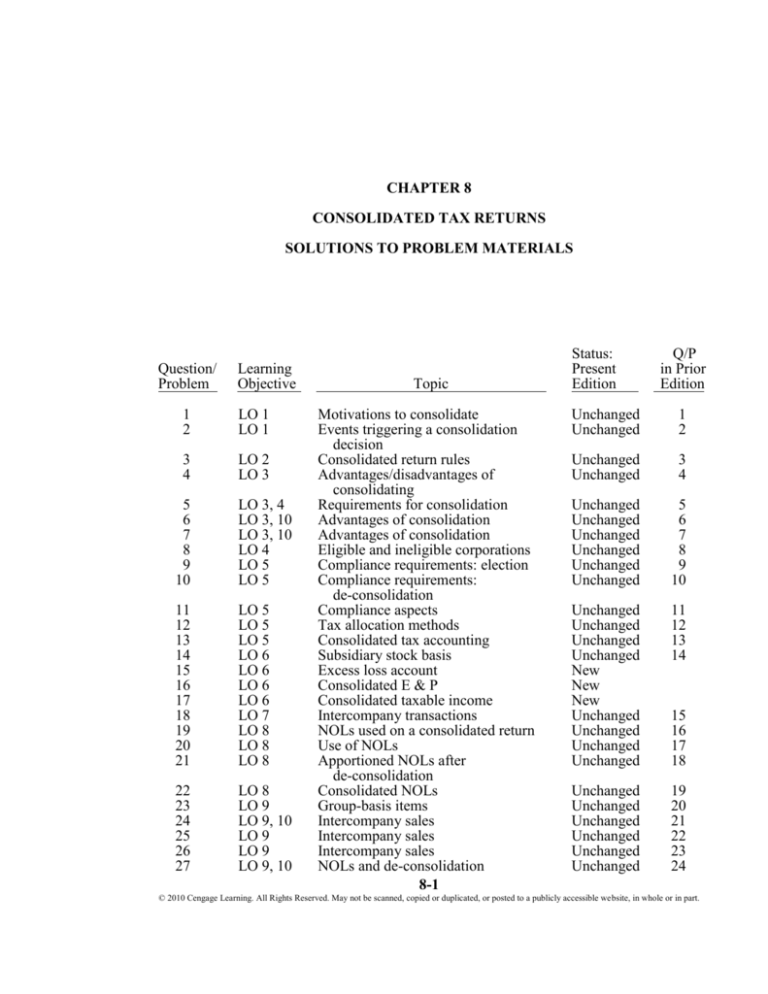

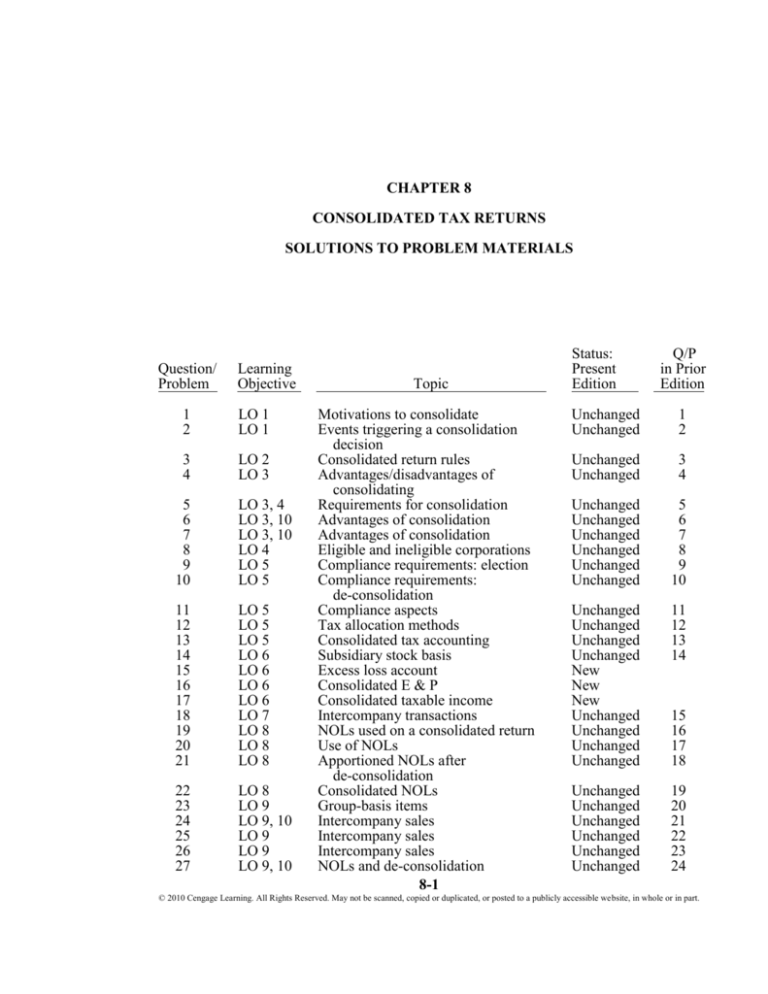

CHAPTER 8

CONSOLIDATED TAX RETURNS

SOLUTIONS TO PROBLEM MATERIALS

Question/

Problem

Learning

Objective

1

2

LO 1

LO 1

3

4

LO 2

LO 3

5

6

7

8

9

10

LO 3, 4

LO 3, 10

LO 3, 10

LO 4

LO 5

LO 5

11

12

13

14

15

16

17

18

19

20

21

LO 5

LO 5

LO 5

LO 6

LO 6

LO 6

LO 6

LO 7

LO 8

LO 8

LO 8

22

23

24

25

26

27

LO 8

LO 9

LO 9, 10

LO 9

LO 9

LO 9, 10

Topic

Motivations to consolidate

Events triggering a consolidation

decision

Consolidated return rules

Advantages/disadvantages of

consolidating

Requirements for consolidation

Advantages of consolidation

Advantages of consolidation

Eligible and ineligible corporations

Compliance requirements: election

Compliance requirements:

de-consolidation

Compliance aspects

Tax allocation methods

Consolidated tax accounting

Subsidiary stock basis

Excess loss account

Consolidated E & P

Consolidated taxable income

Intercompany transactions

NOLs used on a consolidated return

Use of NOLs

Apportioned NOLs after

de-consolidation

Consolidated NOLs

Group-basis items

Intercompany sales

Intercompany sales

Intercompany sales

NOLs and de-consolidation

8-1

Status:

Present

Edition

Q/P

in Prior

Edition

Unchanged

Unchanged

1

2

Unchanged

Unchanged

3

4

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

5

6

7

8

9

10

Unchanged

Unchanged

Unchanged

Unchanged

New

New

New

Unchanged

Unchanged

Unchanged

Unchanged

11

12

13

14

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

19

20

21

22

23

24

15

16

17

18

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-2

2010 Corporations Volume/Solutions Manual

28

*29

LO 10

LO 2

Choosing not to file consolidated

Unchanged

Intercompany transactions: tax versus book Unchanged

Instructor: For difficulty, timing, and assessment information about each item,

see p. 8-3.

Status:

Question/ Learning

Present

Problem

Objective

Topic

Edition

30

31

*32

*33

34

35

*36

*37

*38

LO 3, 9

LO 3, 5

