Econ 435 Spring 2004

advertisement

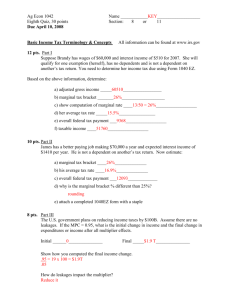

Econ 435 Spring 2004 Name: ________________________ Midterm Exam – Suggested Answers Part 1. Multiple Choice – 2 pts each x 20 = 40 pts 1. Proved reserves are: A. geologically certain but not dependent on price B. known and profitable to extract at current prices C. known and profitable to extract at current and predicted future prices D. determined by the government prior to a lease sale 2. A resource is economically scarce when: A. It has a marginal opportunity cost greater than zero B. The quantity demanded exceeds the quantity supplied at a price of zero C. It has an extraction cost greater than zero D. Both A and B C doesn’t work because we are talking about the resource itself, “in the ground” or “on the stump”, not the extracted resource. To extract, transport, and process the resource will almost always have a significant opportunity cost. I also accepted just B for 1 pt because answer A is somewhat poorly phrased – it fails to distinguish as clearly as it should between the marginal opportunity cost of using up the raw resource itself, and the marginal opportunity cost of extraction and processing. An economically abundant resource can be costly to extract and process – see the example of pine trees in Eastern U.S. in Knapp’s notes, or consider extracting water from the Yukon River and processing it for sale in Texas. In fact the high cost of processing can be THE reason why a raw resource is economically abundant, and if the extraction cost falls due to technological progress, the raw resource can suddenly become scarce. Natural gas for home heating in Anchorage, while not completely abundant, is cheap because of the high cost of transporting it to sell somewhere else. If we could easily export the gas to Chicago, users here would have to pay a higher price. 3. Which diagram depicts an abundant resource: (circle the correct diagram) D S D S S D 4. Which diagram shows the largest amount of economic rent? D S S D S D 5. If you hear an economist say on the radio “We should use the permanent fund to build the gas pipeline,” this is a: A. Normative statement B. Positive statement C. Command statement D. Moral statement 6. If a resource is in perfectly fixed supply and it generates a total economic rent of $200 million for the profit-maximizing landowner, what happens to production if the government levies a severance tax of $150 million on the landowner? B. Production will be stopped to avoid the severance tax A. Production will be reduced until marginal rent per unit equals the severance tax rate C. Production will be increased to make up for the tax. D. Nothing. 7. If the market interest rate was 4% last year but everyone expects it to change to 2% and remain at 2% into the future, then a bond that promises to pay $10 per year forever will have a market value of: A. $250 B. $400 C. $500 D. Infinity, because it pays money forever $500 x .02 = $10 every year forever 8. In this course we have adopted a simple concept for “economic efficiency.” It is: A. Minimization of private extraction costs B. Maximization of net benefits to society C. Maximization of all future gross benefits D. The Pareto principle 9. If there is a positive externality associated with production of a good, then private decisionmakers acting on their own are likely to: A. not produce any of the good B. produce at a level where marginal social benefit exceeds marginal social cost C. produce at a level where marginal private benefit equals marginal private cost D. produce too much relative to the social optimum E. Both B and C Some people got tripped up because this was a positive externality problem not a negative. Several neglected to include C as well as B. If there was no externality, then private cost would equal social cost and private benefit would equal social benefit. But there is a positive externality: social benefit = private benefit + external benefit. 10. One possible goal of resource policy that is really another word for fairness is: A. efficiency B. employment C. equity D. equanimity 11. If market value of a log sold in Japan is $10 and logging costs $3 per log and transportation costs $2 per log as determined in competitive markets for logging services and transportation services, then the netback value or netback price (same thing) of the log itself “on the stump” is: A. $5 B. $15 C. $7 D. $8 12. If a resource has zero extraction costs but there is a fixed and finite supply then we would expect a competitive market equilibrium to have which of the following outcomes: A. the netback price of the resource rises over time at the rate of interest B. the present value of net social benefits is maximized C. the present discounted value of the net back price of the resource remains constant over time D. A,B, and C E. A and B only 13. For a resource with completely fixed supply, even if there is zero marginal cost of extraction, it is likely that my consumption imposes an opportunity cost on society because others must consume less if I consume more. The fancy term for this opportunity cost is: A. marginal discounted extraction cost B. marginal user cost C. pecuniary externality D. net economic rent 14. Consider the statement: “If a nonrenewable resource in fixed supply has zero social opportunity cost of extraction then it is abundant” A. This is always true B. This is always false because the marginal user cost is always greater than zero and counts as part of the marginal opportunity cost