TAXATION OF INVESTMENT INCOME

TAXATION OF INVESTMENT INCOME

INTRODUCTION

In fulfilling their role either as Trustees under a private trust or as Trustees under a Retirement Benefit

Scheme, Trustees will usually have an obligation to invest the assets that are committed to their trust one

way or another. Although it is not often expressly stated, it is usually expected that Trustees would seek to

engage in investments that would not create an additional tax burden on the persons that have appointed

them. In fact any act on the part of the Trustees that would minimize the persons’ tax liability would usually

be most welcome!

The purpose of this diet is to consider the tax implications of the different forms of investment that Trustees

are likely to engage in with a view to identifying the most tax-efficient forms of investment. More often than

not investments are as a result of the creativity of those who initiate them. It is hardly possible, therefore to

consider every single form of investment that can exist but we would attempt to look at broad categories of

investment and discuss their tax implications under the Nigerian tax laws.

1.

FORMS OF INVESTMENT

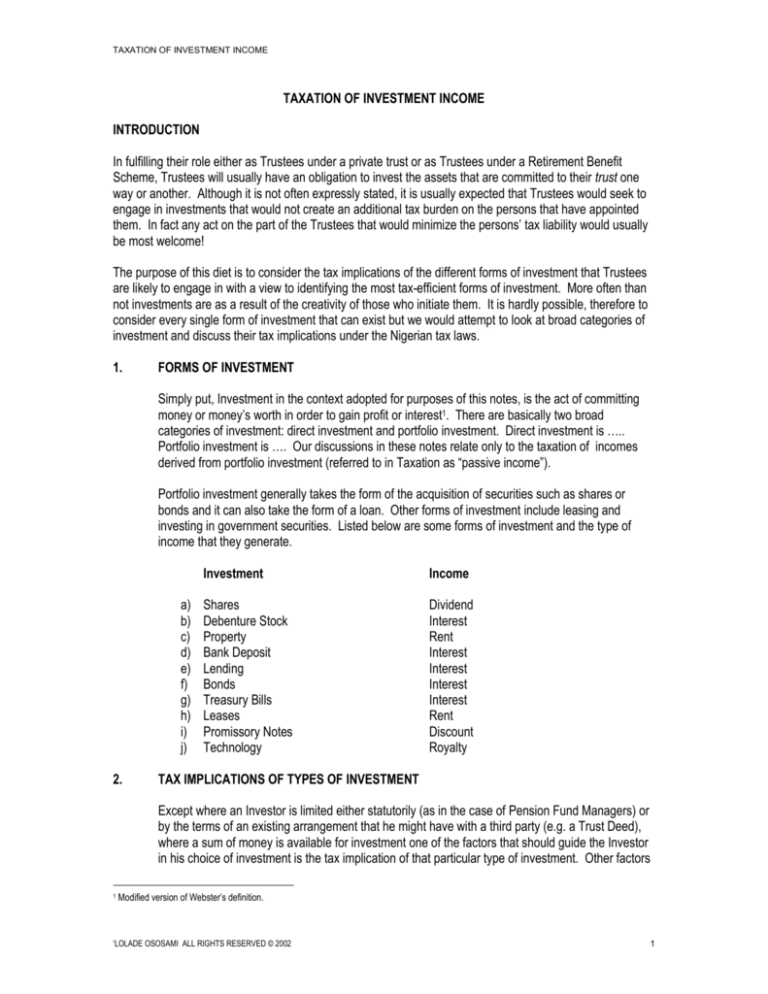

Simply put, Investment in the context adopted for purposes of this notes, is the act of committing

money or money’s worth in order to gain profit or interest1. There are basically two broad

categories of investment: direct investment and portfolio investment. Direct investment is …..

Portfolio investment is …. Our discussions in these notes relate only to the taxation of incomes

derived from portfolio investment (referred to in Taxation as “passive income”).

Portfolio investment generally takes the form of the acquisition of securities such as shares or

bonds and it can also take the form of a loan. Other forms of investment include leasing and

investing in government securities. Listed below are some forms of investment and the type of

income that they generate.

a)

b)

c)

d)

e)

f)

g)

h)

i)

j)

2.