LO 3

LO 4

LO 5

LO 5

LO 5

LO 5

LO 5

*39

40

*41

42

43

44

*45

LO 6

LO 7

LO 7, 8

LO 8

LO 8

LO 8

LO 9

Consolidated group partners

Consolidated group partners

Tax effects of affiliated group

Eligibility to consolidate

Tax liabilities of controlled group

Consolidated estimated taxes

Tax-sharing agreements

Tax-sharing agreements

AMT effects, separate and group basis

computation

Stock basis

Consolidated taxable income

Consolidated taxable income

NOLS and de-consolidation

SRLY and the § 382 overlap rule

SRLY limitations

Matching rule

25

26

Q/P

in Prior

Edition

Unchanged

New

Unchanged

Unchanged

Unchanged

Unchanged

Modified

Modified

Unchanged

27

Unchanged

Modified

Modified

Unchanged

Unchanged

Unchanged

Unchanged

35

36

37

38

39

40

41

28

29

30

31

33

34

32

*The solution to this problem is available on a transparency

master.

Instructor: For difficulty, timing, and assessment information about each item,

see p. 8-3.

Research

Problem

1

2

3

4

5

6

7

8

9

10

Topic

Affiliated group

De-consolidation of a consolidated group

Extending consent period

Consolidated group’s tax year

Internet activity

Internet activity

Internet activity

Internet activity

Internet activity

Internet activity

Status:

Present

Edition

Unchanged

Unchanged

Unchanged

New

Modified

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

Q/P

in Prior

Edition

1

2

3

4

5

6

7

8

9

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

Question/

Problem

Difficulty

Est'd

completion

time

Assessment Information

AICPA*

AACSB*

Core Comp

Core Comp

1

2

3

4

Easy

Medium

Easy

Medium

5

10

5

15

5

6

7

8

9

10

11

12

13

14

Easy

Medium

Medium

Easy

Easy

Easy

Medium

Easy

Medium

Medium

10

15

15

10

5

5

10

5

10

10

15

Medium

10

16

17

18

Easy

Easy

Medium

5

10

10

19

Easy

20

21

22

23

Medium

Easy

Easy

Medium

10

5

5

10

FN-Reporting

FN-Reporting

FN-Measurement

FN-Measurement | FNReporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Reporting

