Tables: see page 371, Table 9-3 (We will use this.) FVA Table FVA = A( ) i, n 3.Calculator (if you have time value functions). 4.Excel spreadsheets. Illustration 6: Future Value of Investment Jane Smith wants to invest $10,000 each year for the next 20 years, for her retirement. What balance will she have at the end of 20 years, assuming a 6% interest rate, compounded annually? FVA Table FVA = A ( ) = i, n FVA Table FVA = ( ) = i=6%, n=20 Illustration 7: Future Value of Investment James Holliman wants to accumulate $200,000 at the end of 10 years, for his son’s education fund. What equal amount must he invest annually to achieve that balance, assuming a 6% interest rate, compounded annually? FVA Table FVA = A ( ) = i, n FVA Table = ( ) i=6%, n=10