C. This is true if the sum of all future quantitites demanded at a zero price is less than the fixed supply D. This is a normative statement 15. The chief drawback of net profit share leasing is: A. It is too complicated in theory for bidders to understand B. It is very hard to monitor profits and actually use the scheme C. It keeps small companies out of the leasing process D. All of the above 16. If a factory is producing 100 cell phones per year, selling them for $50 each, earning $5,000 in revenue, and the external cost of pollution imposed by the factory is constant at $10 per cell phone, then what level of taxation would cause the factory to produce the output level that maximizes net social benefits? A. $10 per cell phone B. $5 per cell phone C. More than $10 but less than $50 per cell phone D. It depends on the demand for cell phones A lot of people chose C. I don’t understand why you would choose C. What am I missing? It seems to me if you charge more than $10 in tax you are going to drive production below the point where net social benefits are maximized. The $50 figure seems to be hardly relevant at all to the problem. 17. If for an oil field the opportunity cost of extraction is $600 million and the market value at the wellhead is $800 million then the economic rent generated is: A. $1.4 billion B. $800 million C. $200 million D. We have no clue using the information given. 18. If the discounted present value of future benefits from a project is $1 million when the interest rate is 5%, What happens to this present value if the interest rate is 10%? A. We have no way of knowing B. It will probably drop because each year’s benefits will be discounted more C. It will probably increase because the time value of money is higher D. It will stay the same due to the invariance principle 19. The “Coase Theorem” says that if property rights to a scarce resource (such as clean unpolluted water) are well-defined (meaning one entity definitely owns and controls the resource), and if it is possible for the resource users to negotiate with each other at low cost, then: A. The parties will negotiate an outcome that is economically efficient, no matter which party has the property rights B. The outcome depends strongly on who has the property rights C. The outcome depends on the potential rents available to the entity with the property rights D. The outcome is a bargaining game and it could be anything 20. The “Coase Theorem” rarely works in practice because: A. The property rights are often not well-defined B. There are many affected parties so they can’t easily negotiate with each other C. Not enough people have taken economics D. Both A and B Short Answer -- Choose only 5 questions out of 6 5 pts each = 25 pts 1) Use a supply and demand diagram to indicate what is likely to happen to the market price and quantity supplied of Alaska hemlock timber "on the stump" if millions of Japanese consumers suddenly decide that they really like hemlock wood for their houses. Show both the short-run and the long-run outcomes. Ssr Slr P1 P2 P0 Dnew Dold Q0 Q1 Q2 The demand curve for timber on the stump shifts out/up as Japanese consumers will want to buy more hemlock wood at any price, meaning lumber companies can afford to pay more for timber on the stump and will bid up the price in the market for timber on the stump. The short run supply is less elastic than the long run supply because it takes time to cut trees let alone to grow them. The market price is likely to rise more in the short run from P0 to P1, then settle back down to P2 as producers respond to the higher prices with more logging and even more growing of trees. Please note that the LR supply curve is meant to take into account ALL long-run responses to changing prices – including the entry of new firms. That’s why the LR supply curve passes through the same initial point as the SR supply curve. You would be correct that the SR supply curve shifts as new entrants enter, but this shift leads to a new SR supply curve and to a point on the LR supply curve. long run supply: includes the effect of more firms entering in repsonse to a percived permanent increase in price. D1 D2 2) The Alaska legislature is sick of paying $ 1million per year to provide fresh water to Whalebone, Alaska by truck. They put out a request for propsals to build a maintenance-free fresh water utility which would provide piped water to the community forever. The Permanent Fund is currently invested at 5 percent and everyone expects this rate to stay constant. If the goal of the legislature is economic efficiency on a statewide basis, what is the maximum amount of money that can be spent on the project. Anything up to 1/.05=20 million dollars would increase net benefits. If they paid $20 million they would gain $1 million per yr in avoided water costs but lose $20 million x .05 = $1 million per yr in interest earnings – a break even proposition. If they paid more they would lose more than 1 million in interest – bad idea. 3) What is the main problem with maximizing employment in resource extraction rather than going for the economically efficient use of capital and labor? (hint, your answer should include the word productivity) If you just maximize employment you will end up with people who have very low output per person – because (for example) they will not be using enough machines or because they are simply redundant (nothing to do). If people have very low productivity then total output for society will be low and net benefits