FN-Reporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Reporting

FN-Reporting

FN-Reporting

FN-Reporting

24

Medium

10

FN-Reporting

25

Easy

5

26

Easy

5

27

Hard

15

28

29

Easy

Medium

5

10

30

Medium

10

31

Medium

10

5

8-3

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Reporting

FN-Reporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Reporting

Analytic

Analytic

Analytic

Communication |

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Communication |

Analytic

Analytic

Analytic

Analytic

Analytic | Reflective

Thinking

Analytic | Reflective

Thinking

Analytic

Analytic

Analytic

Communication |

Analytic

Analytic | Reflective

Thinking

Analytic

Analytic

Communication |

Analytic

Analytic

Analytic

Analytic | Reflective

Thinking

Analytic | Reflective

Thinking

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-4

2010 Corporations Volume/Solutions Manual

Question/

Problem

Est'd

completion

time

Difficulty

32

Medium

10

33

Medium

10

Assessment Information

AICPA*

AACSB*

Core Comp

Core Comp

FN-Measurement | FNReporting

FN-Reporting

Analytic

Analytic

*Instructor: See the Introduction to this supplement for a discussion of using AICPA and

AACSB core competencies in assessment.

34

Easy

5

35

Medium

10

36

Medium

10

37

Medium

10

38

Hard

15

39

Medium

10

40

Medium

10

41

Medium

10

42

Easy

5

43

Easy

5

44

Easy

5

45

Medium

10

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

FN-Measurement | FNReporting

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

Analytic

*Instructor: See the Introduction to this supplement for a discussion of using AICPA and

AACSB core competencies in assessment.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

8-5

CHECK FIGURES

29.b.

29.c.

32.a.

32.c.

32.f.

33.c.

34.

35.

36.

37.

LittleCo, no effect.

Big, $50,000 gain.

Separate, $1 million DRD is

allowed.

Consolidated, Giant and

PebbleCo are both fully liable for

$140,000 of tax.

Consolidated, the members can

retain their differing tax

accounting methods.

Controlled group, not affiliated.

Senior is liable for $2.5 million.

Parent remits $950 for 2011.

$241 allocated to Parent.

$269 allocated to Parent.

38.

39.a.

39.c.

40.

41.

42.

43.

44.

45.a.

45.b.

Consolidation reduces group

liability $37,500.

$31 million, end of 2009.

$25 million ELA, end of 2009.

$50,000 for 2010.

2008 $300,000; 2009 $90,000.

$1 million NOL carryforward.

$400,000.

NOL deduction in 2009 =

$500,000.

Consolidated taxable income

$110,000.

Consolidated taxable income

$210,000.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-6

2010 Corporations Volume/Solutions Manual

DISCUSSION QUESTIONS

1.

One can find in the marketplace various motivations to consolidate corporate

holdings in such a way that a consolidated return is attractive.

The isolation of the assets of one corporation for the liabilities of another.

The execution of estate planning objectives.

A perceived value of retaining the separate identities of the acquired

corporation.

A need to shield the identities of a subsidiary’s true owners from the public.

A desire to optimize negotiations with labor unions, suppliers, or

governmental units.

pp. 8-2 and 8-3

2.

A consolidation election may be available as a result of various business

decisions.

A merger, acquisition, or other corporate combination.

A structural change in the capital of a corporation due to regulatory

requirements, competitive pressures, or economizing of operations.

A desire to gain tax or other financial advantages.

pp. 8-3 and 8-4

3.

Delegation of tax-writing authority to the Treasury may be a necessary evil in the

realm of the consolidated return. The length and detail of the rules associated with

consolidated returns makes them poorly suited for placement in the Code.

Moreover, as corporate structures and transactions become more complex every

year, the expertise that Treasury staffers and the tax professionals that they use to

draft the Regulations is critical. As long as the public review process for the

consolidated return Regulations remains thorough, the current situation may be

the best solution possible. p. 8-5

4.

SPEECH OUTLINE

November 3, 2009

WHEN TO USE CONSOLIDATED RETURNS

Potential Advantages of Filing Consolidated Returns

Use the operating and capital loss carryovers of one group member to shelter

the corresponding income of other group members.

Eliminate taxation of all intercompany dividends.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

8-7

Defer recognition of income from certain intercompany transactions.

