Rational for Housing Subsidies in Emerging Economies

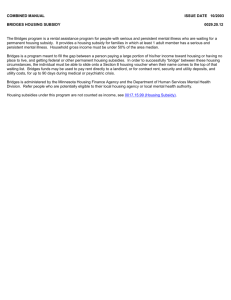

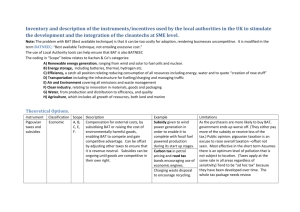

advertisement