will also be low. The whole point of economic growth is to increase output per worker by using more and better technology and by using workers only when they have a marginal product that covers their cost. 4) Suppose Joe’s coffee shop, which he opened on a piece of land that he inherited from his grandfather, happens to be at a very popular location in a big city. Joe earns $100,000 per year in economic rents by producing coffee for 50 cents per cup and selling it for $2.00 per cup. Everyone expects these rents to continue forever. Now Joe decides to sell his coffee shop and head for Mexico. Jack decides to bid on Joe’s shop so that he too can make these phenomenal amounts of money. Jill has the same idea. So does Jane and her three cousins. Joe conducts an auction. Who is going to be rich as a result of this deal? What is a reasonable sales price that Joe can expect to receive if the interest rate is 10% Joe is going to get rich. (Of course, he would also get rich slowly by just continuing to sell coffee and accumulate future rents). The net present value of his future rents is $100,000/.1 = $1 million. If the bidding is reasonably cutthrout the sales price of his business will be less than but close to $1 million. This problem is meant to illustrate the fact that if resource rights can be bought and sold in secondary markets after their initial allocation, then the expected value of all future rents to which that initial allocation gives a property right will be captured by the first entity who doesn’t have to pay for them. This might be the state itself, if they make an itial allocation with an auction. But they often don’t, prefering to make some sort of giveaway in order to get enough political support to move away from total open access to some form of private property right. In this rather common case, the first group that is given the resource rights gets rich, and all future participants just barely get by, because they have to buy their way in to the resource riches. 5) How should you choose the “discount rate” to evaluate a stream of future benefits? (What is the general idea and can you give a specific example of how you might apply it) The discount rate should reflect the opportunity cost of the resources that must be sacrificed to get the future benefits. So, if the State of Alaska is considering spending money now on a hydroelectric dam that will provide electricity in the future, the opportunity cost of doing this is less money in the permanent fund and an appropriate discount rate would be the rate of return on the permanent fund – about 6% “real” (after adjusting for inflation). A private businessperson might have an alternative investment project “B” that returns 12% in that case they would use 12% as a discount rate when evaluating project “A” 6) What are the chief benefits of using a “moral system” to allocate fish and game in a small village? What are one or two changes that might occur in this village that would make the “moral system” become less effective? Benefits are ease of enforcement and implementation, as long as parents and peers keep on passing along the same information about what is “right” and “wrong” and back it up with whatever informal enforcement works (such as dirty looks or put-downs for violators). If number of people increased too much or if people began to disagree on what was the “right” amount to harvest or the acceptable uses (such as subsistence vs commercial sale for cash), then the moral system might break down. Problems (10 pts and 25 pts) Problem 1 - (10 pts) Suppose that the following diagram refers to a fixed amount of ice cream – 20 cones -- that has been delivered (by magic!) to rooms 216 and 220. The lines are the demand curves. Explain everything you think is important about this diagram – what does it tell us about whether the ice cream is abundant or not, how should it be allocated to maximize “economic efficiency”, what does that mean in this case, does the diagram show the efficient allocation, can you show what the net benefits are? (show them on the diagram, don’t need to calculate them), and how does the diagram show why a final consumption of 10 cones by each room would be inefficient…. 16 14 Room 216 Rm 220 12 10 8 6 4 M 2 0 0 5 10 15 20 The ice cream is scarce overall because the total quantity demanded at a price of zero is 24 which exceeds the total supply of 20. To maximize efficiency ice cream should be allocated to maximize total net benefits. Since there is no “extraction cost”, the net benefits can be measured as the areas under the two demand curves above the horizontal axis. The diagram shows the efficient allocation to be 13 in room 216 and 7 in room 220. This is efficient because any other allocation would have a mismatch between the value placed on the last cone in 216 and the value placed on the last cone consumed in 220. For example, suppose you tried 10,10. In that case room 216 would value an 11th cone at $4 while room 220 would give up zero value if it dropped back to 9. We could create $4 more net benefits by reallocating from 10,10 to 11,9. This process could go on until we reached 13,7 where the marginal valuations are the same as the diagram shows. At this efficient point total net benefits are the combined area of the trapezoids “15-0-13-M” and “M-13-20-9” which I think you understand – I can’t label digitally without a huge hassle. It is not correct to say that one room values ice cream more than another room. That’s just too much of a generalization, although