Optimize certain deductions and credits, by using consolidated amounts in

computing pertinent limitations.

Increase the tax basis of investments in the stock of subsidiaries by the

amount of positive subsidiary taxable income.

The domestic production activities deduction (§ 199) of a group might be

greater than the sum of the deductions for all of the affiliates, as the formula

for the deduction is optimized under the statute.

Use the alternative minimum tax (AMT) attributes of all group members in

deriving consolidated alternative minimum taxable income (AMTI), thereby

reducing the magnitude of the adjustment for adjusted current earnings (ACE)

and of other AMT preferences and adjustments.

Use the current-year operating losses of one group member to defer or reduce

the (regular or AMT) estimated tax payments of the entire group.

Potential Disadvantages of Filing Consolidated Returns

Binding nature of the election on all subsequent tax years of the group

members, unless either the makeup of the affiliated group changes, or the IRS

consents to a ‘‘de-consolidation.”

Apply the capital and operating losses of one group member against the

corresponding income of the other group members when assignment of such

losses to separate return years would produce a greater tax reduction

therefrom.

Defer recognition of losses from certain intercompany transactions.

Decrease the amounts of certain deductions and credits, by using consolidated

amounts in computing pertinent limitations.

Decrease the tax basis of investments in the stock of subsidiaries by the

amount of negative subsidiary taxable income, and by distributions therefrom.

Creation of short taxable years of subsidiaries, in meeting the requirement that

all group members use the parent’s tax year, thereby bunching income and

expending one of the years of the subsidiary’s charitable contribution and loss

carryforward period.

Recognition of legal and other rights of minority shareholders in the context

of a consolidated group.

Incurring of additional administrative costs in complying with the

consolidated return regulations.

pp. 8-6, 8-7, and Concept Summary 8.1

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-8

5.

2010 Corporations Volume/Solutions Manual

Before a consolidation election can be made under the tax law, three major

requirements first must be met.

Affiliated group status

Eligible corporation to file consolidated Statutory definitions

Compliance requirements

Stock ownership tests

Identifiable parent corporation

Forms 851, 1122

Conformity to parent’s tax year

pp. 8-8, 8-12, 8-13, and Concept Summary 8.1

6.

Pertinent tax issues include the following.

How accurate are the income and loss projections of the group members?

Will Black’s NOLs be available for deduction against future group taxable

income?

Will Black’s NOLs be available for immediate carryback, producing a tax

refund in the near future?

Will Red produce net taxable income at levels that will accelerate the use of

Black’s NOLs?

Will Red begin to produce new NOLs in the future?

Will Red’s new NOLs be deductible against group taxable income ?

pp. 8-6 and 8-7

7.

Additional pertinent tax issues include the following.

How will the group charitable contribution deduction be computed in the

future?

Will all of Brown’s charitable gifts be deductible against group taxable

income (i.e., considering the 10% floor on a group basis)?

How will the group’s § 1231 gain or loss be computed in the future?

How will Brown’s realized gain and loss affect the group’s § 1231 netting and

computation in the future?

Example 6

8.

The U.S. Red Cross

The Mutual of Kansas Insurance Company

Tequila Telefono, an entity organized in El Salvador

The Boston Yankees Partnership

The Henry Pontiac Trust

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

8-9

pp. 8-12 and 8-13

9.

In most cases, the decision to consolidate must be made no later than the extended

due date of the parent’s return for the year. Here, that date is September 15, 2010.

p. 8-13

10.

Terminations must be applied for at least 90 days prior to the extended due date of

the consolidated return. Here, that date is June 15, 2010. pp. 8-13 and 8-14

11.

a.

The first consolidated tax return for Lavender and Azure is due. Forms

851 and 1122 are attached.

b.

Separate company estimated payments are still allowed as the third year

has not yet been reached.

c.

The results of Rose’s tax year are included in the group return. The Form

851 now includes Rose, but no additional Form 1122 need be filed.

d.

The first date upon which an election to re-form the Lavender Azure and

Rose group would be allowed, lacking IRS permission. This is after five

tax years pass since Rose left the group.

Filing dates can be extended, or Rose might not elect immediately to be included

in the group. The two-year rule for estimated taxes cannot be extended by

taxpayer election, and it is difficult to get the IRS to shorten the five-year waiting

period.

pp. 8-13 and 8-14

12.

Under the relative taxable income method, the consolidated tax liability is

allocated among the members based on their amounts of separate taxable income.

When the relative tax liability method is used, the allocation is based on the

hypothetical separate tax liabilities of the affiliates. Example 16

13.

