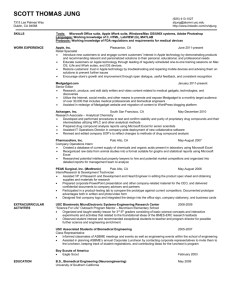

- ILO Institute

advertisement