Investment

Income

Shares

Debenture Stock

Property

Bank Deposit

Lending

Bonds

Treasury Bills

Leases

Promissory Notes

Technology

Dividend

Interest

Rent

Interest

Interest

Interest

Interest

Rent

Discount

Royalty

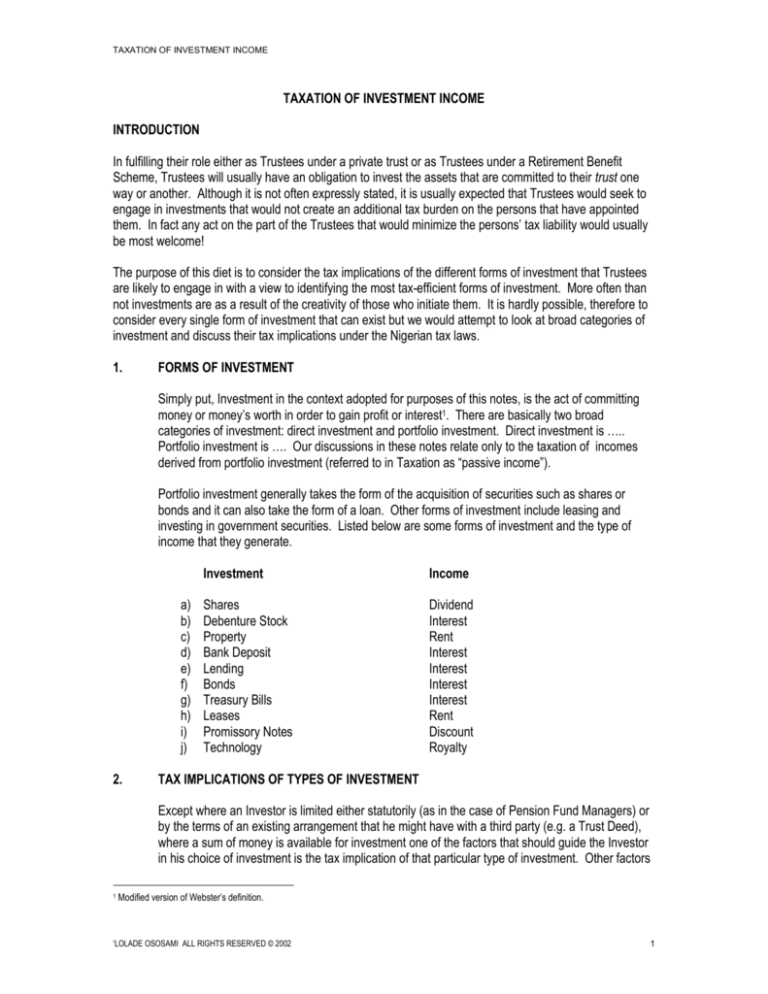

TAX IMPLICATIONS OF TYPES OF INVESTMENT

Except where an Investor is limited either statutorily (as in the case of Pension Fund Managers) or

by the terms of an existing arrangement that he might have with a third party (e.g. a Trust Deed),

where a sum of money is available for investment one of the factors that should guide the Investor

in his choice of investment is the tax implication of that particular type of investment. Other factors

1

Modified version of Webster’s definition.

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

1

TAXATION OF INVESTMENT INCOME

that the Investor might consider will include the time frame within which he needs to realize a return

on that investment, the economic indices prevalent at the time of investment and other variables.

Whatever the considerations, the Investor’s intention is to maximize his returns within a particular

time frame. Thus, investment could be short-term, medium term or long term. These notes

highlight the relevant provisions that can guide an investor in selecting the type of investment to

make, from a tax viewpoint.

Other than the withholding tax rules, the treatment of investment income under the Companies

Income Tax Act and the Personal Income Tax Act are quite similar. Where the income that arises

from an investment accrues to a company the provisions of the Companies Income Tax will apply,

while that of the Personal Income Tax Act will apply in the case of an individual or persons taxable

under the Personal Income Tax Act. Of all the relevant provisions of these laws our concern is to

try to identify which types of investment would generate the least tax burden in the hands of its

recipient.