the statement relates to some things that are true. We don’t know how many people are in each room. We could say that rm 216 has a higher total willingness to pay for any “bundle” of ice cream, such as 5 cones. But so what? That kind of thinking doesn’t get us to efficiency – it might get us to a clearly inefficient outcome if you said, “OK, since room 216 values ice cream more than 220, they should get it.” Well, do you mean ALL of it? I hope not! No, you have to think cone by cone because the ice cream can be allocated cone by cone. Thinking cone by cone, the 7th cone in room 216 is valued by them the same as the 1st cone in 220. The 10th cone in 216 is valued less than the 2d cone in 220. The MAIN points of the ice cream problem relevant to natural resources are: 1) A resource can be scarce even when it has zero extraction costs and is a “gift from nature” 2) In order to maximize net benefits in this problem where the question is allocation to 2 places, the last unit of ice cream consumed in each place should be valued the same 3) This logic also applies to the last unit consumed during each TIME PERIOD, except that since the valuation comparison of all the consumption has to take place “now” in order to make a tradeoff between “how much now?” and “how much later?”, the values to be compared must be the discounted present values of the future valuations. So for ice cream over time we should allocate cones between now and next year until it turns out that the last cone we consume today has a value of, say, $1 today and the last cone that we allocate to next year will have a value of $1.10 next year (if our discount rate is 10%). Problem 2. (25 pts) [leasing]. Suppose you are an oil company executive considering whether to bid on a set of 10 tracts of land owned by the State of Alaska. You can only bid for all ten tracts together, in a bundle. The probability of finding various volumes of oil on each individual tract is: 2 billion barrels -1 billion barrels -- 50% 50% Your costs to produce the oil are as follows: Exploration cost -- zero Production cost -- $5 per barrel (you pay this only if you decide to develop) 2A) (2 pts) How much total volume of oil can you expect to recover from the ten tracts altogether? (remember-- show calculation for full credit) (2 x .5) + (1 x .5) = 1.5 billion barrels x 10 = 15 billion barrels 2B) (2 pts) If the value of oil delivered to a Texas refinery is $30 per barrel and the cost of transporting oil from wellhead to refinery is $20 per barrel, what is the wellhead value, according to “netback pricing”? 30-20=$10/barrel The wellhead value is not the same as the rent. If you deduct the $5 production cost you would get to $5 per barrel in rent. 2C) (2 pts) Suppose you are sure that the wellhead value of oil is going to remain at $10 per barrel. What is the expected total market value of the oil from the ten tracts? $150 billion 2D) (2 pts) What is the expected total economic rent from the ten tracts? $150 billion mkt value - $75 billion production cost = $75 billion 2E) (2 pts) If the leasing system is "cash bonus bidding" with a zero % royalty rate and a zero% severance tax rate, how much can you afford to bid for the ten tracts? all of the expected rent, $75 billion. 2F) (2 pts) If the leasing system is "cash bonus bidding" with a 10% fixed royalty rate and a zero percent severance tax rate, what are the expected royalty payments you will have to make? .10 x $10 x 15 billion barrels = $15 billion 2G) (2 pts) Would you still want to bid on the tracts with the 10% fixed royalty? (Why/ why not) Absolutely – you are still keeping $60 billion in rent 2H) (4 pts) If the leasing system is "cash bonus bidding" with a 25% fixed royalty rate and a zero percent severance tax rate, what are your expected profits from the bundle of ten tracts with a cash bonus bid of zero? (Use the table to organize the answer) Market Value of oil: __150 billion________ Total production cost: ___75 billion_______ Cash bonus bid: ___0_______ Royalties @ 25%: ___37.5 billion_______ Expected Profits: ___37.5 billion_______ 2I) (3 pts) Explain to the Governor of Alaska why a 25% royalty rate is a bad idea for this lease sale. Suggest two different ways that the State could change the leasing system terms for this sale so as to make everybody better off. I had meant to use $8 production cost - which made the field not profitable at a 25% royalty. Hence this lease would probably not generate any development. Two ways to fix it would have been a lower royalty rate, pure cash bonus bidding, or net profit share leasing. (That’s 3 ways) 2J) (4 pts) Finally, suppose you are the Commissioner of the Department of Revenue. The Governor tells you that the industry has proposed "net profit share leasing" as a way to ensure that development is not stopped by inefficient royalties. What is your advice? Should the State switch to the "net profit share" system for this sale? What are the pros and cons of doing so? I advise against net profit share leasing for Alaska. The benefit is that it potentially allows all fields with any rent to be produced, maximizes total rent generated, and shares the risk somewhat –fields with low rents pay low lease payments while fields with high rents pay high lease payments. The big disadvantage is that it is very hard if not impossible to monitro and compute “profits” because of endless fighting over what are real,true, reasonable, or acceptable costs. Does the corporate retreat in Hawaii count as a cost when computing the net profits?