Members of a consolidated group must use the same tax year-end, but they can

retain differing accounting methods. The $5 million gross-receipts test is applied

on a group basis, so Child may be forced to switch to the accrual basis of

accounting. However, personal service corporations can elect to avoid such a

switch. If Child is found to be in such an industry and the cash method remains

desirable, this election may be attractive. But the list in § 448(d)(2)(A) seems to

preclude the group from making the election to keep Child’s cash basis method.

pp. 8-16, 8-17, and Table 8.1

14.

TAX FILE MEMORANDUM

November 3, 2009

To:

Tax File

From: Stephanie Brewer

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-10

2010 Corporations Volume/Solutions Manual

Re:

Adjustments to subsidiary stock basis

Positive Adjustments

Consolidated taxable income

Unused operating or capital loss

Negative Adjustments

Consolidated taxable loss

Operating and capital losses, used or carried back this year, if not previously

deducted from basis

Dividends paid to parent out of E & P

p. 8-17

15.

A parent’s stock basis in a consolidated subsidiary never can go below zero. But

when negative adjustments exceed the stock basis in the subsidiary, an excess loss

account is created, in the amount of the negative adjustments. This means that

annual operating and other losses of the subsidiary can continue to be deducted on

the consolidated return; their use is not suspended as would be the case with

partnerships and S corporations (see Chapters 10 and 12, respectively).

If the subsidiary stock is sold or redeemed by the parent when an excess loss

account exists, the parent typically recognizes the balance of the account as

capital gain.

p. 8-18

16.

There is no such concept as consolidated earnings and profits (E & P). The

subsidiaries keep track of their respective E & P balances on a pre-consolidated

basis, as does the parent. A subsidiary’s E & P records its own operating results,

and it makes E & P adjustments for its agreed-upon share of the consolidated

Federal income tax liability. E & P of the subsidiary also reflects any gain/loss on

intercompany transactions with other affiliates. p. 8-18

17.

Consolidated taxable income is derived using the following step-wise

computational method.

Compute taxable income for each affiliate on a separate basis, applying the

usual rules of Subchapter C and the rest of the Code.

Remove from each affiliate’s separate taxable income any group items.

Remove from each affiliate’s separate taxable income the tax effects of any

intercompany transactions.

Account for any intercompany distributions and permanent eliminations from

consolidated taxable income.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

8-11

Use the combined amounts from all affiliates to compute the effects on

consolidated taxable income of each of the identified group items. Add these

positive or negative amounts back to taxable income (or the amount of the

AMT base).

Isolate the effects of intercompany transactions on consolidated taxable

income.

Combine all of the pertinent amounts into consolidated taxable income.

p. 8-18 and Figure 8.1

18.

Parent is attempting to mismatch its own 2009 recognition of gross income from

the service contract with a 2010 deduction by Child. Parent’s own NOL situation

for the year makes attractive such a net income acceleration for the group.

Unfortunately for the group, §§ 267(a)(2) and (b)(3) force a matching of the two

events. The deduction is claimed in the year of gross income recognition (here,

2009), and the net result to the group is an addition to consolidated taxable

income of zero.

p. 8-20

19.

Perhaps not. At most, only $1,500,000 of SubOne’s NOL carryforward can be

used in the first tax year, which is that entity’s cumulative contribution to

consolidated taxable income. Then, § 382 may reduce that deduction. Figure 8-3

20.

Under the so-called offspring rule, a consolidated group can carry back a loss that

is apportioned to a group member that did not exist in the carryback year, where

the new corporation’s existence is rooted in the parent’s assets (e.g., due to a

divisive reorganization similar to that which created Junior). If the member joined

the group immediately upon its incorporation, the group can use the loss. Reg.

§1.1502-79(a)(2)

Thus, if Junior consents to join the consolidated group, its $500,000 apportioned

NOL is available for carryback and can create a refund for the group. If Junior

does not join the group this year, the SRLY rules will restrict the use of the NOL

to carryforwards related to the income contributions of Junior to the group after

its consent is received. Example 26

21.

When a member leaves a consolidated return group, it takes with it the net

operating loss carryforwards that are apportioned to it. Thus, assuming that § 382

limitations do not restrict the deduction, White will report a zero taxable income

on its first two separate Forms 1120, and $100,000 on the third. The NOL

carryforwards apportioned to Beige remain with the parent and any newly formed

consolidated group. Example 27

22.

The separate return limitation year (SRLY) rules defer the deduction for the net

operating losses of an affiliate until that corporation contributes positively to

consolidated taxable income. The SRLY rules are intended to prevent an offset

against an existing group’s taxable income by using current loss deductions that

are traceable to an affiliate’s operations prior to its joining the consolidated group.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-12

2010 Corporations Volume/Solutions Manual

The new affiliate’s NOLs are allowed, but only after that affiliate makes positive

contributions to the taxable income of the group.

