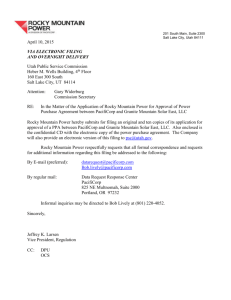

Report of the Utah Independent Evaluator

advertisement