2.1

Investment Incomes under the Companies Income Tax Act

2.1.1

Dividends

Dividend, for purposes of companies’ income tax means, in relation to a company not being in the

process of being wound up or liquidated, any profits distributed to shareholders, whether or not

such profits are of a capital nature. It also includes an amount equal to the nominal value of bonus

shares, debentures or securities awarded to shareholders. In relation to a company that is being

wound up or liquidated, dividend means any profits distributed whether in money or money’s worth

or otherwise, other than those of a capital nature earned before or during the winding up or

liquidation.

Under Section 62 of CITA where any dividend becomes due from or payable by a Nigerian

company to any other company or person, the company paying such dividend or making such

distribution shall deduct tax at the rate of 10% on such payment. Withholding tax is deducted at

the rate of 10% on dividend paid to a company2. Where the recipient company is a foreign

company (i.e. not registered in Nigeria) the tax withheld will represent the final tax payable by the

foreign recipient company3. Depending on whether there is an existing double taxation treaty

between the home state of the foreign recipient, the latter may be entitled to a foreign tax credit or

an exemption for taxes withheld on the dividend in Nigeria. Where a Nigerian company receives

dividend from a foreign company such dividend will not be taxable in Nigeria provided that the

dividend is brought into Nigeria through Government Approved Channels.

Franked Investment Income

Section 62(3) provides that dividend received after deduction of tax prescribed in this section shall

be regarded as “franked investment income” to the recipient company and shall not be charged to

further tax as part of the profits of the recipient company. In distributing the dividends to its own

shareholders, the recipient company is required to offset the withholding tax that it has already

suffered on those dividends.

Where a Nigerian company earns franked investment income, the tax that was withheld (at 10%)

on that income will constitute the final tax payable on that income and it shall be excluded from the

2

3

Section 62, CITA

Section 62(4) CITA

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

2

TAXATION OF INVESTMENT INCOME

total profits of the company when computing its taxable profits. When such income is redistributed,

the company is entitled to offset the withholding tax that could have been due from redistribution

against the withholding tax that it has suffered on the income. This peculiarity is what makes

franked investment income a form of incentive for investment.

Where, however, the company makes distribution to its shareholders from its other profits, the

distribution will be subject to withholding tax and the company would not be entitled to off set the

withholding tax that it suffered on the franked investment income that it earned in that year of

assessment. In order for the company to take advantage of the franked investment income

incentive the distribution that it makes to its shareholders must be from that franked investment

income and not from another source of profits.

Dividends distributed by a Unit Trust

Unit Trust Schemes are, for purposes of companies’ income tax, treated as limited liability

companies. The trustees are considered to be a company that derives income from making

investments; unit holders are considered to be shareholders, their rights are treated as shares and

the income available for distribution to the unit holders is treated as dividends (S.14A CITA).

Dividends earned by a Unit Trust are regarded as franked investment income and where the

dividends are redistributed, such dividends will be exempted from tax (S.19(1)(f) of CITA). Unlike

an ordinary investment company, the dividends distributed to the investors are expressly exempted

from tax. In the case of an investment company, those dividends are not exempted from tax; the

Investment Company merely has a right to offset the withholding tax that it has suffered against the

withholding tax that is due on those distributions.

Dividends exempted from tax

2.1.2

Dividend derived by a company from another Nigerian company for the first five years,

provided that the equity participation of the recipient company is either wholly paid for in

foreign currency or by assets brought or imported into Nigeria; the beneficial owner of the

dividend owns at least 10% equity in the paying company; and the company paying the

dividend is engaged in agricultural or oil and gas operations.

Dividend derived by a company from a country outside Nigeria and brought into Nigeria

through Government approved channels.

Dividend received from small companies in the manufacturing sector, in the first five years

of their operations.

Dividend received from investments in wholly export-oriented businesses.

Dividend distributed by a Unit Trust.

Interest, Royalty

Under Section 60 where any interest (not being interest on inter-bank deposits) or royalty becomes

due from one company to another company or individual liable to Personal Income Tax payment,

the company making such payment shall, from that payment, deduct tax at the rate of 10%.