SRLY rules are overridden to the extent that there is a § 382 limitation on NOL

deductions for the group (see Chapter 7).

pp. 8-25 and 8-26

23.

A consolidated group computes the following items on a group basis when filing

its tax return.

Net capital gain/loss

§ 1231 gain/loss

§ 199 domestic production activities deduction

Casualty/theft gain/loss

Charitable contributions

Dividends received deduction

Net operating loss

Various credits and their recapture

Percentage depletion deduction

AMT exemption, preferences, and adjustments

pp. 8-26 and 8-27

24.

a.

The matching rule generally defers gain/loss recognition until an asset is

sold outside of the consolidated group. The matching rule applies a ‘‘one

company with multiple divisions” approach to intercompany transactions.

The acceleration rule applies when the matching rule is inappropriate,

triggering immediate recognition of the gain/loss.

b.

Most taxpayers prefer to apply the matching rule to gains and the

acceleration rule to losses.

pp. 8-29 and 8-30

25.

The only reflection of these transactions in consolidated taxable income is in Year

4, when the total $60 gain is recognized. The matching rule defers the Year 3

realized gain, as though it were a sale between divisions of one corporation.

Example 34

26.

The only reflection of these transactions in consolidated taxable income is in Year

4, when the total $60 loss is recognized. The matching rule defers the Year 3

realized loss, as though it were a sale between divisions of one corporation. The

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

8-13

matching rule is designed to prevent group members from accelerating loss

deductions that are realized within the group. Example 34

27.

TAX FILE MEMORANDUM

August 4, 2009

To:

File—Pro-Junior version

Re:

Client Junior’s Deferred Loss

Facts

When Junior left the Rice consolidated group, it left behind a

$600,000 deferred loss from intercompany sales.

Issue

Can Junior take the loss with it and use it on subsequent separate

returns?

Conclusion

Junior may have a claim to the loss if ownership levels change

such that it no longer is a member of the Rice controlled group.

Reasoning

Deferred losses remain with the group when the corporation that

generated the loss leaves the group, if the departing member

remains part of the electing entities’ controlled group [§ 267(f)]. It

is unlikely that the group will allow Junior to take the loss without

some offsetting compensation.

TAX FILE MEMORANDUM

August 4, 2009

To:

File—Pro-Rice version

Re:

Client Junior’s Deferred Loss

Facts

When Junior left the Rice consolidated group, it left behind a

$600,000 deferred loss from intercompany sales.

Issue

Can Junior take the loss with it and use it on subsequent separate

returns?

Conclusion

The loss remains with the group, because Junior is still a member

of the Rice controlled group and § 267(f) prohibits the related

party loss deduction, even after Junior leaves the electing

consolidated group.

Reasoning

The asset still is held by the group, and gain recognition is

controlled by whether the asset leaves the group’s ownership.

pp. 8-29 and 8-30

28.

A parent might prefer to avoid the consolidation election when:

An affiliate is organized outside the U.S.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-14

2010 Corporations Volume/Solutions Manual

An affiliate is an insurance company.

An affiliate brings undesired tax attributes to the group, like a sizable balance

in its E & P.

There is a greater tax benefit in merely claiming a dividends received

deduction for payments among group members.

Compliance and administrative costs associated with the consolidated return

election are excessive.

p. 8-31

PROBLEMS

29.

Tax and book treatment of intercompany transactions are similar but not identical.

Example 5

Transaction

Little pays a dividend to

Big

Book Treatment

Consolidated

eliminating entry — No

effect on book income

Little sells an asset at a No effect

gain to Big

Big

sells

the Big reports $150,000

intercompany- sale asset gain

to an outsider

30.

Consolidated Tax Return

Treatment

Consolidated eliminating

entry — No effect on

taxable income

No effect

LittleCo recognizes

$100,000 gain. Big

recognizes $50,000 gain.

Finding good consolidated return partners often means that contrary tax effects

are matched together, resulting in a lower total Federal income tax. Example 6

a.

Probably a good match. Intercompany gains are deferred until a sale is

made to a taxpayer outside of the consolidated group.

b.

Probably not a good match. The parties want to accelerate recognition of

the realized losses, and consolidation results in the deferral of those losses.

c.

Probably a good match, depending on the current marginal tax rates of the

group members. If consolidation occurs, ShortCo’s foreign-source income

could be used to free up the foreign tax credit carryforwards, resulting in

immediate tax reductions.

d.

