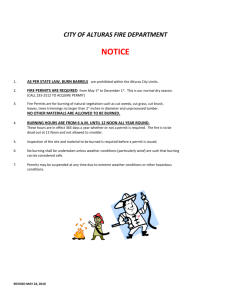

permits harmful

advertisement

Inventory and description of the instruments/incentives used by the local authorities in the UK to stimulate the development and the integration of the cleantechs at SME level. Note: The problem with BAT (Best available technique) is that it can be too costly for adoption, rendering businesses uncompetitive. It is modified in the term BATNEEC; “Best available Technique, not entailing excessive cost.” The use of Local Authority tools can help ensure that BAT is also BATNEEC The coding in “Scope” below relates to Kachan & Co’s categories: A) Renewable energy generation, ranging from wind and solar to fuel cells and nuclear. B) Energy storage, including batteries, thermal, hydrogen etc. C) Efficiency, a catch all position relating reducing consumption of all resources including energy, water and to quote “creation of new stuff” D) Transportation including the infrastructure for fuelling/charging and managing traffic E) Air and Environment covering all emissions and waste management F) Clean industry, relating to innovation in materials, goods and packaging G) Water, from production and distribution to efficiency, and quality H) Agriculture, which includes all growth of resources, both land and marine Theoretical Options. Instrument Pigouvian taxes and subsidies Classification Scope Description Economic A, B, Compensation for external costs, by C, E, subsidising BAT or raising the cost of F. environmentally harmful goods, enabling BAT to compete and gain competitive advantage. Can be offset by adjusting other taxes to ensure that it is revenue neutral. Subsidies can be ongoing until goods are competitive in their own right. Example Subsidy given to wind power generation in order to enable it to complete with fossil fuel powered production during its start up stages. Carbon tax in petrol pricing and road tax bands encouraging use of economic engines. Charging waste disposal to encourage recycling. Limitations As the purchasers are more likely to buy BAT, government ends up worse off. (They either pay more of the subsidy or receive less of the tax.) Public opinion: pigouvian taxation is an excuse to raise overall taxation –offset not seen. Most effective in the short term Assumes there is an optimum level of pollution that is not subject to location. (Taxes apply at the same rate in all areas regardless of sensitivity) Tend to be “ad hoc tax” because they have been developed over time. The whole tax package needs review Instrument Clean tech installation subsidy Recycling Tax-subsidy Permits. (C ommand and control) Tradeable pollution permits Classification Scope Description Economic A, B, The promotion of clean tech supported C, D, by grants and subsidies to cover part or E, F, all of the cost of adoption/installation. G, H, Generally involves one-off payments but can be handled through tax credits. Economic A, B, Taxation on harmful activities that is C, E, recycled as a subsidy to invest in clean F. tech that reduces the harmful activities. Regulation E, F, Licensing the quality and quantity of G. material a business can release into the environment including waste, thus stimulating recycling. Example Subsidies to install insulation in buildings. Regulation USA Power plants were allocated tradeable pollution permits limiting the release of SO2. This enabled those that could improve performance at low cost to do so and sell to those that were unable to change so easily. Now adopted in Europe. The incandescent lightbulb. CFC’s Banning Regulations substances / technologies E, G. Licensing the quality and quantity of material a business can release into the environment. Their tradeable nature encourages investment in better performance rather than simple compliance within the set limits A, B, C, D, E, F, G, H. When there are competing technologies, and the cleaner one has no evident drawback and is sufficiently competitive, then, if the benefits are sufficient to warrant government action, the poorer technology should be Control of sewage discharge by water companies. Exhaust emissions testing as part of MOT Limitations Requires monitoring and enforcement mechanisms to ensure that the subsidy is spent as intended. May not be available to new business and therefore act as a barrier to entry. Taxation should be sufficient to fund subsidies. May not be available to new business and therefore act as a barrier to entry. Requires monitoring and enforcement mechanisms including the installation of potentially expensive measuring systems. Assumes there is an acceptable level of pollution. Non-tradable permits are an “end of pipe” measure; Clean Tech looks for more. Could be a barrier to entry (must obtain permits and measurement technology) Tradable permits do more to encourage reduction but need a market system, a real;istic price for carbon and sufficient businesses to facilitate the trade. Tradeable permits negate any effort to tie permit to location. Trade may be reduced as cost of meeting tougher regulations rise. Therefore most effective when introducing new areas of control. Requires market acceptance. Could create other costs; eg if the alternative technology is produced by different organisations, it could result in job losses / business failure. Instrument Classification Scope Description withdrawn. Certification Voluntary self regulatory A, B, C, D, E, F,. Exhibitions A, B, C, D, E, F, G, H D, E. Knowledge exchange / Partnership s Urban design Structures Businesses adopt these standards voluntarily. They are audited, and entail continual improvement. Importantly, they cascade down the supply chain offering competitive advantage. The provision of exhibition centres and Travelling or static, temporary or permanent sites. Example Limitations ISO14000 series. EMAS Can be a barrier for small businesses because of the wide range of issues and expertise required. The coming Gastech exhibition and Excel. Seimens exhibition centre Controlled traffic access / bus priority lanes / transport hubs / parking controls / design to reduce volume of journeys. Tree planting / regenerate or rebuild. The challenge of the SME: Too small to have specialists and significant resources Can operate without chamber of commerce knowledge – no “central register” Wide range of activities leading to diverse needs. Promotion and take up required. Timing of temporary exhibitions must match need, or the content could be forgotten. Cost and time involved can be deterrent to small businesses. Many techniques are long term. Can have unforeseen consequences