Although the law states that tax should be withheld at 10%, in practice, tax on royalty is withheld at

the rate of 15%. This is by virtue of information circular No. 9502 issued by the Federal Inland

Revenue Service in 1995.

Interest earned by Foreign Companies

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

3

TAXATION OF INVESTMENT INCOME

Where interest accrues to a foreign company from a Nigerian company, the interest shall be

deemed to be derived from Nigeria and subject to withholding tax (see S.8(2)(b)) and the tax

withheld shall constitute the final tax payable by the foreign company (S.60(4)). It does not matter

whether or not the interest is paid outside Nigeria. The foreign recipient may be entitled to a

foreign tax credit or exemption in his home state if there is an existing double taxation treatry

between the two countries.

Interest exempted from tax

Interest payable to a foreign company on a loan granted to a Nigerian company or

individual for purposes of any trade, business or vocation in Nigeria, which is not repayable for a period of ten years. Where the loan is not payable for a period of five years,

tax will be charged and withheld at the rate of 5%. (S.9(1)) CITA.

Interest payable on any loan granted for purposes of an agricultural trade or business

shall be exempted from tax, provided that the moratorium is not less than 18 months and

the rate of interest is not more than the base lending rate at the time the loan was

obtained.(S.9(7).

Interest payable on loans granted to companies engaged in the fabrication of any local

plant and machinery and companies using the loan as working capital for cottage

industries established under FEAP.(S.3, No.18, 1998).

Interest payable on any loan granted by a bank for purposes of manufacturing goods for

export.

Interest derived by a Nigerian company from outside Nigeria, which is brought into Nigeria

through Government Approved Channels (i.e. CBN and other approved banks).

Interest that accrues on deposit accounts of a foreign company provided that the deposits

are transfers wholly of foreign currencies to Nigeria through Government Approved

Channels.

Any income that is not taxable is not subject to withholding tax. The categories of interest

payments listed above are exempted from tax under the CITA and are consequently not subject to

withholding tax deductions.

2.1.3

Rents

Section 61 of CITA provides that where any rent becomes due from or payable by one company to

another company or to any person liable to Personal Income Tax payment, the company paying

such rent shall, at the date when the rent is paid or credited, whichever first occurs, deduct tax at

the rate of 10% from such rent and pay the amount deducted to the FBIR.

“Rents” include payments for the use of or hire of any equipments, payment for charter vessels,

ships, or aircraft, and all such other payments for the use or hire of movable and immovable

property.(S.61(6)).

Tax withheld on rents paid to a foreign company will be the final tax payable by the foreign

company on that rent payment. Where a Nigerian company brings in rent payments received

outside Nigeria, such rent payment will not be subject to withholding tax if brought in through an

approved channel.

2.2

Investment Incomes Subject to Personal Income Tax

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

4

TAXATION OF INVESTMENT INCOME

Incomes chargeable to Personal Income Tax include incomes earned by individuals and income

arising from a trust or estate due to a trustee. A corporate Trustee would be taxable under the

Companies’ Income Tax Act on incomes earned from the provision of Trustee services. In the

case of a body of individuals, however, they would be taxable under the Personal Income Tax Act.

In either of the two instances, the income that arises from the Trust itself would be taxable under

the Personal Income Tax Act.

2.2.1

Dividend

Dividend is a taxable income under the PITA4. Dividend for purposes of Personal Income Tax

means, in relation to a company not being in the process of being wound up or liquidated, any

profits distributed to shareholders, whether or not such profits are of a capital nature, including an

amount equal to the nominal value of bonus shares, debentures or securities awarded to

shareholders. In relation to a company that is being wound up or liquidated, dividend means any

profits distributed whether in money or money’s worth or otherwise, other than those of a capital

nature earned before or during the winding up or liquidation5.

Dividend is subject to withholding tax at the rate of 10%6. With effect from 19967 the tax withheld

on dividend shall be the final tax payable by the recipient of that dividend. Prior to 1996 this

provision only applied to non-resident recipients. However in a bid to promote investment in the

capital markets the tax payable by individuals and persons taxable under the PITA was reduced to

10%.