Probably not a good match. An attractive consolidated return partner

would allow ParentCo to shelter some of its Federal taxable income, and

Small will produce such losses for only one tax year. Moreover, after a deconsolidation, the group probably could not re-elect to form a group again

for five tax years, so planning flexibility would be lost.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

31.

32.

8-15

Finding good consolidated return partners often, but not always, means that

contrary tax effects are matched together, resulting in a lower total Federal

income tax. Example 6

a.

Probably a good match, especially if the affiliated group’s domestic

production activities deduction (DPAD) is greater than the sum of Parent’s

and SubCo’s DPAD.

b.

Perhaps not a good match. The election to consolidate cannot be “turned

on and off.” The election is binding on all future tax years, and this may

not be a desirable result if both affiliates generate a positive taxable

income. If an election is made and approved to “de-consolidate,” the same

group cannot re-elect consolidated status for five years.

c.

Probably not a good match. Tax return elections made by the parent of a

consolidated group are binding on all members of the filing group for the

tax year.

d.

Probably not a good match. SubTwo must convert to a calendar tax year

upon joining the ParentCo consolidated group, and this may result for the

group in a bunching of more than twelve months of taxable income into

the calendar year of the election.

When an affiliated group exists, Federal income tax treatment often changes for

the group members. Table 8.1

Item

If Consolidated Return Is Filed

If Separate Returns Are Filed

a.

The payment is eliminated in

dividend computing consolidated

taxable income, so no tax.

Only one 15% tax bracket is allowed

to the affiliated group, so total

Federal income tax is $22,250. An

allocation method is used to

determine the payment of each

member.

Both corporations are fully liable for

the $140,000 tax liability. An

allocation method is used to

determine the payment of each

member.

Only one $250,000 floor is allowed

to the affiliated group in computing

the accumulated earnings credit. The

parties are not allowed two such

floors.

Giant reports $1 million in income,

then claims a $1 million dividends

received deduction.

Only one 15% tax bracket is

allowed to the controlled group, so

total Federal income tax is $22,250.

b.

c.

d.

Giant is liable only for its $65,000

liability, and PebbleCo for its

$75,000.

Only one $250,000 floor is allowed

to the controlled group in

computing

the

accumulated

earnings credit. The parties are not

allowed two such floors

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-16

33.

2010 Corporations Volume/Solutions Manual

Item

If Consolidated Return Is Filed

If Separate Returns Are Filed

e.

PebbleCo must convert to a calendar PebbleCo can retain its fiscal tax

tax year, immediately upon joining year.

the Giant consolidated group.

f.

The affiliates can continue to use

different inventory tax accounting

methods.

The affiliates can continue to use

different inventory tax accounting

methods.

The 80% test is failed in a. In b., stock attribution rules apply in identifying a

controlled group, but not an affiliated group. In c., the affiliated group test must

be met on every day of the tax year, while the controlled group test must be met

only on the last day of the year. pp. 8-9, 8-10, and 8-12

Situation

a.

b.

c.

Facts

Parent-Subsidiary

Controlled

Group? (Y/N)

Affiliated

Group?

(Y/N)

N

N

Y

N

Y

N

Throughout the year, P

owns 65% of the stock of S.

Parent owns 70% of SubCo.

The other 30% of SubCo

stock is owned by Senior, a

wholly owned subsidiary of

Parent.

For 11 months, P owns 75%

of the stock of S. For the

last month of the tax year, P

owns 100% of the S stock.

34.

Senior must pay the $2.5 million for Junior’s Federal Income taxes, as

consolidated return partners have joint and several liability as to taxes due. The

bankruptcy receiver will determine the ultimate disposition of the $1 million

owed to the supplier, but Senior is not likely to have any responsibility for paying

that obligation. p. 8-14

35.

Consolidated tax estimates are not required of the group until its third tax year

under the election. Lacking an agreement to the contrary, Sub makes its own

estimates for 2008 and 2009. p. 8-14

Year

2008

2009

2010

2011

Parent Remits

$500

$500

$900

$950

Sub Remits

$220

$200

$0

$0

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

36.

8-17

Consolidated tax liabilities are shared in the following manner.

Separate Taxable Allocation Ratio Allocated Tax Due

Income

Parent

SubOne

SubTwo

SubThree

Totals

$ 850

300

50

–0–

$1,200

850/1,200

300/1,200

50/1,200

0

$241

85

14

–0–

$340

Example 16

37.

Consolidated tax liabilities are shared in the following manner.