Dividends Exempted From Tax

Dividend paid to a person by a company incorporated in Nigeria provided that the equity

participation of the person in the company paying the dividend is either wholly paid for in

foreign currency or by assets brought into Nigeria between 1st January, 1987 and 31st

December, 1992 and the person to whom the dividends are paid owns not less than 10%

of the equity share capital of the company8.

Dividend earned outside Nigeria and brought into Nigeria by a Nigerian resident provided

that such income is brought in convertible currency and paid into a domiciliary account in

a bank approved by the government9.

2.2.2

Interest

Interest is a taxable income under the PITA10. Withholding tax is deductible on interest at the rate

of 10%11. The tax withheld on interest shall be the final tax payable by the recipient of the

interest12. This provision relates to a situation where the lender is a taxable person under the

PITA. A company that earns interest from a taxable person under the PITA will not qualify for this

reduction.

Section 3(1)(d) PITA

Section 3(3)(e)

6 Section 70

7 Section 9 of Decree No. 32 of 1996

8 Para. 24 of Schedule 3, PITA

9 Decree 32 of 1996

10 Section 3(1)(d)

11 Section 69(2) PITA

12 This is with effect from 1996. See S.8 of Decree 32 of 1996

4

5

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

5

TAXATION OF INVESTMENT INCOME

A taxable person under the PITA shall be allowed to deduct interests paid on loans acquired and

employed as capital in acquiring its income13.

Interest Earned by Foreign Persons

Interest earned by an individual or an executor, or a trustee outside Nigeria from a loan granted to

a person in Nigeria (including a person who is resident or present in Nigeria at the time of the loan)

shall be deemed to be derived from Nigeria if there is liability to payment in Nigeria of the interest

regardless of what form the payment takes and wherever payment is made; or if the interest

accrues in Nigeria to a foreign company or person regardless of what form the payment takes and

wherever the payment is made14.

Interest Exempted from Tax

Under Schedule 3 of the PITA, which deals with incomes that are exempted from tax, there are

some categories of interest that are exempted form tax in the hands of the recipient. One of such

categories is that which relates to interest earned by foreign bodies on loans charged on the public

revenue of the Federation and bonds that are issued by the Government of the Federation to

secure repayment of loans raised from the International Bank for Reconstruction and Development

under the authority of the Railway Loan (International Bank) Act15. Other categories of interest that

are tax-exempt are as follows:

2.2.3

Interest on any money borrowed by the Government of the Federation or of a State on

terms which include the exemption of interest from tax in the hands of a non-resident

person;

Where the Minister of Finance so consents, the interest on any monies borrowed outside

Nigeria by a corporation established by a law in Nigeria upon terms which include the

exemption of such interest from tax in the hands of any non-resident person;

Interest on deposit accounts, provided the deposits are transfers wholly made up of

foreign currencies to Nigeria on or after 1st January 1990 through Government Approved

Channels and the depositor does not become non-resident after making the transfer while

in Nigeria;

Interest accruing to a person on foreign currency domiciliary accounts;

Interest earned by banks on a savings account less than =N=50,000.00 (Fifty thousand

Naira).

Rent

Rent can either be earned from leasing property or equipment. Under the PITA rent is a taxable

income, which is subject to withholding tax at the rate of 10%16. Unlike the other investment

incomes, the tax withheld on rents shall be the final tax payable only by a non-resident recipient.

2.2.4

Royalty, Discount

Section 20(1)(a)

Section 14 PITA

15 Cap. 387 LFN 1990

16 Section 68

13

14

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

6

TAXATION OF INVESTMENT INCOME

Royalty is subject to withholding tax at the rate of 5% and this shall be the final tax payable by the

recipient. Although discount is a taxable income under the Act17, it is not subject to withholding tax.

Income earned as discount would therefore form part of the taxable person’s assessable income.

3.

Investment Incentives

Investment Incentives are special provisions that provide more favorable tax treatment than that

accorded under the ‘normal’ tax system. Incentives may take the form of exemptions or reduced

tax rates (withholding or otherwise). Before embarking on an investment an investor should

consider whether there are specific incentives that relate to the kind of investment that he is

planning to embark on.

17

see Section 3(1)(d) PITA

‘LOLADE OSOSAMI ALL RIGHTS RESERVED © 2002

7