Separate

Taxable

Income

Parent

SubOne

SubTwo

SubThree

Totals

$ 850

300

50

–0–

$1,200

Separate Tax

Liability

Allocation

Ratio

Allocated

Tax Due

$297.5

65, after

applying energy

tax credit

17.5

–0–

$380.00

297.5/380

$266

65/380

58

17.5/380

0

16

–0–

$340

Example 16

38.

ACE Adjustment = .75(ACE – Pre-ACE AMTI)

Without consolidation

As consolidated

ParentCo

DaughterCo

Group

.75($700,000) = $525,000

$0 [Negative $187,500 adjustment is

wasted]

$525,000

Group

.75($450,000) = $337,500

The unused “negative” ACE adjustment of $187,500 generated by DaughterCo is

used by the group when a consolidation election is in force.

AMT Exemption

The affiliates share one exemption, but because of the phaseout percentages, the

exemption becomes zero whether or not a consolidation election is made.

Thus, the election to consolidate benefits the group overall by reducing the group

liability by $37,500 ($187,500 reduction in aggregate ACE adjustment × 20%

AMT), in a manner traceable to the computation of the ACE adjustment.

p. 8-16 and Chapter 3

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-18

339.

2010 Corporations Volume/Solutions Manual

Stock Basis at

End of Year

Alternative A

Alternative B

2008

2009

$34 million

$41 million

$34 million

$19 million

2010

$51 million

$29 million

Alternative C

$34 million

$15 million Excess Loss

Account

$5 million Excess Loss

Account

If a subsidiary is sold while its parent holds an Excess Loss Account in it, capital

gain income is created to the extent of the account balance.

Examples 18 and 19

40.

Consolidated taxable income is computed as follows.

2008

$200,000

2009

170,000

2010

50,000

2011

340,000

The Orange losses offset the Teal income dollar for dollar, but they never become

large enough to produce a consolidated loss. Because both corporations produce

ordinary income, there are no adjustments to make using the format of Figure 8.2.

There are no consolidated NOL carryovers in any of the specified years.

Example 21

41.

It is assumed that the group does not elect to forgo the carryback of the 2010

consolidated net operating loss.

Consolidated taxable income

2008

$300,000

2009

90,000

2010

0

2011

($350,000) NOL carryback. This first generates a full refund

of the 2008 group tax liability. The remaining $50,000 NOL

carryback then generates a partial refund of the 2009 group

income tax liability. The 2010 NOL now is fully used.

325,000

Example 23

42.

In years when a group member files a separate return (e.g., due to a deconsolidation of the member from the group), each member can carry over only

its apportioned segment of the group NOL. Thus, Ocelot can use its $1 million

share of the group NOL carryforward on its 2009 separate return. Figure 8.3

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Consolidated Tax Returns

8-19

43.

The NOL deduction is limited to $400,000, the annual § 382 amount. The § 382

provisions prevail over those of the SRLY rules when both restrictions apply.

Example 30 and Chapter 7

44.

Under the SRLY rules, the group cannot carry back the losses that Child brings

into the group. Subsequent deductions are limited to the cumulative positive

contributions toward group taxable income that are traceable to Child. Child’s

NOL can be deducted by the Thrust group as follows.

2008. . . . . . $0

(exhausted)

2009. . . . . . $500,000

2010. . . . . . $400,000

Figure 8-3

45.

a.

This intercompany transaction is subject to the matching rule. Realized

gain is deferred, through an elimination in the computation of consolidated

taxable income. The $80,000 gain is recognized when SubCo later sells

the land to Outsider.

Separate

Taxable Income

ParentCo

$210,000

Information

SubCo Information

Group-Basis

Transactions

Intercompany

Events

Consolidated

Taxable Income

NOTES

† Matching Rule

Adjustments

PostAdjustment

Amounts

$210,000

($ 20,000)

($ 20,000)

– $80,000 Gain on

intercompany sale

to SubCo †

($ 80,000)

$110,000

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

8-20

2010 Corporations Volume/Solutions Manual

b.

The solution includes the $10,000 post-acquisition gain realized and

recognized by SubCo on the land.

Separate

Taxable

Income

ParentCo

Information

SubCo Information

Group-Basis

Transactions

Intercompany

Events

Consolidated

Taxable Income

Adjustments

Post-Adjustment

Amounts

$90,000

$ 90,000

$40,000

$ 40,000

– $80,000 Restore

gain on ParentCo’s

Sale to SubCo †

+ $ 80,000

$210,000

NOTES

† Matching Rule

Example 34

The answers to the Research Problems are incorporated into the Instructor’s Guide with

Lecture Notes to accompany the 2010 Annual Edition of SOUTH-WESTERN FEDERAL

TAXATION: CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS.

© 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.